Recreational boats manufacturer Malibu Boats (NASDAQ:MBUU) missed analysts' expectations in Q1 CY2024, with revenue down 45.8% year on year to $203.4 million. It made a non-GAAP profit of $0.63 per share, down from its profit of $2.52 per share in the same quarter last year.

Malibu Boats (MBUU) Q1 CY2024 Highlights:

- Revenue: $203.4 million vs analyst estimates of $206.5 million (1.5% miss)

- EPS (non-GAAP): $0.63 vs analyst estimates of $0.48 (31.9% beat)

- Gross Margin (GAAP): 19.8%, down from 26.3% in the same quarter last year

- Market Capitalization: $675.4 million

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats was established to enhance the on-water experience. The company's initial objective was to produce boats that offered exceptional performance and quality for water skiing enthusiasts, leading to its recognition as a reputable brand among watermen.

Today, Malibu Boats offers a wide range of products including performance sport boats and luxury models across eight brands that cater to a more leisurely boating experience. The company's brands span namesake Malibu, Cobalt , Pursuit, and Cobia. Some of these brands were developed organically while others joined the company's portfolio through acquisitions.

Malibu Boats serves the watersport and marine enthusiast, and customers tend to be higher-income individuals or families that have the extra disposable income for a boat that is clearly not a primary vehicle. Malibu Boats generates most of its revenue from selling its range of watercraft, utilizing a broad dealer network and direct sales strategies. The company seeks to maintain its industry position by developing innovative features, such as its patented Surf Gate technology.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the sports boats and luxury watercraft market include Brunswick (NYSE:BC), Marine Products Corporation (NYSE:MPX), and MasterCraft Boat Holdings (NASDAQ:MCFT).Sales Growth

