Email monitoring and security company Mimecast (NASDAQ:MIME) reported Q4 FY2021 results beating Wall St's expectations, with revenue up 17.2% year on year to $133.8 million. Mimecast made a GAAP profit of $5.76 million, improving on its profit of $2.52 million, in the same quarter last year.

Get investing superpowers with StockStory. View our latest analysis for Mimecast

Mimecast (NASDAQ:MIME) Q4 FY2021 Highlights:

- Revenue: $133.8 million vs analyst estimates of $131.2 million (2.04% beat)

- EPS (non-GAAP): $0.28 vs analyst estimates of $0.23 (21.7% beat)

- Revenue guidance for Q1 2022 is $137.9 million at the midpoint, above analyst estimates of $131.5 million

- Management's revenue guidance for upcoming financial year 2022 is $574.7 million at the midpoint, predicting 14.6% growth (vs 22.7% in FY2021)

- Free cash flow of $24 million, roughly flat from previous quarter

- Net Revenue Retention Rate: 104%, in line with previous quarter

- Customers: 39,900, up from 39,600 in previous quarter

- Gross Margin (GAAP): 76.1%, in line with previous quarter

Peter Bauer, chief executive officer of Mimecast, said, “We delivered solid results against what remains a challenging macro backdrop, which speaks to the durability of our business model, our differentiated platform, and our focused execution against our three-pronged strategy. We are staying close to our customers, continuing to strengthen our go-to-market teams and strategies, and innovating on and expanding our platform to anticipate the evolving threat landscape.”

Mimecast Makes Emails Safer

South Africans Peter Bauer and Neil Murray founded Mimecast in London, back in 2003, when email was just hitting the mainstream. The pair sought to fix perceived shortcomings in email security and archiving. Though threat detection has since moved far beyond email, the need remains, and the company now serves thousands of diverse companies from hospitals to banks and a lot in between.

Mimecast's (NASDAQ:MIME) software as a service offerings are focussed on email security, whether the threat be malware, trickery or betrayal. For example, Mimecast automatically detects any infected emails and can delete them from employees inboxes, as well as blocking links to risky sites. However, it can also block employees' private email accounts, like gmail, and prevent delivery of any emails they send with specific protected files. It uses analytics to try to prevent phishing and it can archive all emails, creating both redundancy in the case of a ransomware attack, as well as a searchable database.

Mimecast competes with a range of vendors such as Microsoft (NASDAQ: MSFT), Cisco (NASDAQ: CSCO) and Broadcom, which purchased part of the legacy Symantec enterprise security business. One of Mimecast's strengths is that it can prevent security breaches using AI-based behavioral analysis, implying that its scale and experience feeds into improving its capabilities. Furthermore, the rise of state sponsored espionage means that more companies should respond to the threat of phishing (where employees are tricked into sharing sensitive information). If Mimecast is benefiting from these factors, revenues should grow.

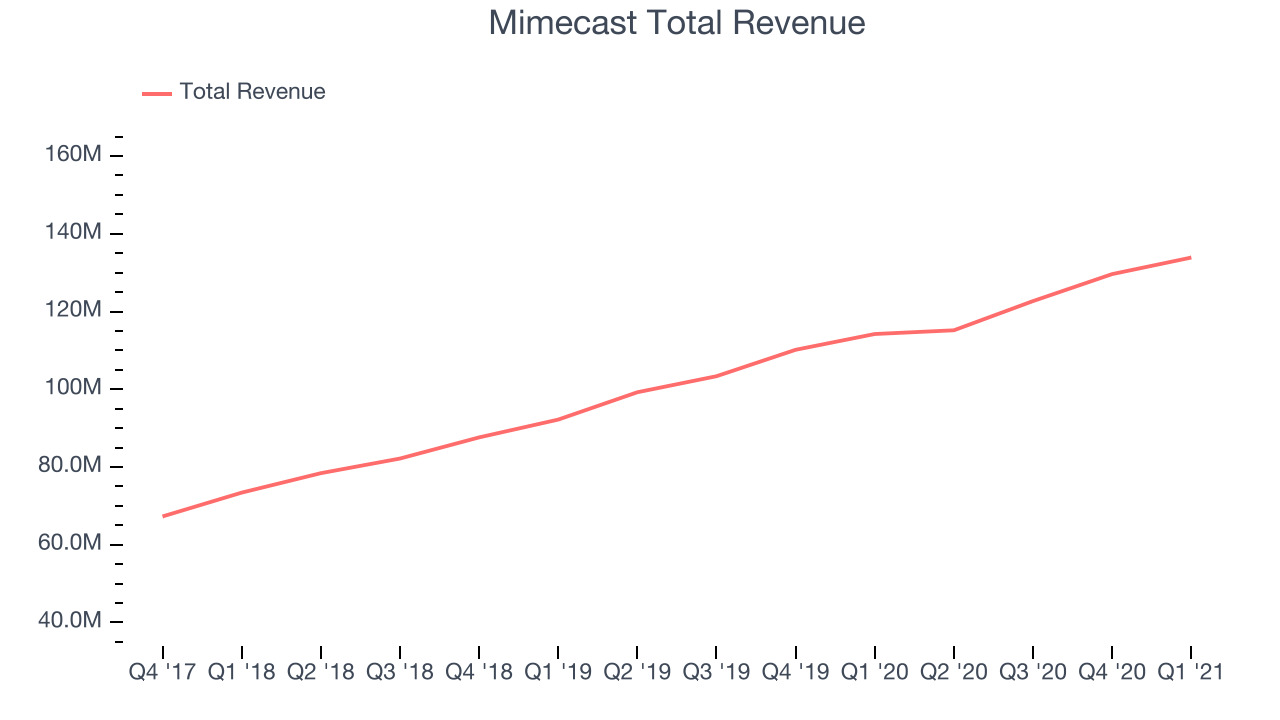

As you can see below, Mimecast's revenue growth has been strong over the last twelve months, growing from $114.2 million to $133.8 million.

