Latin American e-commerce and fintech company MercadoLibre (NASDAQ:MELI) beat analysts' expectations in Q1 CY2024, with revenue up 42.7% year on year to $4.33 billion. It made a GAAP profit of $6.78 per share, improving from its profit of $3.92 per share in the same quarter last year.

MercadoLibre (MELI) Q1 CY2024 Highlights:

- Revenue: $4.33 billion vs analyst estimates of $3.87 billion (12.1% beat)

- EPS: $6.78 vs analyst estimates of $5.95 (14% beat)

- Gross Margin (GAAP): 46.7%, down from 50.6% in the same quarter last year

- Free Cash Flow of $1.37 billion, down 21.9% from the previous quarter

- Market Capitalization: $73.84 billion

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

The company connects buyers and sellers in the majority of countries across the continent. MercadoLibre allows buyers to browse and purchase products ranging from furniture to groceries, while sellers can list products and access tools to manage online stores. The company also offers payment and shipping solutions, as well as financial services such as loans through subsidiary MercadoPago.

MercadoLibre addresses the lack of a reliable and convenient e-commerce platform in Latin America. Before MercadoLibre, consumers in the region had to rely on traditional stores or informal markets to purchase goods, which often meant time spent going from one physical location to another, limited options, and sometimes uncompetitive prices. Sellers could only reach buyers who were close enough to physically visit their store or stand. MercadoLibre therefore provides a convenient and trusted way for consumers to shop online, while also allowing sellers to reach a wider audience.

MercadoLibre generates revenue primarily through commissions on transactions, as the company holds no inventory. For example, when a seller makes a sale, MercadoLibre charges a commission ranging from mid-single-digits percentages to mid-teens percentages, depending on the category and sales volume. Advertising and its fintech services are additional sources of revenue.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors operating similar platforms include Amazon.com (NASDAQ:AMZN), Alibaba (NYSE:BABA), and eBay (NASDAQ:EBAY).Sales Growth

