Project management software maker Monday.com (NASDAQ:MNDY) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 33.7% year on year to $216.9 million. Guidance for next quarter's revenue was also better than expected at $228 million at the midpoint, 1.2% above analysts' estimates. It made a non-GAAP profit of $0.61 per share, improving from its profit of $0.14 per share in the same quarter last year.

Is now the time to buy Monday.com? Find out by accessing our full research report, it's free.

Monday.com (MNDY) Q1 CY2024 Highlights:

- Revenue: $216.9 million vs analyst estimates of $210.6 million (3% beat)

- EPS (non-GAAP): $0.61 vs analyst estimates of $0.40 (50.9% beat)

- Revenue Guidance for Q2 CY2024 is $228 million at the midpoint, above analyst estimates of $225.2 million

- The company lifted its revenue guidance for the full year from $929 million to $945 million at the midpoint, a 1.7% increase

- The company lifted its operating profit (non-GAAP) guidance for the full year from $61 million to $80 million at the midpoint, a large 30+% increase

- Gross Margin (GAAP): 89.2%, in line with the same quarter last year

- Free Cash Flow of $89.89 million, up 62.1% from the previous quarter

- Net Revenue Retention Rate: 114%, up from 110% in the previous quarter

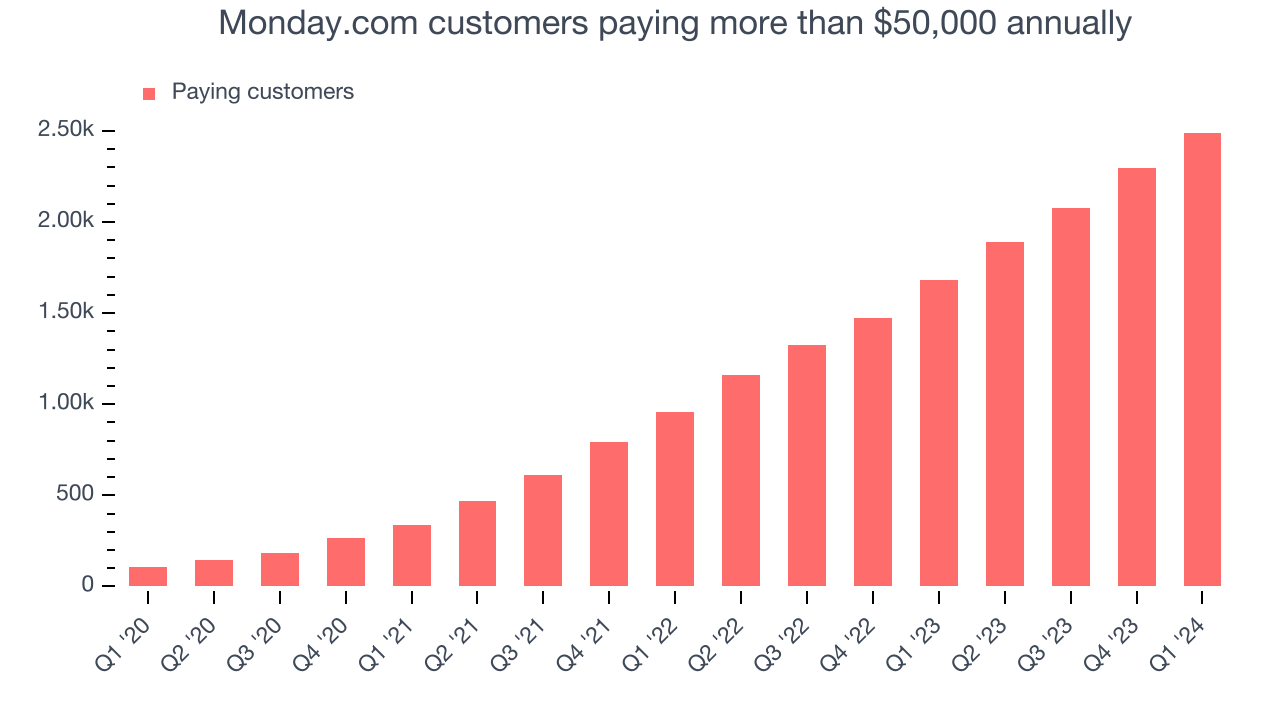

- Customers: 2,491 customers paying more than $50,000 annually

- Market Capitalization: $8.90 billion

“Q1 represents another great step forward for monday.com, with strong revenue growth and profitability, as well as record free cash flow. These results are supported by recent adjustments made to our pricing model, which thus far have exceeded our initial expectations,” said Eliran Glazer, monday.com CFO.

