As customer experience software stocks’ Q3 earnings season wraps, let's dig into this quarter's best and worst performers, including Momentive (NASDAQ:MNTV) and its peers.

The Internet has given customers more choice on whom to conduct business with and has also given them the power to easily share their experiences with other customers. These twin dynamics effectively have increased pressure on companies to both improve their customer service and also monitor their brand reputation online, driving the need for customer experience software offerings.

The 4 customer experience software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 2.31%, while on average next quarter revenue guidance was 0.76% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but customer experience software stocks held their ground better than others, with the share prices up 21.2% since the previous earnings results, on average.

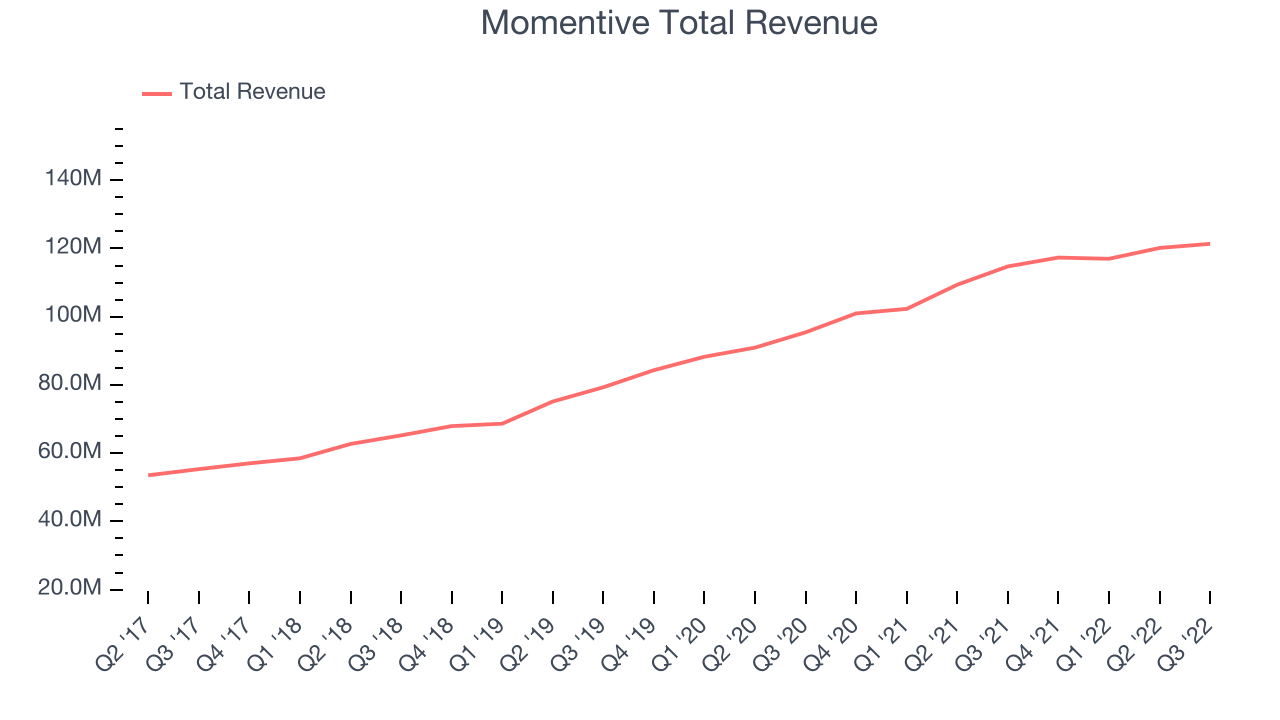

Slowest Q3: Momentive (NASDAQ:MNTV)

Previously known as SurveyMonkey, Momentive (NASDAQ:MNTV) offers software as a service that makes it easy for users create, manage and distribute online surveys.

Momentive reported revenues of $121.3 million, up 5.76% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and decelerating customer growth.

“In the third quarter, we remained focused on our long-term revenue growth and profitability targets while navigating an increasingly challenging macroeconomic environment,” said Zander Lurie, chief executive officer of Momentive.

Momentive delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full year guidance update of the whole group. The company lost 12,200 customers and ended up with a total of 897,500. The stock is down 2.83% since the results and currently trades at $6.86.

Read our full report on Momentive here, it's free.

