Recreational boats manufacturer Malibu Boats (NASDAQ:MBUU) missed analysts' expectations in Q1 CY2024, with revenue down 45.8% year on year to $203.4 million. It made a non-GAAP profit of $0.63 per share, down from its profit of $2.52 per share in the same quarter last year.

Is now the time to buy Malibu Boats? Find out by accessing our full research report, it's free.

Malibu Boats (MBUU) Q1 CY2024 Highlights:

- Revenue: $203.4 million vs analyst estimates of $206.5 million (1.5% miss)

- EPS (non-GAAP): $0.63 vs analyst estimates of $0.48 (31.9% beat)

- Gross Margin (GAAP): 19.8%, down from 26.3% in the same quarter last year

- Market Capitalization: $675.4 million

“In the fiscal third quarter, we continued to navigate a softened retail demand environment, with notable weakness in the tow boat and value boat markets. Despite this challenge, we are encouraged by pockets of strength we are seeing across Cobalt and Pursuit, showcasing resiliency within certain segments of our portfolio,” commented Jack Springer, Chief Executive Officer of Malibu Boats.

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

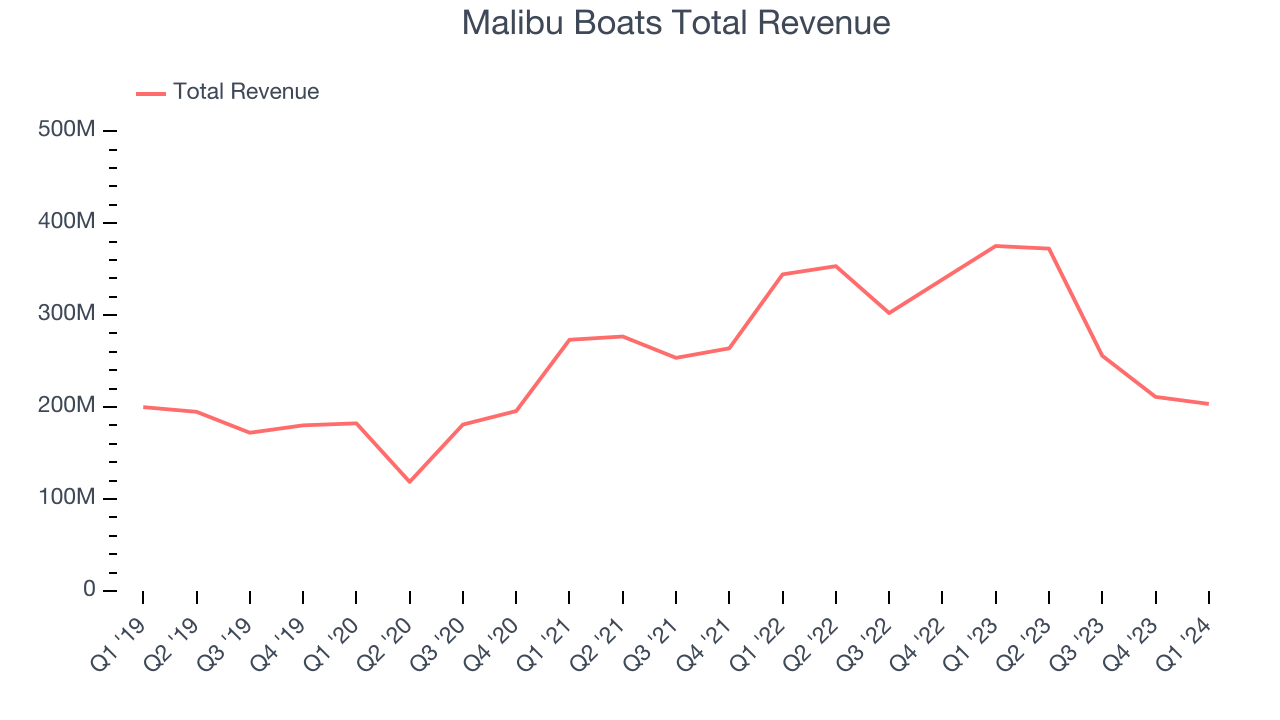

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Malibu Boats's annualized revenue growth rate of 10.7% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Malibu Boats's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 4.3% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Malibu Boats's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 4.3% over the last two years.

