Social network operator Meta Platforms (NASDAQ:META) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 27.3% year on year to $36.46 billion. On the other hand, next quarter's revenue guidance of $37.75 billion was less impressive, coming in 1.5% below analysts' estimates. It made a GAAP profit of $4.71 per share, improving from its profit of $2.20 per share in the same quarter last year.

Meta (META) Q1 CY2024 Highlights:

- Revenue: $36.46 billion vs analyst estimates of $36.22 billion (small beat)

- EPS: $4.71 vs analyst estimates of $4.32 (8.9% beat)

- Revenue Guidance for Q2 CY2024 is $37.75 billion at the midpoint, below analyst estimates of $38.32 billion

- Gross Margin (GAAP): 81.8%, up from 78.3% in the same quarter last year

- Free Cash Flow of $12.53 billion, similar to the previous quarter

- Daily Active Users: 3.24 billion

- Market Capitalization: $1.26 trillion

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

The need for connection is foundational to human experience, and remains the driver of Meta’s mission - to connect the world. Through its platforms, users can connect, share, discover, and communicate with family and friends on just about any connected device. Its massive global aggregated audience of over 3 billion users spends over two hours per day on properties.

Meta’s innovative digital ad tools, massive scale, and demographic data have also transformed how businesses operate, allowing a much more granular targeted approach to interacting with customers. Its high return on investment (ROI) advertising tools have allowed millions of new small businesses to spring up by aggregating potential customers online which were previously dispersed to identify and profitably sell to. Meta’s product offerings to businesses have continued to evolve to include commerce and payment functionality, while continuing to create new ad formats and ways to interact.

The company changed its name to Meta Platforms in October 2021 to signal its increased emphasis on building a new computing platform that will evolve how Meta connects people (and advertisers) from a place to share experiences to a place of shared experiences. They introduced a new product segment, Facebook Reality Labs, whose focus is to create immersive technologies (AR/VR) meant to provide new ways to socialize, work, shop, and game.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Meta Platforms competes with fellow social media advertising platforms like Google (NASDAQ:GOOGL), Snapchat (NYSE:SNAP), Twitter (NYSE:TWTR), and Pinterest (NASDAQ:PINS)

