Email monitoring and security company Mimecast (NASDAQ:MIME) reported Q2 FY2022 results topping analyst expectations, with revenue up 20% year on year to $147.2 million. Guidance for next quarter's revenue was $149.9 million at the midpoint, 2.6% above the average of analyst estimates. Mimecast made a GAAP profit of $17.5 million, improving on its profit of $10 million, in the same quarter last year.

Mimecast (MIME) Q2 FY2022 Highlights:

- Revenue: $147.2 million vs analyst estimates of $142.8 million (3.08% beat)

- EPS (non-GAAP): $0.40 vs analyst estimates of $0.34 (19.4% beat)

- Revenue guidance for Q3 2022 is $149.9 million at the midpoint, above analyst estimates of $146.1 million

- The company lifted revenue guidance for the full year, from $580 million to $591.7 million at the midpoint, a 2.01% increase

- Free cash flow of $31.1 million, roughly flat from previous quarter

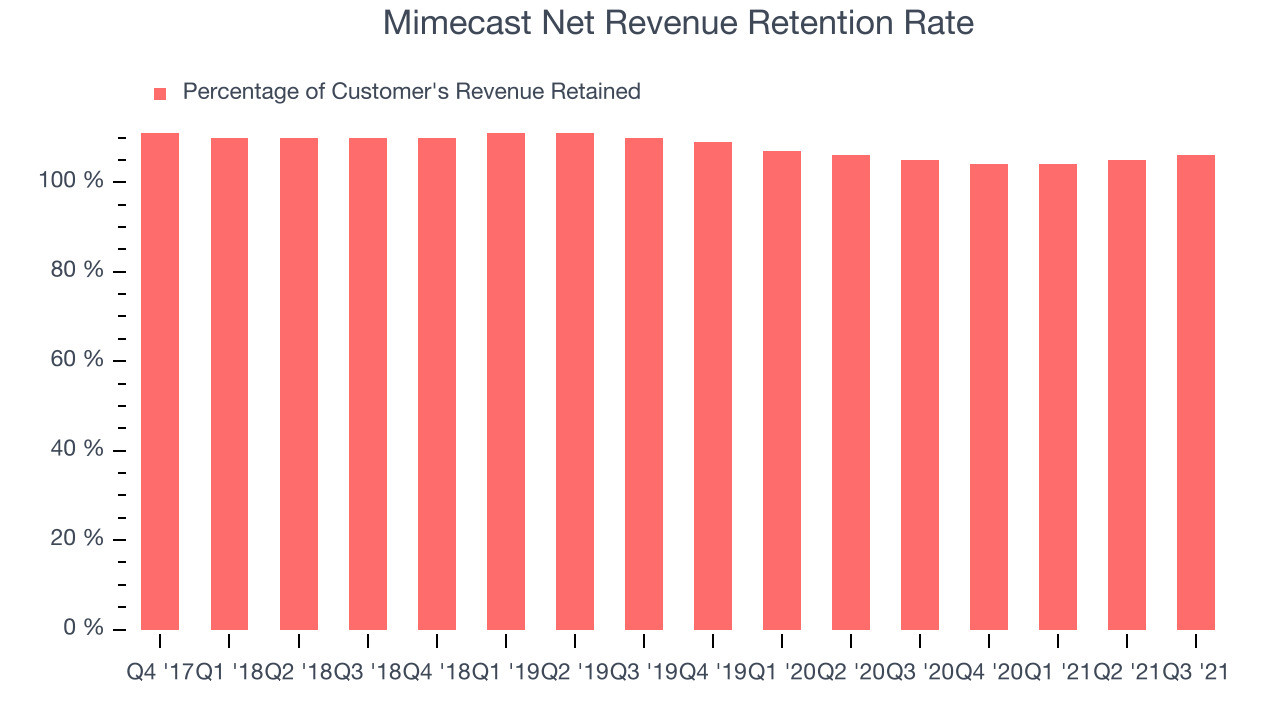

- Net Revenue Retention Rate: 106%, in line with previous quarter

- Customers: 39,600, down from 40,600 in previous quarter

- Gross Margin (GAAP): 77.2%, up from 75.7% same quarter last year

Founded in London by South Africans Peter Bauer and Neil Murray, Mimecast (NASDAQ:MIME) provides cloud-based filtering service for securing business email accounts.

