Database software company MongoDB (MDB) reported strong growth in the Q4 FY2021 earnings announcement, with revenue up 38.43% year on year to $171.0 million. MongoDB made a GAAP loss of $75.80 million, down on its loss of $62.56 million, in the same quarter last year.

MongoDB (MDB) Q4 FY2021 Highlights:

- Revenue: $171.0 million vs analyst estimates of $157.0 million (8.9% beat)

- EPS (non-GAAP): -$0.33 vs analyst estimates of -$0.39

- Revenue guidance for Q1 2022 is $168.5 million at the midpoint, above analyst estimates of $166.8 million

- Management's revenue guidance for FY2022 of $755.0 million at the midpoint, predicting 27.88% growth (vs 49.56% in FY2021)

- Free cash flow was negative -$20.66 million, compared to negative free cash flow of -$14.93 million in previous quarter

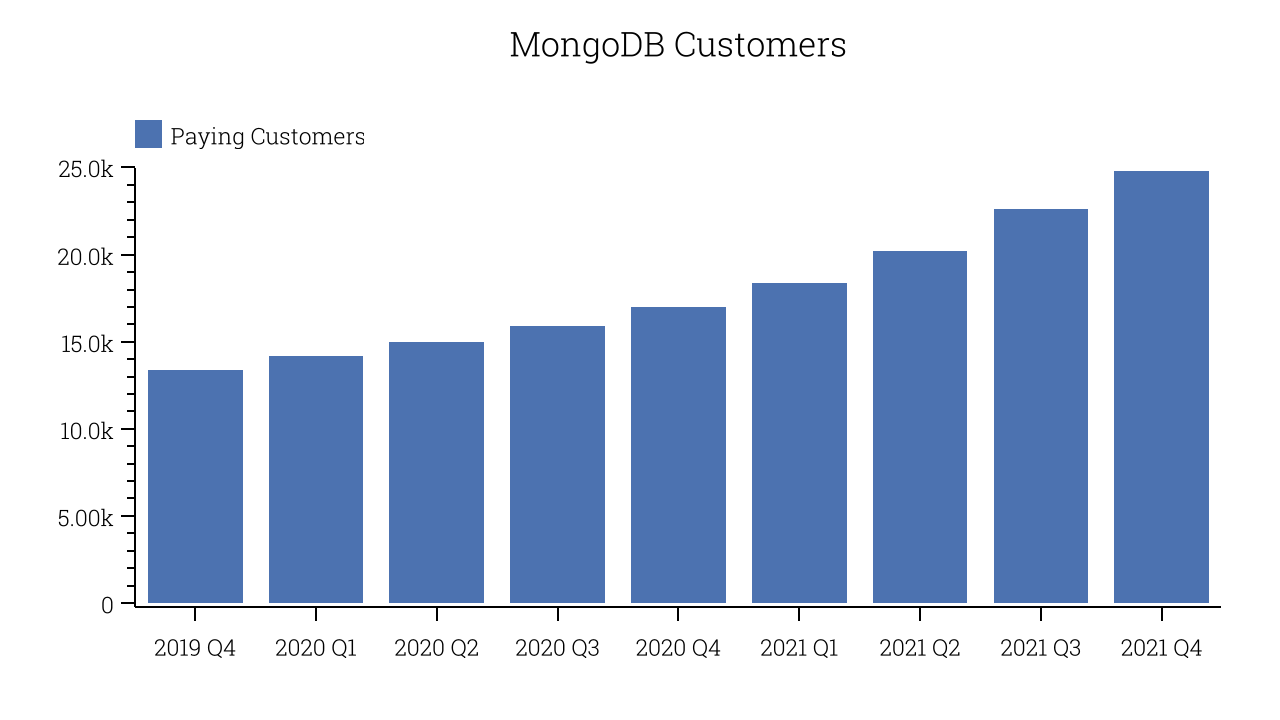

- 24,800 customers, up from 22,600 in previous quarter

- Gross Margin (GAAP): 70.18%, up from 69.42% previous quarter

"As we look ahead to fiscal 2022, MongoDB is in an excellent position to benefit from the shift to the cloud and the need to build smarter and more powerful applications that transform a company's business. We are confident in our ability to keep delivering strong growth at scale and will continue to invest in our platform to ensure we fully capitalize on our large market opportunity over the long-term," said Dev Ittycheria, President and Chief Executive Officer of MongoDB.

Database As A Service

MongoDB was started in 2007 by the team behind Google’s ad platform DoubleClick, and offers database-as-a-service that helps companies store large volumes of semi-structured data. The standard relational databases function like Excel on steroids, they store data in rows and columns across different tables. This works well if you need to store a lot of data that has similar structure, but can create potential inefficiencies if the structure of the data you are storing varies a lot. MongoDB instead stores data in records called documents, which similarly to a patient’s documents in a doctor’s office, have all the data for one entity in one folder, even though what is in the folder can vary a lot between entities.