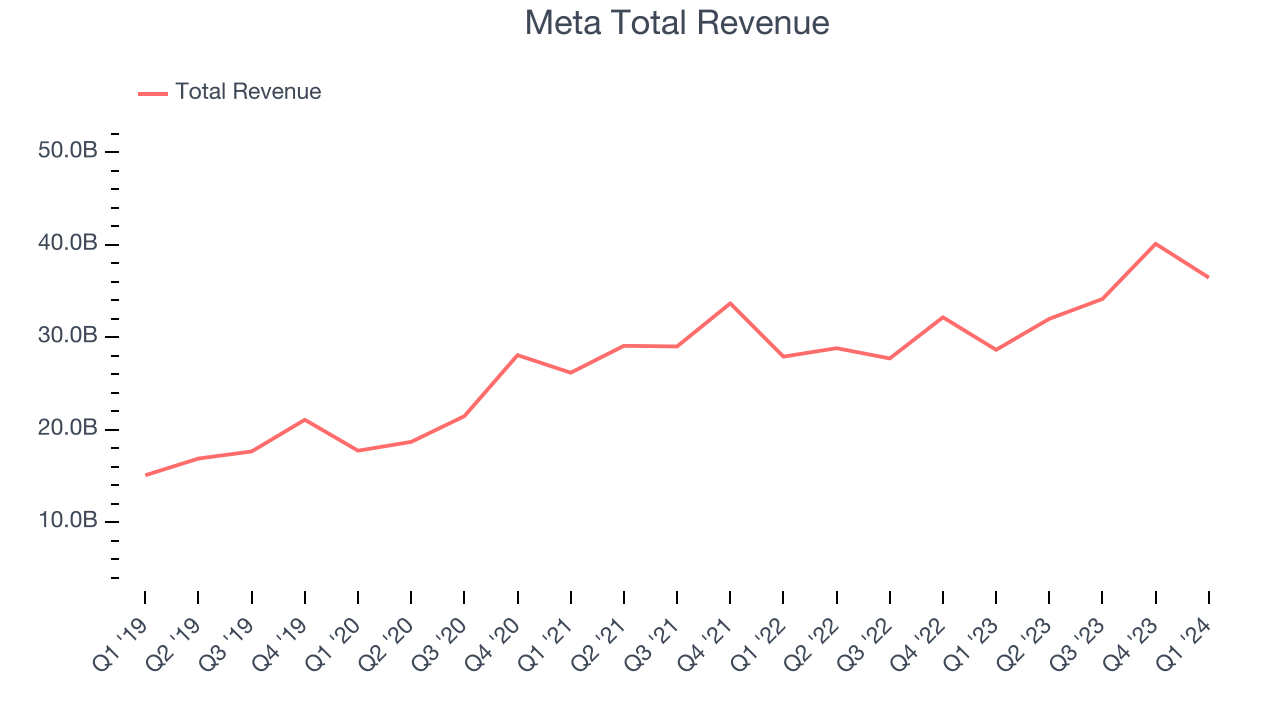

Sales Growth

Meta's revenue growth over the last three years has been mediocre, averaging 16.4% annually. This quarter, Meta reported decent 27.3% year-on-year revenue growth, in line with analysts' expectations.

Guidance for the next quarter indicates Meta is expecting revenue to grow 18% year on year to $37.75 billion, improving from the 11% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 14.9% over the next 12 months.

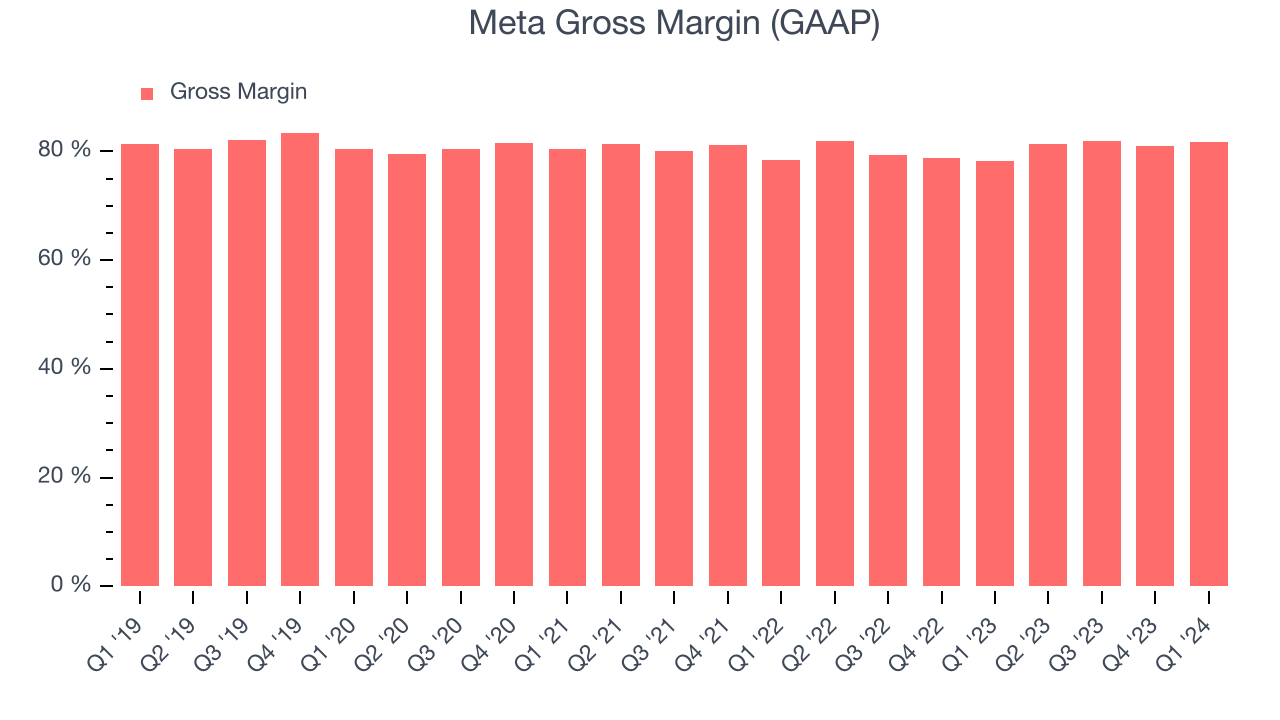

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Meta's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 81.8% this quarter, up 3.5 percentage points year on year.

