Social network operator Meta Platforms (NASDAQ:META) reported results ahead of analysts' expectations in Q4 FY2023, with revenue up 24.7% year on year to $40.11 billion. Guidance for next quarter's revenue was also optimistic at $35.75 billion at the midpoint, 5.5% above analysts' estimates. It made a GAAP profit of $5.33 per share, improving from its profit of $3.14 per share in the same quarter last year.

Meta (META) Q4 FY2023 Highlights:

- Revenue: $40.11 billion vs analyst estimates of $39.17 billion (2.4% beat)

- EPS: $5.33 vs analyst estimates of $4.94 (7.9% beat)

- Revenue Guidance for Q1 2024 is $35.75 billion at the midpoint, above analyst estimates of $33.87 billion

- Free Cash Flow of $11.51 billion, down 17.3% from the previous quarter

- Gross Margin (GAAP): 80.8%, up from 78.6% in the same quarter last year

- Family Monthly Active People: 3.98 billion, up 240 million year on year

- Market Capitalization: $1.00 trillion

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

The need for connection is foundational to human experience, and remains the driver of Meta’s mission - to connect the world. Through its platforms, users can connect, share, discover, and communicate with family and friends on just about any connected device. Its massive global aggregated audience of over 3 billion users spends over two hours per day on properties.

Meta’s innovative digital ad tools, massive scale, and demographic data have also transformed how businesses operate, allowing a much more granular targeted approach to interacting with customers. Its high return on investment (ROI) advertising tools have allowed millions of new small businesses to spring up by aggregating potential customers online which were previously dispersed to identify and profitably sell to. Meta’s product offerings to businesses have continued to evolve to include commerce and payment functionality, while continuing to create new ad formats and ways to interact.

The company changed its name to Meta Platforms in October 2021 to signal its increased emphasis on building a new computing platform that will evolve how Meta connects people (and advertisers) from a place to share experiences to a place of shared experiences. They introduced a new product segment, Facebook Reality Labs, whose focus is to create immersive technologies (AR/VR) meant to provide new ways to socialize, work, shop, and game.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Meta Platforms competes with fellow social media advertising platforms like Google (NASDAQ:GOOGL), Snapchat (NYSE:SNAP), Twitter (NYSE:TWTR), and Pinterest (NASDAQ:PINS)

