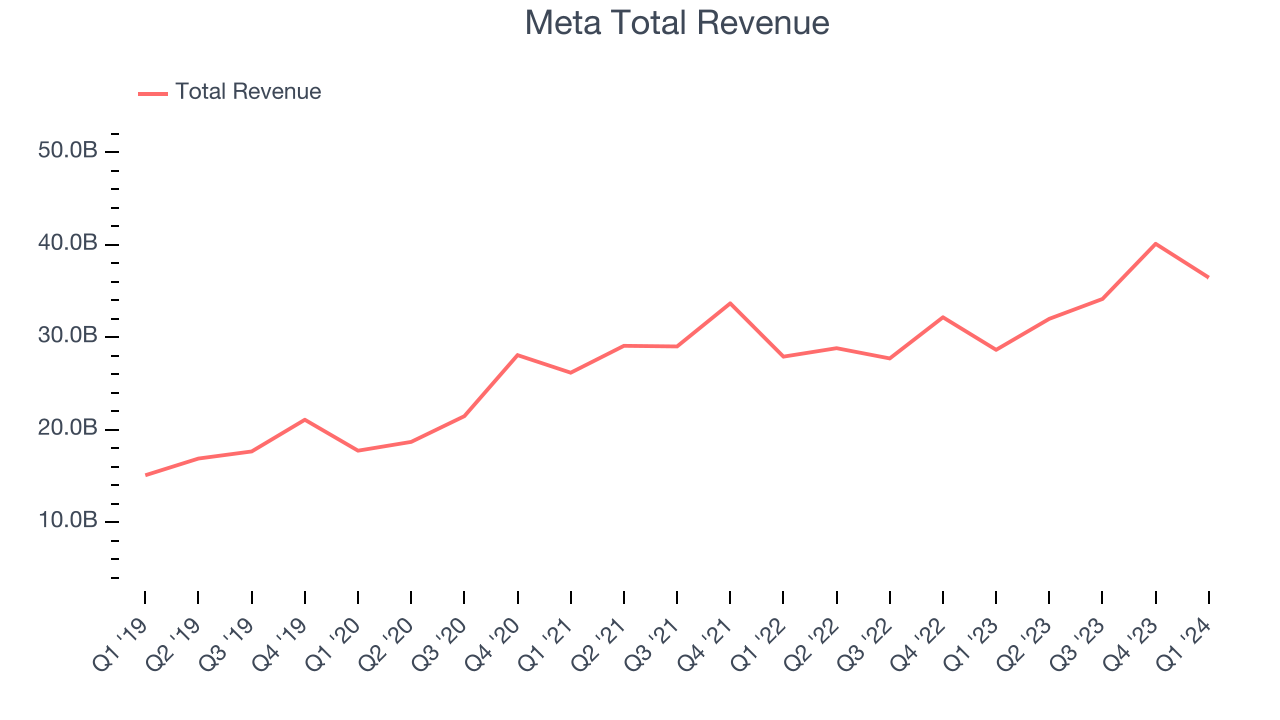

Social network operator Meta Platforms (NASDAQ:META) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 27.3% year on year to $36.46 billion. On the other hand, next quarter's revenue guidance of $37.75 billion was less impressive, coming in 1.5% below analysts' estimates. It made a GAAP profit of $4.71 per share, improving from its profit of $2.20 per share in the same quarter last year.

Is now the time to buy Meta? Find out by accessing our full research report, it's free.

Meta (META) Q1 CY2024 Highlights:

- Revenue: $36.46 billion vs analyst estimates of $36.22 billion (small beat)

- EPS: $4.71 vs analyst estimates of $4.32 (8.9% beat)

- Revenue Guidance for Q2 CY2024 is $37.75 billion at the midpoint, below analyst estimates of $38.32 billion

- Gross Margin (GAAP): 81.8%, up from 78.3% in the same quarter last year

- Free Cash Flow of $12.53 billion, similar to the previous quarter

- Daily Active Users: 3.24 billion

- Market Capitalization: $1.26 trillion

"The new version of Meta AI with Llama 3 is another step towards building the world's leading AI. We're seeing healthy growth across our apps and we continue making steady progress building the metaverse as well," said Mark Zuckerberg, Meta founder and CEO.

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Sales Growth

Meta's revenue growth over the last three years has been mediocre, averaging 16.4% annually. This quarter, Meta reported decent 27.3% year-on-year revenue growth, in line with analysts' expectations.

Guidance for the next quarter indicates Meta is expecting revenue to grow 18% year on year to $37.75 billion, improving from the 11% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 14.9% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Key Takeaways from Meta's Q1 Results

It was great to see Meta deliver solid revenue, operating profit, and EPS growth this quarter, which beat analysts' estimates. That was driven by more daily active users than expected and 6% year-on-year growth in average ad prices. On the other hand, its revenue guidance for next quarter missed analysts' expectations and it took up its forecasted operating expenses and capital expenditures for the full year. The increased costs are related to the company's AI infrastructure.

During the quarter, Meta released its AI assistant, Meta AI. This product was rolled out across its family of apps and is powered by Llama 3, an open-source large language model that is a ChatGPT competitor. The product is quite exciting and we recommend readers to try it out.

Overall, this quarter's print was solid but the weaker expected revenue for next quarter and higher expenses for the full year are spooking investors. The company is down 9.4% on the results and currently trades at $447.52 per share.

Meta may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.