Project management software maker Monday.com (NASDAQ:MNDY) reported Q1 FY2022 results that beat analyst expectations, with revenue up 83.9% year on year to $108.4 million. On top of that, guidance for next quarter's revenue was surprisingly good, being $118 million at the midpoint, 6.42% above what analysts were expecting. monday.com made a GAAP loss of $66.6 million, down on its loss of $38.9 million, in the same quarter last year.

Is now the time to buy monday.com? Access our full analysis of the earnings results here, it's free.

monday.com (MNDY) Q1 FY2022 Highlights:

- Revenue: $108.4 million vs analyst estimates of $101.3 million (7.09% beat)

- EPS (non-GAAP): -$0.96 vs analyst estimates of -$1.01

- Revenue guidance for Q2 2022 is $118 million at the midpoint, above analyst estimates of $110.8 million

- The company lifted revenue guidance for the full year, from $472.5 million to $490 million at the midpoint, a 3.7% increase

- Free cash flow was negative $16.1 million, down from positive free cash flow of $10.1 million in previous quarter

- Net Revenue Retention Rate: 135%, in line with previous quarter

- Customers: 960 customers paying more than $50,000 annually

- Gross Margin (GAAP): 86.5%, in line with same quarter last year

“In the first quarter we made meaningful progress in capturing our large market opportunity with strong top line growth and increasing net dollar retention,” said monday.com founder and co-CEO, Roy Mann.

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

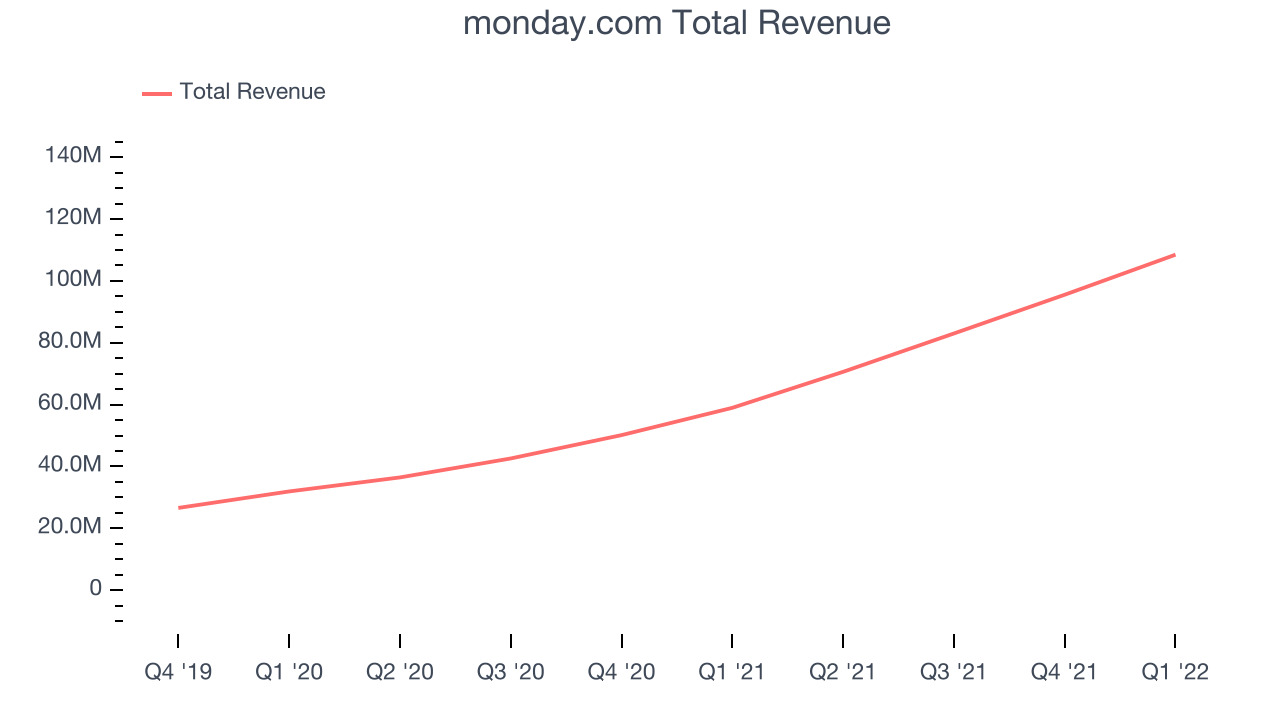

Sales Growth

As you can see below, monday.com's revenue growth has been incredible over the last year, growing from quarterly revenue of $58.9 million, to $108.4 million.

