Energy drink company Monster Beverage (NASDAQ:MNST) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 11.8% year on year to $1.90 billion. It made a GAAP profit of $0.42 per share, improving from its profit of $0.38 per share in the same quarter last year.

Monster (MNST) Q1 CY2024 Highlights:

- Revenue: $1.90 billion vs analyst estimates of $1.90 billion (small miss)

- EPS: $0.42 vs analyst expectations of $0.44 (3.6% miss)

- Gross Margin (GAAP): 54.1%, up from 52.8% in the same quarter last year

- Company to commence tender offer to repurchase up to $3.0 billion of stock

- Market Capitalization: $55.77 billion

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

The energy drink category was new and catered to a niche demographic early in the company’s history. Its beverages sought to disrupt the huge soda market as consumers began to shy away from drinks with too much sugar. Monster helped create and capitalized on the demand for better-for-you functional beverages.

The unique selling proposition of Monster Beverage is a reliable energy source with a refreshing taste. This is achieved through a proprietary blend of caffeine, taurine, B vitamins, and herbal extracts. Monster also partners with popular and alternative sports to further cement the brand image as one for active lifestyles, not couch potatoes who want something to wash down some fast food with.

Monster Beverage's products have achieved widespread distribution over time and can be found on the shelves of convenience stores, gas stations, supermarkets, and mass merchandise retailers. Sports arenas, movie theaters, and other venues also sell Monster's products. Lastly, the company launched its e-commerce platform in 2015, allowing consumers to purchase beverages and merchandise directly from their website.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer energy drinks or alternatives to energy drinks include Rockstar Energy from PepsiCo (NASDAQ:PEP), Coca-Cola Energy and Full Throttle from Coca-Cola (NYSE:KO), and Celsius (NASDAQ:CELH).Sales Growth

Monster is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

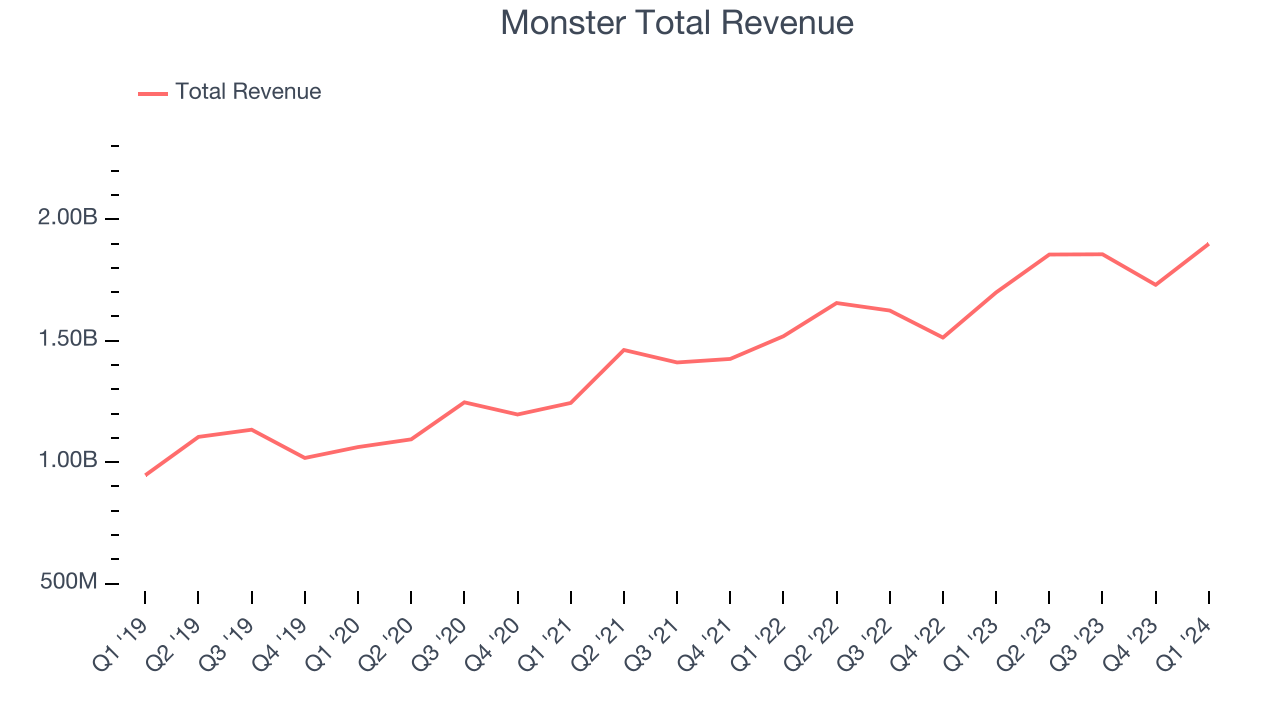

As you can see below, the company's annualized revenue growth rate of 15.4% over the last three years was solid for a consumer staples business.

