Sport boat manufacturer MasterCraft (NASDAQ:MCFT) announced better-than-expected results in Q1 CY2024, with revenue down 42.6% year on year to $95.71 million. On the other hand, the company's full-year revenue guidance of $362.5 million at the midpoint came in 10.6% below analysts' estimates. It made a non-GAAP profit of $0.37 per share, down from its profit of $1.36 per share in the same quarter last year.

MasterCraft (MCFT) Q1 CY2024 Highlights:

- Revenue: $95.71 million vs analyst estimates of $92.83 million (3.1% beat)

- EPS (non-GAAP): $0.37 vs analyst estimates of $0.23 ($0.14 beat)

- Gross Margin (GAAP): 19.2%, down from 25.5% in the same quarter last year

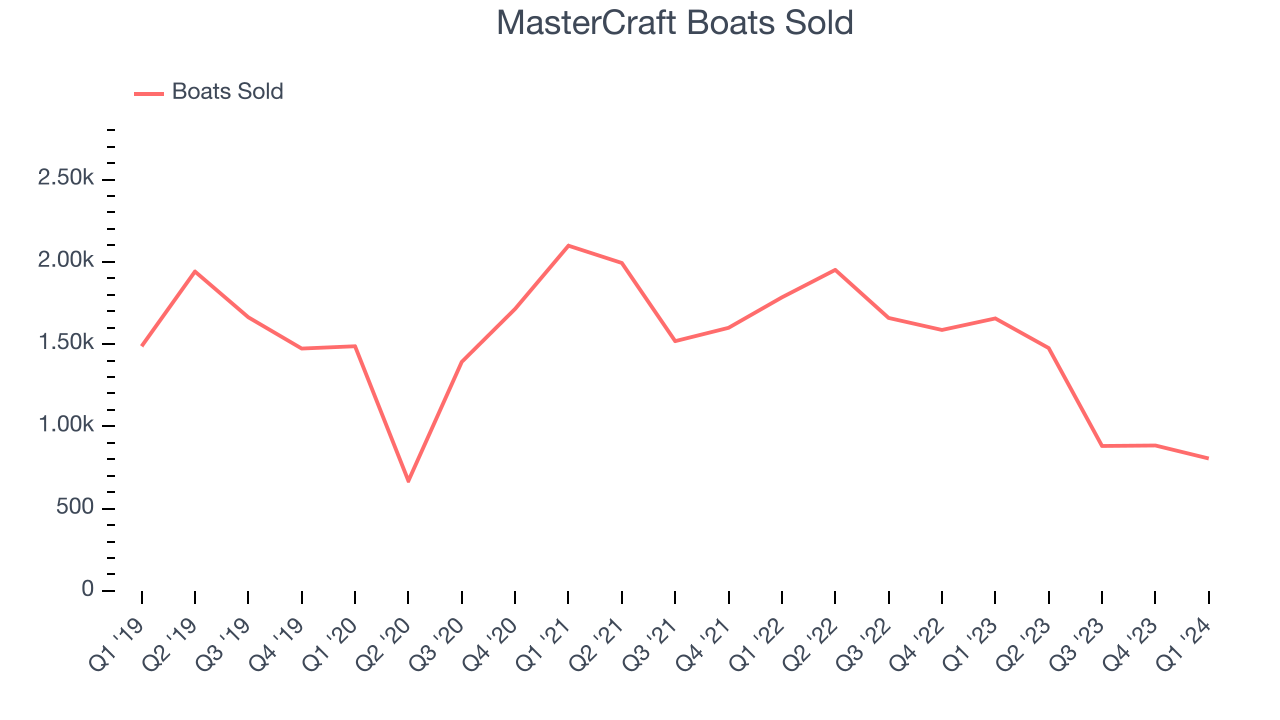

- Boats Sold: 805

- Market Capitalization: $342 million

Started by a waterskiing instructor, MasterCraft (NASDAQ:MCFT) specializes in designing, manufacturing, and selling sport boats.

MasterCraft was founded to manufacture high-performance sport boats. The company emerged to address the specific needs of waterskiing and wakeboarding enthusiasts, offering a range of boats that are designed to enhance the watersports experience.

Products from MasterCraft include sport boats that cater to various watersports activities, including waterskiing, wakeboarding, and luxury boating. Each model is designed to meet the performance demands of both recreational users and professional athletes, incorporating features aimed at improving functionality and onboard comfort.

