Earnings results often indicate what direction a company will take in the months ahead. With Q4 now behind us, let’s have a look at Malibu Boats (NASDAQ:MBUU) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 16 leisure products stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 0.7%, while next quarter's revenue guidance was 11.6% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. The beginning of 2024 saw mixed inflation data, however, leading to more volatile stock performance, and while some of the leisure products stocks have fared somewhat better than others, they collectively declined, with share prices falling 4% on average since the previous earnings results.

Malibu Boats (NASDAQ:MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

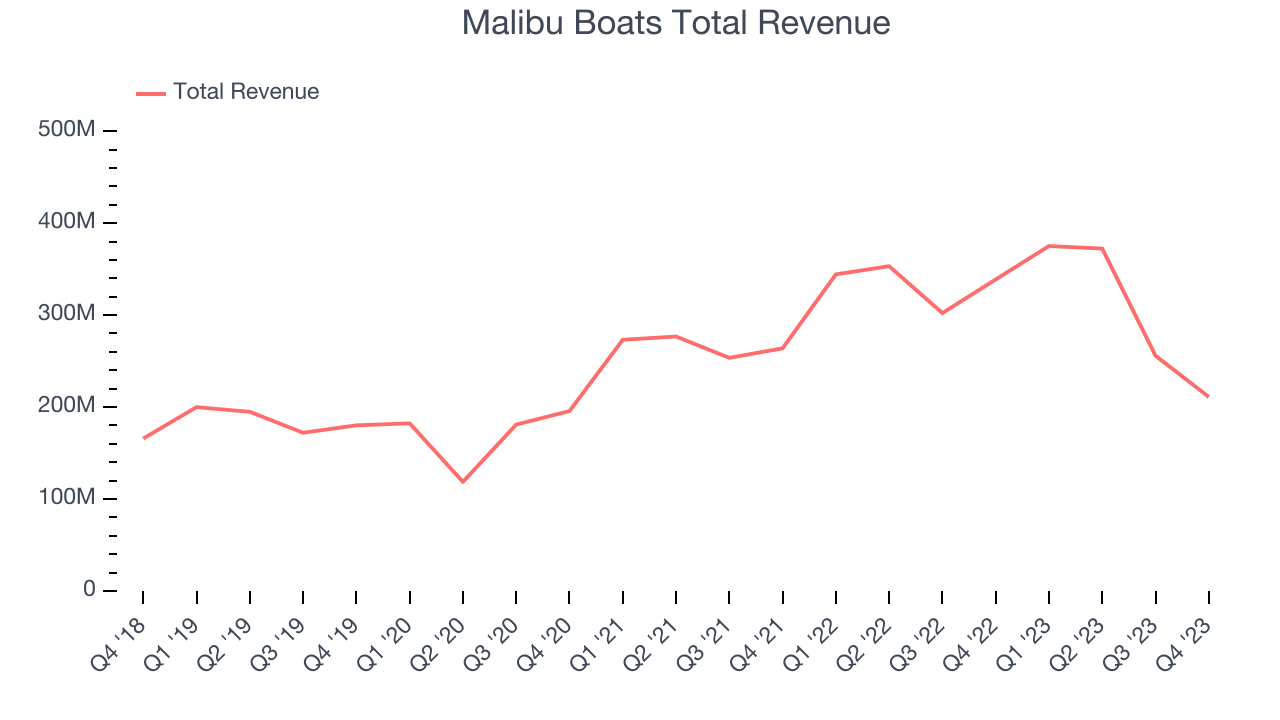

Malibu Boats reported revenues of $211.1 million, down 37.7% year on year, falling short of analyst expectations by 4.1%. It was a mixed quarter for the company, with a solid beat of analysts' earnings estimates but a miss of analysts' units sold estimates.

“Our second quarter results, historically our slowest time of the year, were impacted by weak retail demand,” commented Jack Springer, Chief Executive Officer of Malibu Boats,

Malibu Boats delivered the slowest revenue growth of the whole group. The stock is down 33.3% since the results and currently trades at $34.

Read our full report on Malibu Boats here, it's free.