For example, Mimecast automatically detects any infected emails and can delete them from employees inboxes, as well as blocking links to risky sites. However, it can also block employees' private email accounts, like gmail, and prevent delivery of any emails they send with specific protected files. It uses analytics to try to prevent phishing and it can archive all emails, creating both redundancy in the case of a ransomware attack, as well as a searchable database.

When the company was founded back in 2003, email was just hitting the mainstream and the founding pair sought to fix perceived shortcomings in email security and archiving. Though threat detection has since moved far beyond email, the need remains, and the company now serves thousands of diverse companies from hospitals to banks and a lot in between.

The rise of criminal and state sponsored cyber attacks means that more companies should are in a situation where they need to be responding to the threat of ransomware or phishing (where employees are tricked into sharing sensitive information). Email often serves as a gateway into successfully planting malware onto a company’s network and that drives demand for cybersecurity solutions that can help keep it safe.

Mimecast competes with a range of vendors such as Microsoft (NASDAQ: MSFT), Cisco (NASDAQ: CSCO) and Broadcom, which purchased part of the legacy Symantec enterprise security business.

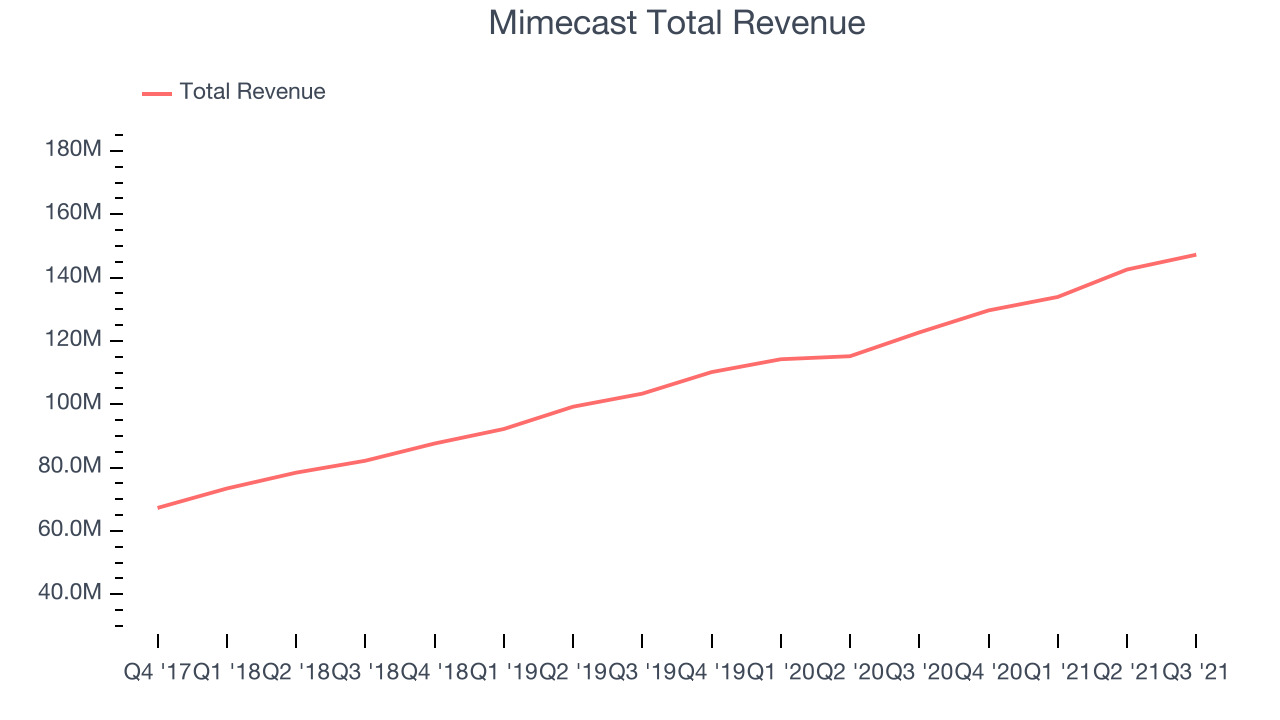

Sales Growth

As you can see below, Mimecast's revenue growth has been decent over the last year, growing from quarterly revenue of $122.6 million, to $147.2 million.