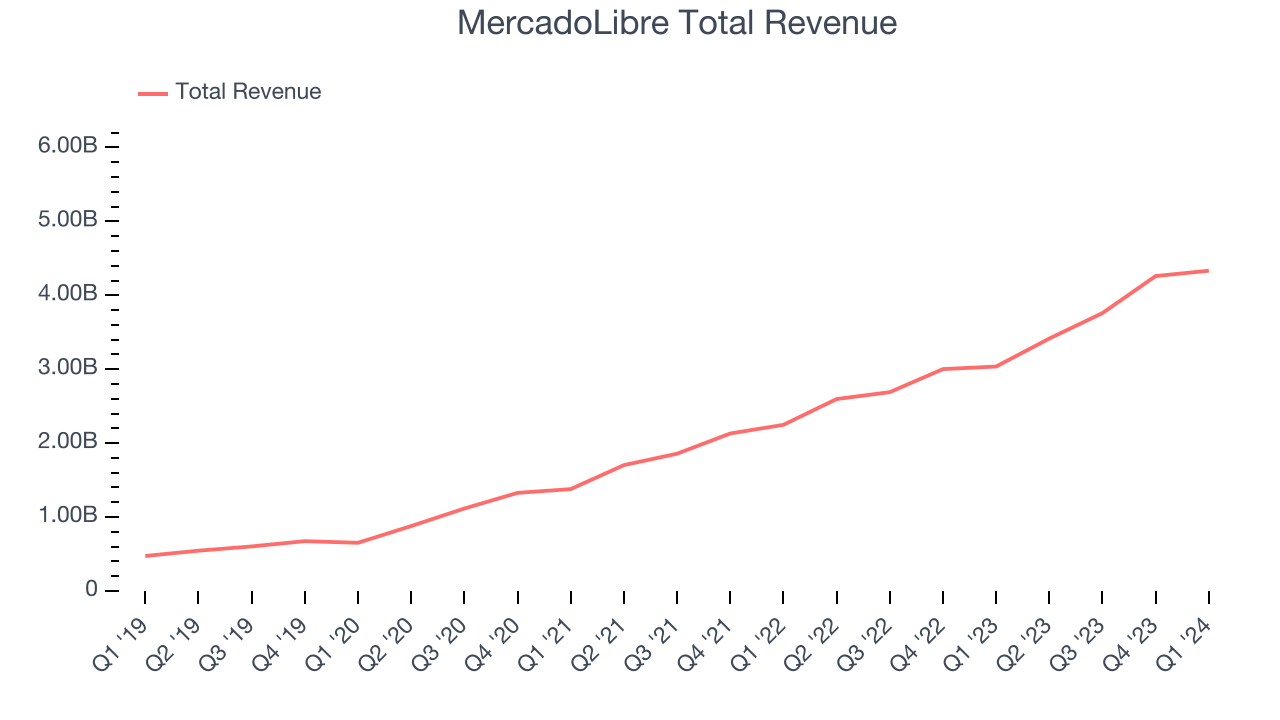

MercadoLibre's revenue growth over the last three years has been exceptional, averaging 51.1% annually. This quarter, MercadoLibre beat analysts' estimates and reported excellent 42.7% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 17.2% over the next 12 months.

Pricing Power

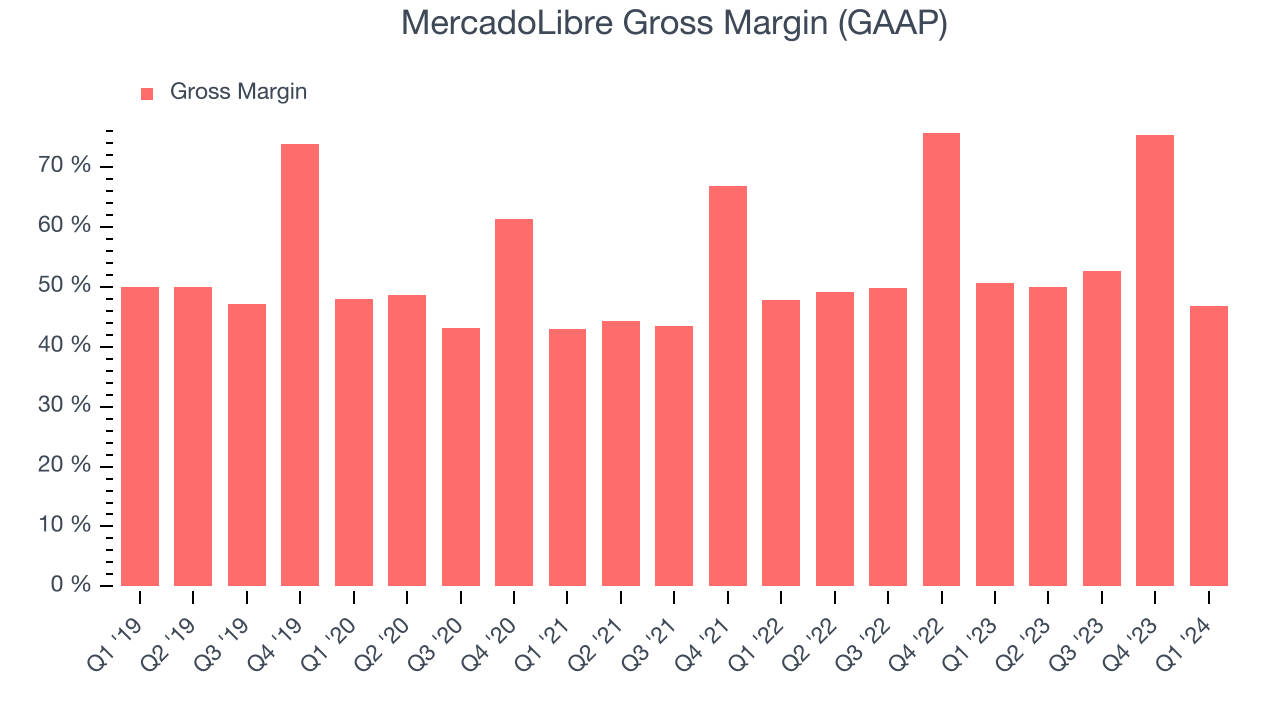

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

MercadoLibre's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 46.7% this quarter, down 3.9 percentage points year on year.

