Leading edge card issuer Marqeta (NASDAQ: MQ) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 45.7% year on year to $118 million. It made a GAAP loss of $0.07 per share, improving from its loss of $0.13 per share in the same quarter last year.

Marqeta (MQ) Q1 CY2024 Highlights:

- Revenue: $118 million vs analyst estimates of $116.9 million (small beat)

- EPS: -$0.07 vs analyst expectations of -$0.08 (in line)

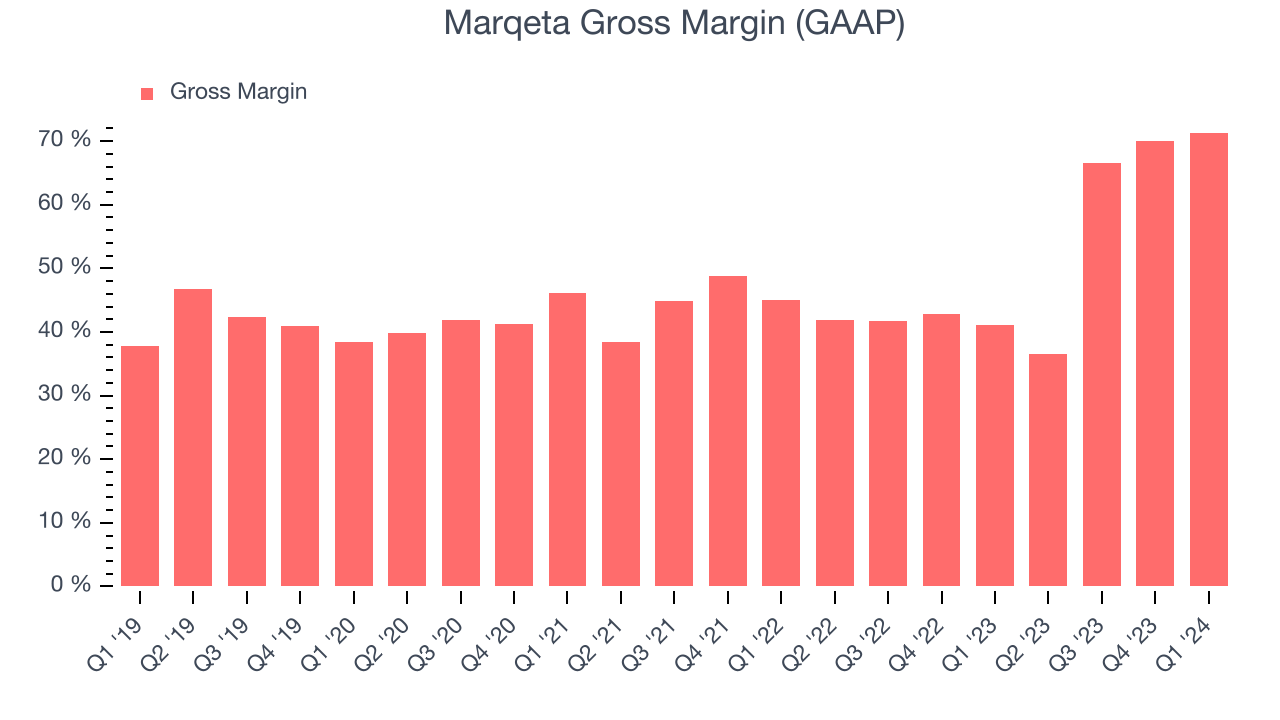

- Gross Margin (GAAP): 71.3%, up from 41% in the same quarter last year

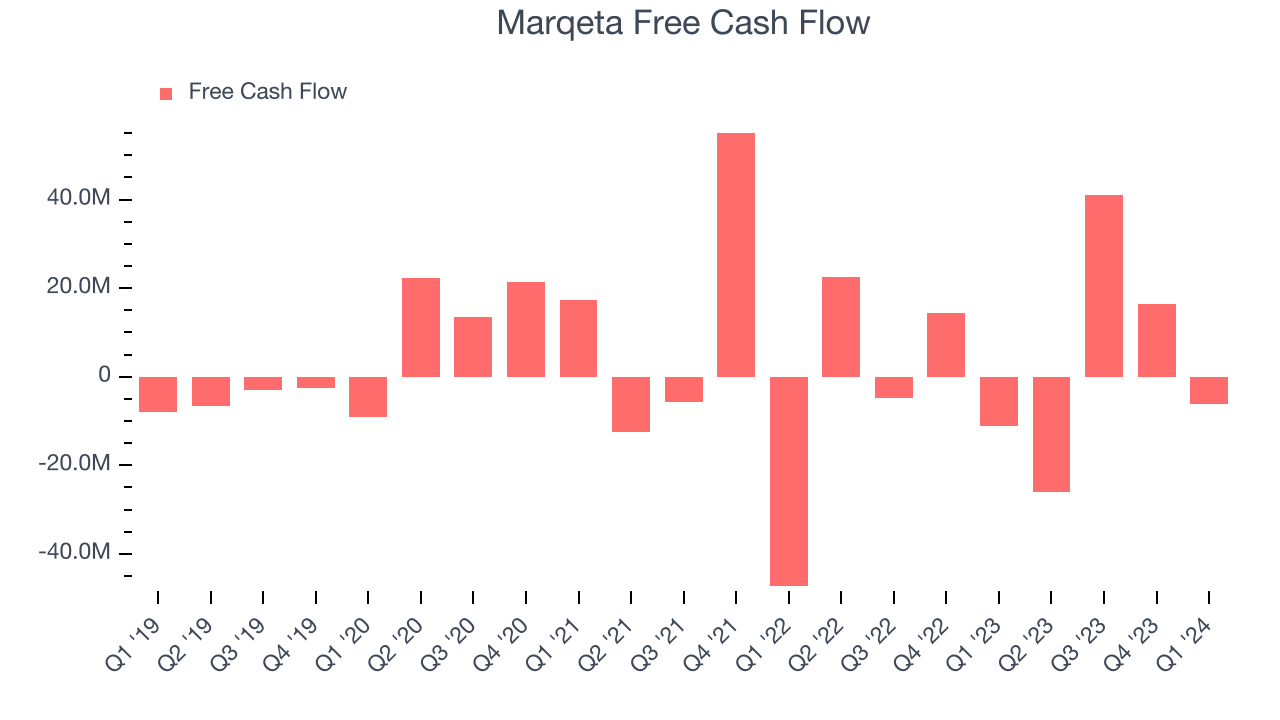

- Free Cash Flow was -$6.07 million, down from $16.48 million in the previous quarter

- Market Capitalization: $2.97 billion

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

The digitization and commercialization of electronic payments is accelerating as commerce continues to shift to online and mobile payments. Likewise, thanks to innovative products like Square almost any merchant can accept card payments while new business models have sprung up which involve multiple payments to multiple parties like Uber or DoorDash. However, legacy card issuers have been slow to innovate card issuing because their main customer bases were large financial institutions that didn’t demand expanded functionality.

Marqeta provides modern card issuing infrastructure that is open to developers, which enables businesses to develop modern, frictionless payment card experiences for consumer and commercial use cases that are either the core of their core business. Marqeta generates revenues from its platform’s usage: interchange and processing fees.

As might be expected, Marqeta’s customer base is largely comprised of digital-native businesses. Square uses Marqeta to offer Cash Card for its Cash App customers, which is a customizable Visa card that enables consumers to make purchases with funds in their Cash App stored balance. It also uses Marqeta for the Square card, which is a Mastercard debit card that enables merchants to make payments using their Square account balance. Marqeta also provides virtual card services for buy now pay later players like Klarna, Affirm, and Afterpay, which require cards to be issued to process payments to merchants for installment payments.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Marqeta’s competition can be grouped into legacy card issuers such as Global Payments (NYSE: GPN), Fidelity National Information Services (NYSE:FIS), Fiserv (NASDAQ: FISV), and modern card issuing peers like Adyen (ENXTAM: ADYN), Stripe and Galileo who is owned by Sofi (NASDAQ:SOFI).