This quarter, Monster's revenue grew 11.8% year on year to $1.90 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 10.6% over the next 12 months, a deceleration from this quarter.

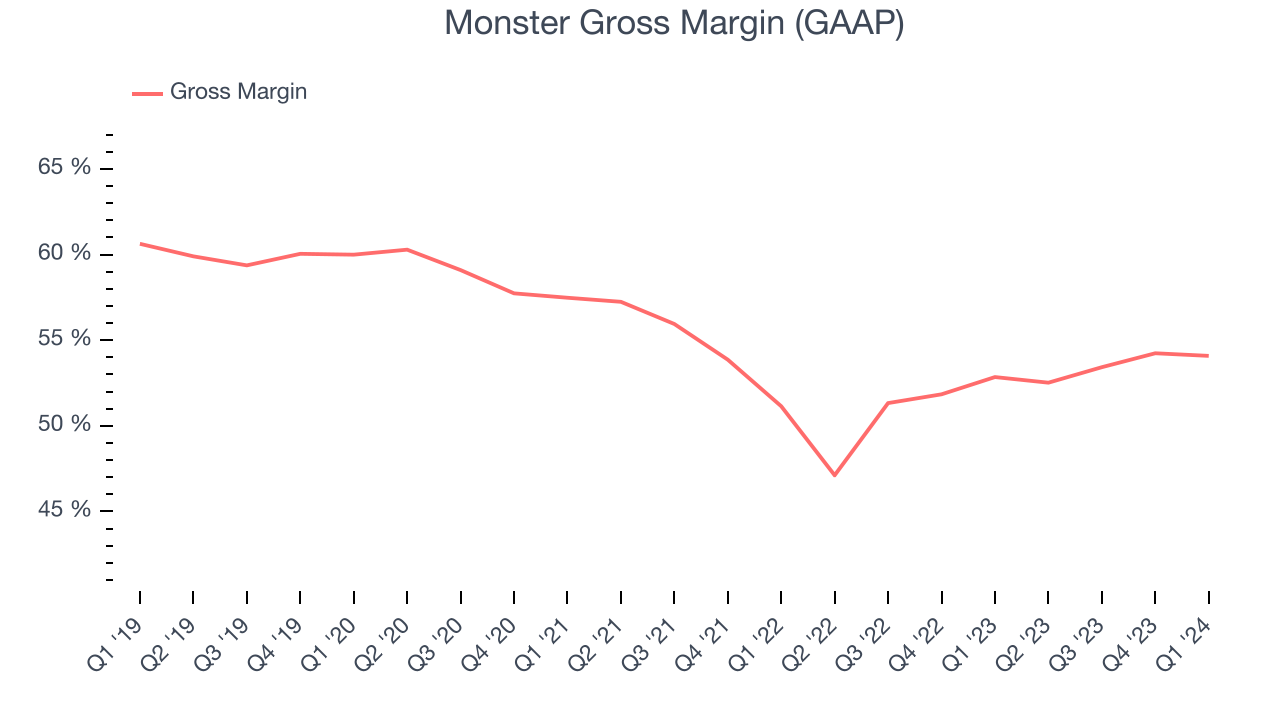

Gross Margin & Pricing Power

All else equal, we prefer higher gross margins. They make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

This quarter, Monster's gross profit margin was 54.1%, up 1.2 percentage points year on year. That means for every $1 in revenue, $0.46 went towards paying for raw materials, production of goods, and distribution expenses.

Monster has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 52.3% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 5.6% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

