As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the consumer internet stocks, including Meta (NASDAQ:META) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 17 consumer internet stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.41%, while on average next quarter revenue guidance was 3.9% under consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but consumer internet stocks held their ground better than others, with the share prices up 6.03% since the previous earnings results, on average.

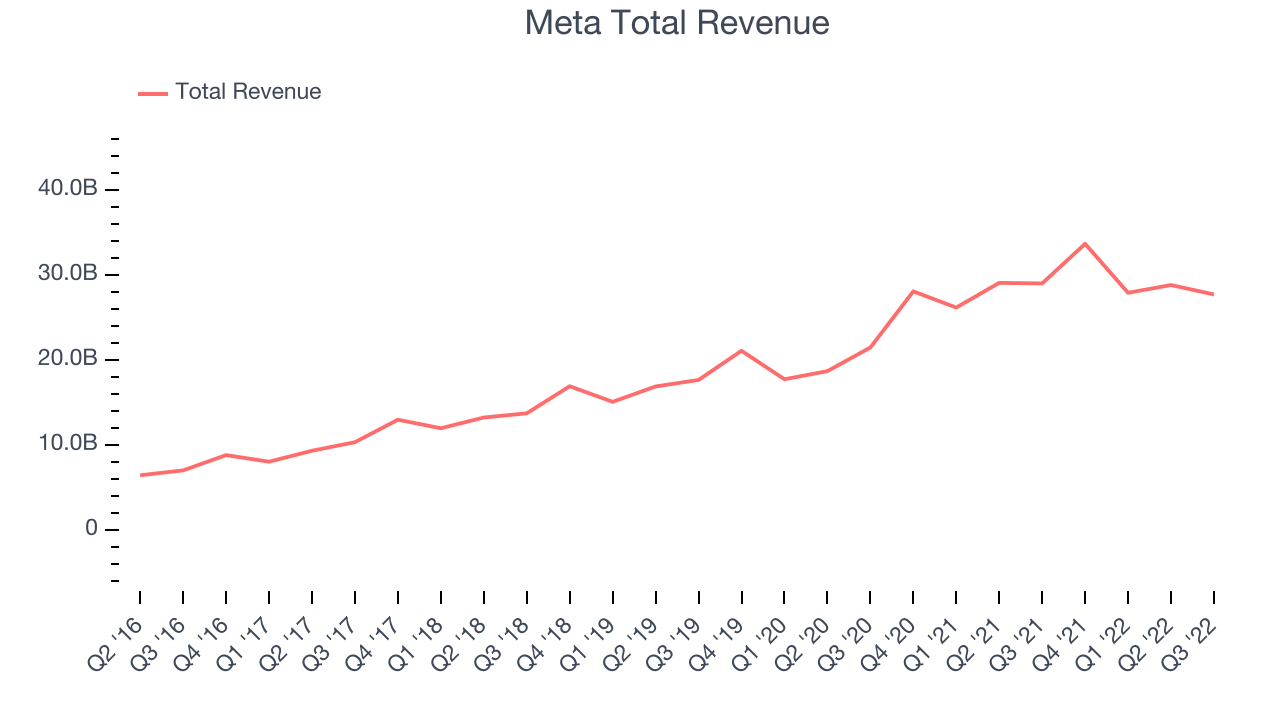

Meta (NASDAQ:META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META ) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Meta reported revenues of $27.7 billion, down 4.46% year on year, beating analyst expectations by 1.14%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

"Our community continues to grow and I'm pleased with the strong engagement we're seeing driven by progress on our discovery engine and products like Reels," said Mark Zuckerberg, Meta founder and CEO.

The company reported 3.71 billion monthly active users, up 3.63% year on year. The stock is up 2.53% since the results and currently trades at $133.15.

Is now the time to buy Meta? Access our full analysis of the earnings results here, it's free.