This quarter, Mimecast's quarterly revenue was once again up a very solid 20% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $4.68 million in Q2, compared to $8.65 million in Q1 2022. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Analysts covering the company are expecting the revenues to grow 11.4% over the next twelve months, although estimates are likely to change post earnings.

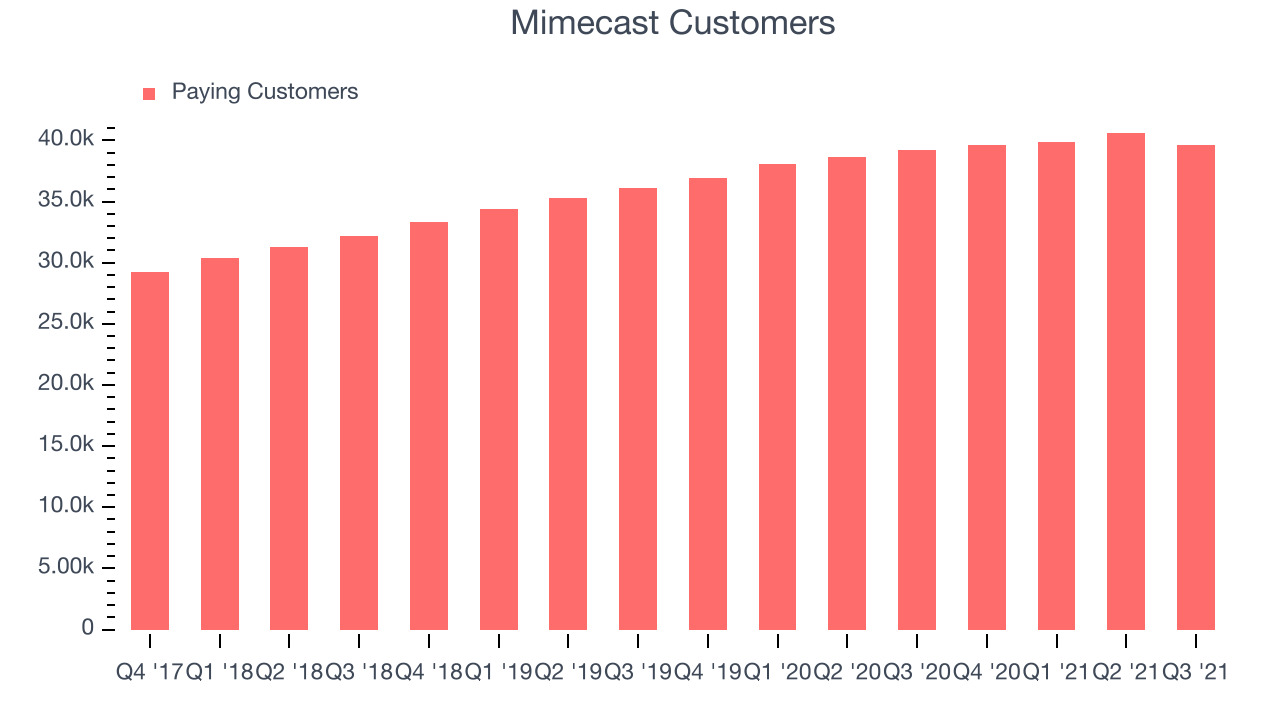

Customer Growth

You can see below that Mimecast reported 39,600 customers at the end of the quarter, a decrease of 1,000 from 40,600 last quarter. That is suggesting that the customer acquisition momentum is slowing a bit.

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

Mimecast's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 106% in Q2. That means even if they didn't win any new customers, Mimecast would have grown its revenue 6% year on year. That is a decent retention rate and it shows us that not only Mimecast's customers stick around but at least some of them get increasing value from its software over time.