Best Q4: Smith & Wesson (NASDAQ:SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

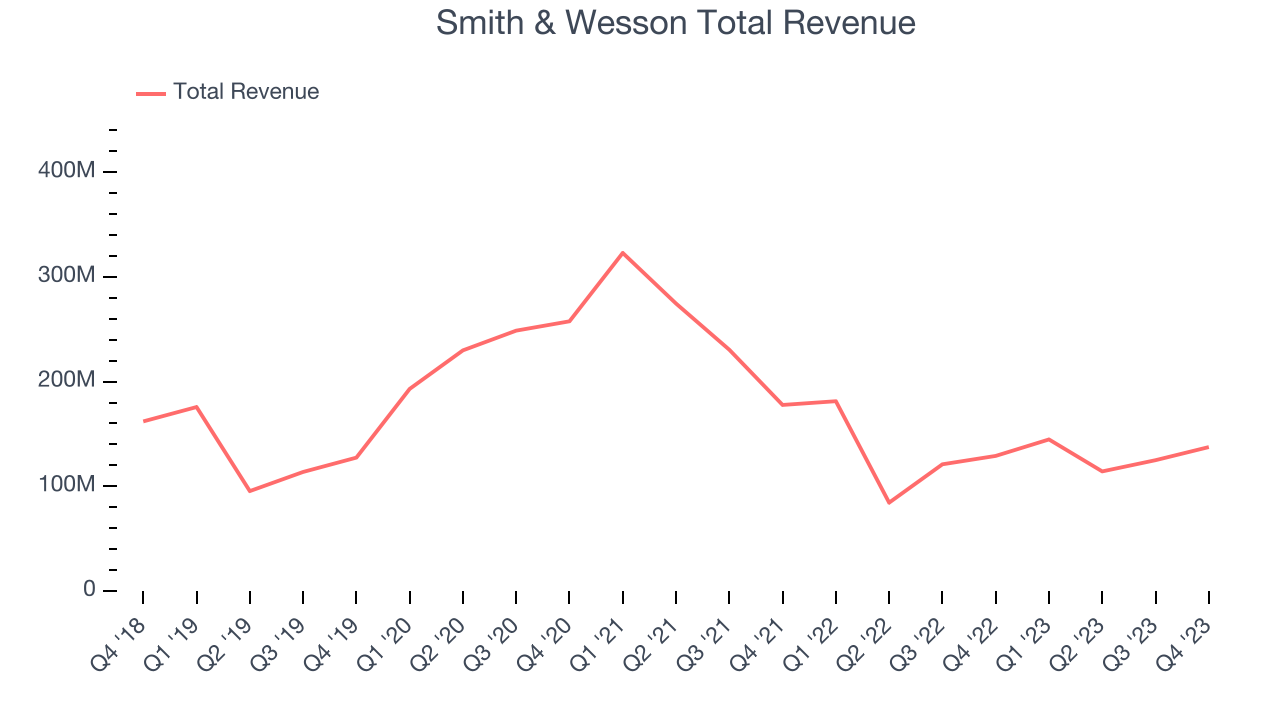

Smith & Wesson reported revenues of $137.5 million, up 6.5% year on year, outperforming analyst expectations by 2.9%. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 26.3% since the results and currently trades at $16.97.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it's free.

Clarus (NASDAQ:CLAR)

Initially a financial services business, Clarus (NASDAQ:CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

Clarus reported revenues of $76.5 million, up 3.6% year on year, falling short of analyst expectations by 8.7%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and a miss of analysts' revenue estimates.

Clarus had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is up 17.8% since the results and currently trades at $6.21.

Read our full analysis of Clarus's results here.

Latham (NASDAQ:SWIM)

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $90.87 million, down 15.8% year on year, surpassing analyst expectations by 4.5%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates but full-year revenue guidance missing analysts' expectations.

The stock is down 8.7% since the results and currently trades at $3.

Read our full, actionable report on Latham here, it's free.

Harley-Davidson (NYSE:HOG)

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $1.05 billion, down 7.8% year on year, surpassing analyst expectations by 20.4%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' motorcycle shipments estimates.

Harley-Davidson delivered the biggest analyst estimates beat among its peers. The stock is up 10.2% since the results and currently trades at $38.04.

Read our full, actionable report on Harley-Davidson here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.