As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the finance and HR software stocks, starting with Marqeta (NASDAQ:MQ).

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 5.01%, while on average next quarter revenue guidance was 3.19% above consensus. Tech stocks have been under pressure as inflation makes their long-dated profits less valuable, but finance and HR software stocks held their ground better than others, with the share prices up 1.75% since the previous earnings results, on average.

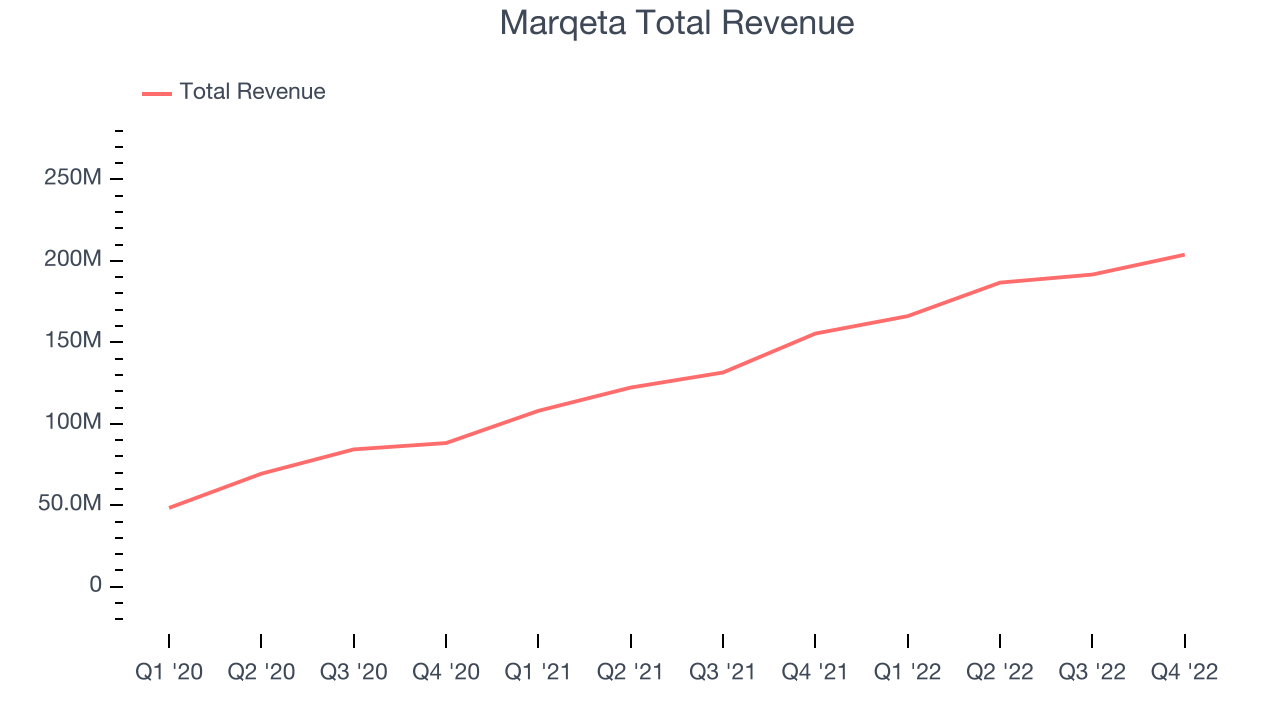

Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $203.8 million, up 31.1% year on year, in line with analyst expectations. It was a solid quarter for the company, with strong top line growth and a meaningful improvement in gross margin.

"I am very proud of the scale our business reached in 2022," said Simon Khalaf, CEO of Marqeta.