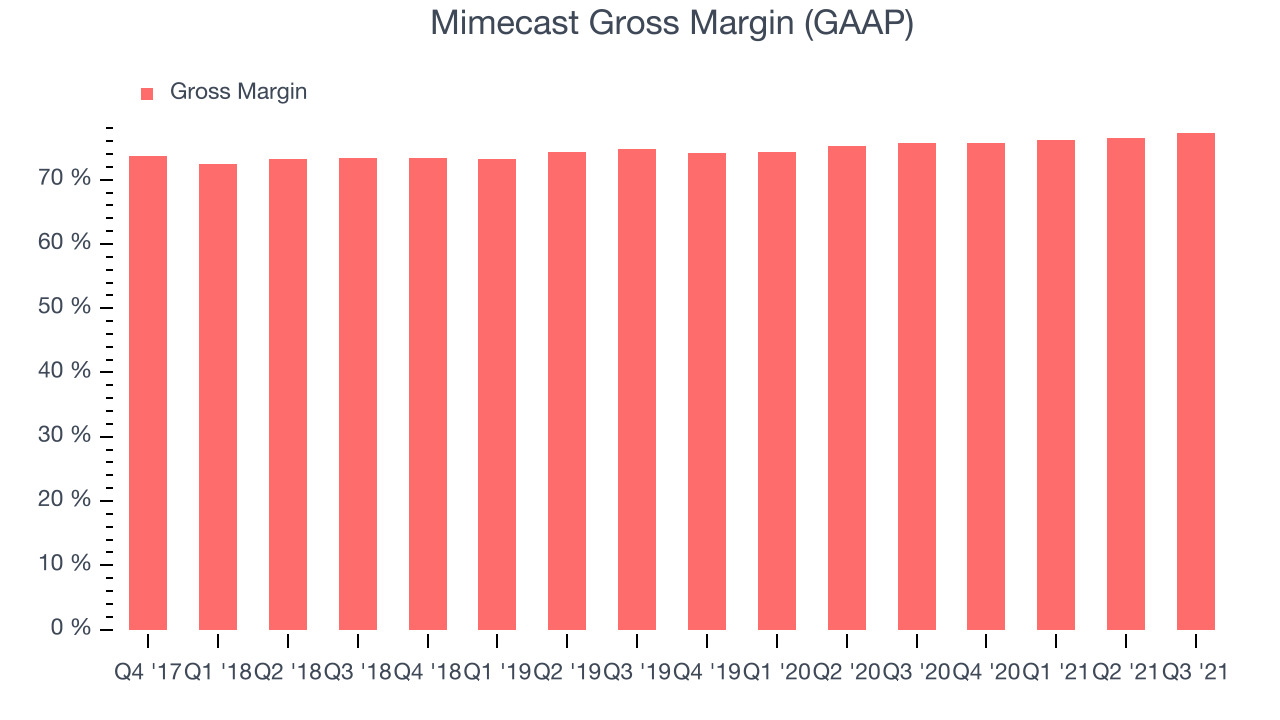

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Mimecast's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 77.2% in Q2.

That means that for every $1 in revenue the company had $0.77 left to spend on developing new products, marketing & sales and the general administrative overhead. Significantly up from the last quarter, this is a good gross margin that allows companies like Mimecast to fund large investments in product and sales during periods of rapid growth and be profitable when they reach maturity.

Key Takeaways from Mimecast's Q2 Results

With a market capitalization of $4.97 billion Mimecast is among smaller companies, but its more than $366.6 million in cash and positive free cash flow over the last twelve months give us confidence that Mimecast has the resources it needs to pursue a high growth business strategy.

Mimecast' revenue guidance for the next quarter looks quite a bit better than what the analysts were expecting. And we were also excited to see that it outperformed analysts' revenue expectations. On the other hand, it was unfortunate to see the slowdown in customer growth. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on target. But investors might have been expecting more and the company is down 1.39% on the results and currently trades at $74 per share.

Is Now The Time?

When considering Mimecast, investors should take into account its valuation and business qualities, as well as what happened in the latest quarter. Although Mimecast is not a bad business, it probably wouldn't be one of our picks. Its revenue growth has been solid, though we don't expect it to maintain historical growth rates.

Mimecast's price to sales ratio based on the next twelve months is 8.4x, suggesting that the market has lower expectations of the business, relative to the high growth tech stocks. We can find things to like about Mimecast and there's no doubt it is a bit of a market darling, at least for some. But it seems that there is a lot of optimism already priced in and we are wondering whether there might be better opportunities elsewhere right now.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds from the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.