As online marketplace stocks’ Q1 earnings season wraps, let's dig into this quarter's best and worst performers, including MercadoLibre (NASDAQ:MELI) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission paying sellers, generating flywheel scale effects which feed back into further customer acquisition.

The 11 online marketplace stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 3.34%, while on average next quarter revenue guidance was 1.52% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but online marketplace stocks held their ground better than others, with the share prices up 4.09% since the previous earnings results, on average.

Best Q1: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

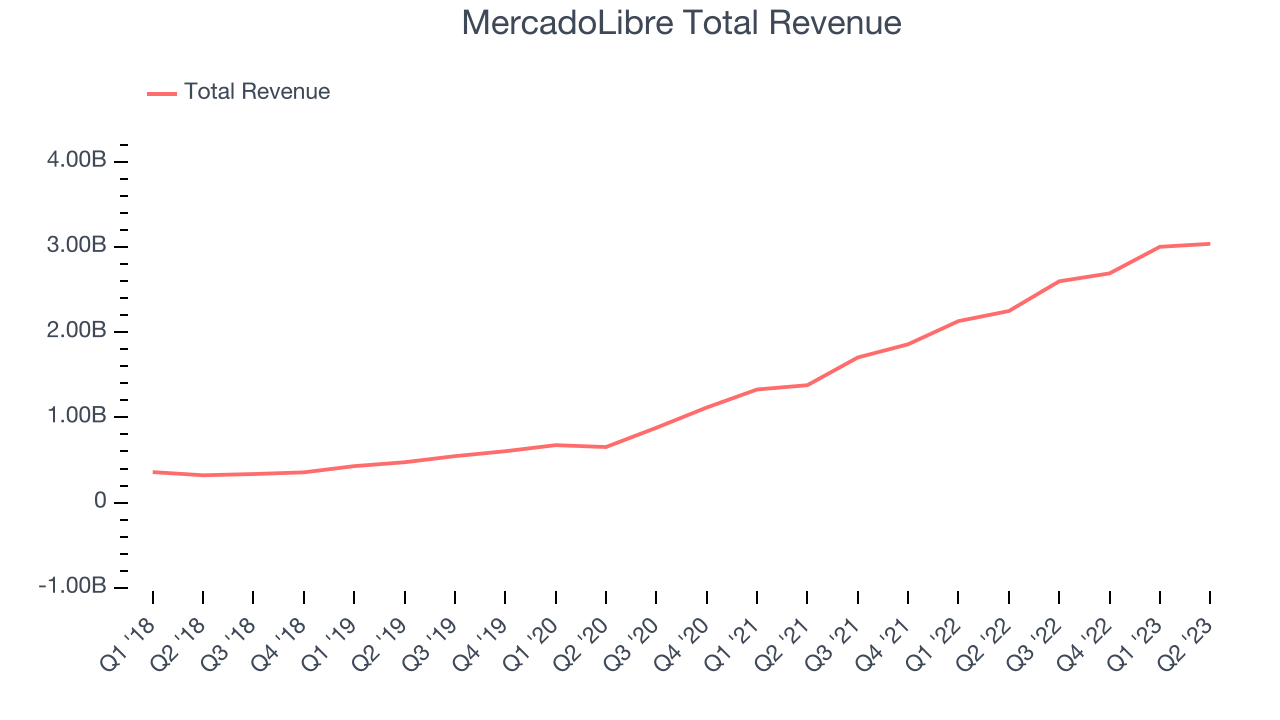

MercadoLibre reported revenues of $3.04 billion, up 35.1% year on year, beating analyst expectations by 5.22%. It was a very strong quarter for the company, with growing number of users and a solid beat of analyst estimates.

MercadoLibre pulled off the fastest revenue growth of the whole group. The company reported 101 million daily active users, up 24.7% year on year. The stock is down 10.4% since the results and currently trades at $1,150.21.

LegalZoom (NASDAQ:LZ)

LegalZoom (NASDAQ:LZ) is an online platform that provides online legal services to individuals and small businesses. The company’s co-founders found it difficult and expensive to find lawyers and file paperwork when trying to start a business so they started LegalZoom instead to address this pain point.

LegalZoom reported revenues of $165.9 million, up 7.6% year on year, beating analyst expectations by 6.94%. It was a strong quarter for the company, with a solid beat of analyst estimates. In addition, revenue and adjusted EBITDA guidance for the next quarter were above consensus, and the full-year revenue guidance was lifted.

LegalZoom pulled off the highest full year guidance raise among its peers. The company reported 1.5 million users, up 10.2% year on year. The stock is up 38.2% since the results and currently trades at $11.53.

Is now the time to buy LegalZoom? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Sea Limited (NYSE:SE)

Founded in 2009 and a publicly-traded company since 2017, Sea Limited (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea Limited reported revenues of $3.04 billion, up 4.88% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining users and slow revenue growth. Looking ahead, management did not provide guidance but said that "as we continue to fine-tune our operations and navigate near-term macro uncertainties, we remain highly confident in the long-term opportunities in our markets and our ability to capture those profitably."

The company reported 37.6 million paying users, down 38.8% year on year. The stock is down 37.8% since the results and currently trades at $54.82.

Read our full analysis of Sea Limited's results here.

CarGurus (NASDAQ:CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ:CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $232 million, down 46.1% year on year, beating analyst expectations by 8.22%. It was a solid quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

CarGurus scored the strongest analyst estimates beat but had the slowest revenue growth among the peers. The company reported 31.3 thousand users, up 1.37% year on year. The stock is up 32.1% since the results and currently trades at $21.63.

Read our full, actionable report on CarGurus here, it's free.

Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $1.82 billion, up 20.5% year on year, beating analyst expectations by 1.72%. It was a mixed quarter for the company, with growing number of users but an underwhelming revenue guidance for the next quarter.

The company reported 121.1 million nights booked, up 18.6% year on year. The stock is up 0.48% since the results and currently trades at $127.62.

Read our full, actionable report on Airbnb here, it's free.

The author has no position in any of the stocks mentioned