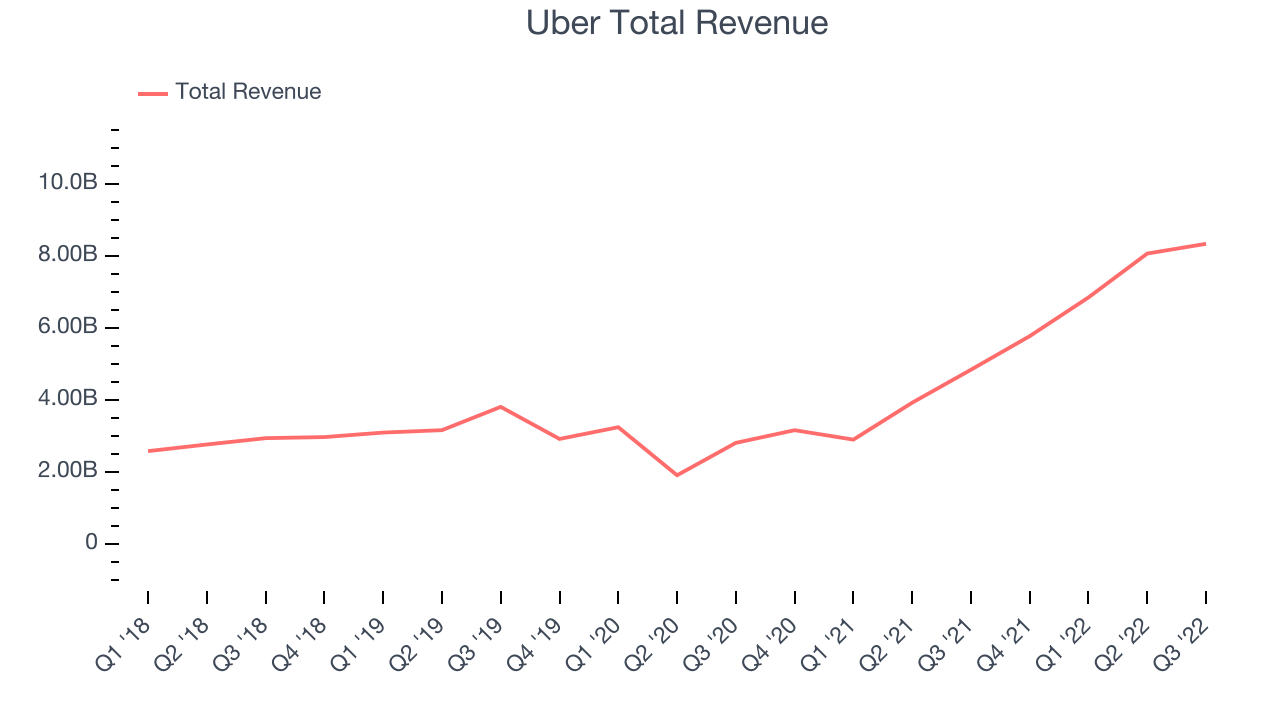

Best Q3: Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

Uber reported revenues of $8.34 billion, up 72.1% year on year, beating analyst expectations by 3.52%. It was a very strong quarter for the company, with exceptional revenue growth and a decent beat of analyst estimates.

Uber achieved the fastest revenue growth among its peers. The company reported 124 million paying users, up 13.7% year on year. The stock is up 6.47% since the results and currently trades at $28.30.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $460.2 million, down 33.2% year on year, missing analyst expectations by 2.66%. It was a weak quarter for the company, with declining number of users and revenue.

The company reported 5.8 million active buyers, down 33.3% year on year. The stock is down 17.4% since the results and currently trades at $21.15.

Read our full analysis of Overstock's results here.

Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $2.84 billion, down 9% year on year, beating analyst expectations by 1.07%. It was a weak quarter for the company, with declining number of users and revenue.

The company reported 22.6 million active buyers, down 22.6% year on year. The stock is up 17.5% since the results and currently trades at $41.94.

Read our full, actionable report on Wayfair here, it's free.

Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $684.5 million, up 8.15% year on year, beating analyst expectations by 2.68%. It was a decent quarter for the company, with a beat of topline growth estimates.

The company reported 445 million monthly active users, up 0.22% year on year. The stock is up 21.4% since the results and currently trades at $26.59.

Read our full, actionable report on Pinterest here, it's free.

The author has no position in any of the stocks mentioned