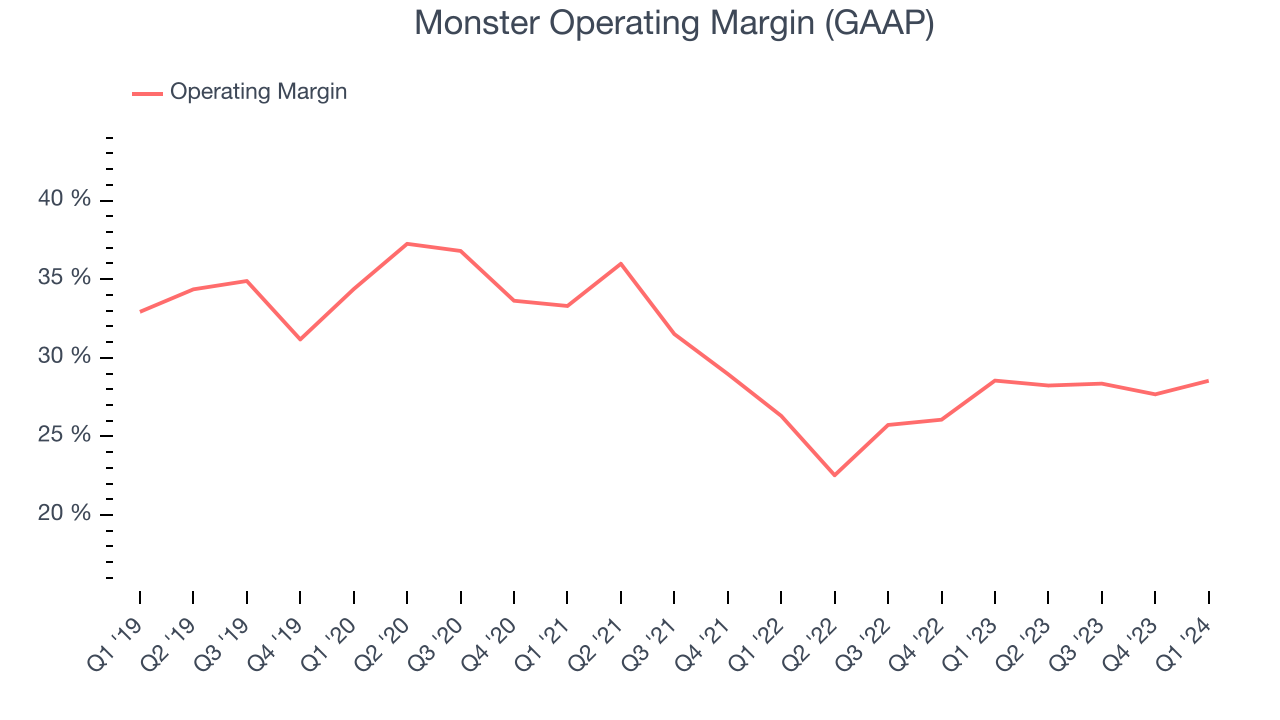

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Monster generated an operating profit margin of 28.5%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Monster has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 27%. On top of that, its margin has risen by 2.5 percentage points on average over the last year, showing the company is improving its fundamentals.

Zooming out, Monster has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 27%. On top of that, its margin has risen by 2.5 percentage points on average over the last year, showing the company is improving its fundamentals. EPS

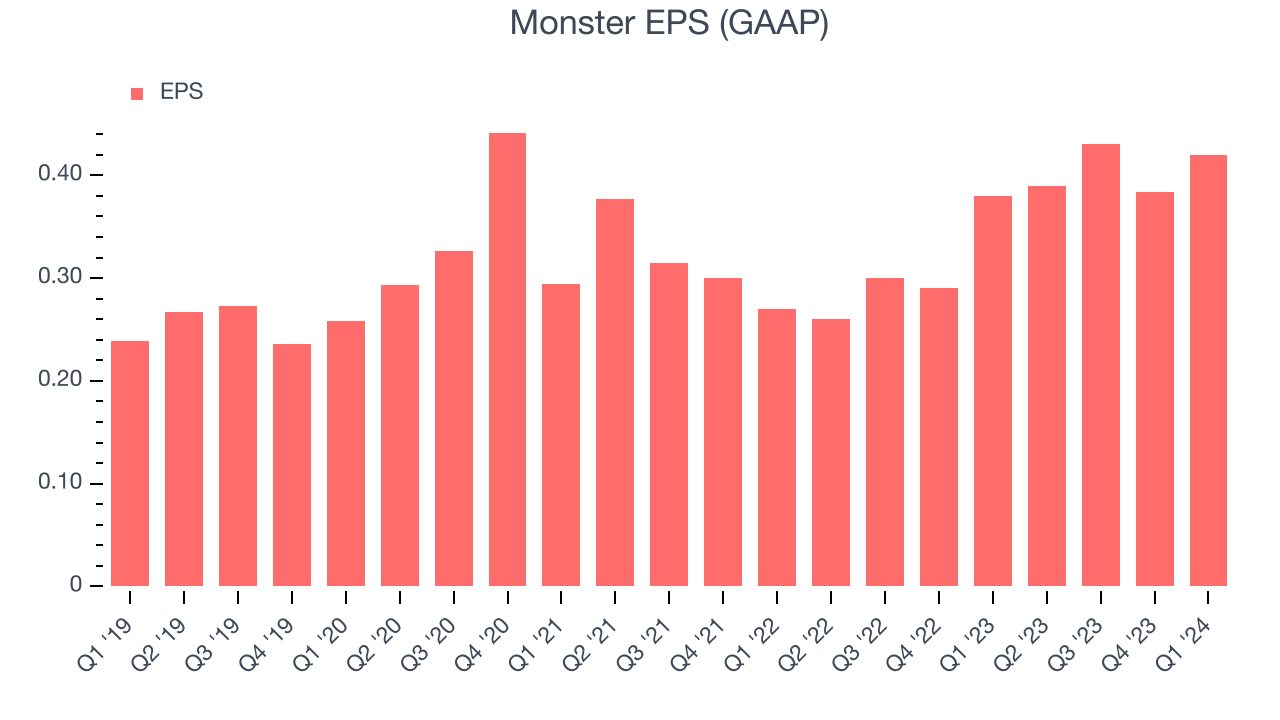

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Monster reported EPS at $0.42, up from $0.38 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Monster's EPS grew 19.8%, translating into a decent 6.2% compounded annual growth rate.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 14.4% year-on-year increase in EPS.