This was another standout quarter with the revenue up a splendid 83.9% year on year. Quarter on quarter the revenue increased by $12.9 million in Q1, which was roughly in line with the Q4 2021 increase. This steady quarter-on-quarter growth shows the company is able to maintain a strong growth trajectory.

Guidance for the next quarter indicates monday.com is expecting revenue to grow 67.1% year on year to $118 million, slowing down from the 93.6% year-over-year increase in revenue the company had recorded in the same quarter last year. Ahead of the earnings results the analysts covering the company were estimating sales to grow 46.4% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

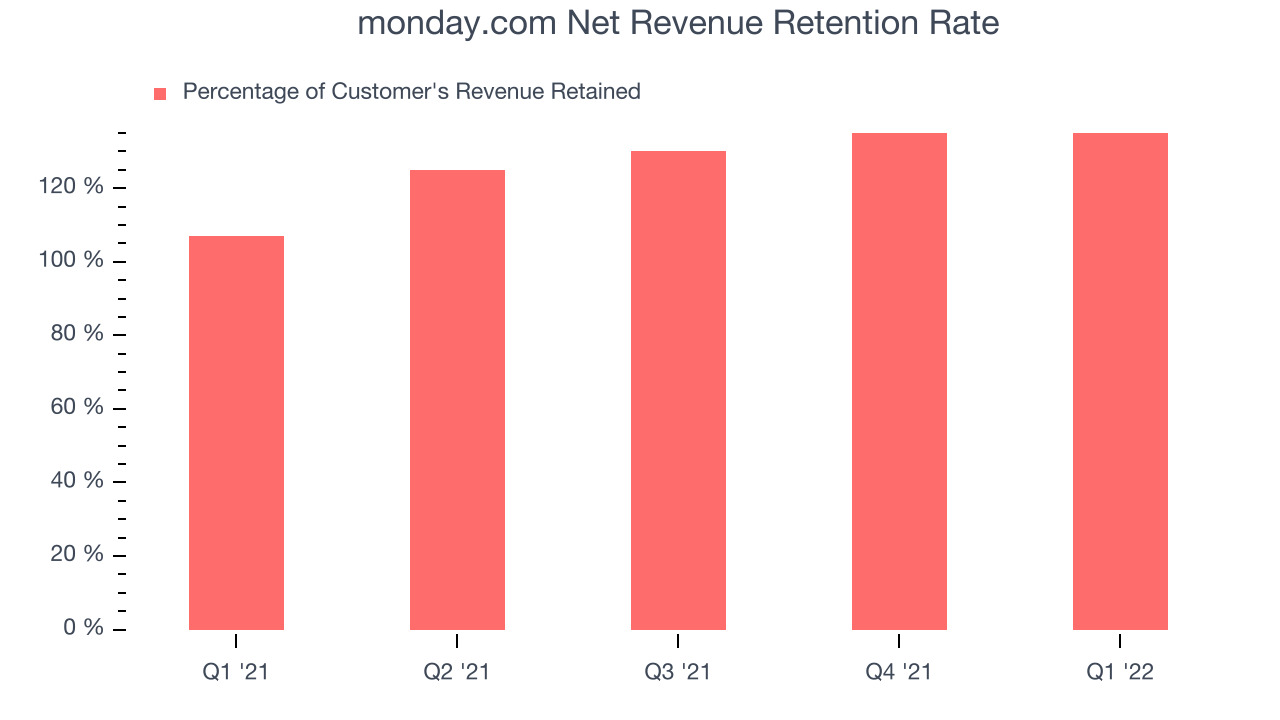

Product Success

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time.

monday.com's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 135% in Q1. That means even if they didn't win any new customers, monday.com would have grown its revenue 35% year on year. Trending up over the last year, this is a great retention rate and a clear proof of a great product. We can see that monday.com's customers are very satisfied with their software and are using it more and more over time.

Key Takeaways from monday.com's Q1 Results

With a market capitalization of $4.95 billion monday.com is among smaller companies, but its more than $849.5 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We were impressed by the very optimistic revenue guidance monday.com provided for the next quarter. And we were also excited to see the really strong revenue growth. On the other hand, there was a deterioration in gross margin. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. The company is flat on the results and currently trades at $104.61 per share.

monday.com may have had a good quarter, so should you invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.