Email monitoring and security company Mimecast (NASDAQ:MIME) announced better-than-expected results in the Q1 FY2022 quarter, with revenue up 23.7% year on year to $142.5 million. Mimecast made a GAAP profit of $10 million, improving on its profit of $3.13 million, in the same quarter last year.

Is now the time to buy Mimecast? Access our full analysis of the earnings results here, it's free.

Mimecast (MIME) Q1 FY2022 Highlights:

- Revenue: $142.5 million vs analyst estimates of $138.1 million (3.19% beat)

- EPS (non-GAAP): $0.32 vs analyst estimates of $0.30 (7.86% beat)

- Revenue guidance for Q2 2022 is $142.5 million at the midpoint, above analyst estimates of $141.1 million

- The company reconfirmed revenue guidance for the full year, at $580 million at the midpoint

- Free cash flow of $31.6 million, up 31.4% from previous quarter

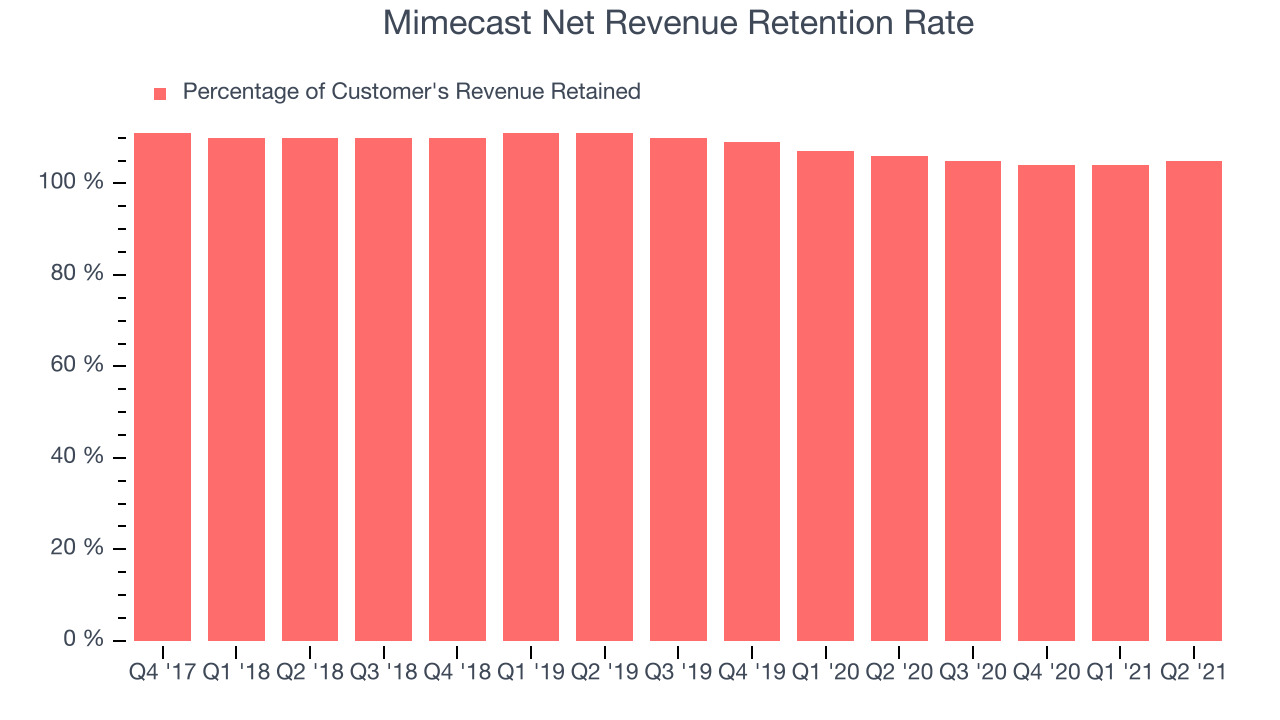

- Net Revenue Retention Rate: 105%, in line with previous quarter

- Customers: 40,600, up from 39,900 in previous quarter

- Gross Margin (GAAP): 76.4%, in line with previous quarter

Peter Bauer, chief executive officer of Mimecast, said, “Our results this quarter underscore the strength of our multi-product platform and continued improvement in our business in our largest geographies. We delivered sequential improvement in our net revenue retention rate, driven by improving upsell and reduced downsell and churn rates. We believe the actions we have taken to strengthen our marketing team and build an integrated product organization will help us continue our sales momentum and accelerate product development to meet our customer’s evolving needs.”

Founded in London by South Africans Peter Bauer and Neil Murray, Mimecast (NASDAQ:MIME) provides cloud-based filtering service for securing business email accounts.