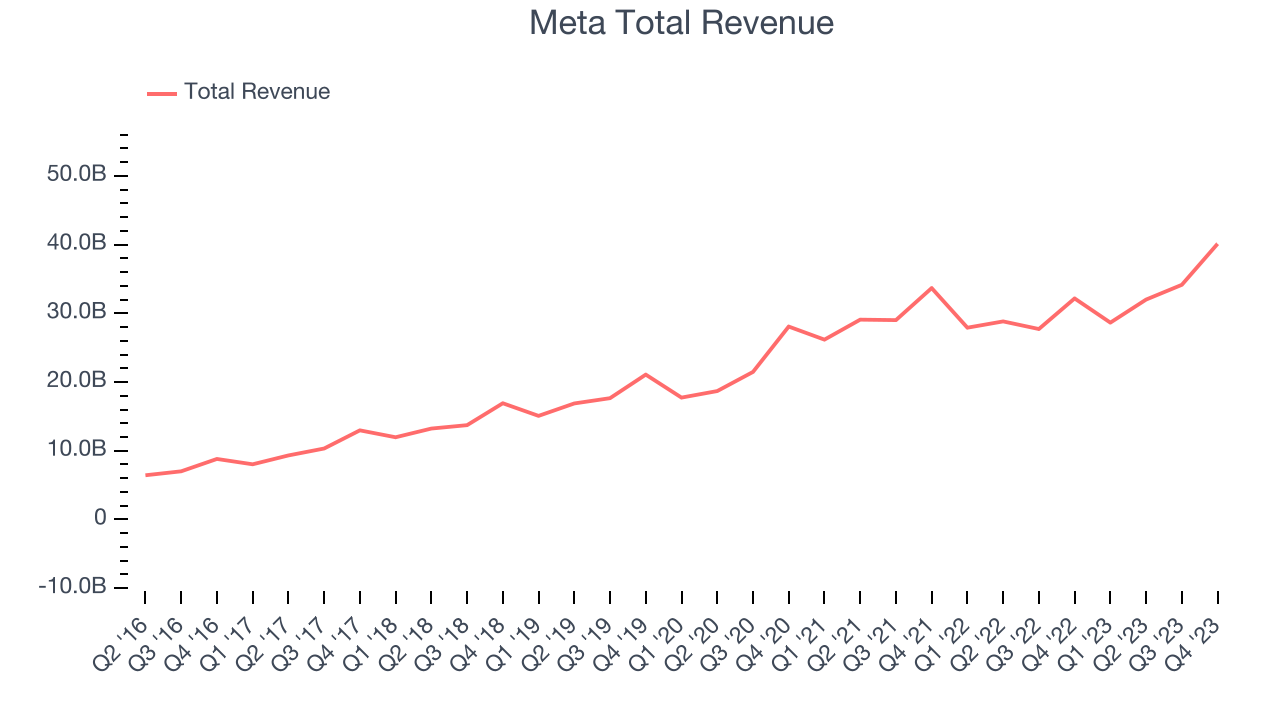

Sales Growth

Meta's revenue growth over the last three years has been solid, averaging 18.1% annually. This quarter, Meta beat analysts' estimates and reported decent 24.7% year-on-year revenue growth.

Guidance for the next quarter indicates Meta is expecting revenue to grow 24.8% year on year to $35.75 billion, improving on the 2.6% year-on-year increase it recorded in the same quarter last year.