For online marketplaces like MercadoLibre, these aforementioned costs typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification. After paying for these expenses, MercadoLibre had $0.47 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

MercadoLibre's gross margins have been stable over the last 12 months, averaging 56.5%, and remain roughly in line with other consumer internet companies. These margins indicate that MercadoLibre is remaining competitive in a stable pricing environment.

User Acquisition Efficiency

Consumer internet businesses like MercadoLibre grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

MercadoLibre is extremely efficient at acquiring new users, spending only 21.2% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving MercadoLibre the freedom to invest its resources into new growth initiatives while maintaining optionality.

Profitability & Free Cash Flow

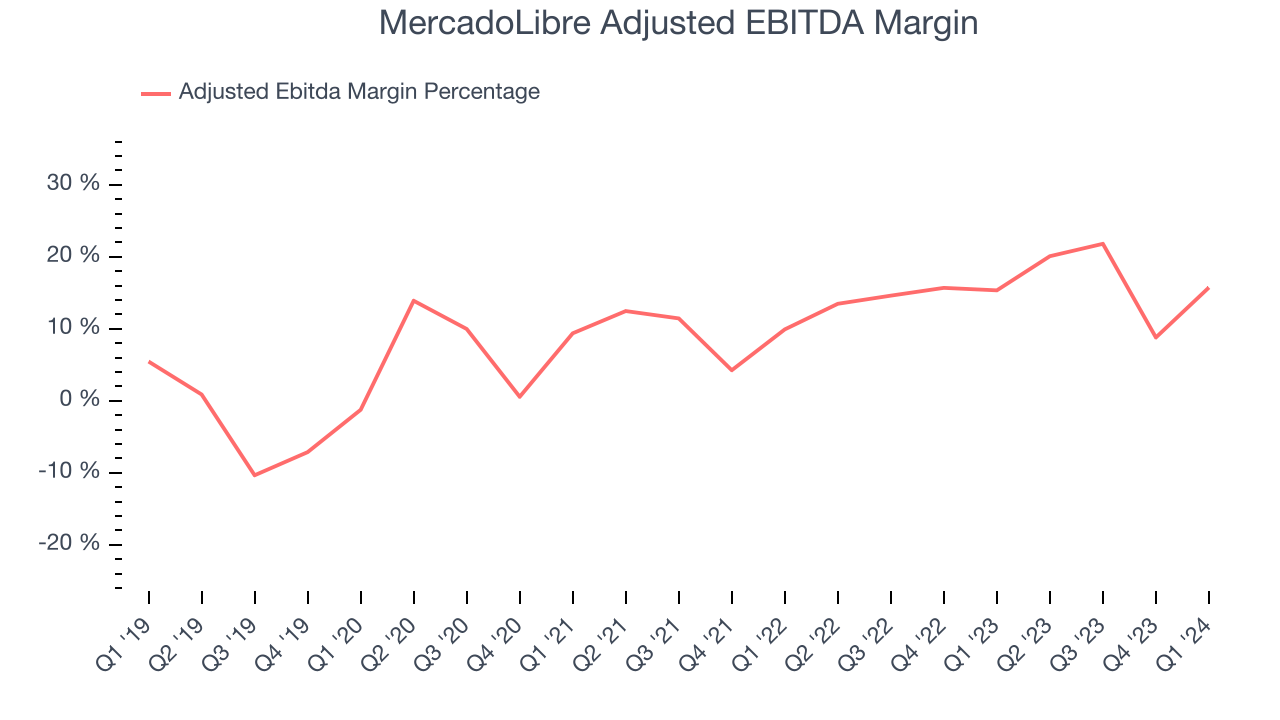

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

MercadoLibre reported EBITDA of $682 million this quarter, resulting in a 15.7% margin. Furthermore, MercadoLibre has shown strong profitability over the last four quarters, with average EBITDA margins of 16.3%.