This quarter, Malibu Boats missed Wall Street's estimates and reported a rather uninspiring 45.8% year-on-year revenue decline, generating $203.4 million of revenue. Looking ahead, Wall Street expects revenue to decline 8.8% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

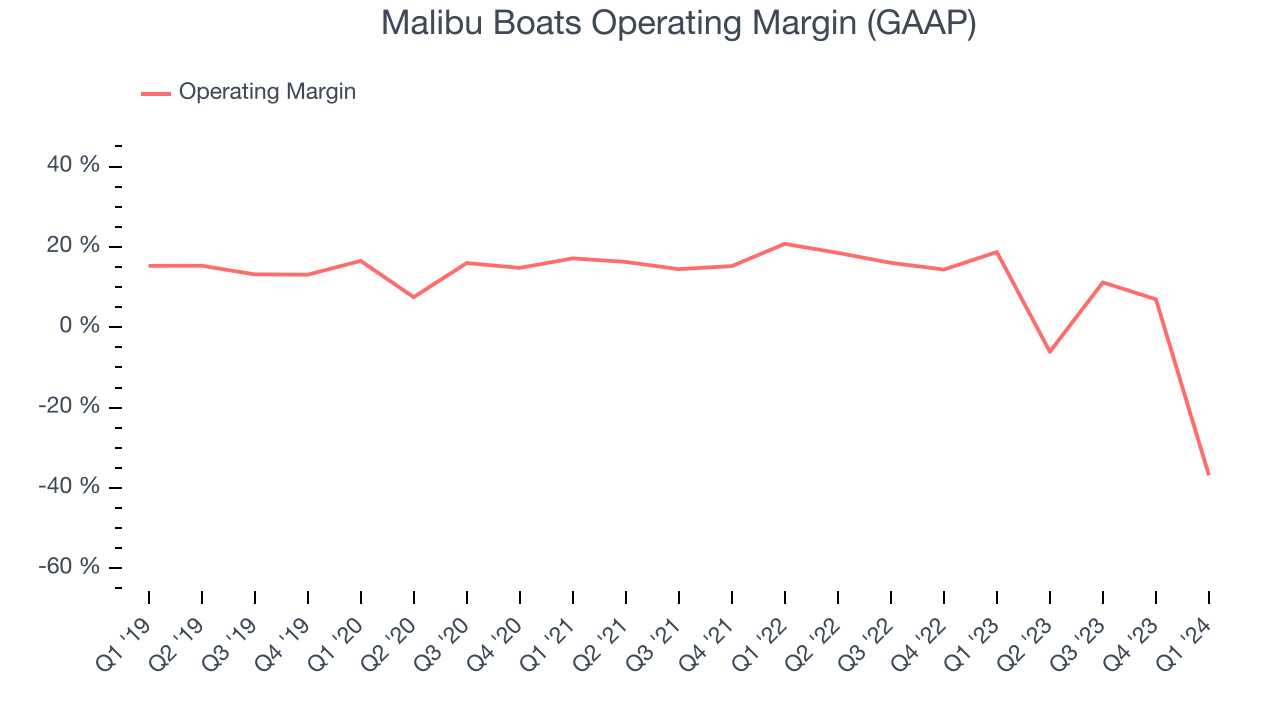

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Malibu Boats was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 7.4%.

This quarter, Malibu Boats generated an operating profit margin of negative 36.8%, down 55.6 percentage points year on year.

Over the next 12 months, Wall Street expects Malibu Boats to become profitable. Analysts are expecting the company’s LTM operating margin of negative 5.2% to rise to positive 9.4%.Key Takeaways from Malibu Boats's Q1 Results

It was good to see Malibu Boats top analysts' adjusted EPS expectations this quarter, though much of the beat came from the non-recurring add-back of goodwill impairments (not indicative of business fundamentals). In worse news, its revenue and operating margin missed Wall Street's estimates as its unit volumes declined a whopping 52%. Looking ahead, management continues to see a weak consumer environment and expects revenue to fall 40% for the year, falling short of expectations. Overall, this was a tough quarter for Malibu Boats. The company is down 2.5% on the results and currently trades at $32.25 per share.

Malibu Boats may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.