Social network operator Meta Platforms (NASDAQ: META) reported Q4 FY2022 results beating Wall St's expectations, with revenue down 4.47% year on year to $32.1 billion. The company expects that next quarter's revenue would be around $27.2 billion, which is the midpoint of the guidance range. That was in roughly line with analyst expectations. Meta made a GAAP profit of $4.65 billion, down on its profit of $10.2 billion, in the same quarter last year.

Is now the time to buy Meta? Access our full analysis of the earnings results here, it's free.

Meta (META) Q4 FY2022 Highlights:

- Revenue: $32.1 billion vs analyst estimates of $31.6 billion (1.49% beat)

- EPS: $1.76 vs analyst expectations of $2.24 (21.5% miss)

- Revenue guidance for Q1 2023 is $27.2 billion at the midpoint, roughly in line with what analysts were expecting

- Free cash flow of $5.28 billion, up from $173 million in previous quarter

- Gross Margin (GAAP): 74%, down from 81.1% same quarter last year

- Family Monthly Active People: 3.74 billion, up 150 million year on year

"Our community continues to grow and I'm pleased with the strong engagement across our apps. Facebook just reached the milestone of 2 billion daily actives," said Mark Zuckerberg, Meta founder and CEO.

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META ) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Sales Growth

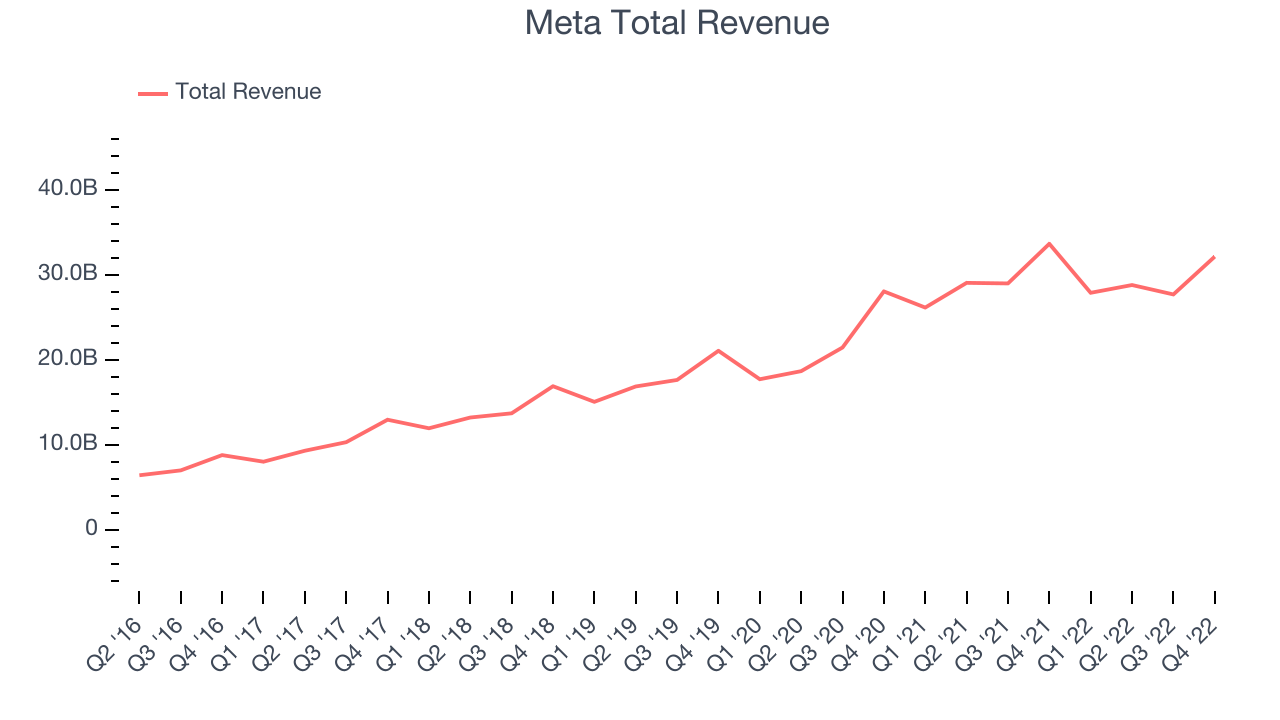

Meta's revenue growth over the last three years has been solid, averaging 19.8% annually. The initial impact of the pandemic was positive for Meta's revenue, pulling forward sales, but quarterly revenue subsequently normalized, year over year.