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

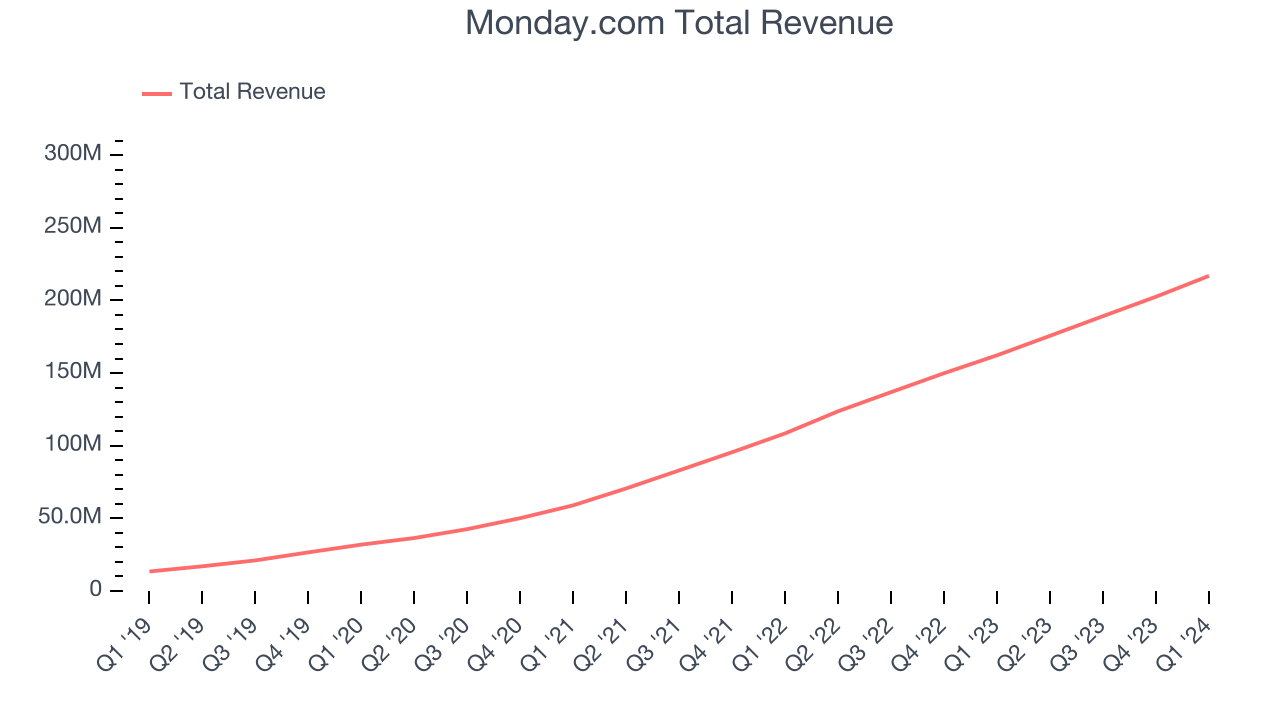

Sales Growth

As you can see below, Monday.com's revenue growth has been incredible over the last three years, growing from $58.97 million in Q1 2021 to $216.9 million this quarter.

Unsurprisingly, this was another great quarter for Monday.com with revenue up 33.7% year on year. On top of that, its revenue increased $14.34 million quarter on quarter, a solid improvement from the $13.38 million increase in Q4 CY2023. This is a sign of slight acceleration of growth.

Next quarter's guidance suggests that Monday.com is expecting revenue to grow 29.8% year on year to $228 million, slowing down from the 42% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 26.3% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Large Customers Growth

This quarter, Monday.com reported 2,491 enterprise customers paying more than $50,000 annually, an increase of 196 from the previous quarter. That's a bit fewer contract wins than last quarter but quite a bit above what we've typically seen over the last 12 months, suggesting that its sales momentum is healthy but softening after a tough comp quarter from last year.

Key Takeaways from Monday.com's Q1 Results

This was a 'beat and raise' quarter. Specifically, we enjoyed seeing Monday.com materially improve its net revenue retention this quarter. We were also glad its revenue outperformed Wall Street's estimates. Looking ahead, the company raised its full year guidance across the board, all of which is above expectations. The full year operating profit raise was particularly large, showing that the business is more profitable than expected. Overall, this quarter's results were great and shareholders should feel optimistic. The stock is up 20.2% after reporting and currently trades at $218.22 per share.

Monday.com may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.