MasterCraft generates revenue through its global dealership network and direct sales to consumers, enabling it to reach a broad market segment. This business model facilitates the company's engagement with its target audience, ensuring that its boats are accessible to a wide range of customers seeking specialized watersports equipment.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the recreational watercraft industry include Brunswick (NYSE:BC), Malibu Boats (NASDAQ:MBUU), and Marine Products (NYSE:MPX).Sales Growth

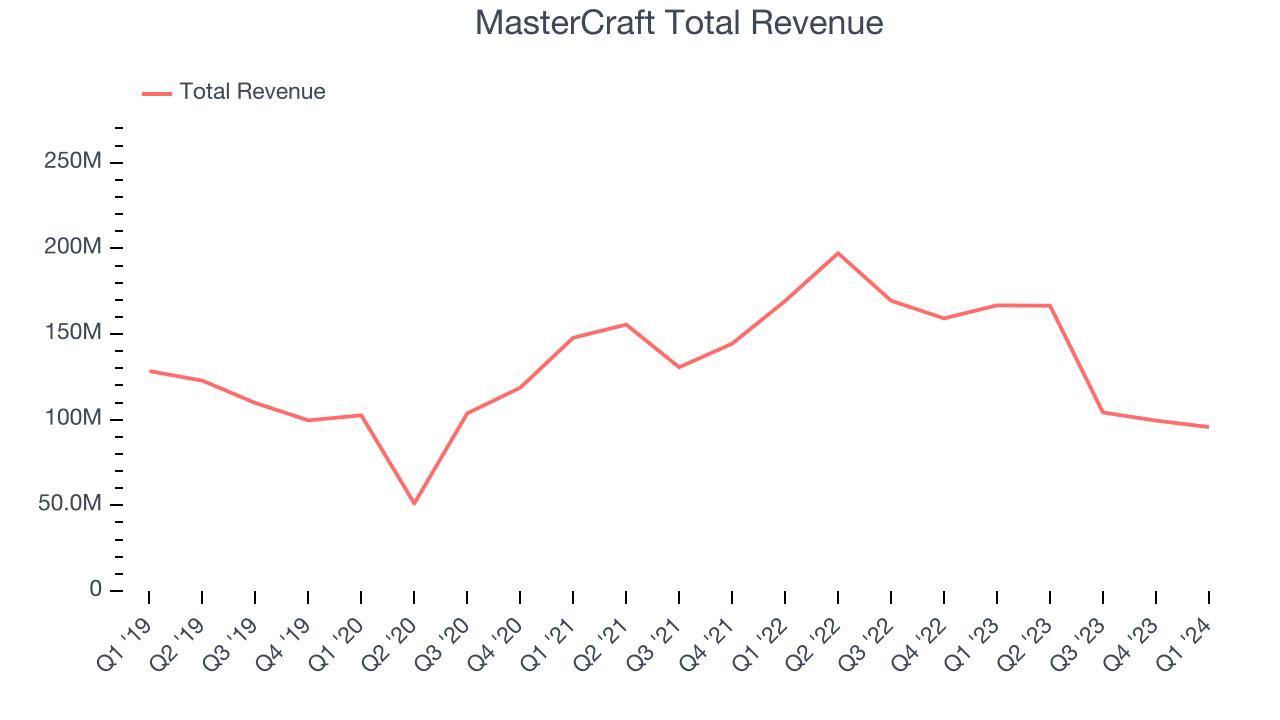

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. MasterCraft's annualized revenue growth rate of 1.2% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. MasterCraft's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 11.9% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. MasterCraft's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 11.9% over the last two years.

We can dig even further into the company's revenue dynamics by analyzing its number of boats sold, which reached 805 in the latest quarter. Over the last two years, MasterCraft's boats sold averaged 21% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company's monetization of its consumers has risen.

This quarter, MasterCraft's revenue fell 42.6% year on year to $95.71 million but beat Wall Street's estimates by 3.1%. Looking ahead, Wall Street expects revenue to decline 3.8% over the next 12 months.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