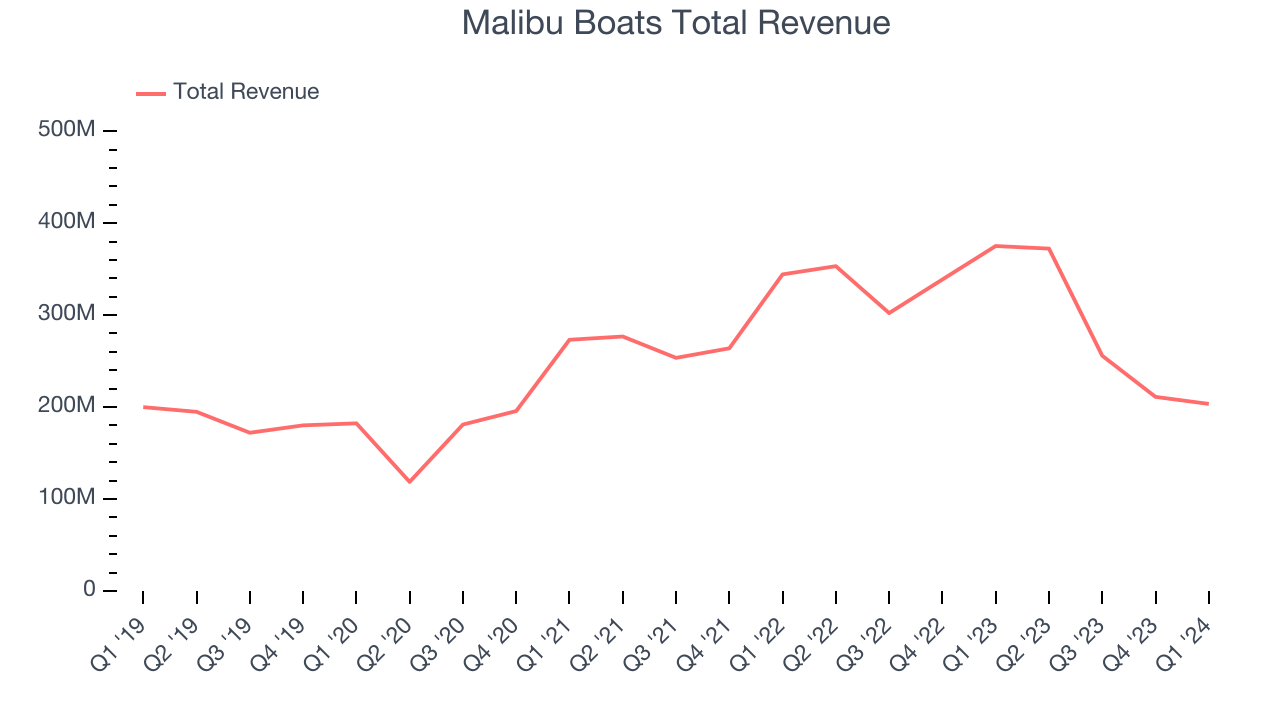

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Malibu Boats's annualized revenue growth rate of 10.7% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Malibu Boats's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 4.3% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Malibu Boats's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 4.3% over the last two years.

This quarter, Malibu Boats missed Wall Street's estimates and reported a rather uninspiring 45.8% year-on-year revenue decline, generating $203.4 million of revenue. Looking ahead, Wall Street expects revenue to decline 8.8% over the next 12 months.

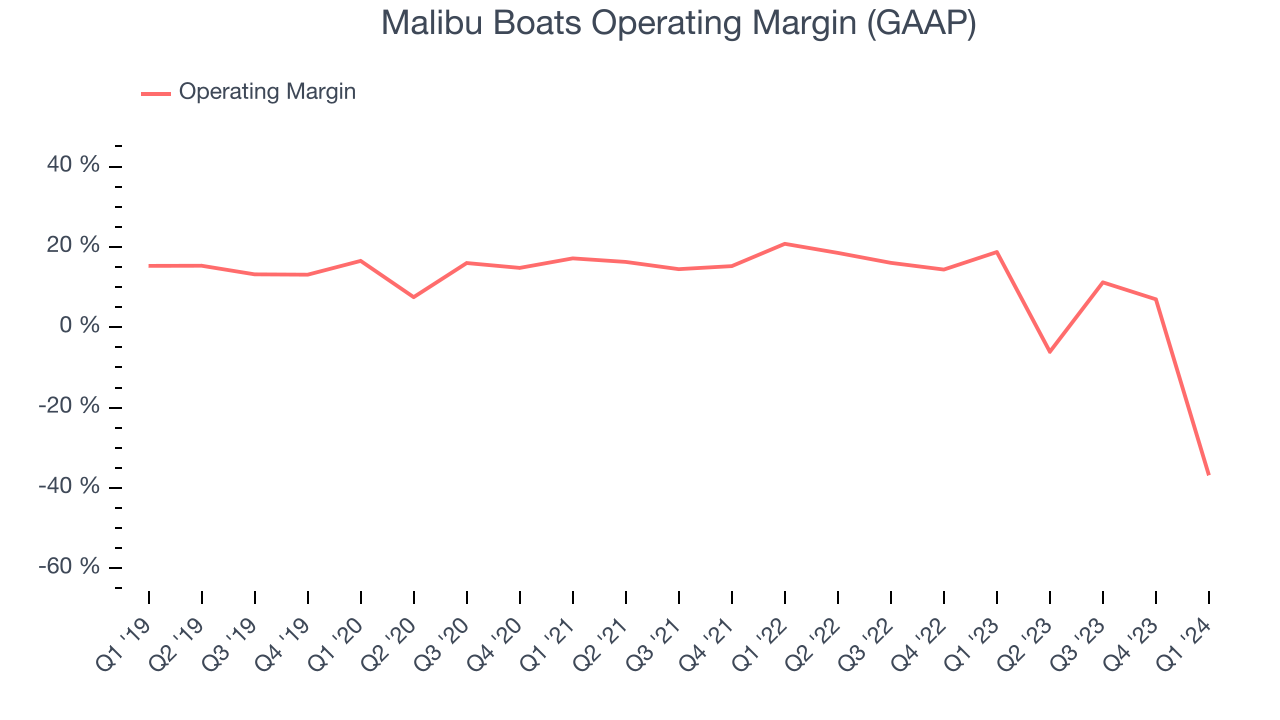

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Malibu Boats was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 7.4%.

