Auto services provider Monro (NASDAQ:MNRO) fell short of analysts' expectations in Q3 FY2024, with revenue down 5.2% year on year to $317.7 million. It made a non-GAAP profit of $0.39 per share, down from its profit of $0.43 per share in the same quarter last year.

Monro (MNRO) Q3 FY2024 Highlights:

- Market Capitalization: $933.9 million

- Revenue: $317.7 million vs analyst estimates of $324.8 million (2.2% miss)

- EPS (non-GAAP): $0.39 vs analyst expectations of $0.39 (small miss)

- Gross Margin (GAAP): 35.5%, up from 33.8% in the same quarter last year

- Same-Store Sales were down 6.1% year on year

- Store Locations: 1,347 at quarter end, increasing by 51 over the last 12 months

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

The core customer is someone who relies on their cars for daily needs, which is most of suburban and rural America. Monro understands that these car owners have busy lives and may lack the expertise to diagnose and address issues with their automobiles. The company therefore aims to be a one-stop-shop for everything from periodic maintenance to more involved repairs.

Monro locations are moderate in size, typically 5,000 square feet and equipped with specialty tools and technology for auto repairs. These locations are strategically located in suburban areas, close to residential neighborhoods and major roadways. Even though you can’t have your car fixed online, Monro does have an e-commerce presence where customers can schedule appointments, access information Monro’s services, and even purchase products like tires and motor oil.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Auto parts and services providers include Advance Auto Parts (NYSE:AAP), AutoZone (NYSE:AZO), O’Reilly Automotive (NASDAQ:ORLY), and private company Pep Boys.Sales Growth

