Meta (NASDAQ:META) Q4 Sales Beat Estimates, Stock Soars

Anthony Lee /

February 1, 2024

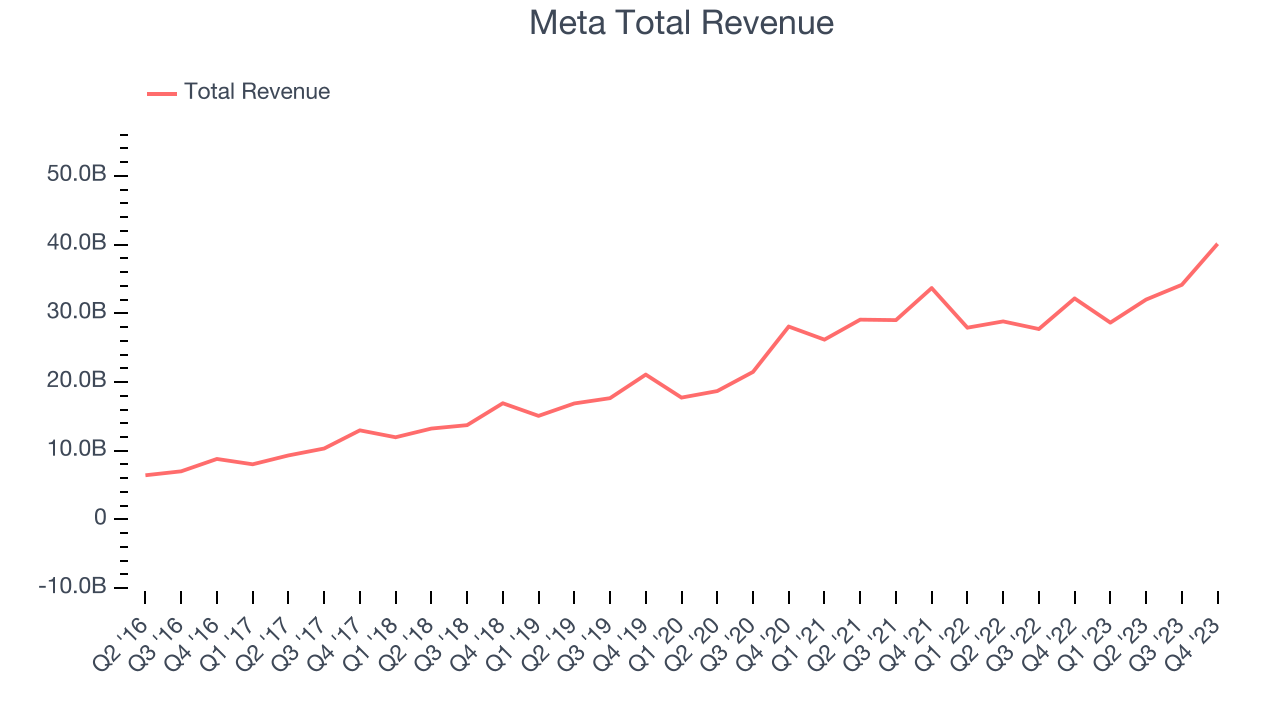

Social network operator Meta Platforms (NASDAQ:META) reported Q4 FY2023 results topping analysts' expectations, with revenue up 24.7% year on year to $40.11 billion. Guidance for next quarter's revenue was also optimistic at $35.75 billion at the midpoint, 5.5% above analysts' estimates. It made a GAAP profit of $5.33 per share, improving from its profit of $3.14 per share in the same quarter last year.

Is now the time to buy Meta? Find out in our full research report.