For social network businesses like Meta, these aforementioned costs typically include customer service, data center, and other infrastructure expenses. After paying for these expenses, Meta had $0.82 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Meta's gross margins have been trending up over the last 12 months, averaging 81.5%. Its margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Consumer internet businesses like Meta grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Meta is extremely efficient at acquiring new users, spending only 9.7% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving Meta the freedom to invest its resources into new growth initiatives while maintaining optionality.

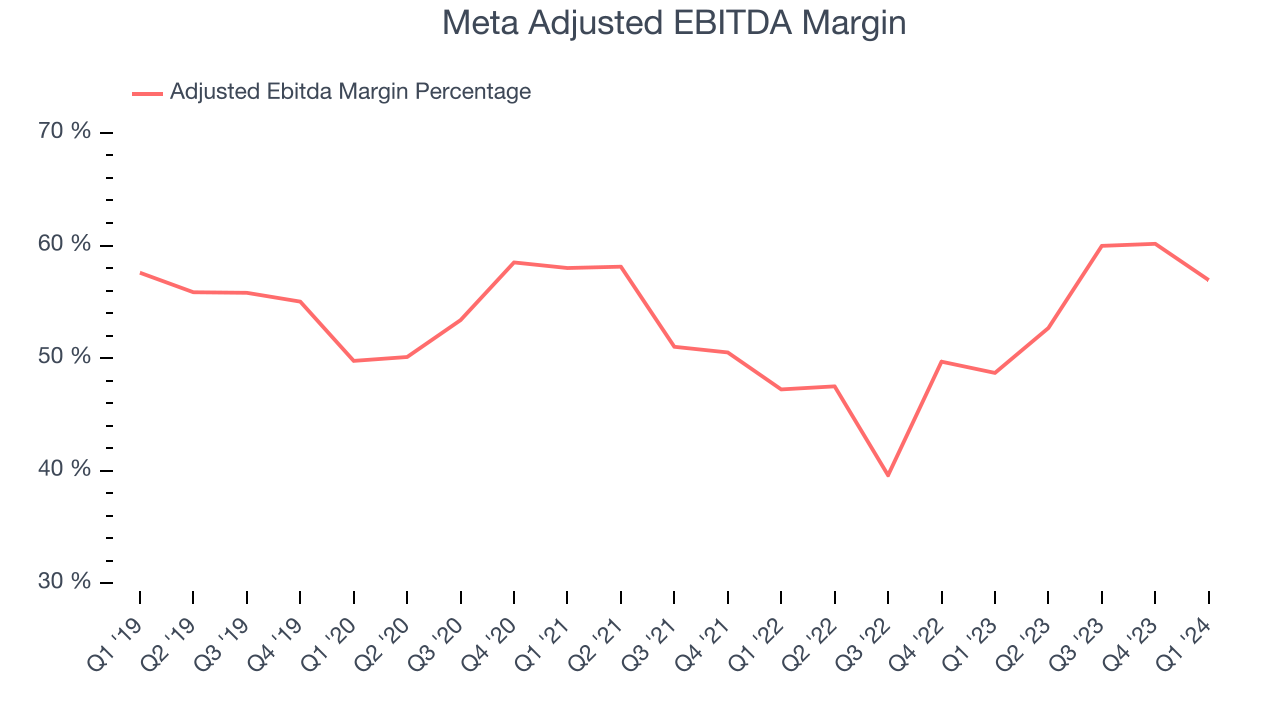

Profitability & Free Cash Flow

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

This quarter, Meta's EBITDA came in at $20.75 billion, resulting in a 56.9% margin. On top of that, Meta's spectacular EBITDA margins over the last four quarters have placed it among the most profitable consumer internet companies in the world.