This quarter, Mimecast's quarterly revenue was once again up 17.2% year on year. We can see that revenue increased by just $4.25 million in Q4, down from $6.94 million in Q3 2021. So while we're impressed by Mimecast's growth rates generally, we have no doubt shareholders would like to see the company add more than that when it reports next.

On The Coattails Of Their Customers

Mimecast tends to sell its services on a per user, per month basis. Generally speaking, that's a good thing, because it means Mimecast should grow with its customers. Of course, the flip side is that if their customers are suffering, they may reduce headcount and thus end up paying less money to Mimecast. Nonetheless, the ability to retain existing customers, and even grow revenues from them, is a very important indicator of the value proposition of its software.

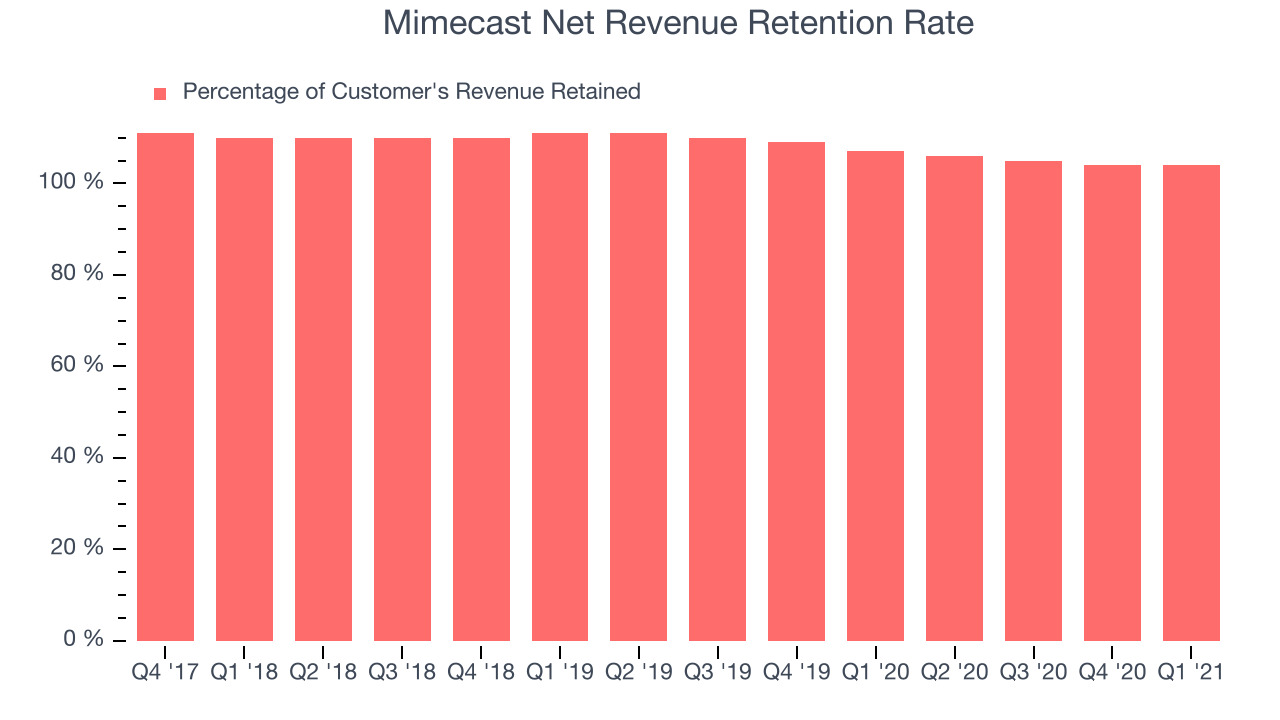

Mimecast's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 104% in Q4. That means even if they didn't win any new customers, Mimecast would have grown its revenue 4% year on year. Despite it going down over the last year this is still a fair retention rate and it shows us that customers stick around. But Mimecast is lagging a little behind the best SaaS businesses that achieve net dollar retention rates of over 120%.

Key Takeaways from Mimecast's Q4 Results

With market capitalisation of $2.78 billion Mimecast is among smaller companies, but its more than $292.9 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

We were impressed by the very optimistic revenue guidance Mimecast provided for the next quarter. And we were also excited to see it that it outperformed analysts' revenue expectations. On the other hand, the revenue guidance for next full year indicates a significant slowdown in revenue growth. Zooming out, we think this was still a decent, albeit mixed, quarter. Mimecast isn't necessarily our first pick when looking for the best growth stocks, but while these results didn't make us much more excited about the company they also didn't hurt.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.