Leading edge card issuer Marqeta (NASDAQ: MQ) reported Q2 CY2024 results topping analysts' expectations, with revenue down 45.8% year on year to $125.3 million. It made a GAAP profit of $0.23 per share, improving from its loss of $0.11 per share in the same quarter last year.

Is now the time to buy Marqeta? Find out by accessing our full research report, it's free.

Marqeta (MQ) Q2 CY2024 Highlights:

- Revenue: $125.3 million vs analyst estimates of $121.5 million (3.1% beat)

- EPS: $0.23 vs analyst estimates of $0.21 (8.9% beat)

- Gross Margin (GAAP): 63.3%, up from 36.6% in the same quarter last year

- Free Cash Flow of $14.24 million is up from -$765,000 in the previous quarter

- Market Capitalization: $2.53 billion

"The second quarter demonstrates the great returns on our reinvigorated go-to-market approach combined with our ability to deliver innovation at scale. We signed a pioneering techbank, launched a new payment innovation that reimagines what a card can be, and deepened the array of services we can offer globally, all while continuing to grow our TPV and operate with focused efficiency,” said Simon Khalaf, CEO at Marqeta.

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Sales Growth

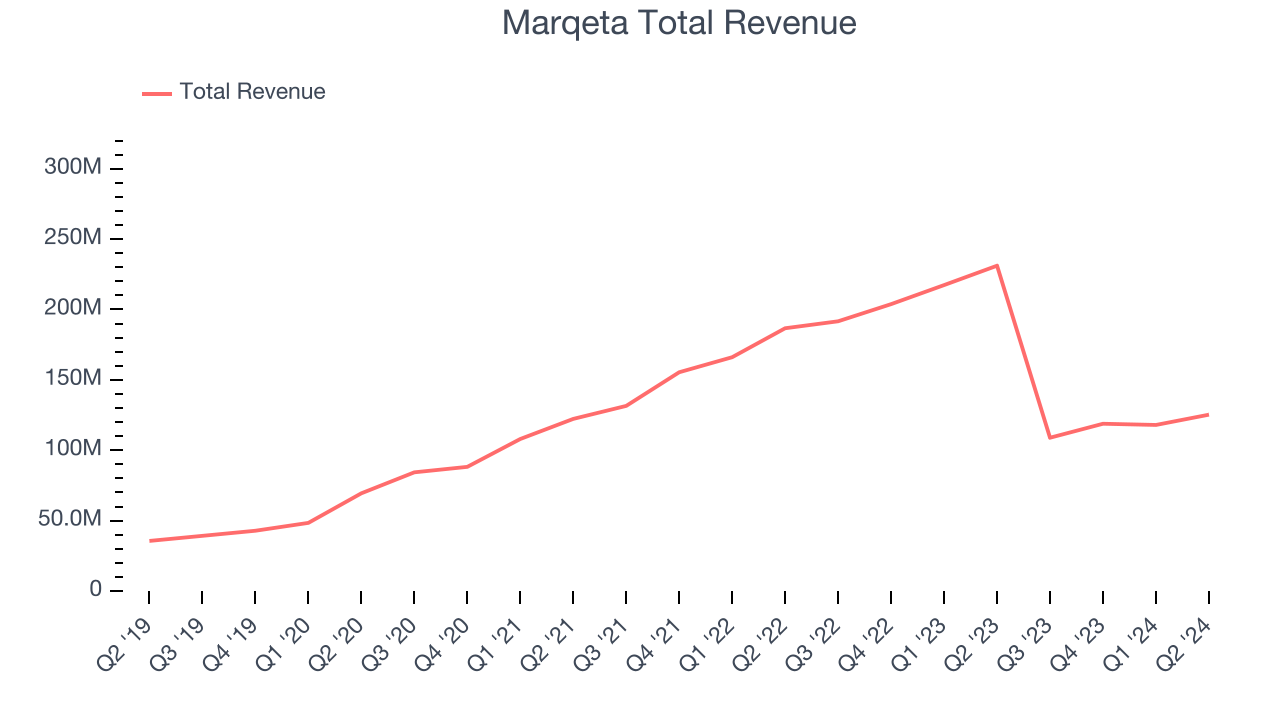

As you can see below, Marqeta's 5.4% annualized revenue growth over the last three years has been weak, and its sales came in at $125.3 million this quarter.