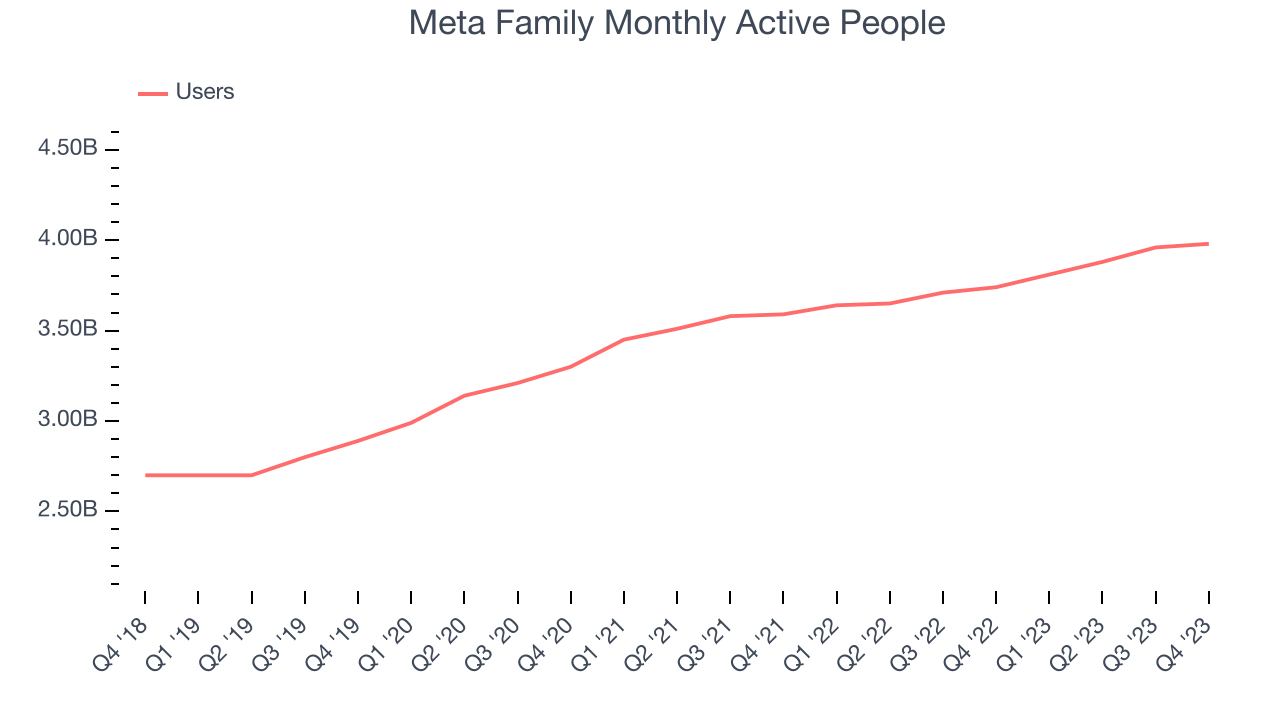

Usage Growth

As a social network, Meta generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Meta's monthly active users, a key performance metric for the company, grew 5.2% annually to 3.98 billion. This growth lags behind the hottest consumer internet apps.

In Q4, Meta added 240 million monthly active users, translating into 6.4% year-on-year growth.

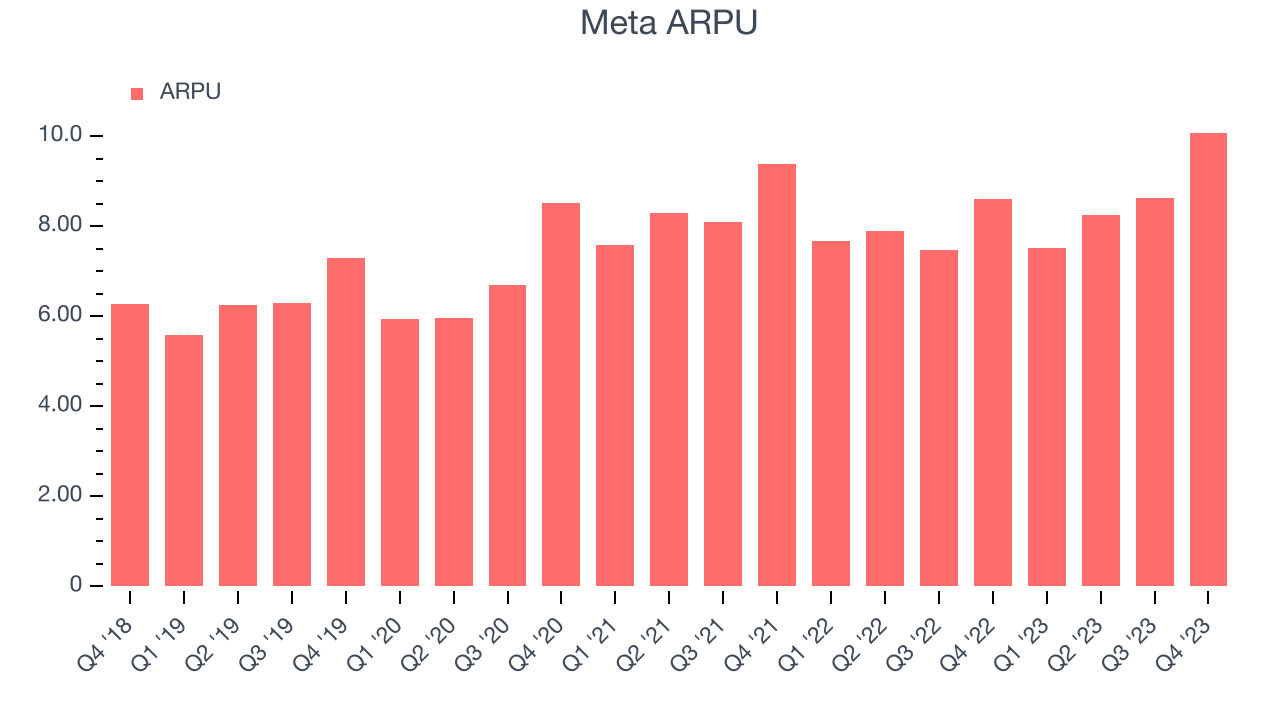

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Meta because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Meta's audience and its ad-targeting capabilities.