This quarter, Meta reported a rather lacklustre 4.47% year on year revenue decline, in line with analyst estimates.

Meta is guiding for revenue to decline next quarter 2.35% year on year to $27.2 billion, a further deceleration on the 6.63% year-over-year decrease in revenue the company had recorded in the same quarter last year.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Usage Growth

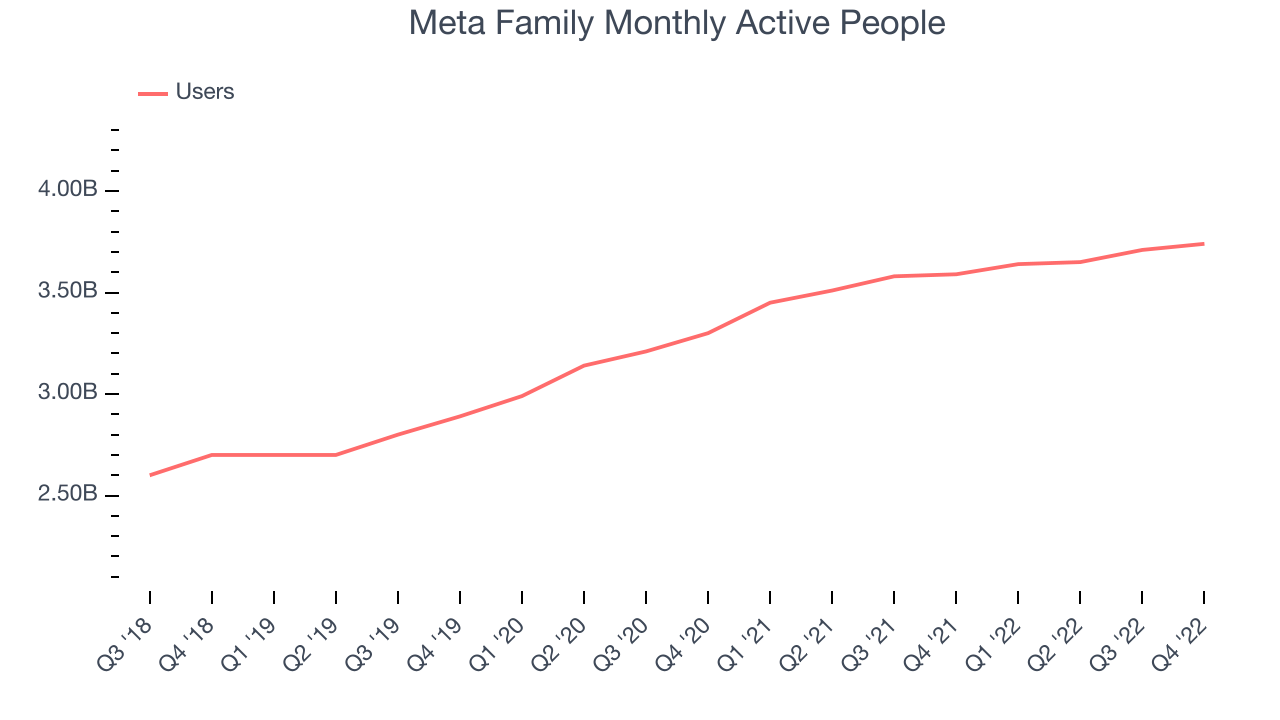

As a social network, Meta can generate revenue growth by increasing user numbers, and by charging more for the ads each user is exposed to.

Over the last two years the number of Meta's monthly active users, a key usage metric for the company, grew 8.09% annually to 3.74 billion users. This is decent growth for a consumer internet company.

In Q4 the company added 150 million monthly active users, translating to a 4.17% growth year on year.

Key Takeaways from Meta's Q4 Results

Sporting a market capitalization of $390 billion, more than $40.7 billion in cash and with positive free cash flow over the last twelve months, we're confident that Meta has the resources it needs to pursue a high growth business strategy.

Meta has reported results mostly in-line with analysts' estimates. And it topped analysts’ revenue expectations this quarter, even if just narrowly and user numbers are still growing. On the other hand, revenue has declined in absolute numbers. Overall, this quarter's results were decent, especially considering the numbers reported by Snap yesterday. The company is up 13% on the results and currently trades at $173.1 per share.

Meta may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.