Sales Growth

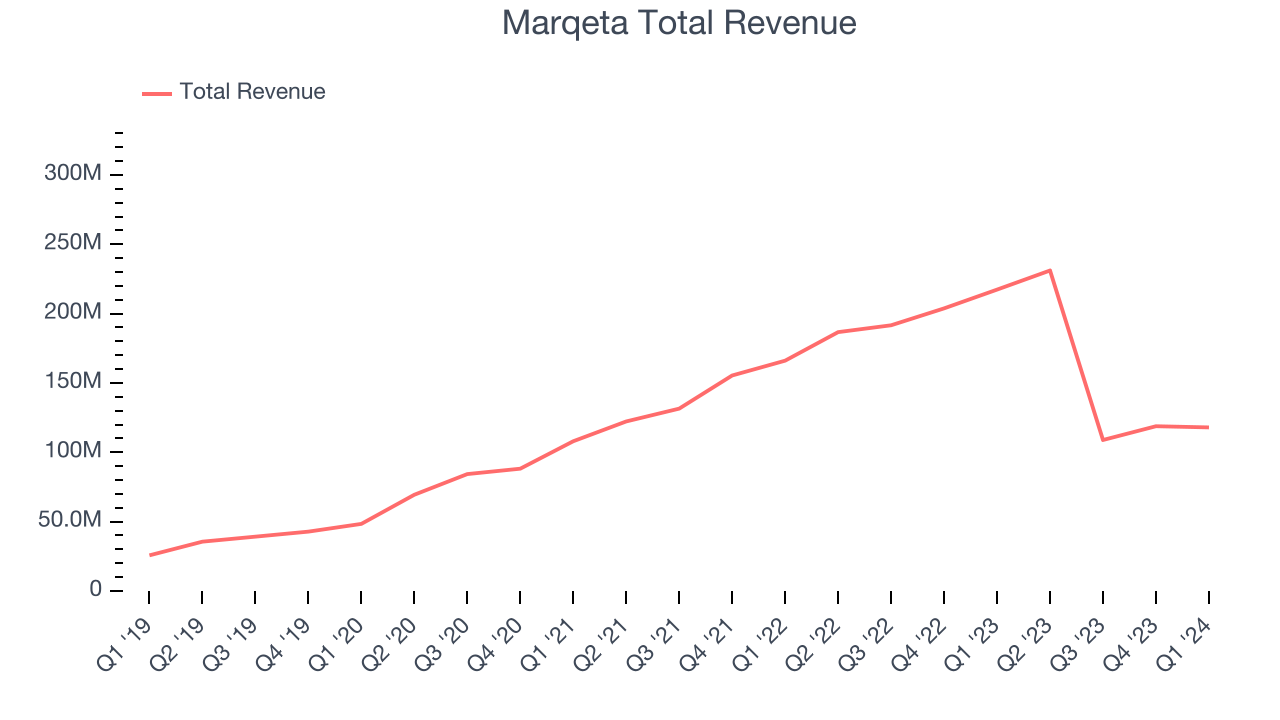

As you can see below, Marqeta's revenue growth has been solid over the last three years, growing from $108 million in Q1 2021 to $118 million this quarter.

This quarter, Marqeta's revenue was down 45.7% year on year, due to a contract renewal with Cash App and resulting change in revenue presentation. The impact of fees owed to Issuing Banks and Card Networks related to the Cash App primary Card Network volume is since Q3 netted against revenue earned from the Cash App program within Net Revenue, negatively impacting the growth rate. In prior periods, these costs were included within Costs of Revenue, so on the other hand Gross Margin has improved significantly.

Looking ahead, Wall Street was expecting revenue to decline 3.4% over the next 12 months before the earnings results announcement.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Marqeta's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.3% in Q1.

That means that for every $1 in revenue the company had $0.71 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite improving significantly since the last quarter, Marqeta's gross margin is still lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Marqeta burned through $6.07 million of cash in Q1 , increasing its cash burn by 45.4% year on year.

Marqeta has generated $25.39 million in free cash flow over the last 12 months, or 4.4% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Marqeta's Q1 Results

Zooming out, we think this was a decent quarter, showing that the company is staying on target. The stock is up 3.8% after reporting and currently trades at $6.05 per share.

Is Now The Time?

When considering an investment in Marqeta, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Marqeta, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last three years, and analysts don't see anything changing. On top of that, its customer acquisition is less efficient than many comparable companies, and its gross margins show its business model is much less lucrative than the best software businesses.

Given its price-to-sales ratio of 5.4x based on the next 12 months, Marqeta is priced with expectations for long-term growth. While there are some things to like about Marqeta and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $7.60 right before these results (compared to the current share price of $6.05).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.