Meta (META) Q4 FY2023 Highlights:

- Revenue: $40.11 billion vs analyst estimates of $39.17 billion (2.4% beat)

- EPS: $5.33 vs analyst estimates of $4.94 (7.9% beat)

- Revenue Guidance for Q1 2024 is $35.75 billion at the midpoint, above analyst estimates of $33.87 billion

- Free Cash Flow of $11.51 billion, down 17.3% from the previous quarter

- Gross Margin (GAAP): 80.8%, up from 78.6% in the same quarter last year

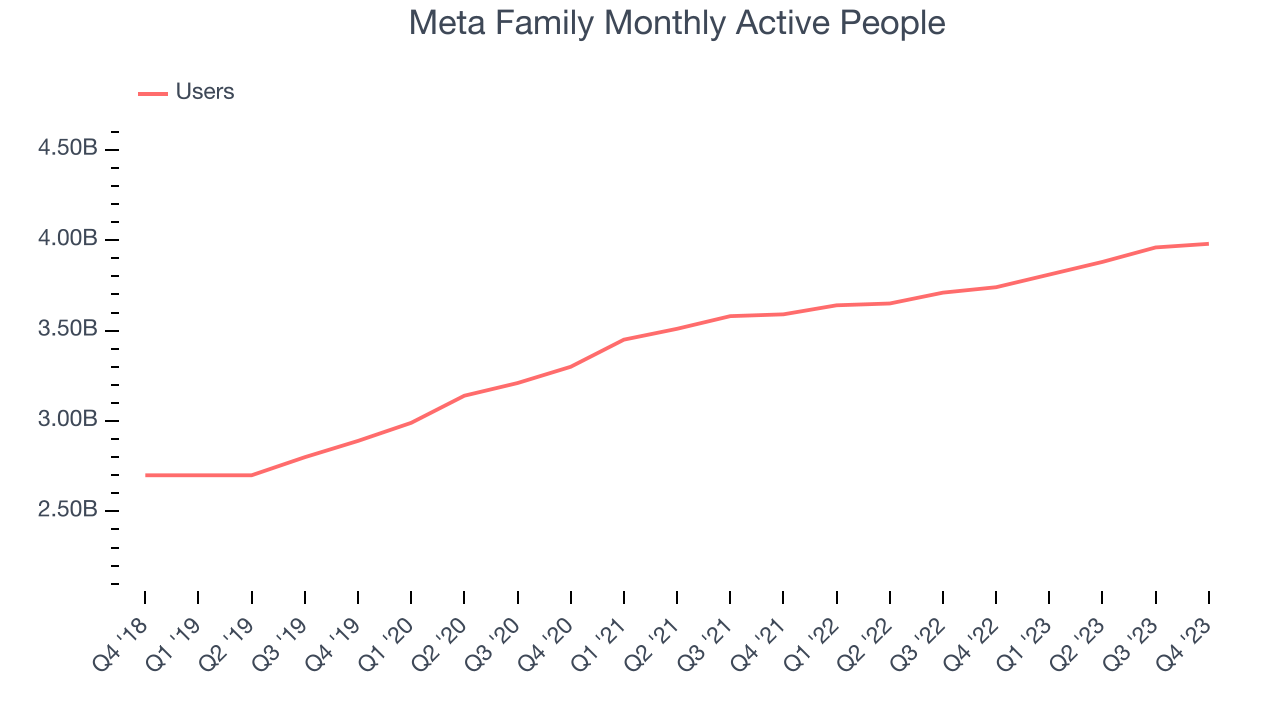

- Family Monthly Active People: 3.98 billion, up 240 million year on year

- Market Capitalization: $1.00 trillion

"We had a good quarter as our community and business continue to grow," said Mark Zuckerberg, Meta founder and CEO.

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Sales Growth

Meta's revenue growth over the last three years has been solid, averaging 18.1% annually. This quarter, Meta beat analysts' estimates and reported decent 24.7% year-on-year revenue growth.

Guidance for the next quarter indicates Meta is expecting revenue to grow 24.8% year on year to $35.75 billion, improving on the 2.6% year-on-year increase it recorded in the same quarter last year.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Usage Growth

As a social network, Meta generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Meta's monthly active users, a key performance metric for the company, grew 5.2% annually to 3.98 billion. This growth lags behind the hottest consumer internet apps.

In Q4, Meta added 240 million monthly active users, translating into 6.4% year-on-year growth.