Monro is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

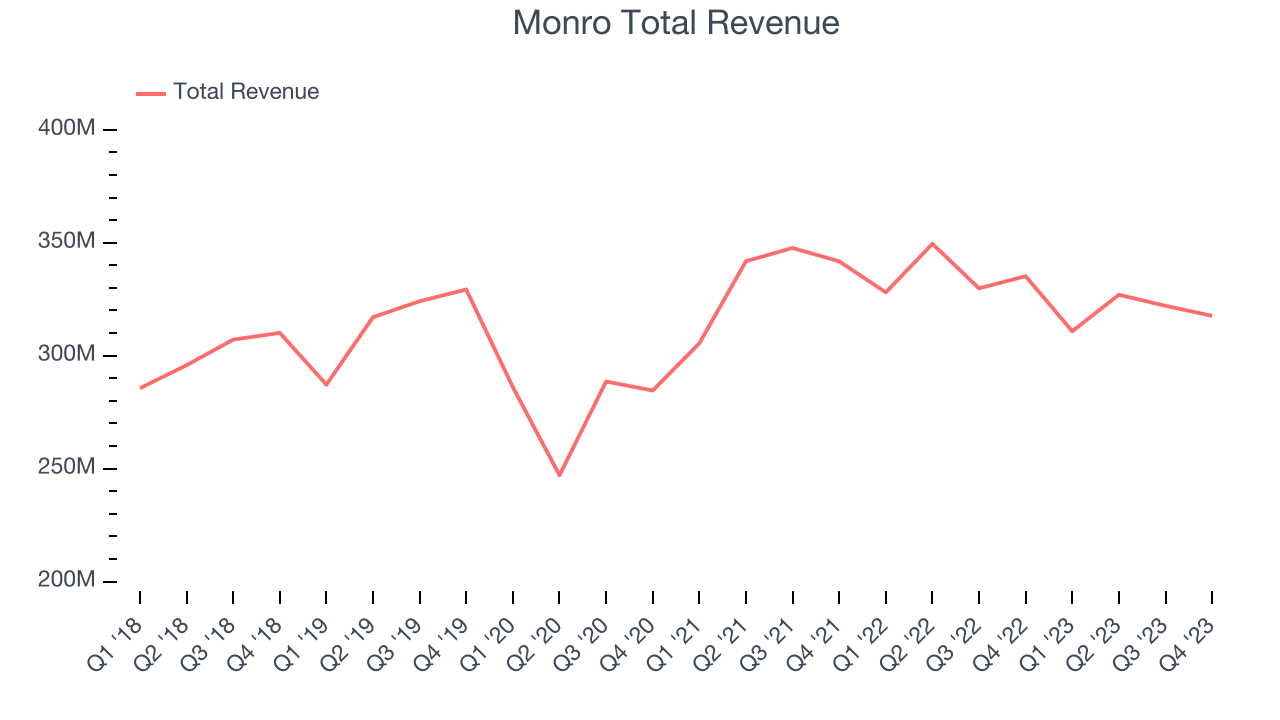

As you can see below, the company's revenue was flat over the last four years (we compare to 2019 to normalize for COVID-19 impacts) as its store footprint remained relatively unchanged, implying that growth was driven by more sales at existing, established stores.

This quarter, Monro missed Wall Street's estimates and reported a rather uninspiring 5.2% year-on-year revenue decline, generating $317.7 million in revenue. Looking ahead, Wall Street expects sales to grow 4.8% over the next 12 months, an acceleration from this quarter.

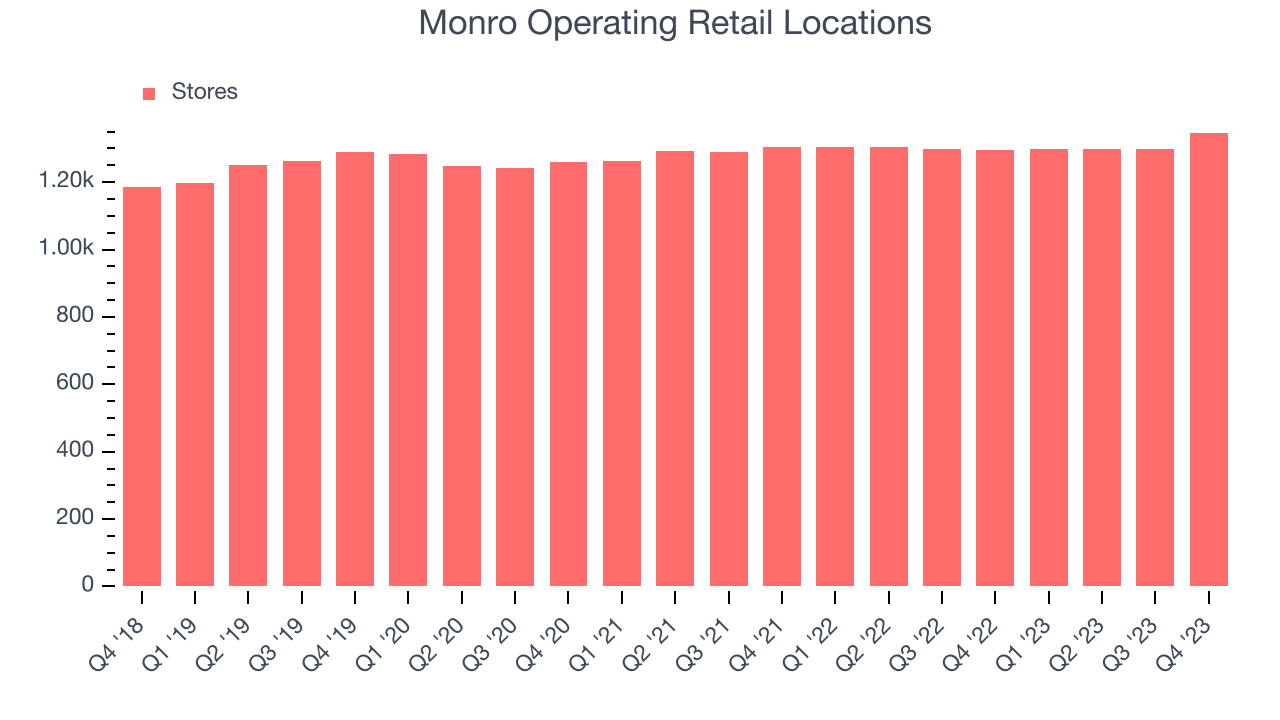

Number of Stores

When a retailer like Monro keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Monro's store count increased by 51 locations, or 3.9%, over the last 12 months to 1,347 total retail locations in the most recently reported quarter.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

