Earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s have a look at how Momentive (NASDAQ:MNTV) and the rest of the sales and marketing software stocks fared in Q2.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 15 sales and marketing software stocks we track reported a a decent Q2; on average, revenues beat analyst consensus estimates by 3.52%, while on average next quarter revenue guidance was 2.08% above consensus. On average the share price was down 2.67% the day after the earnings.

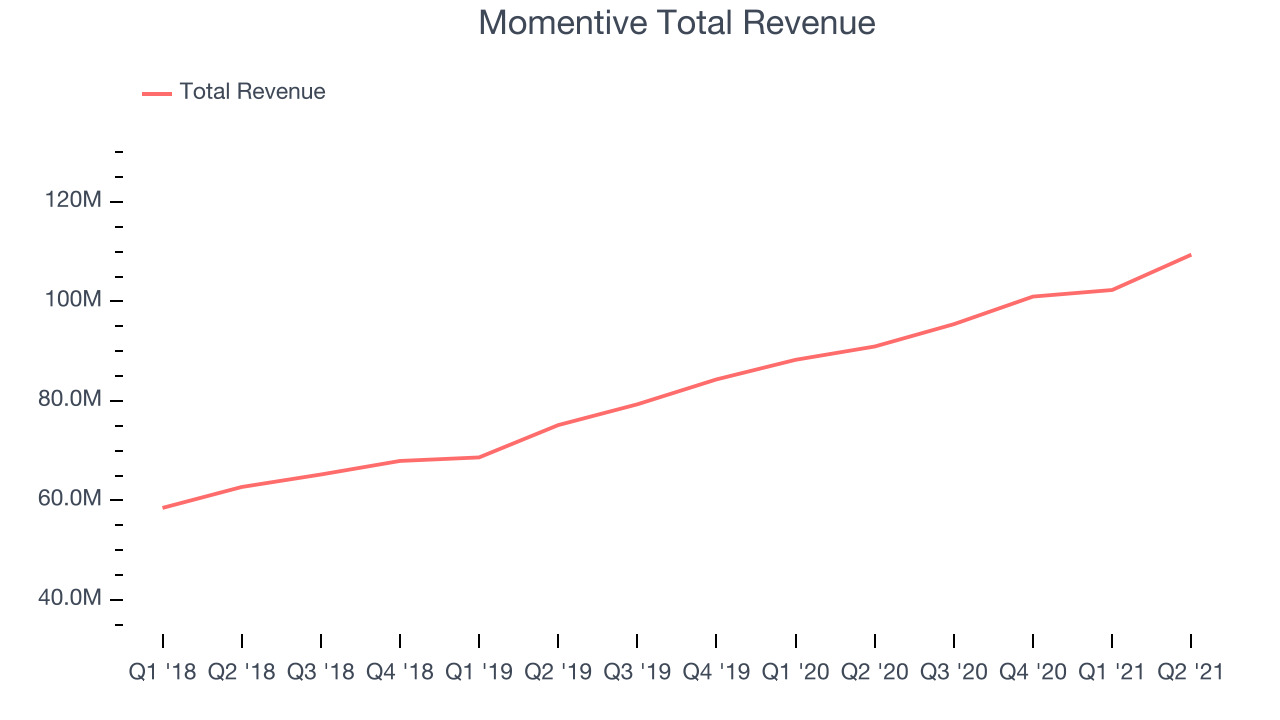

Momentive (NASDAQ:MNTV)

Previously known as SurveyMonkey, Momentive (NASDAQ:MNTV) offers software as a service that makes it easy for users create, manage and distribute online surveys.

Momentive reported revenues of $109.3 million, up 20.2% year on year, beating analyst expectations by 1.82%. It was a weaker quarter for the company, with a decent beat of analyst estimates but decelerating customer growth.

“In Q2, we executed on our corporate rebrand to Momentive while delivering strong Q2 financial results: 20% year-over-year revenue growth, even faster expansion of our leading growth indicators, and a 22% free cash flow margin,” said Zander Lurie, chief executive officer of Momentive.

The stock is up 17.2% since the results and currently trades at $24.32.

Is now the time to buy Momentive? Access our full analysis of the earnings results here, it's free.