The rise of criminal and state sponsored cyber attacks means that more companies should are in a situation where they need to be responding to the threat of ransomware or phishing (where employees are tricked into sharing sensitive information). Email often serves as a gateway into successfully planting malware onto a company’s network and that drives demand for cybersecurity solutions that can help keep it safe.

Sales Growth

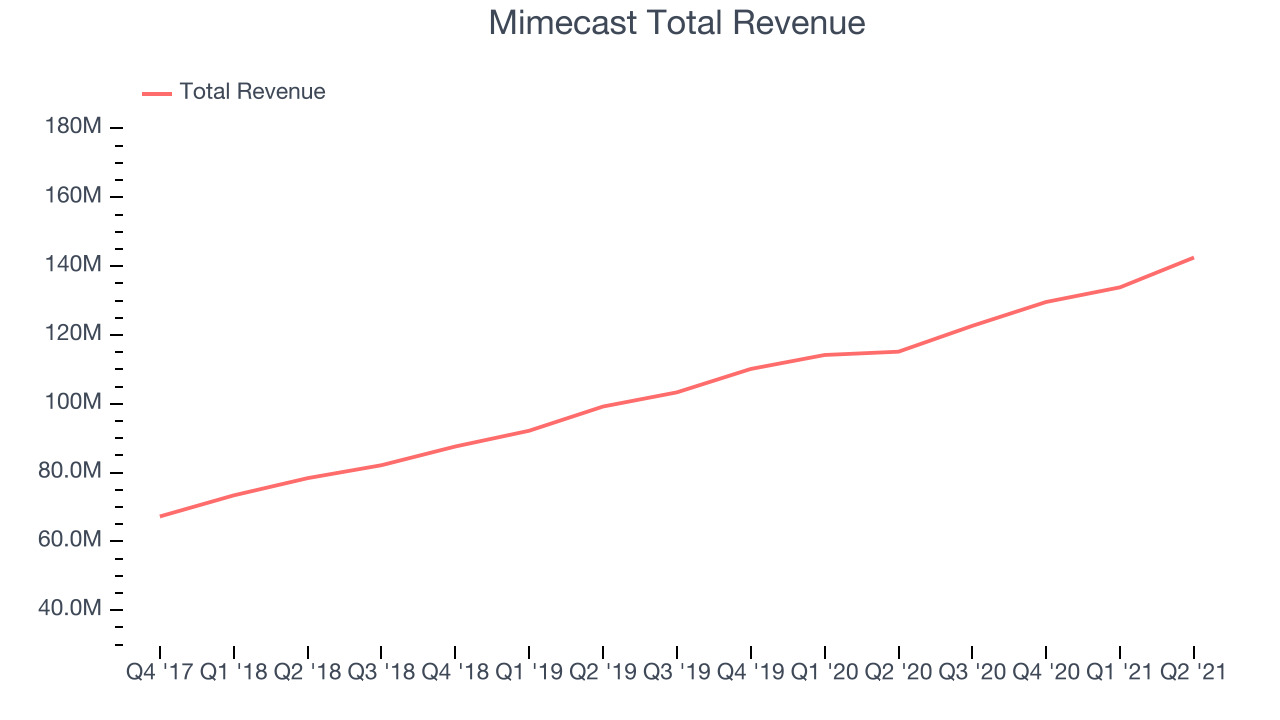

As you can see below, Mimecast's revenue growth has been decent over the last year, growing from quarterly revenue of $115.1 million, to $142.5 million.

This quarter, Mimecast's quarterly revenue was once again up a very solid 23.7% year on year. On top of that, revenue increased $8.65 million quarter on quarter, a very strong improvement on the $4.25 million increase in Q4 2021, which shows acceleration of growth, and is great to see.

Analysts covering the company are expecting the revenues to grow 12.4% over the next twelve months, although we would expect them to review their estimates once they get to read these results.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

Mimecast's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 105% in Q1. That means even if they didn't win any new customers, Mimecast would have grown its revenue 5% year on year. That is a fair retention rate and it shows us that customers stick around.

Key Takeaways from Mimecast's Q1 Results

With market capitalisation of $3.62 billion Mimecast is among smaller companies, but its more than $338.4 million in cash and positive free cash flow over the last twelve months give us confidence that Mimecast has the resources it needs to pursue a high growth business strategy.

We were very impressed by Mimecast’s very strong acceleration in customer growth this quarter. And we were also excited to see it that it outperformed analysts' revenue expectations. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. The company is up 0.7% on the results and currently trades at $55.5 per share.

Should you invest in Mimecast right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. You will find that in our full report which you can already access now, it's free.

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.