Database software company MongoDB (MDB) reported Q4 FY2024 results exceeding Wall Street analysts' expectations, with revenue up 26.8% year on year to $458 million. On the other hand, next quarter's revenue guidance of $438 million was less impressive, coming in 2.5% below analysts' estimates. It made a non-GAAP profit of $0.86 per share, improving from its profit of $0.57 per share in the same quarter last year.

MongoDB (MDB) Q4 FY2024 Highlights:

- Revenue: $458 million vs analyst estimates of $435.6 million (5.2% beat)

- EPS (non-GAAP): $0.86 vs analyst estimates of $0.48 (79.1% beat)

- Revenue Guidance for Q1 2025 is $438 million at the midpoint, below analyst estimates of $449.1 million

- Management's revenue guidance for the upcoming financial year 2025 is $1.92 billion at the midpoint, missing analyst estimates by 5.8% and implying 13.8% growth (vs 31.3% in FY2024)

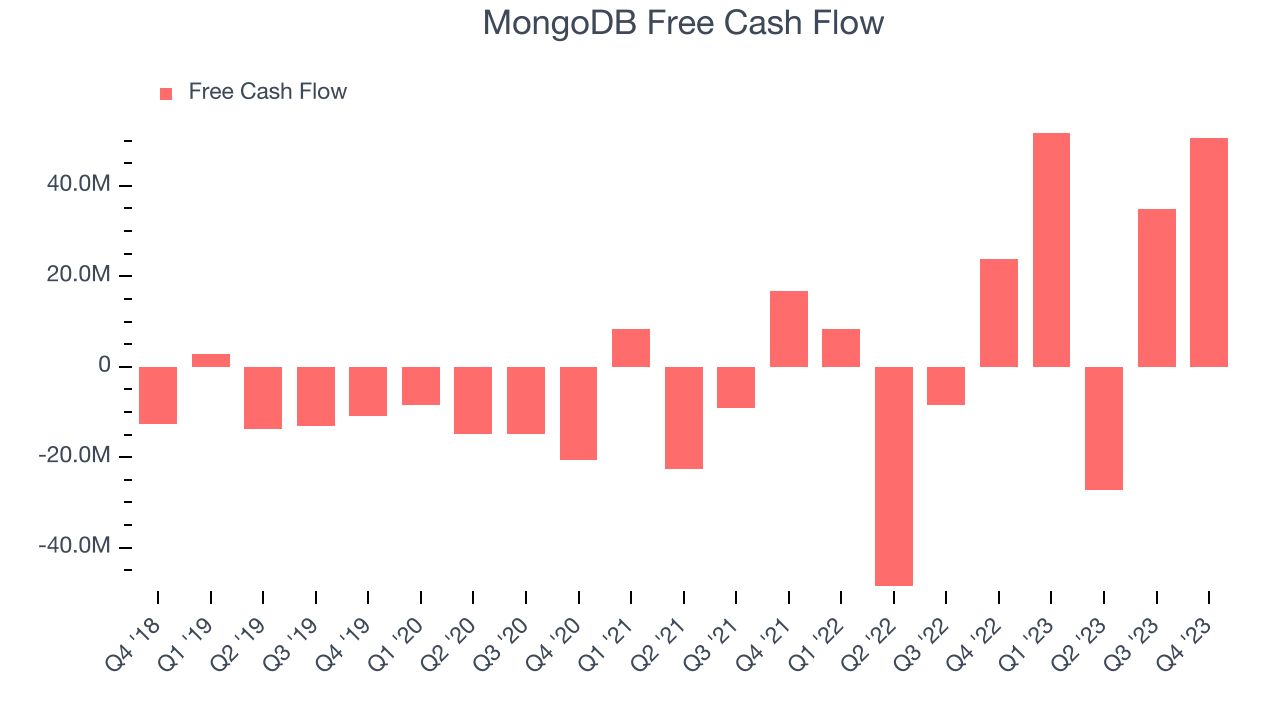

- Free Cash Flow of $50.49 million, up 44.4% from the previous quarter

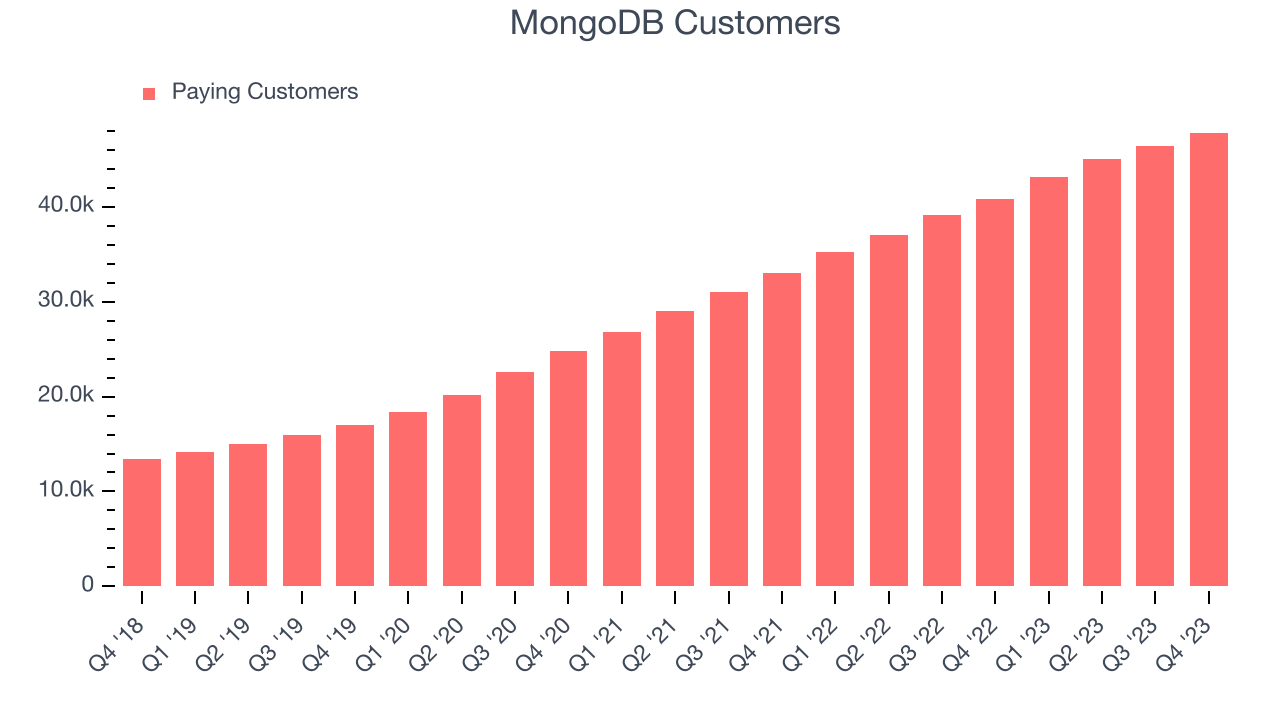

- Customers: 47,800, up from 46,400 in the previous quarter

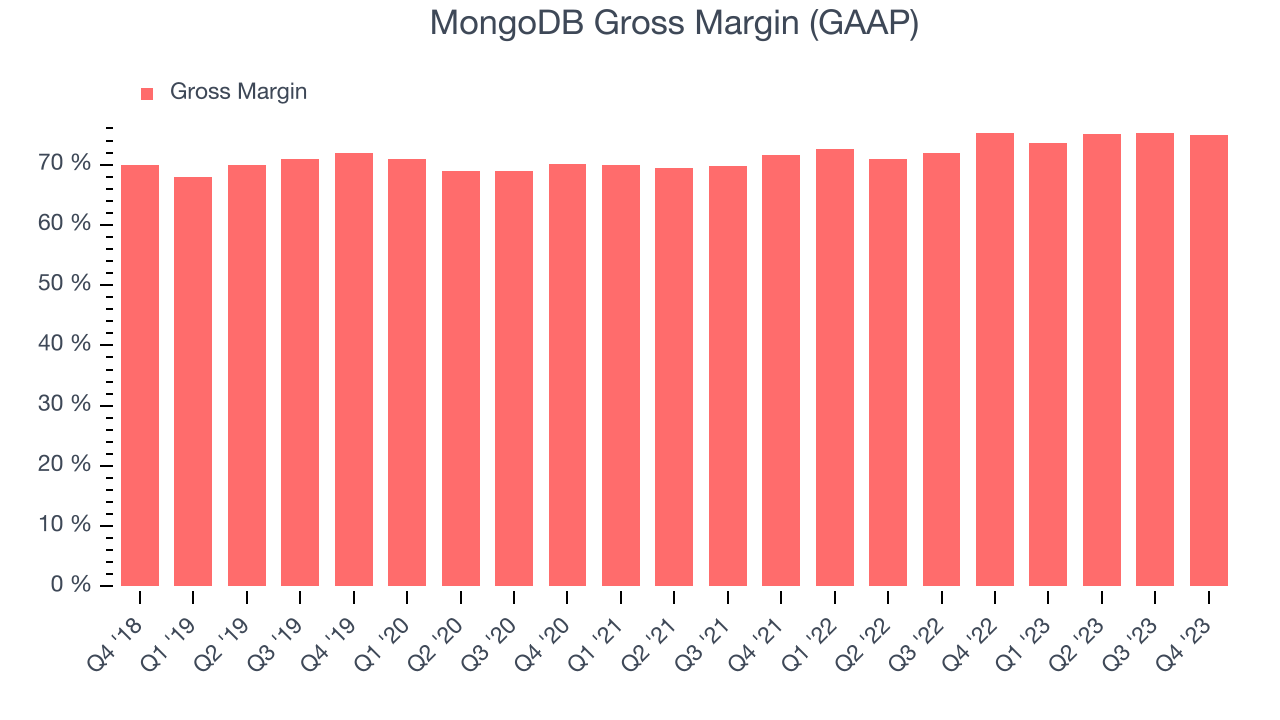

- Gross Margin (GAAP): 75%, in line with the same quarter last year

- Market Capitalization: $29.56 billion

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

The standard relational databases function like Excel on steroids, they store data in rows and columns across different tables. This works well if you need to store a lot of data that has a similar structure, but it can create potential inefficiencies if the structure of the data you are storing varies a lot. MongoDB instead stores data in records called documents, which, similarly to a patient’s documents in a doctor’s office, have all the data for one entity in one folder, even though what is in the folder can vary a lot between entities.

Similar to other businesses like Elastic (ESTC), MongoDB is built on a business model that combines free open source software with paid offerings. The paid product has features valuable for enterprise customers and offers a fully hosted service, but developers can also download and use the limited version of MongoDB for free, which makes it really easy to try and evaluate.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Competitors include database providers such as IBM (NYSE:IBM), and Oracle (NYSE:ORCL) as well as cloud offerings provided by Amazon (NASDAQ:AMZN), Google, and Microsoft (NASDAQ:MSFT).