This quarter, Malibu Boats generated an operating profit margin of negative 36.8%, down 55.6 percentage points year on year.

Over the next 12 months, Wall Street expects Malibu Boats to become profitable. Analysts are expecting the company’s LTM operating margin of negative 5.2% to rise to positive 9.4%.EPS

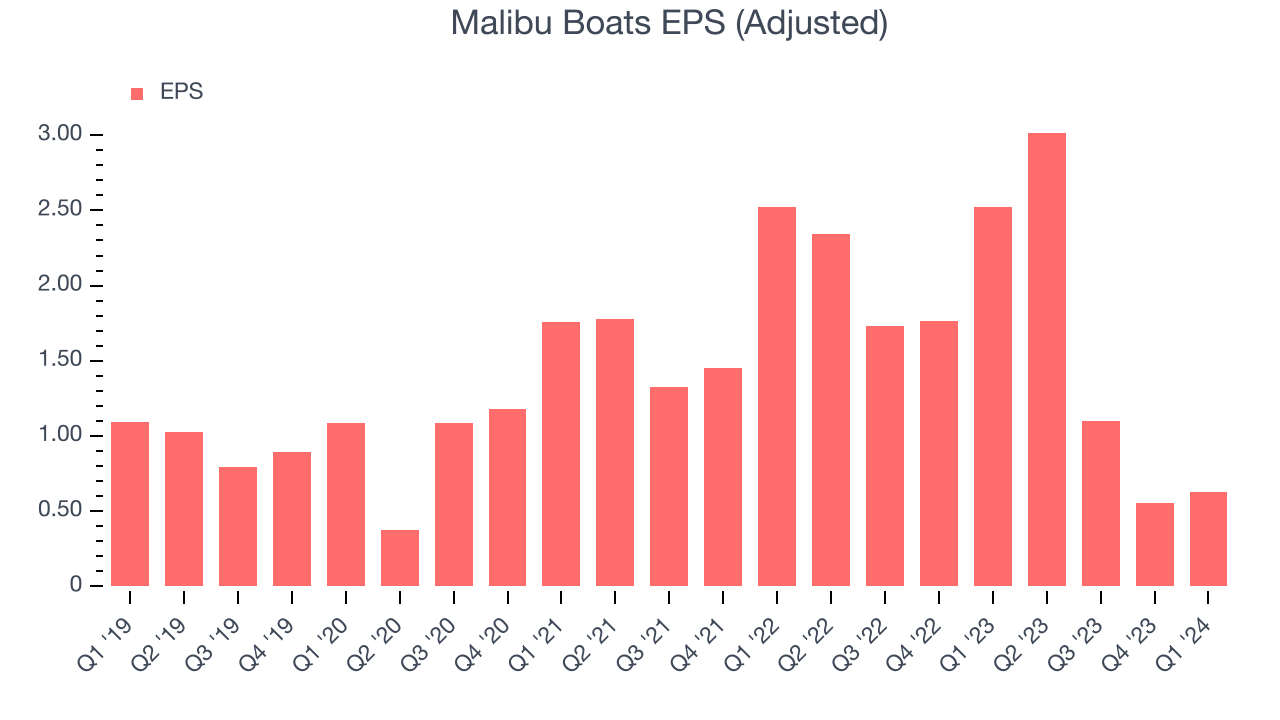

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Malibu Boats's EPS grew 75.6%, translating into a decent 11.9% compounded annual growth rate. This performance is higher than its 10.7% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

A five-year view shows that Malibu Boats has repurchased its stock, shrinking its share count by 2.9%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Malibu Boats reported EPS at $0.63, down from $2.52 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 31.9%. Over the next 12 months, Wall Street expects Malibu Boats to perform poorly. Analysts are projecting its LTM EPS of $5.31 to shrink by 33.5% to $3.53.