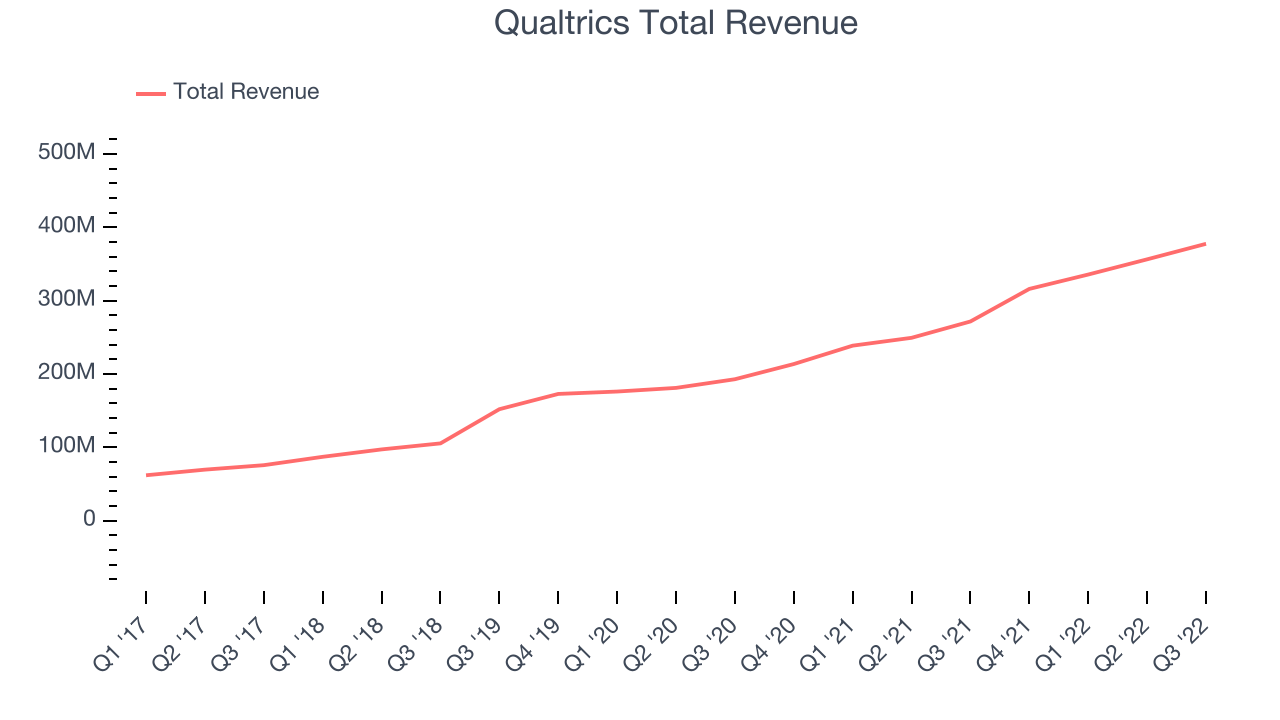

Best Q3: Qualtrics (NASDAQ:XM)

Founded in 2002 by Utah-based entrepreneur Ryan Smith, along with his father and brother, Qualtrics (NASDAQ:XM) provides organizations with software to collect and analyze feedback from customers and employees.

Qualtrics reported revenues of $377.5 million, up 38.9% year on year, beating analyst expectations by 5.29%. It was a strong quarter for the company, with exceptional revenue growth and a solid beat of analyst estimates.

Qualtrics achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is down 0.95% since the results and currently trades at $10.38.

Is now the time to buy Qualtrics? Access our full analysis of the earnings results here, it's free.

Sprinklr (NYSE:CXM)

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Sprinklr reported revenues of $157.2 million, up 23.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for the next quarter and full year missing analysts' expectations.

The stock is down 5.83% since the results and currently trades at $7.75.

Read our full analysis of Sprinklr's results here.

UserTesting (NYSE:USER)

Founded in 1999 and staying private for 22 years before a 2021 IPO, UserTesting (NYSE:USER) enables companies to receive feedback from users so they can improve their customer experience.

UserTesting reported revenues of $49.4 million, up 27.8% year on year, beating analyst expectations by 2.91%. It was a solid quarter for the company, with a decent beat of analyst estimates.

The stock is up 94.5% since the results and currently trades at $7.51.

UserTesting announced that it had entered into a definitive agreement to be acquired by Thoma Bravo, a leading software investment firm, and significant minority owner Sunstone Partners, for $7.50 per share, in an all-cash transaction valued at approximately $1.3 billion

Read our full, actionable report on UserTesting here, it's free.

The author has no position in any of the stocks mentioned