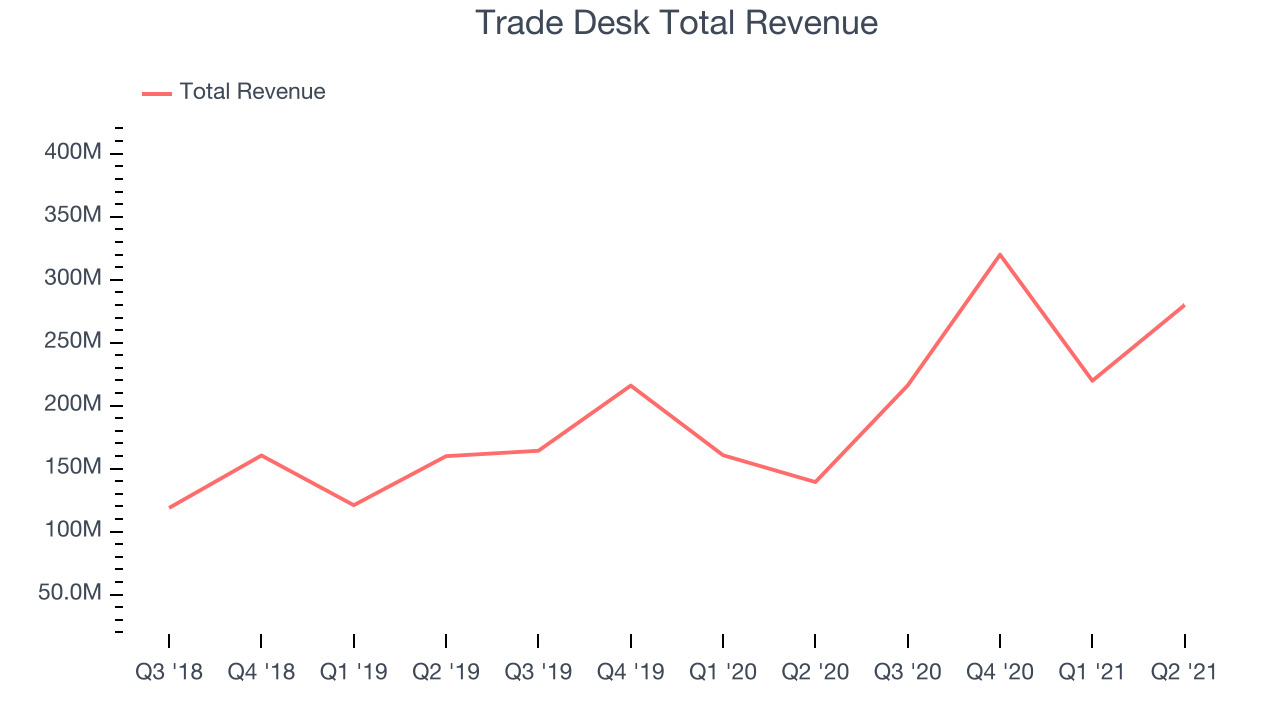

Best Q2: Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place and target their online ads.

Trade Desk reported revenues of $279.9 million, up 100% year on year, beating analyst expectations by 6.52%. It was an exceptional quarter for the company, with an impressive revenue growth and a significant improvement in gross margin.

Trade Desk delivered the fastest revenue growth among its peers. The stock is down 7.63% since the results and currently trades at $77.58.

Is now the time to buy Trade Desk? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Wix (NASDAQ:WIX)

Founded in 2006 in Tel Aviv, Wix.com offers a free and easy to operate website building platform.

Wix reported revenues of $316.4 million, up 34% year on year, beating analyst expectations by 1.52%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations.

The stock is down 26.4% since the results and currently trades at $190.69.

Read our full analysis of Wix's results here.

ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $52.1 million, up 43.4% year on year, beating analyst expectations by 2.06%. It was a weak quarter for the company, with an underwhelming full year guidance.

ON24 had the weakest full year guidance update among the peers. The stock is down 37.6% since the results and currently trades at $20.09.

Read our full, actionable report on ON24 here, it's free.

GoDaddy (NYSE:GDDY)

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE: GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

GoDaddy reported revenues of $931.3 million, up 15.4% year on year, beating analyst expectations by 1.19%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

The stock is down 15.9% since the results and currently trades at $70.22.

Read our full, actionable report on GoDaddy here, it's free.

The author has no position in any of the stocks mentioned