Monro's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Monro's same-store sales fell 6.1% year on year. This decline was a reversal from the 5.6% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

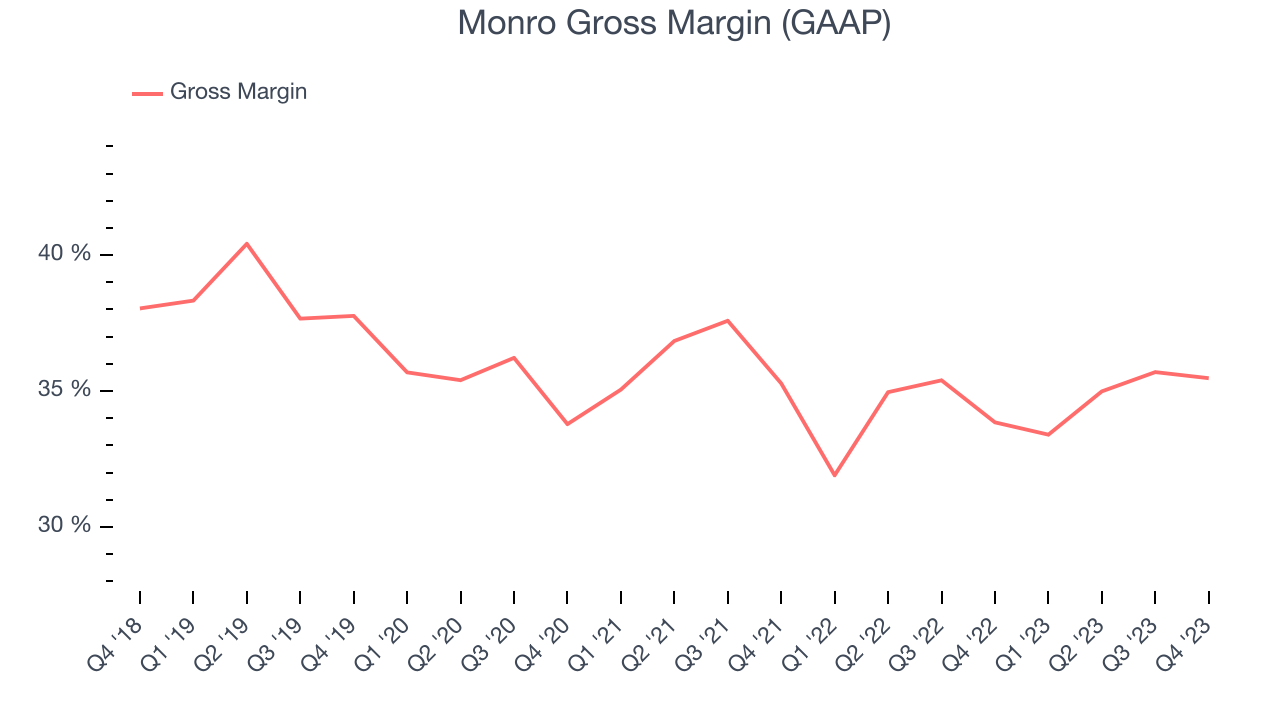

Gross Margin & Pricing Power

Monro has subpar unit economics for a retailer, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged a paltry 34.5% gross margin over the last two years. This means the company makes $0.34 for every $1 in revenue before accounting for its operating expenses.

Monro produced a 35.5% gross profit margin in Q3, marking a 1.6 percentage point increase from 33.8% in the same quarter last year. This margin expansion is a good sign in the near term. If this trend continues, it could signal a less competitive environment where the company has better pricing power, less pressure to discount products, and more stable input costs (such as distribution expenses to move goods).