This quarter, Marqeta's revenue was down 45.8% year on year, which might disappointment some shareholders.

Looking ahead, analysts covering the company were expecting sales to grow 22.1% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

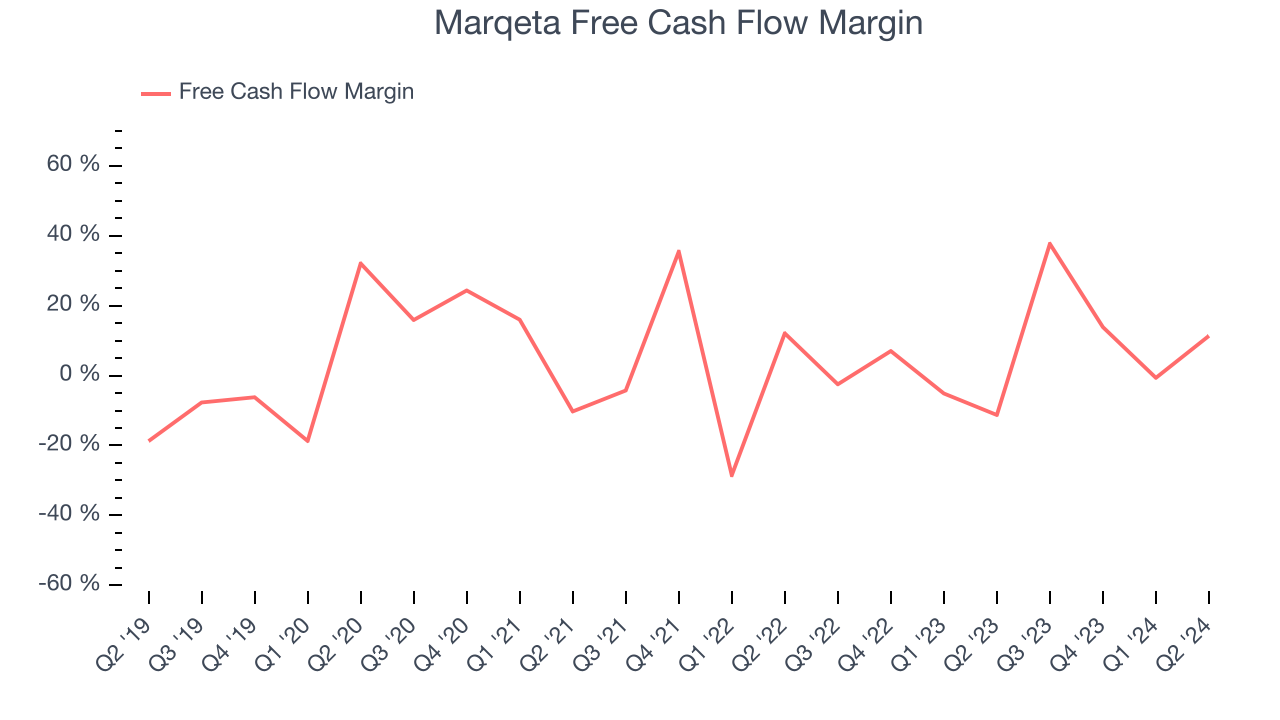

Marqeta has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company's free cash flow margin averaged 15.1% over the last year, better than the broader software sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Marqeta's free cash flow clocked in at $14.24 million in Q2, equivalent to a 11.4% margin. This quarter's result was nice as its cash flow turned positive after being negative in the same quarter last year, but we wouldn't put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Marqeta's Q2 Results

It was good to see Marqeta beat analysts' revenue expectations this quarter. On the other hand, its gross margin declined. Zooming out, we think this was a mixed quarter. The stock remained flat at $4.92 immediately after reporting.

So should you invest in Marqeta right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.