Project management software maker Monday.com (NASDAQ:MNDY) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 33.7% year on year to $216.9 million. Guidance for next quarter's revenue was also better than expected at $228 million at the midpoint, 1.2% above analysts' estimates. It made a non-GAAP profit of $0.61 per share, improving from its profit of $0.14 per share in the same quarter last year.

Monday.com (MNDY) Q1 CY2024 Highlights:

- Revenue: $216.9 million vs analyst estimates of $210.6 million (3% beat)

- EPS (non-GAAP): $0.61 vs analyst estimates of $0.40 (50.9% beat)

- Revenue Guidance for Q2 CY2024 is $228 million at the midpoint, above analyst estimates of $225.2 million

- The company lifted its revenue guidance for the full year from $929 million to $945 million at the midpoint, a 1.7% increase

- The company lifted its operating profit (non-GAAP) guidance for the full year from $61 million to $80 million at the midpoint, a large 30+% increase

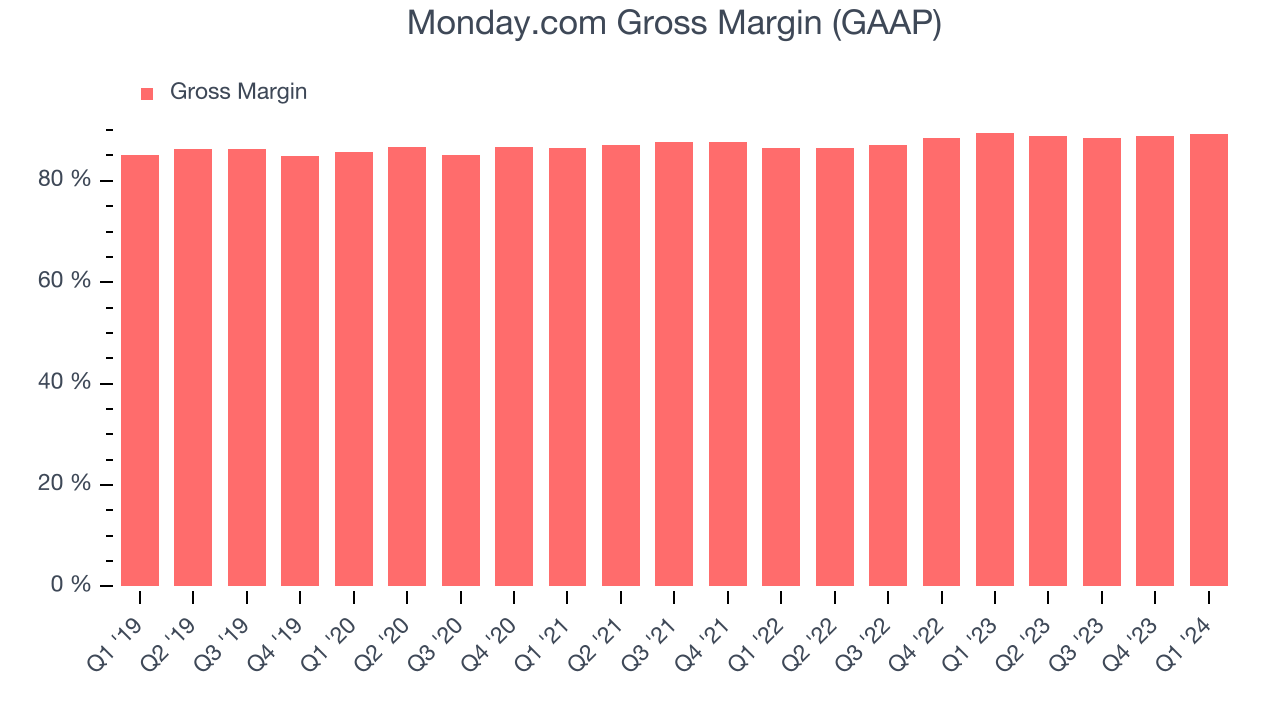

- Gross Margin (GAAP): 89.2%, in line with the same quarter last year

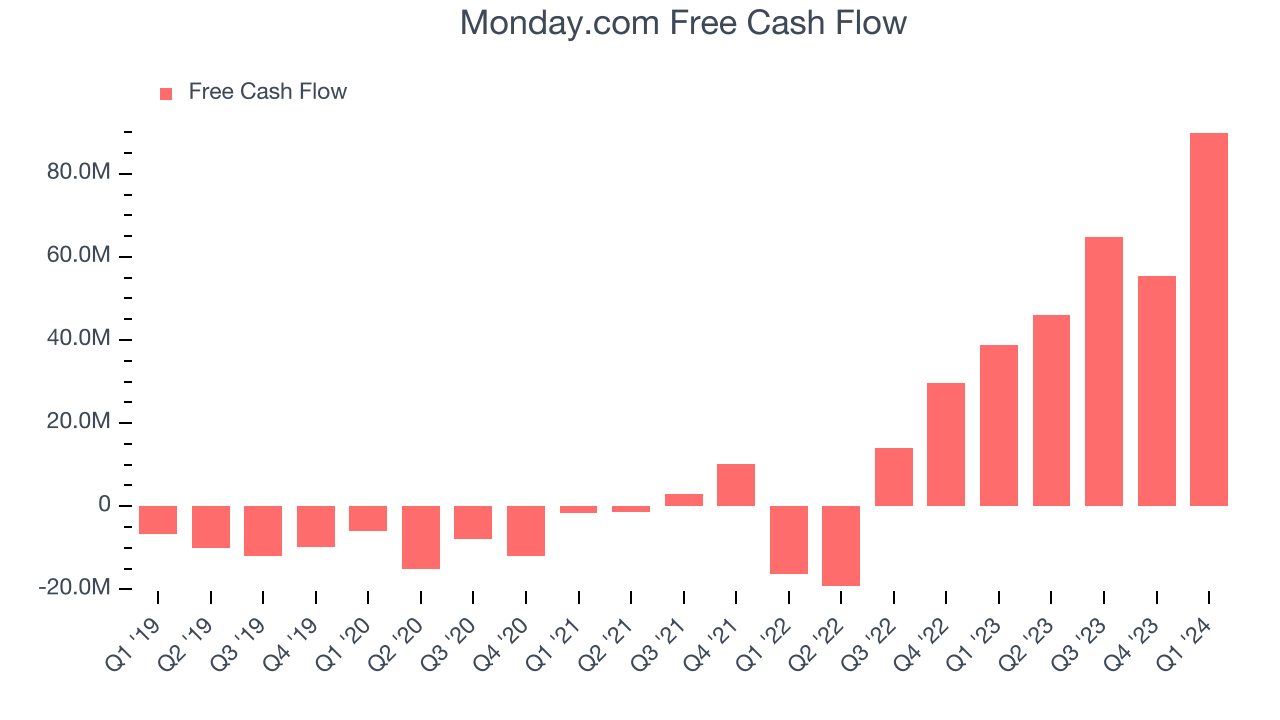

- Free Cash Flow of $89.89 million, up 62.1% from the previous quarter

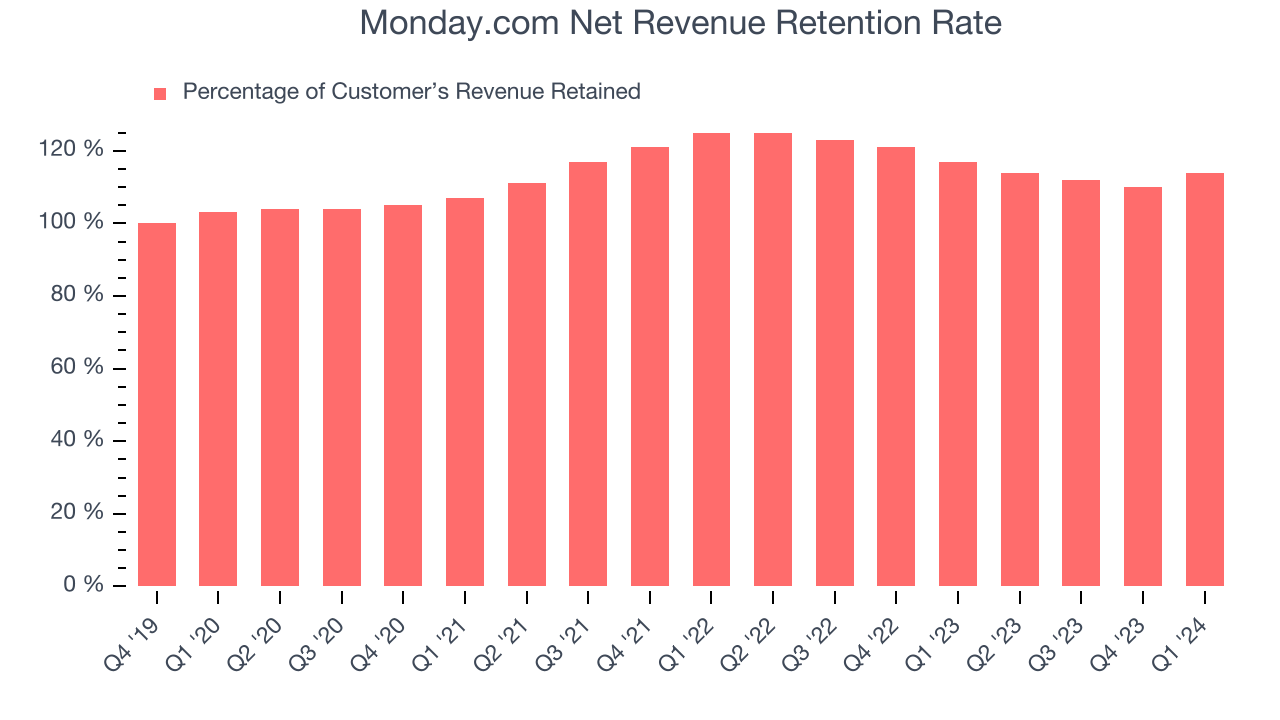

- Net Revenue Retention Rate: 114%, up from 110% in the previous quarter

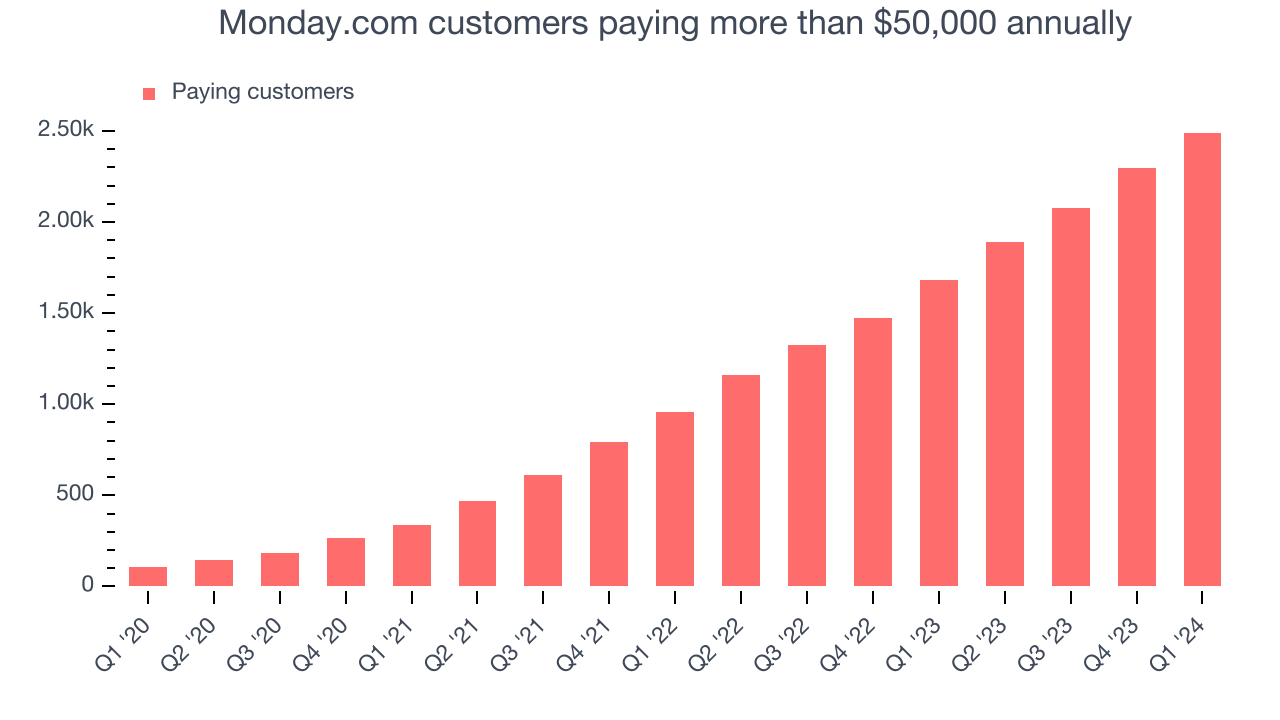

- Customers: 2,491 customers paying more than $50,000 annually

- Market Capitalization: $8.90 billion

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

A lot of project planning and management work is still done with a mixture of emails, spreadsheets that only exist on one person’s computer, hand written notes and in-person meetings. As a result, a lot of time is lost tracking down who does what, when, and how, with team managers organizing multiple meetings to get accurate updates on the progress of a project.

To help companies better plan their work, Monday.com provides them with a centralized online dashboard where tasks can be created, assigned and tracked. The platform integrates with other applications such as email, calendar or online document storage and is able to automate basic workflows such as sending emails when a task is due or importing information from a document. The key point is that the project management software becomes a system of record for the whole team, a central place where the information is always available and up to date. To make project managers even more efficient, Monday.com also provides them with a number of reusable templates that make it easy for them to create marketing dashboards, budget calculators and manage approval flows.

For example when developing a video game, the project manager can set up all the tasks in Monday.com including cost estimates and ask the client for approval on each of them. Once the work begins, the company management can see what the engineering team is working on in real time, and using the cost vs time tracking can easily tell if there’s a chance the cost might be higher than what was initially calculated.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Other competitors in the project management space include Smartsheet (NYSE:SMAR), Asana (NYSE:ASAN), and Trello which is owned by Atlassian (NASDAQ:TEAM).