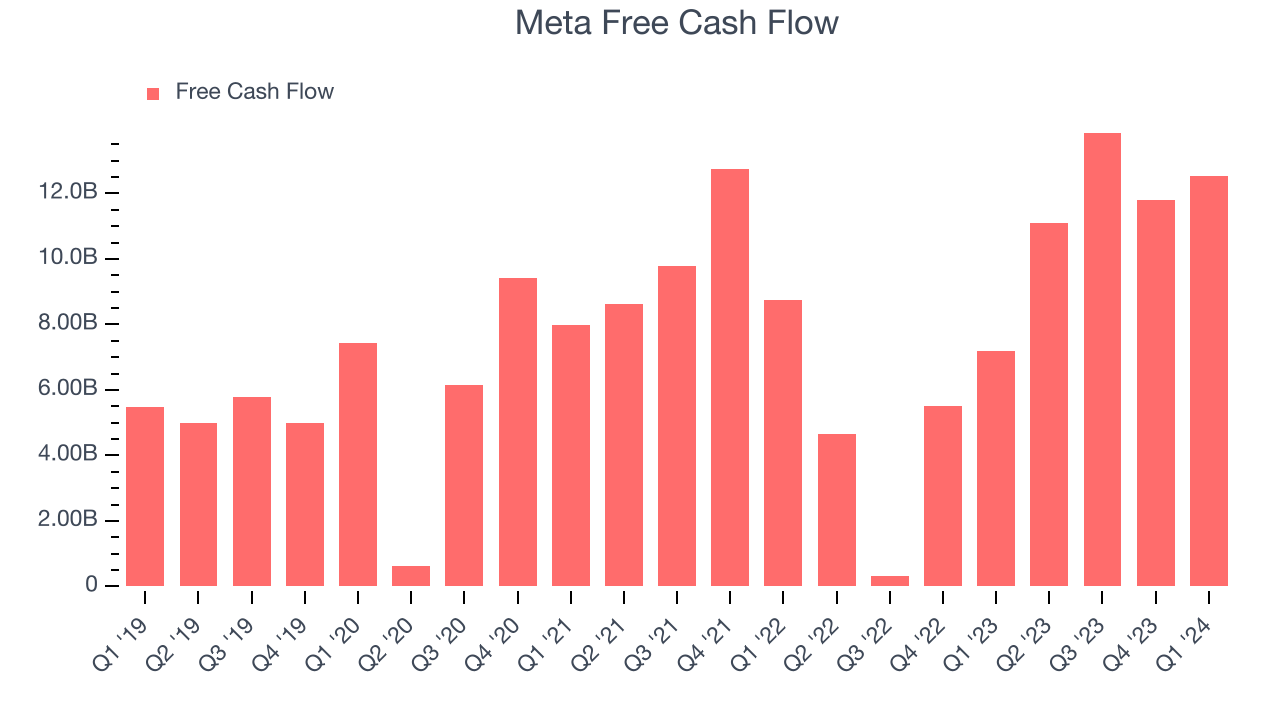

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Meta's free cash flow came in at $12.53 billion in Q1, up 74.6% year on year.

Meta has generated $49.3 billion in free cash flow over the last 12 months, an eye-popping 34.5% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Meta is a profitable, well-capitalized company with $58.12 billion of cash and $18.39 billion of debt, meaning it could pay back all its debt tomorrow and still have $39.73 billion of cash on its balance sheet. This net cash position gives Meta the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Meta's Q1 Results

It was great to see Meta deliver solid revenue, operating profit, and EPS growth this quarter, which beat analysts' estimates. That was driven by more daily active users than expected and 6% year-on-year growth in average ad prices. On the other hand, its revenue guidance for next quarter missed analysts' expectations and it took up its forecasted operating expenses and capital expenditures for the full year. The increased costs are related to the company's AI infrastructure.

During the quarter, Meta released its AI assistant, Meta AI. This product was rolled out across its family of apps and is powered by Llama 3, an open-source large language model that is a ChatGPT competitor. The product is quite exciting and we recommend readers to try it out.

Overall, this quarter's print was solid but the weaker expected revenue for next quarter and higher expenses for the full year are spooking investors. The company is down 9.4% on the results and currently trades at $447.52 per share.

Is Now The Time?

Meta may have had a mixed quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Meta is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been decent over the last three years. And while its monthly active users have declined, the good news is its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its impressive gross margins are a wonderful starting point for the overall profitability of the business.

At the moment, Meta trades at 13.4x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, Meta's qualities really stand out, and we really like it at this price.

Wall Street analysts covering the company had a one-year price target of $541.20 per share right before these results (compared to the current share price of $447.52), implying they saw upside in buying Meta in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.