Meta's ARPU growth has been subpar over the last two years, averaging 1.9%. The company's ability to increase prices while maintaining its monthly active users, however, shows the value of its platform. This quarter, ARPU grew 17.2% year on year to $10.08 per user.

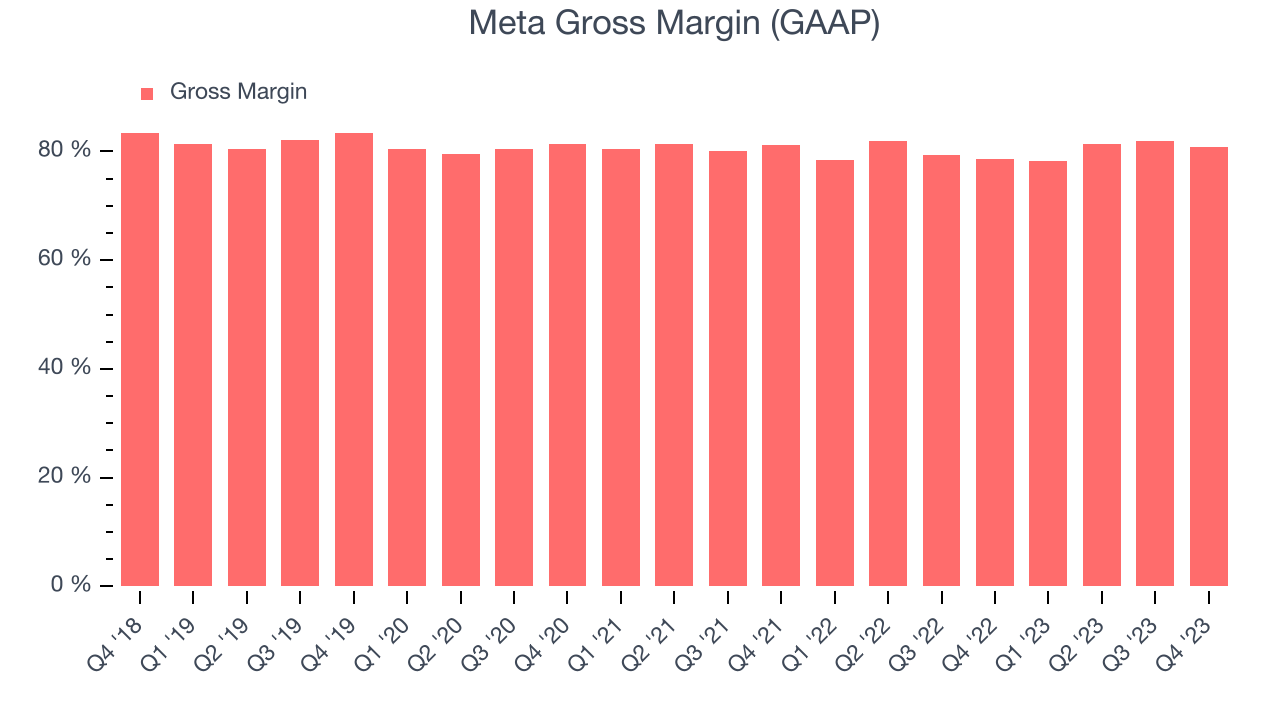

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor. Meta's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 80.8% this quarter, up 2.2 percentage points year on year.

For social network businesses like Meta, these aforementioned costs typically include customer service, data center, and other infrastructure expenses. After paying for these expenses, Meta had $0.81 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Gross margins have been trending up over the last 12 months, averaging 80.6%. Meta's margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Meta grow from a combination of product virality, paid advertisement, and incentives.

Meta is extremely efficient at acquiring new users, spending only 11% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving Meta the freedom to invest its resources into new growth initiatives while maintaining optionality.

