As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the data storage stocks, starting with MongoDB (NASDAQ:MDB).

Data is the lifeblood of the internet and software in general, and the amount of data created is growing at an accelerating pace. Likewise, the importance of storing the data in scalable and efficient formats continues to rise, especially as the diversity of the data and associated use cases expand from analyzing simple, structured data to high-scale processing of unstructured data, images, audio and video.

The 5 data storage stocks we track reported a solid Q4; on average, revenues beat analyst consensus estimates by 3.99%, while on average next quarter revenue guidance was 1.45% above consensus. Technology stocks have been hit hard on fears of higher interest rates , but data storage stocks held their ground better than others, with the share price up 9.41% since earnings, on average.

MongoDB (NASDAQ:MDB)

Started in 2007 by the team behind Google’s ad platform DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

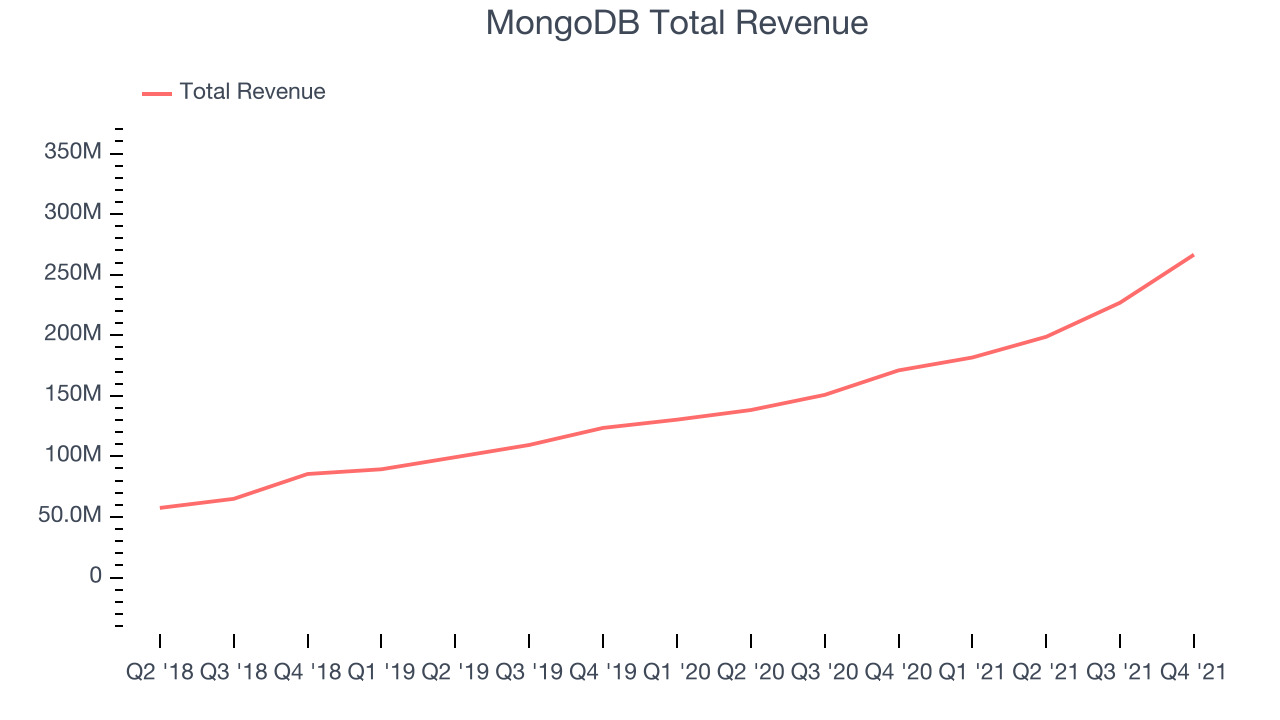

MongoDB reported revenues of $266.4 million, up 55.8% year on year, beating analyst expectations by 9.47%. It was a strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

"MongoDB delivered exceptional fourth quarter results, highlighted by delivering 85% Atlas revenue growth and surpassing $1 billion in annualized revenue. Our success is being driven by the fact that our modern application data platform dramatically reduces friction in the development process to make it incredibly easy for developers to build compelling applications that create a competitive advantage," said Dev Ittycheria, President and Chief Executive Officer of MongoDB.

MongoDB scored the strongest analyst estimates beat and highest full year guidance raise of the whole group. The company added 106 enterprise customers paying more than $100,000 annually to a total of 1,307. The stock is up 54.6% since the results and currently trades at $435.99.

Is now the time to buy MongoDB? Access our full analysis of the earnings results here, it's free.