Operating Margin

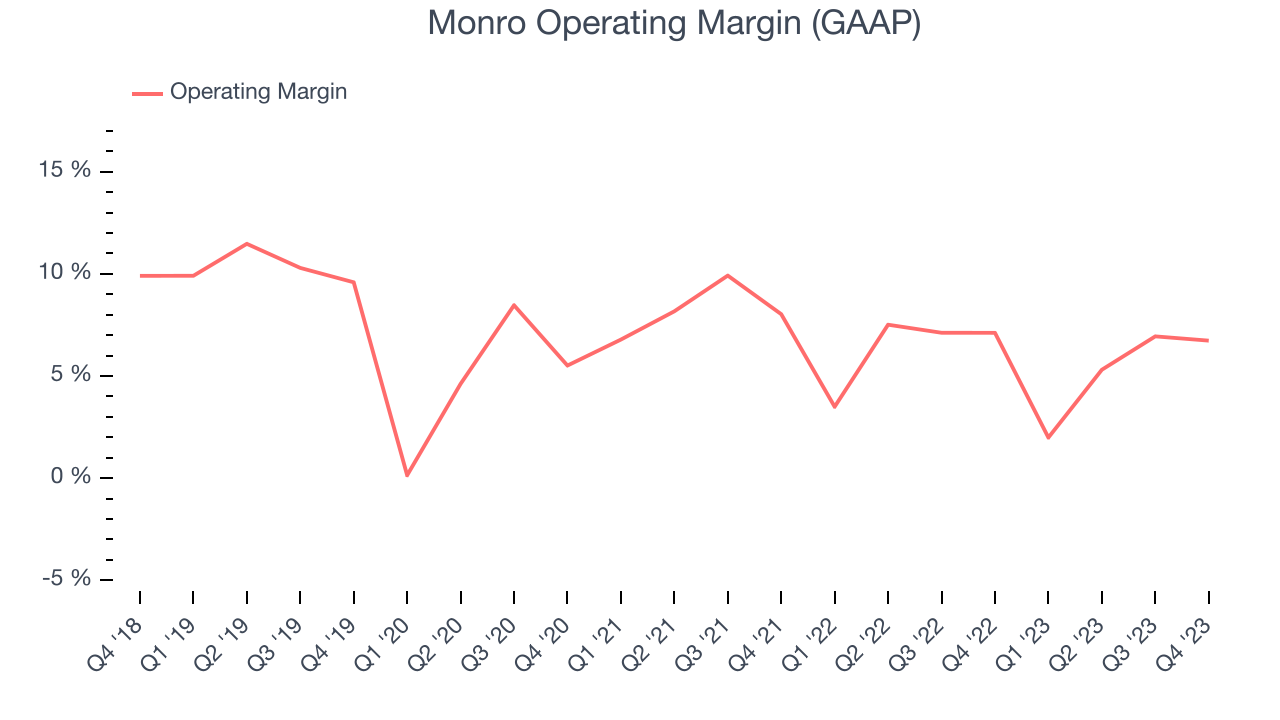

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q3, Monro generated an operating profit margin of 6.7%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Monro was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 5.8%. On top of that, Monro's margin has slightly declined, on average, by 1.1 percentage points year on year. This shows Monro has faced some speed bumps.

Zooming out, Monro was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 5.8%. On top of that, Monro's margin has slightly declined, on average, by 1.1 percentage points year on year. This shows Monro has faced some speed bumps.EPS