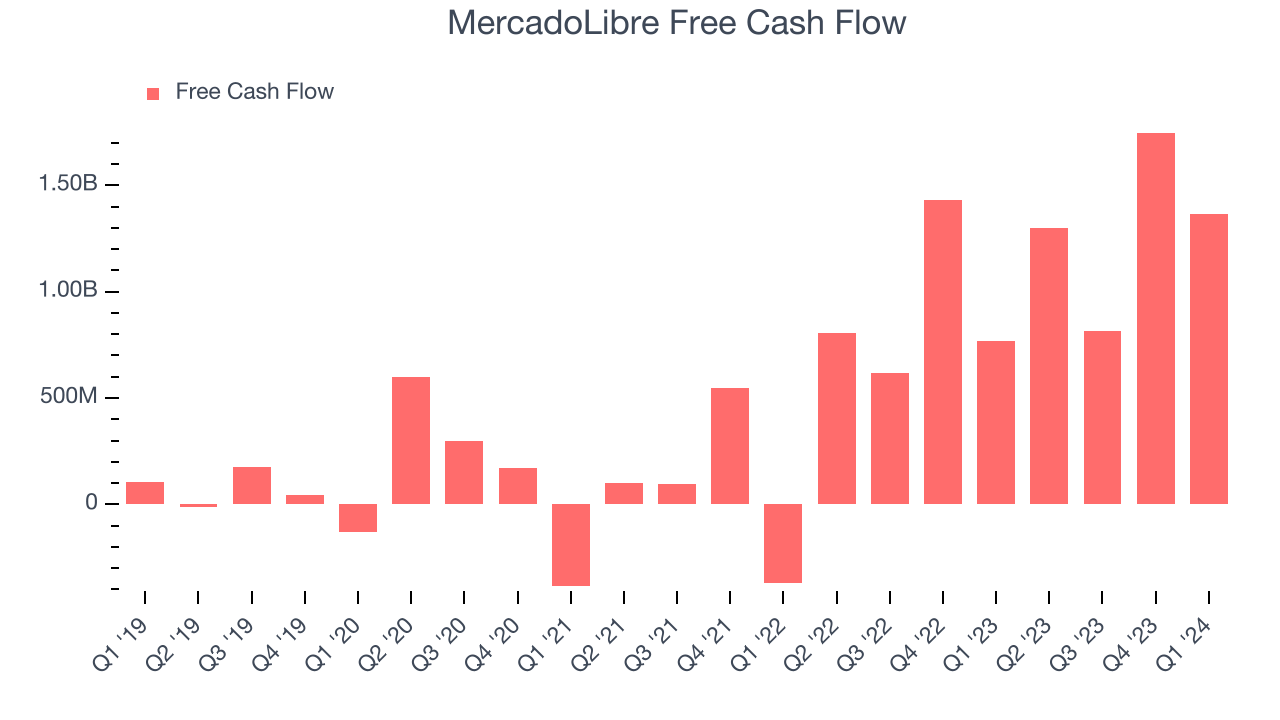

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. MercadoLibre's free cash flow came in at $1.37 billion in Q1, up 77.4% year on year.

MercadoLibre has generated $5.23 billion in free cash flow over the last 12 months, an eye-popping 33.1% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from MercadoLibre's Q1 Results

We were impressed by how significantly MercadoLibre blew past analysts' revenue and EPS estimates this quarter, driven by better-than-expected GMV on its e-commerce platform. The company stated it's seeing record levels of retention for its newest customer cohorts and strong traction for MELI+ as loyalty members are spending more than non-loyalty members. MercadoLibre's ad business is also growing nicely (64% year on year) and reached 1.9% of GMV, up from 1.4% in the same quarter last year.

On the other hand, the company's TPV missed Wall Street's projections, but looking under the hood, traction was still strong. MercadoPago users were up 38% year on year to 49 million MAUs while assets under management were up 90% year on year. The credit quality of its loan book also rose with late payments (90 days+) falling 10 percentage points year on year.

Turning to macro, Brazil and Mexico are still performing extremely well while Argentina is still struggling. Despite the Argentina headwinds, MELI still posted better consumption trends than the broader economy, which is encouraging. We're hopeful Argentina can turn it around with Javier Milei as its new president.

Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 7.2% after reporting and currently trades at $1,615 per share.

Is Now The Time?

When considering an investment in MercadoLibre, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think MercadoLibre is one of the best consumer internet companies out there. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. Additionally, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits and its user acquisition efficiency is best in class.

At the moment, MercadoLibre trades at 22.4x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, MercadoLibre's qualities really stand out, and we really like it at this price.

Wall Street analysts covering the company had a one-year price target of $1,903 per share right before these results (compared to the current share price of $1,615), implying they saw upside in buying MercadoLibre in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.