The stock is down 21.9% since the results and currently trades at $4.54.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

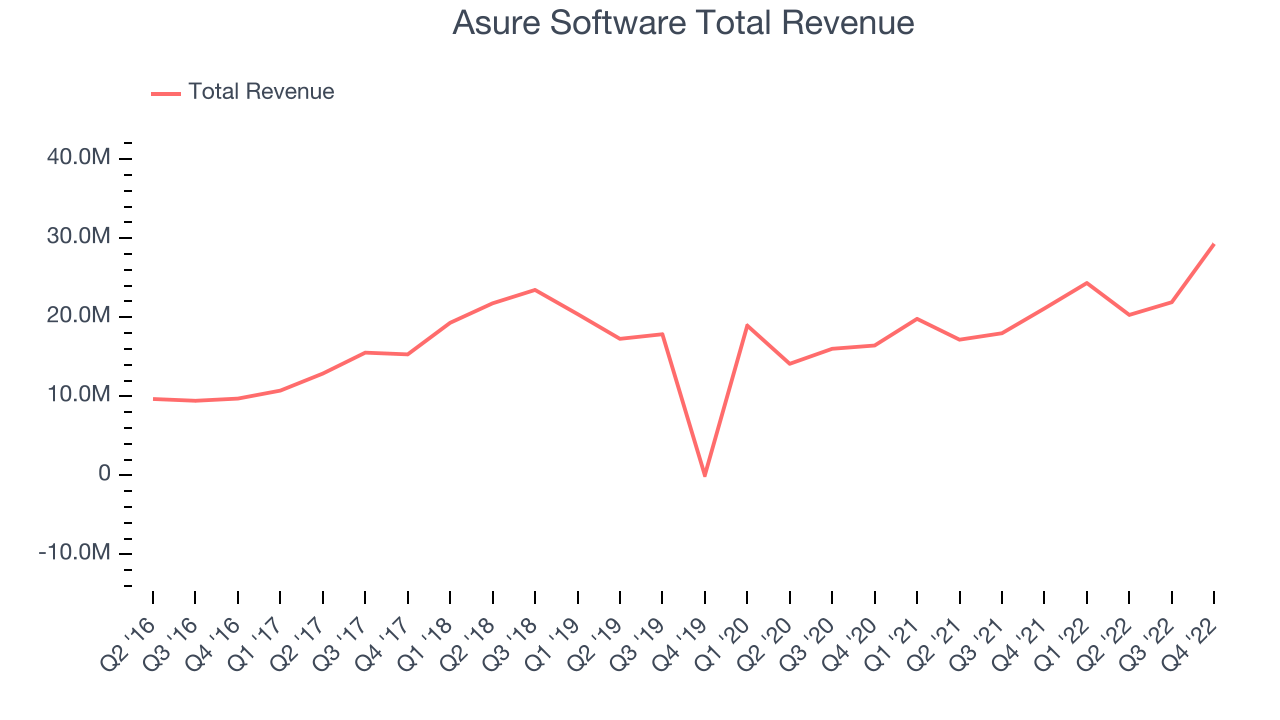

Best Q4: Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $29.3 million, up 38.7% year on year, beating analyst expectations by 23.3%. It was an impressive quarter for the company, with a significant improvement in gross margin and a solid beat of analyst estimates.

Asure Software achieved the strongest analyst estimates beat among its peers. The stock is up 28.2% since the results and currently trades at $14.4.

Is now the time to buy Asure Software? Access our full analysis of the earnings results here, it's free.

Slowest Q4: BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $140 million, up 21.4% year on year, in line with analyst expectations. It was a weaker quarter for the company, with full-year revenue guidance missing analysts' expectations.

BlackLine had the weakest performance against analyst estimates and weakest full year guidance update in the group. The company added 128 customers to a total of 4,188. The stock is down 7.4% since the results and currently trades at $67.15.

Read our full analysis of BlackLine's results here.

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $103 million, up 13.6% year on year, beating analyst expectations by 2.8%. It was a slower quarter for the company, with decelerating growth in large customers and underwhelming guidance for the next year.

The company added 3 enterprise customers paying more than $100,000 annually to a total of 773. The stock is up 18.3% since the results and currently trades at $9.69.

Read our full, actionable report on Zuora here, it's free.

Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $73.1 million, up 42.1% year on year, beating analyst expectations by 11.5%. It was a strong quarter for the company, with an impressive beat of analyst estimates.

Flywire pulled off the highest full year guidance raise among the peers. The stock is up 17.3% since the results and currently trades at $29.02.

Read our full, actionable report on Flywire here, it's free.

The author has no position in any of the stocks mentioned