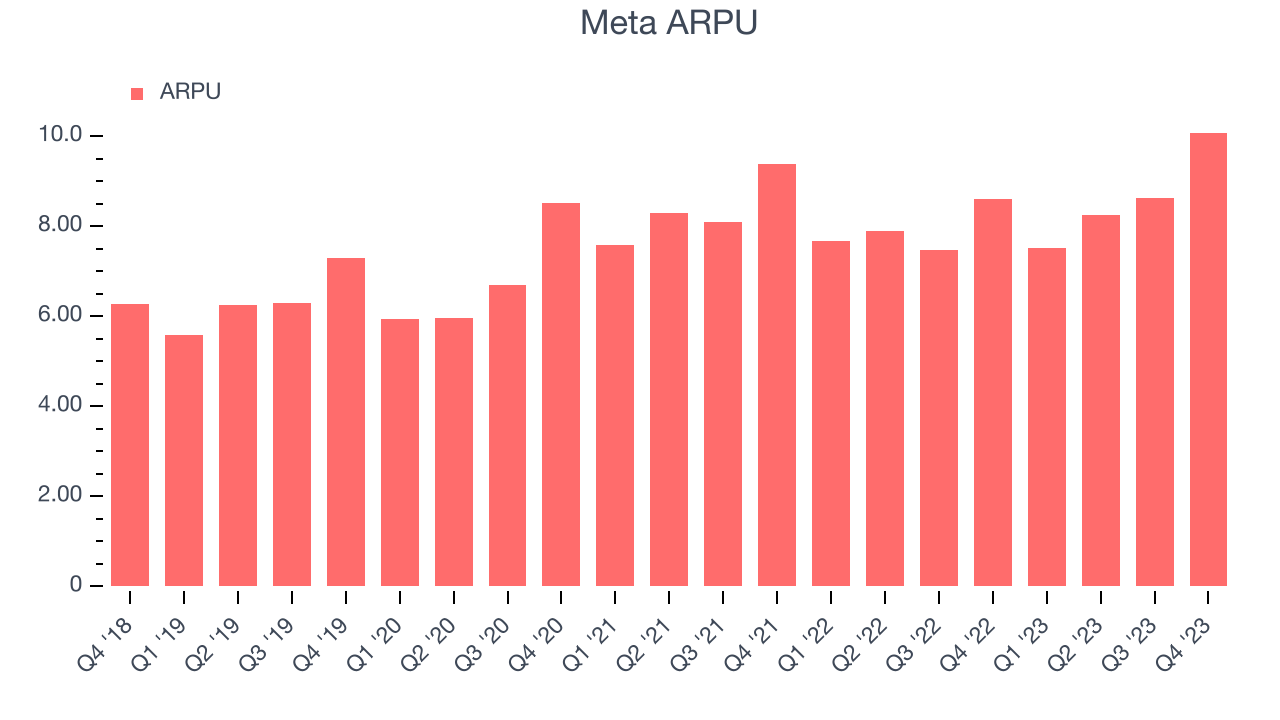

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Meta because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Meta's audience and its ad-targeting capabilities.

Meta's ARPU growth has been subpar over the last two years, averaging 1.9%. The company's ability to increase prices while maintaining its monthly active users, however, shows the value of its platform. This quarter, ARPU grew 17.2% year on year to $10.08 per user.

Key Takeaways from Meta's Q4 Results

We were impressed by Meta's revenue, operating income, and EPS growth this quarter, which all blew past analysts' estimates. These beats were driven by better-than-expected daily and monthly active users along with a 21% year-on-year increase in ad impressions. Meta also saw a 2% tailwind in advertising pricing. Commentary across the sector suggests the advertising market is likely to rebound in 2024, partly explaining why Meta had a strong quarter.

Looking ahead, Meta's Q1 2024 revenue guidance topped Wall Street's forecast while its anticipated full-year 2024 capital expenditures came in slightly higher. The company expects this capex growth to come from investments in servers, including AI and non-AI hardware (you're welcome, Nvidia), and data centers as it ramps up construction for its new data center architecture. These investments will be key for its open-source large language model, Llama, to successfully compete against OpenAI's closed-source ChatGPT.

Perhaps the most interesting part of the quarter was the announcement of a quarterly dividend - the first in the company's history. Stockholders as of February 22, 2024 are set to receive $0.50 per share per quarter.

Overall, we think this was a really good quarter that should please shareholders. The stock is up 8.3% after reporting and currently trades at $427.75 per share.

So should you invest in Meta right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.