Best Q4: Snowflake (NYSE:SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

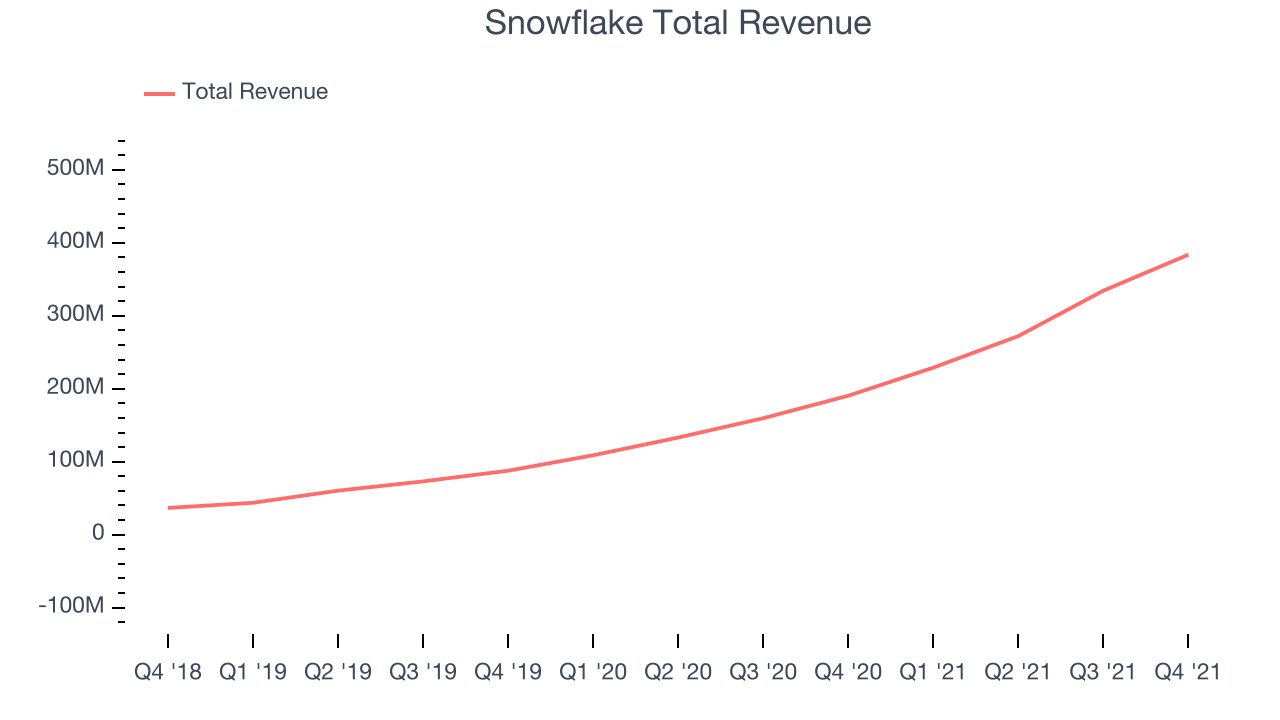

Snowflake reported revenues of $383.7 million, up 101% year on year, beating analyst expectations by 2.92%. It was a very strong quarter for the company, with an exceptional revenue growth and a meaningful improvement in net revenue retention rate.

Snowflake achieved the fastest revenue growth among its peers. The company added 36 enterprise customers paying more than $1m annually to a total of 184. The stock is down 19.4% since the results and currently trades at $214.41.

Is now the time to buy Snowflake? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Couchbase (NASDAQ:BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database as a service platform that allows enterprises to store large volumes of semi-structured data.

Couchbase reported revenues of $35 million, up 19.2% year on year, beating analyst expectations by 3.13%. It was a slower quarter for the company, with a full year guidance missing analysts' expectations and an underwhelming revenue guidance for the next quarter.

Couchbase had the weakest full year guidance update in the group. The stock is down 1.99% since the results and currently trades at $18.22.

Read our full analysis of Couchbase's results here.

Commvault Systems (NASDAQ:CVLT)

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention and compliance.

Commvault Systems reported revenues of $202.3 million, up 7.65% year on year, beating analyst expectations by 3.91%. It was a mixed quarter for the company, with a decent beat of top-line estimates but slow revenue growth.

Commvault Systems had the slowest revenue growth among the peers. The company added 62 enterprise customers paying more than $100,000 annually to a total of 225. The stock is down 3.35% since the results and currently trades at $65.49.

Read our full, actionable report on Commvault Systems here, it's free.

DigitalOcean (NYSE:DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $119.6 million, up 36.7% year on year, in line with analyst expectations. It was a strong quarter for the company, with accelerating customer growth and revenue guidance for the full year in line with analysts' expectations.

DigitalOcean had the weakest performance against analyst estimates among the peers. The company added 11,000 customers to a total of 609,000. The stock is up 17.1% since the results and currently trades at $54.99.

Read our full, actionable report on DigitalOcean here, it's free.

The author has no position in any of the stocks mentioned