Sales Growth

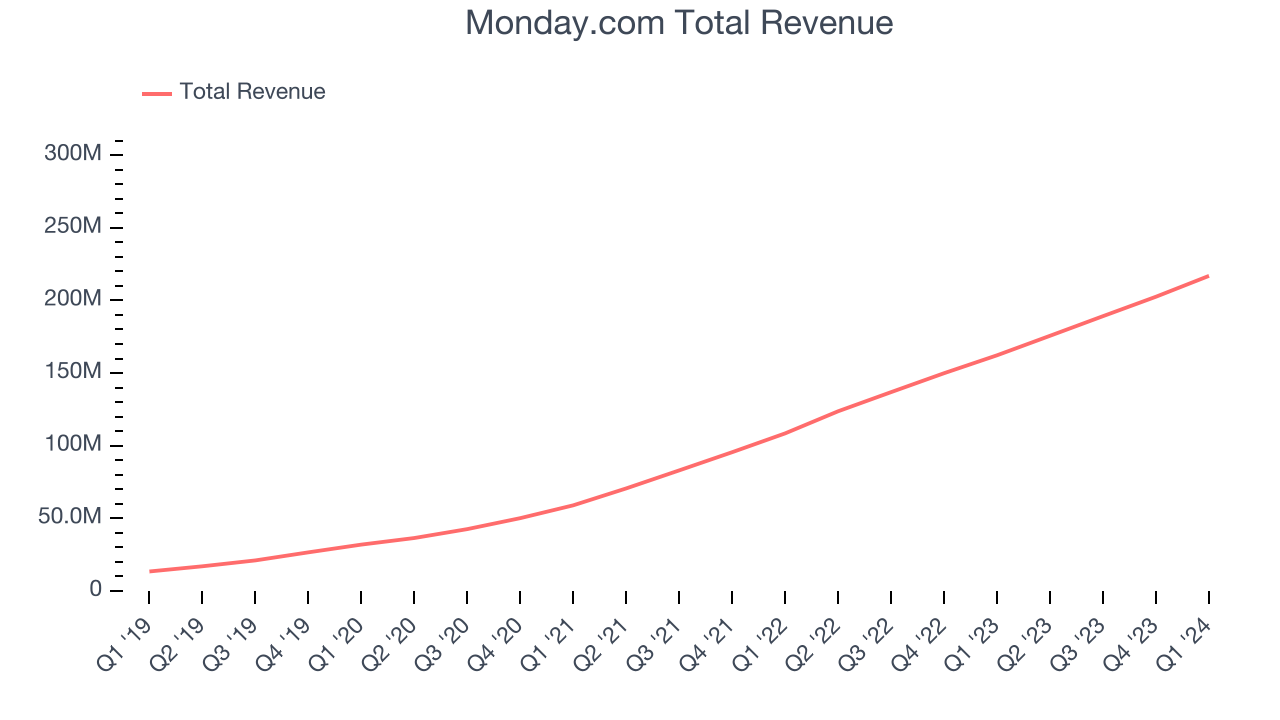

As you can see below, Monday.com's revenue growth has been incredible over the last three years, growing from $58.97 million in Q1 2021 to $216.9 million this quarter.

Unsurprisingly, this was another great quarter for Monday.com with revenue up 33.7% year on year. On top of that, its revenue increased $14.34 million quarter on quarter, a solid improvement from the $13.38 million increase in Q4 CY2023. This is a sign of slight acceleration of growth.

Next quarter's guidance suggests that Monday.com is expecting revenue to grow 29.8% year on year to $228 million, slowing down from the 42% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 26.3% over the next 12 months before the earnings results announcement.

Large Customers Growth

This quarter, Monday.com reported 2,491 enterprise customers paying more than $50,000 annually, an increase of 196 from the previous quarter. That's a bit fewer contract wins than last quarter but quite a bit above what we've typically seen over the last 12 months, suggesting that its sales momentum is healthy but softening after a tough comp quarter from last year.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Monday.com's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 114% in Q1. This means that even if Monday.com didn't win any new customers over the last 12 months, it would've grown its revenue by 14%.

Significantly up from the last quarter, Monday.com has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Monday.com's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 89.2% in Q1.

That means that for every $1 in revenue the company had $0.89 left to spend on developing new products, sales and marketing, and general administrative overhead. Monday.com's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Monday.com is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Monday.com's free cash flow came in at $89.89 million in Q1, up 132% year on year.

Monday.com has generated $256.2 million in free cash flow over the last 12 months, an eye-popping 32.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Monday.com's Q1 Results

This was a 'beat and raise' quarter. Specifically, we enjoyed seeing Monday.com materially improve its net revenue retention this quarter. We were also glad its revenue outperformed Wall Street's estimates. Looking ahead, the company raised its full year guidance across the board, all of which is above expectations. The full year operating profit raise was particularly large, showing that the business is more profitable than expected. Overall, this quarter's results were great and shareholders should feel optimistic. The stock is up 20.2% after reporting and currently trades at $218.22 per share.

Is Now The Time?

When considering an investment in Monday.com, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are numerous reasons why we think Monday.com is one of the best software as service companies out there. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. Additionally, its bountiful generation of free cash flow empowers it to invest in growth initiatives, and its impressive gross margins indicate excellent business economics.

The market is certainly expecting long-term growth from Monday.com given its price-to-sales ratio based on the next 12 months is 9.5x. But looking at the tech landscape today, Monday.com's qualities as one of the best businesses really stand out. We still like the stock at this price, despite the higher multiple.

Wall Street analysts covering the company had a one-year price target of $245.28 right before these results (compared to the current share price of $218.22), implying they see short-term upside potential in Monday.com.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.