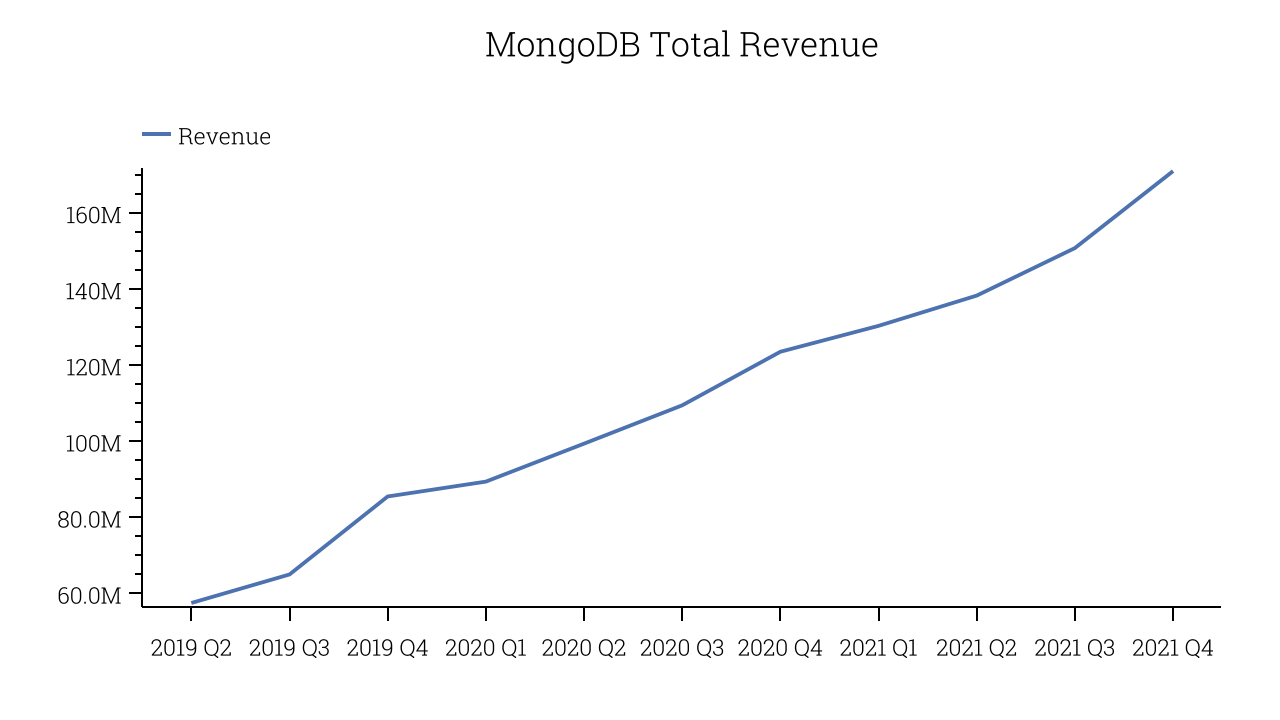

There are many types of databases and they all have their pros and cons and can be useful for different purposes, but the overall need to store data has been growing consistently for many years. As you can see below, MongoDB's revenue growth has been impressive over the last twelve months, growing from $123.5 million to $171.0 million.

And unsurprisingly, this was another great quarter for MongoDB with revenue up an absolutely stunning 38.43% year on year. On top of that, revenue increased $20.23 million quarter on quarter, a very strong improvement on the $12.49 million increase in Q3 2021, and a sign of re-acceleration of growth.

Free Can Be A Good Business

Similarly to other businesses like Elastic (ESTC), MongoDB is built on a business model that combines free open source software with paid offerings. The paid product has features valuable for enterprise customers and offers a fully hosted service, but developers can also download and use limited version of MongoDB for free, which makes it really easy to try and evaluate.

You can see below that MongoDB reported 24,800 customers at the end of the quarter, an increase of 2,200 on last quarter. That's about the same customer growth as what we seen last quarter and quite a bit again above what we have typically seen over the last year, confirming the company is sustaining a good pace of sales.

Key Takeaways from MongoDB's Q4 Results

With market capitalisation of $17.30 billion, more than $957.7 million in cash and operating close to free cash flow break-even, we're confident that MongoDB has the resources it needs to pursue a high growth business strategy.

We were impressed by how strongly MongoDB outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. On the other hand, it was disappointing that the revenue guidance for next year was a little weaker than we expected. But overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Therefore, we think MongoDB will become more attractive to investors, compared to before these results.

The author has no position in any of the stocks mentioned.