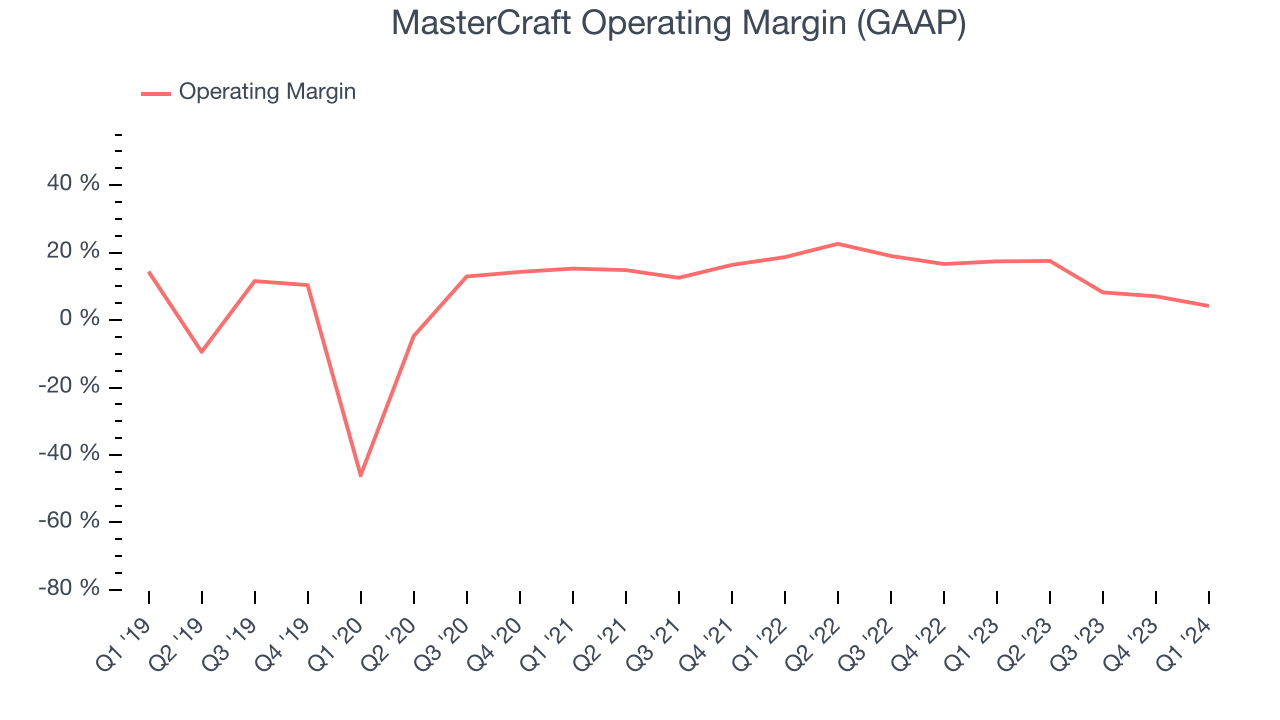

MasterCraft has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer discretionary business, producing an average operating margin of 15.6%.

This quarter, MasterCraft generated an operating profit margin of 4.2%, down 13.2 percentage points year on year.

Over the next 12 months, Wall Street expects MasterCraft to become less profitable. Analysts are expecting the company’s LTM operating margin of 10.5% to decline to 9%.EPS

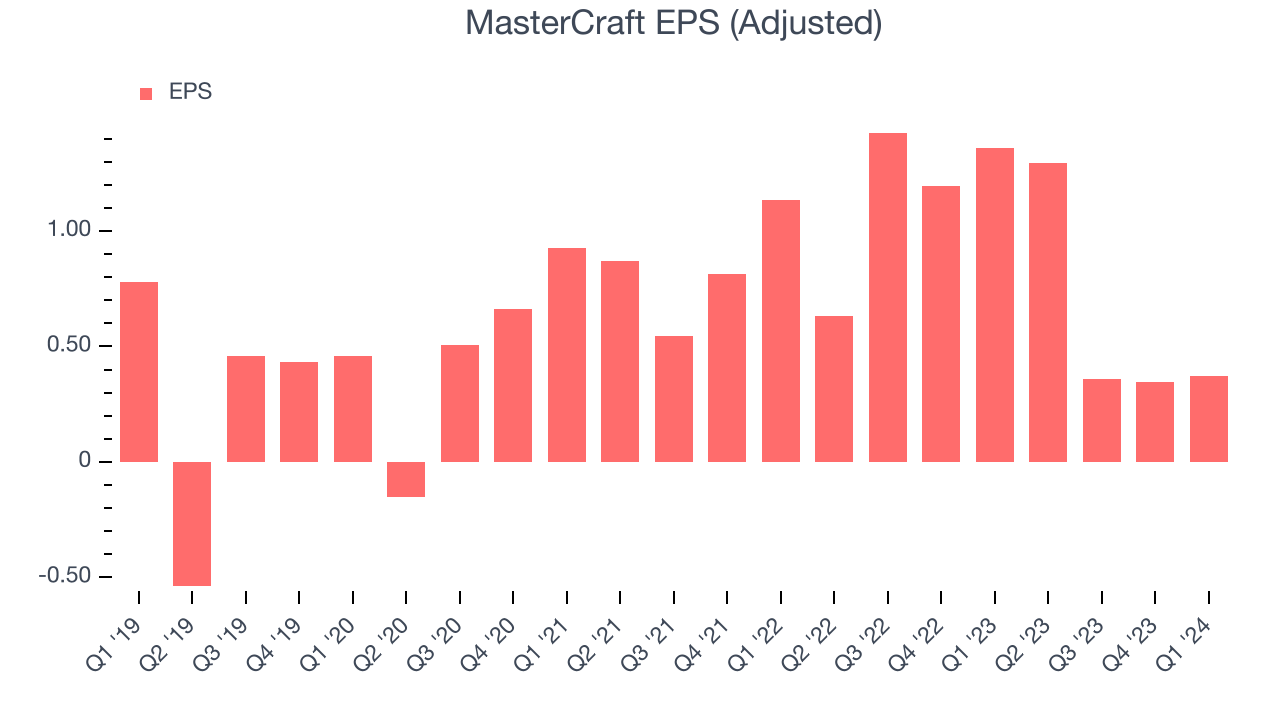

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, MasterCraft's EPS was roughly flat, which isn't ideal. We hope the company can generate some earnings growth in the future.