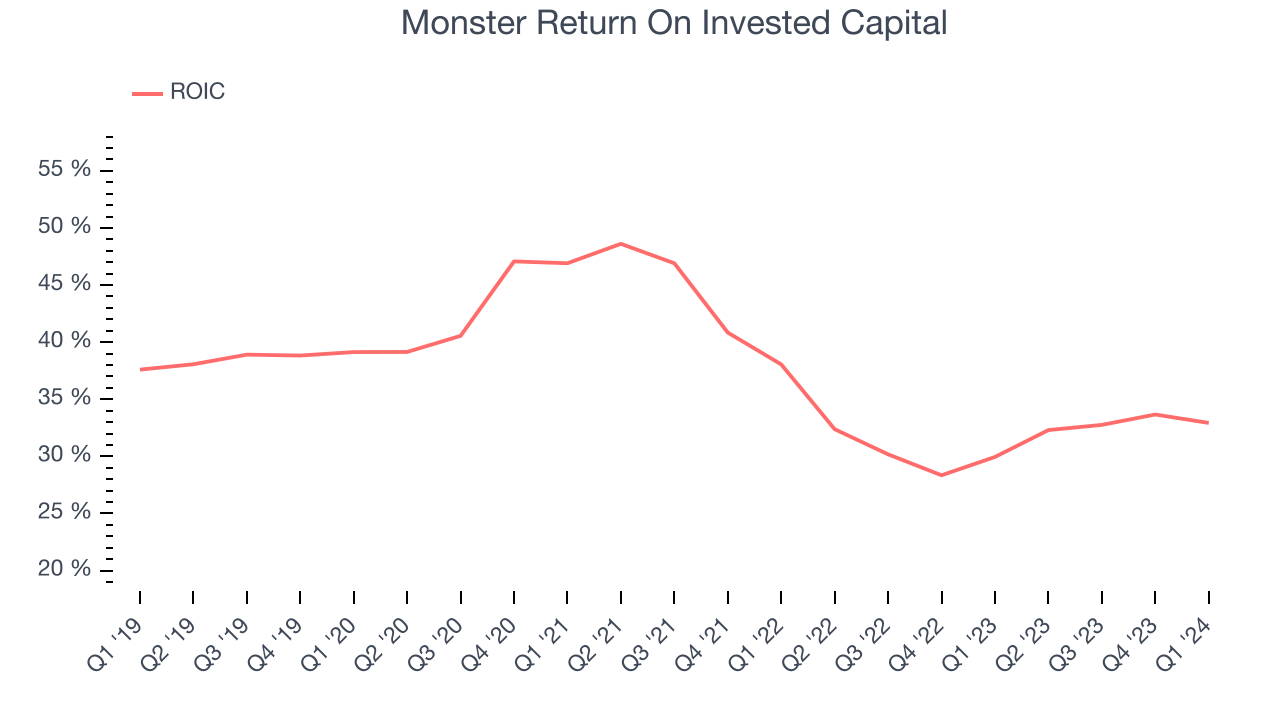

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Monster's five-year average ROIC was 37.4%, placing it among the best consumer staples companies. Just as you’d like your investment dollars to generate returns, Monster's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Monster's ROIC averaged 11.6 percentage point decreases over the last few years. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Key Takeaways from Monster's Q1 Results

Monster's revenue was roughly in line and EPS missed analysts' expectations. The company also announced that intends to commence a tender offer to repurchase up to $3 billion of stock. Overall, this was a mixed quarter for Monster. The stock is up 3.7% after reporting and currently trades at $55.4 per share.

Is Now The Time?

Monster may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Monster is a great business. For starters, its revenue growth has been good over the last three years. On top of that, its impressive operating margins show it has a highly efficient business model, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Monster's price-to-earnings ratio based on the next 12 months is 28.7x. Looking at the consumer staples landscape today, Monster's qualities as one of the best businesses really stand out, and despite the higher valuation, we still like it at this price.

Wall Street analysts covering the company had a one-year price target of $62.46 per share right before these results (compared to the current share price of $55.40), implying they saw upside in buying Monster in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.