Sales Growth

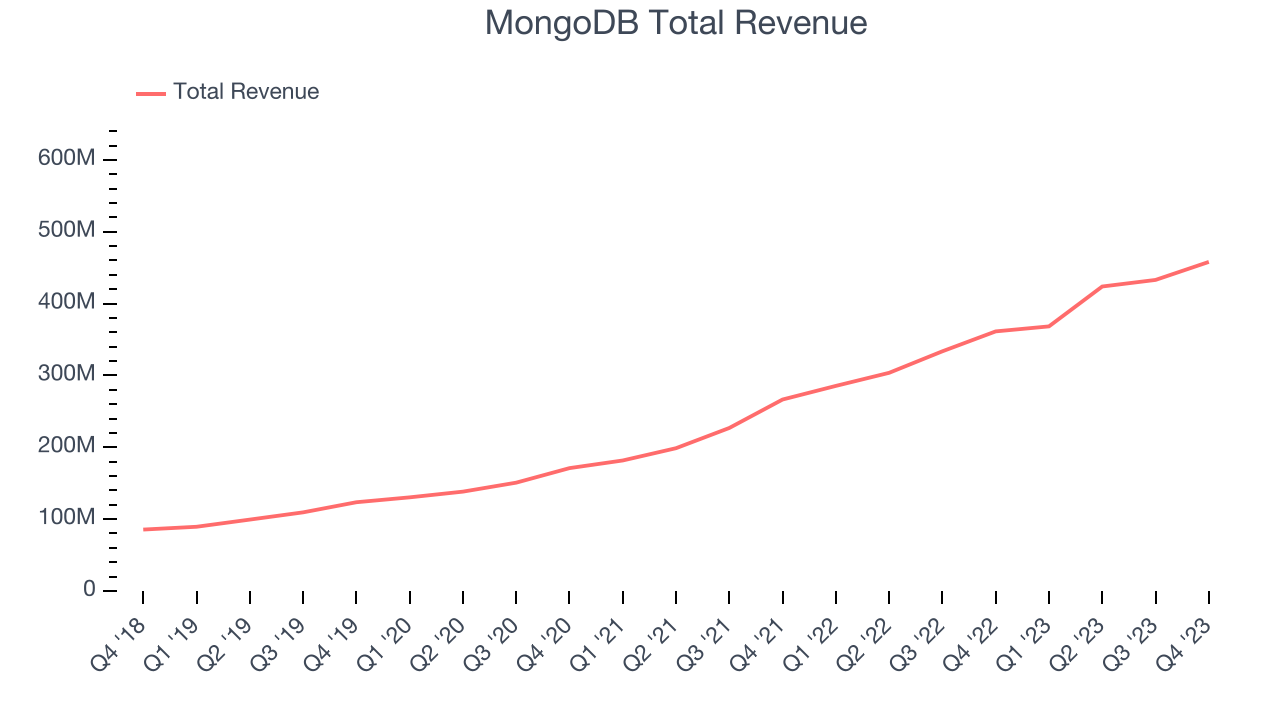

As you can see below, MongoDB's revenue growth has been very strong over the last two years, growing from $266.5 million in Q4 FY2022 to $458 million this quarter.

This quarter, MongoDB's quarterly revenue was once again up a very solid 26.8% year on year. On top of that, its revenue increased $25.06 million quarter on quarter, a very strong improvement from the $9.15 million increase in Q3 2024. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that MongoDB is expecting revenue to grow 18.9% year on year to $438 million, slowing down from the 29% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.92 billion at the midpoint, growing 13.8% year on year compared to the 31.1% increase in FY2024.

Customer Growth

MongoDB reported 47,800 customers at the end of the quarter, an increase of 1,400 from the previous quarter. That's in line with the customer growth we observed last quarter but a bit below what we've typically seen over the last year, suggesting that sales momentum may be slowing a little.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. MongoDB's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 75% in Q4.

That means that for every $1 in revenue the company had $0.75 left to spend on developing new products, sales and marketing, and general administrative overhead. MongoDB's gross margin is around the average of a typical SaaS businesses. It's encouraging to see its gross margin remain stable, indicating that MongoDB is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. MongoDB's free cash flow came in at $50.49 million in Q4, up 112% year on year.

MongoDB has generated $109.9 million in free cash flow over the last 12 months, or 6.5% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from MongoDB's Q4 Results

We enjoyed seeing MongoDB exceed analysts' revenue expectations and deliver strong free cash flow this quarter. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand. Overall, this was a mixed quarter for MongoDB. The company is down 7.1% on the results and currently trades at $382.94 per share.

Is Now The Time?

MongoDB may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think MongoDB is a good business. We'd expect growth rates to moderate from here, but its revenue growth has been impressive. And while its low free cash flow margins give it little breathing room, the good news is its customers are increasing their spending quite quickly, suggesting they love the product. On top of that, its strong gross margins suggest it can operate profitably and sustainably.

MongoDB's price-to-sales ratio based on the next 12 months of 14.7x indicates that the market is certainly optimistic about its growth prospects. There's definitely a lot of things to like about MongoDB and looking at the tech landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $471.64 per share right before these results (compared to the current share price of $382.94), implying they saw upside in buying MongoDB in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.