In Q1, MasterCraft reported EPS at $0.37, down from $1.36 in the same quarter last year. Despite falling year on year, this print beat analysts' estimates by 61.9%. Over the next 12 months, Wall Street expects MasterCraft to perform poorly. Analysts are projecting its LTM EPS of $2.37 to shrink by 10.7% to $2.12.

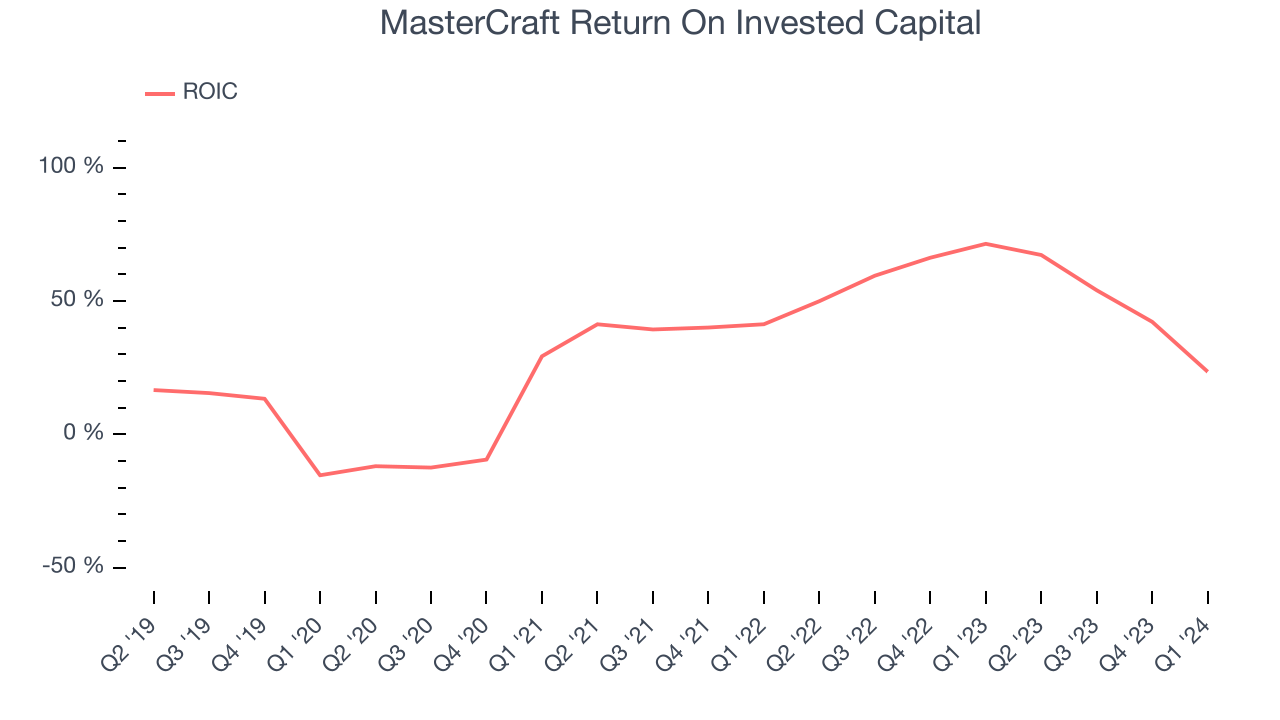

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although MasterCraft hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 30.1%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, MasterCraft's ROIC has significantly increased. This is a good sign, and we hope the company can continue improving.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

MasterCraft reported $22.51 million of cash and $53.21 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $64.37 million of EBITDA over the last 12 months, we view MasterCraft's 0.5x net-debt-to-EBITDA ratio as safe. We also see its $1.03 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from MasterCraft's Q1 Results

We were impressed by how significantly MasterCraft blew past analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its full-year revenue and EPS guidance fell short of Wall Street's estimates. Overall, this was a bad quarter for MasterCraft. The company is down 5.7% on the results and currently trades at $18.94 per share.

Is Now The Time?

MasterCraft may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of MasterCraft, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, and analysts expect growth to deteriorate from here. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its number of boats sold has been disappointing. On top of that, its projected EPS for the next year is lacking.

MasterCraft's price-to-earnings ratio based on the next 12 months is 9.5x. While there are some things to like about MasterCraft and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $23.50 per share right before these results (compared to the current share price of $18.94).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.