Profitability & Free Cash Flow

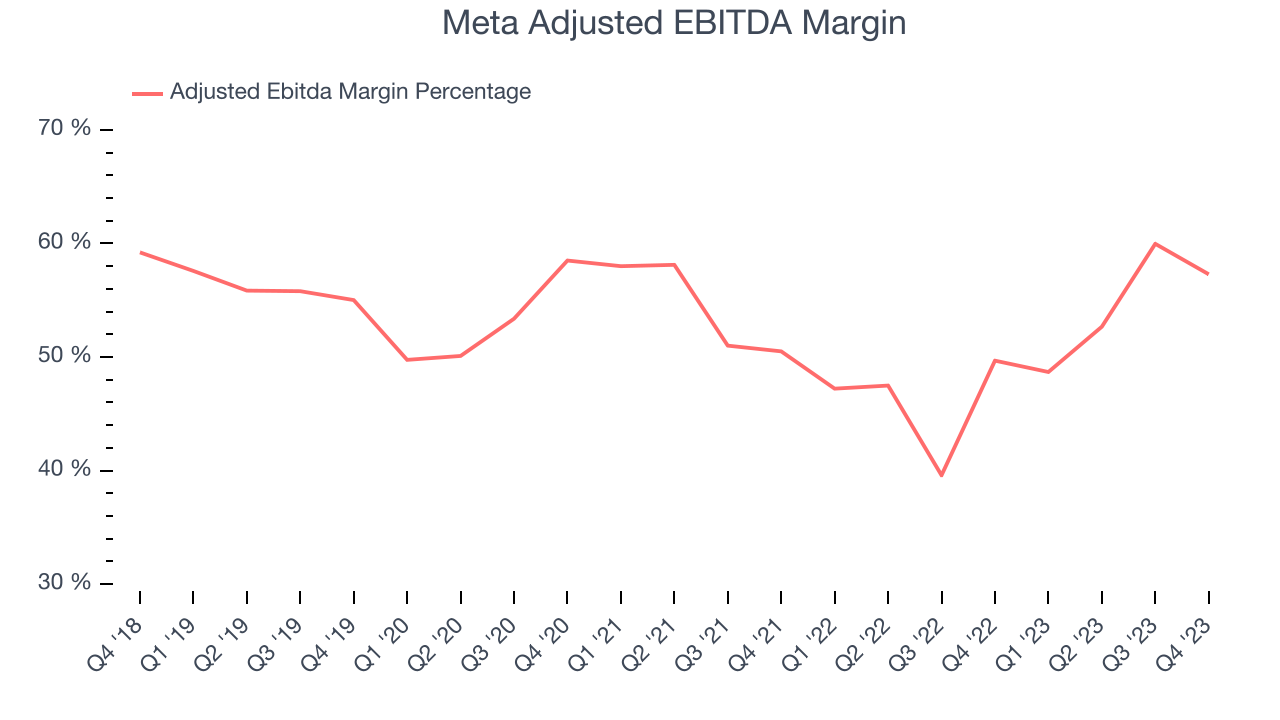

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Meta's EBITDA was $22.98 billion this quarter, translating into a 57.3% margin. On top of that, Meta's spectacular EBITDA margins over the last four quarters have placed it among a handful of the most profitable consumer internet companies in the world.