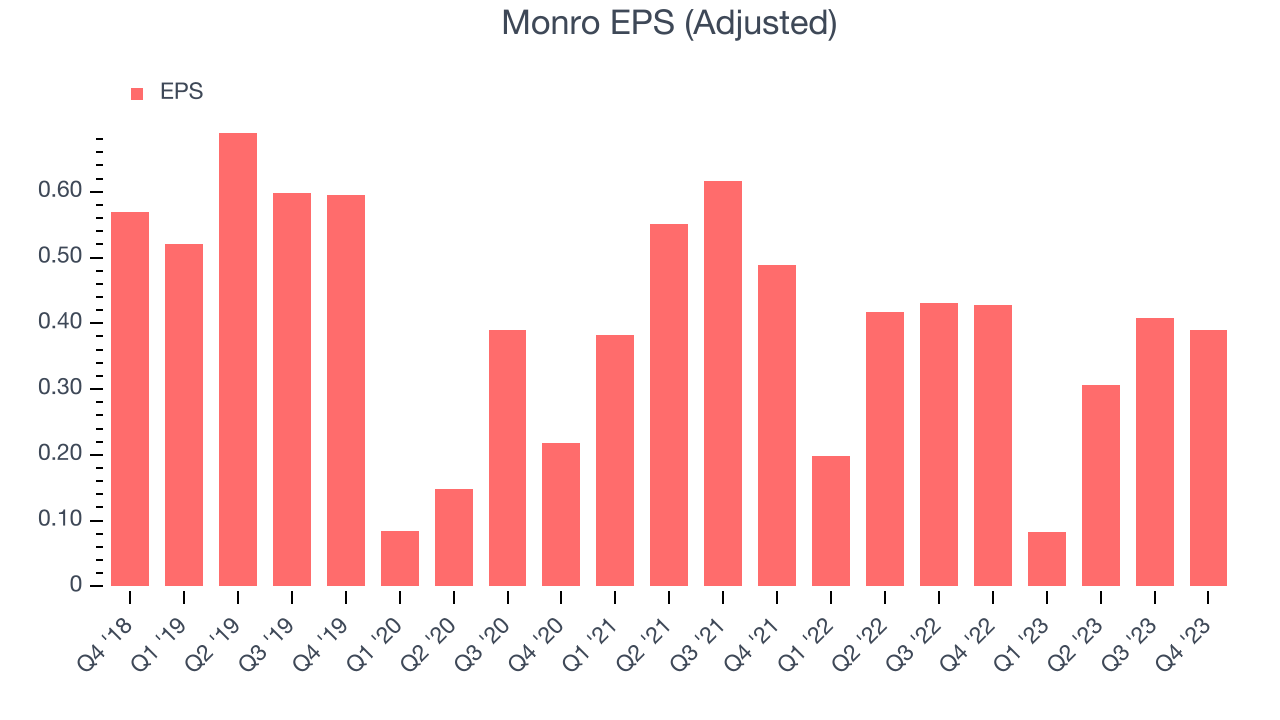

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q3, Monro reported EPS at $0.39, down from $0.43 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2020 and FY2024, Monro's adjusted diluted EPS dropped 64.6%, translating into 16.2% average annual declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 40.9% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS growth informs us whether a company's revenue growth was profitable. But was it capital-efficient? For example, if two companies had the same EPS growth, we’d prefer the one putting up those numbers with lower capital requirements (usually in the form of balance sheet debt and equity).

Understanding a company’s long-term ROIC (return on invested capital) gives another level of insight because it factors the total debt and equity needed to generate operating profits. This metric is a proxy for not only the capital efficiency of a business but also its management team's decision-making prowess (because they're the individuals dictating what the company invests in).

Monro's five-year average ROIC was 7.5%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable growth initiatives. The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Monro's ROIC has averaged 1.5 percentage point decreases each year. This is yet another strike against the company and suggests its profitable investment opportunities are even fewer than in the past.

Key Takeaways from Monro's Q3 Results

It was good to see Monro beat analysts' gross margin expectations this quarter by executing inventory optimizations. That stood out as a positive in these results. On the other hand, its revenue unfortunately missed analysts' expectations, driven by a 6.1% decrease in its same-store sales. Management noted its tires segment performed the worst, with same-store sales dropping 9%. This was due to pressured low-to-middle-income consumers deferring purchases in the company's higher-priced tire offerings. Industry data from Torqata, however, shows that the company's tire performance was in line with the broader industry and that it maintained its market share during the period. Because of these headwinds, Monro now expects full-year sales to be flat year on year. Overall, this was a mediocre quarter for Monro. The stock is flat after reporting and currently trades at $29.7 per share.

Is Now The Time?

When considering an investment in Monro, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Monro, we'll be cheering from the sidelines. Its revenue growth has been weak over the last four years, but at least growth is expected to increase in the short term. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its brand caters to a niche market. On top of that, its mediocre same-store sales performance has been a headwind.

Monro's price-to-earnings ratio based on the next 12 months is 17.7x. While the price is reasonable and there are some things to like about Monro, we think there are better opportunities elsewhere in the market right now.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.