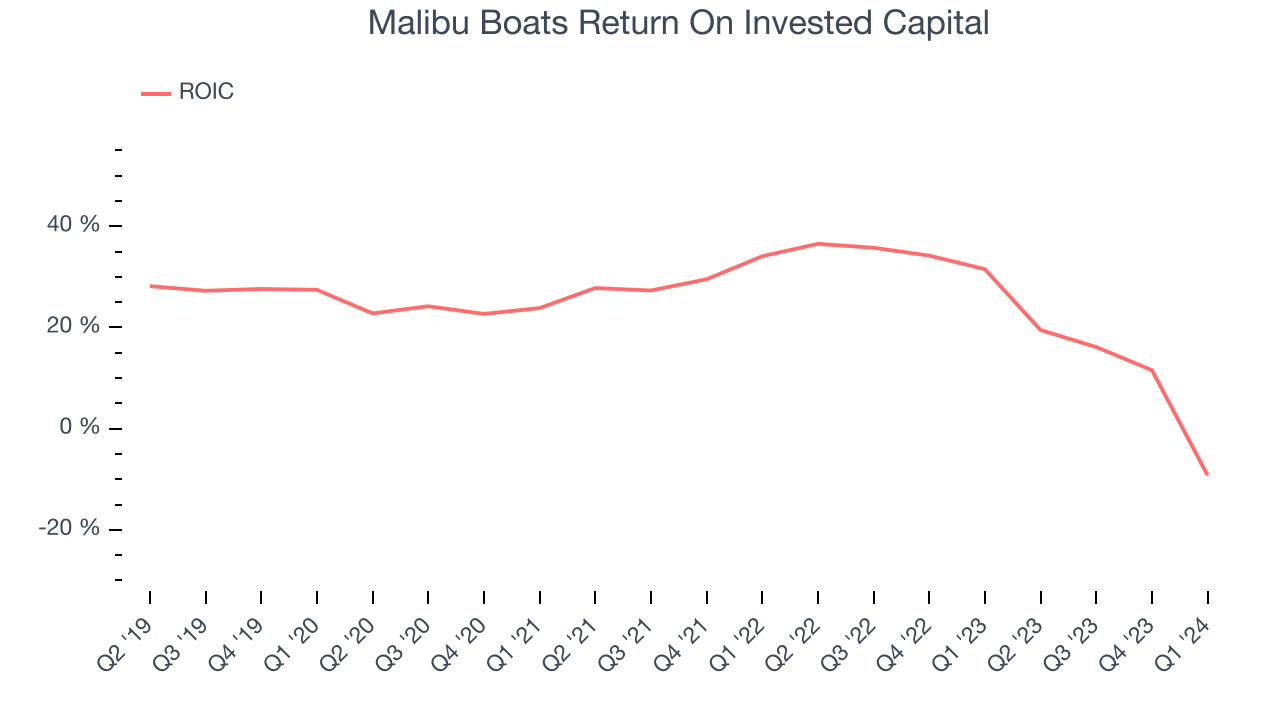

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Malibu Boats hasn't been the highest-quality company lately, it historically did an excellent job investing in profitable business initiatives. Its five-year average return on invested capital was 21.5%, impressive for a consumer discretionary company.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Malibu Boats's ROIC averaged 14.5 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Malibu Boats is a well-capitalized company with $47.12 million of cash and $15 million of debt, meaning it could pay back all its debt tomorrow and still have $32.12 million of cash on its balance sheet. This net cash position gives Malibu Boats the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Malibu Boats's Q1 Results

It was good to see Malibu Boats top analysts' adjusted EPS expectations this quarter, though much of the beat came from the non-recurring add-back of goodwill impairments (not indicative of business fundamentals). In worse news, its revenue and operating margin missed Wall Street's estimates as its unit volumes declined a whopping 52%. Looking ahead, management continues to see a weak consumer environment and expects revenue to fall 40% for the year, falling short of expectations. Overall, this was a tough quarter for Malibu Boats. The company is down 2.5% on the results and currently trades at $32.25 per share.

Is Now The Time?

Malibu Boats may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Malibu Boats, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its market-beating ROIC suggests it has been a well-managed company historically, the downside is its number of boats sold has been disappointing. On top of that, its projected EPS for the next year is lacking.

Malibu Boats's price-to-earnings ratio based on the next 12 months is 9.4x. While there are some things to like about Malibu Boats and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $49.43 per share right before these results (compared to the current share price of $32.25).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.