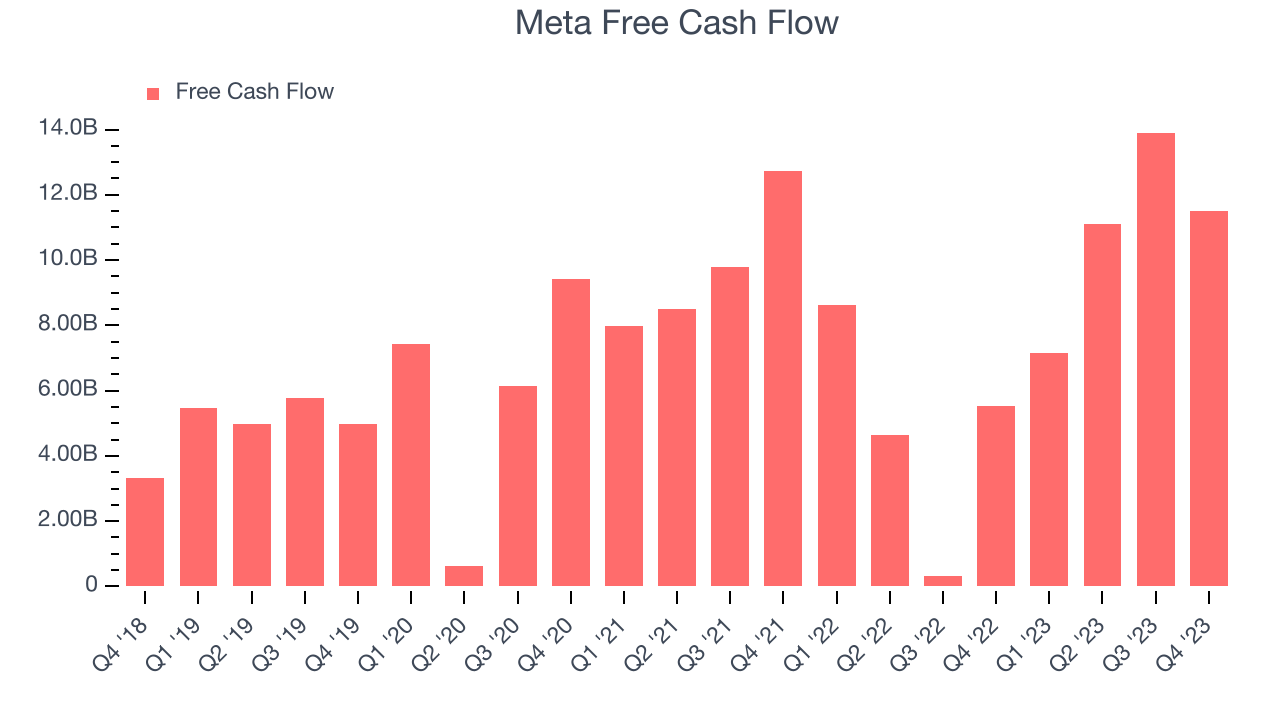

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Meta's free cash flow came in at $11.51 billion in Q4, up 108% year on year.

Meta has generated $43.66 billion in free cash flow over the last 12 months, an eye-popping 32.3% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Meta's Q4 Results

We were impressed by Meta's revenue, operating income, and EPS growth this quarter, which all blew past analysts' estimates. These beats were driven by better-than-expected daily and monthly active users along with a 21% year-on-year increase in ad impressions. Meta also saw a 2% tailwind in advertising pricing. Commentary across the sector suggests the advertising market is likely to rebound in 2024, partly explaining why Meta had a strong quarter.

Looking ahead, Meta's Q1 2024 revenue guidance topped Wall Street's forecast while its anticipated full-year 2024 capital expenditures came in slightly higher. The company expects this capex growth to come from investments in servers, including AI and non-AI hardware (you're welcome, Nvidia), and data centers as it ramps up construction for its new data center architecture. These investments will be key for its open-source large language model, Llama, to successfully compete against OpenAI's closed-source ChatGPT.

Perhaps the most interesting part of the quarter was the announcement of a quarterly dividend - the first in the company's history. Stockholders as of February 22, 2024 are set to receive $0.50 per share per quarter.

Overall, we think this was a really good quarter that should please shareholders. The stock is up 8.3% after reporting and currently trades at $427.75 per share.

Is Now The Time?

When considering an investment in Meta, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think Meta is a great business. First off, its revenue growth has been decent over the last three years. And while its growth in monthly active users has been slower, the good news is its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its impressive gross margins are a wonderful starting point for the overall profitability of the business.

At the moment Meta trades at 12.0x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, Meta's qualities really stand out, and we really like it at this price.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.