Tech giant Microsoft (NASDAQ:MSFT) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 16% year on year to $65.59 billion. Its EPS of $3.30 per share was also 6.2% above analysts’ consensus estimates.

Is now the time to buy Microsoft? Find out by accessing our full research report, it’s free.

Microsoft (MSFT) Q3 CY2024 Highlights:

- NOTE THAT MSFT HAS CHANGED THE WAY IT REPORTS SEGMENTS, MAKING FOR SOME WEIRD COMPARISONS; FOR THIS QUARTER, WE URGE INVESTORS TO PAY ATTENTION MORE TO CONSOLIDATED RESULTS

- Revenue: $65.59 billion vs analyst estimates of $64.56 billion (1.6% beat)

- Operating Profit (GAAP): $30.55 billion vs analyst estimates of $29.2 billion (4.6% beat)

- EPS (GAAP): $3.30 vs analyst estimates of $3.11 (6.2% beat)

- Gross Margin: 69.4%, down from 71.2% in the same quarter last year

- Operating Margin: 46.6%, down from 47.6% in the same quarter last year

- Free Cash Flow Margin: 29.4%, down from 36.6% in the same quarter last year

- Market Capitalization: $3.21 trillion

Key Topics & Areas Of Debate

AI is probably the hottest topic in the world of investing today, and the debate for Microsoft is simple. How big is the AI benefit, when will we see it flow into revenue, and how much will it cost from an operating expense and capital expenditure perspective?

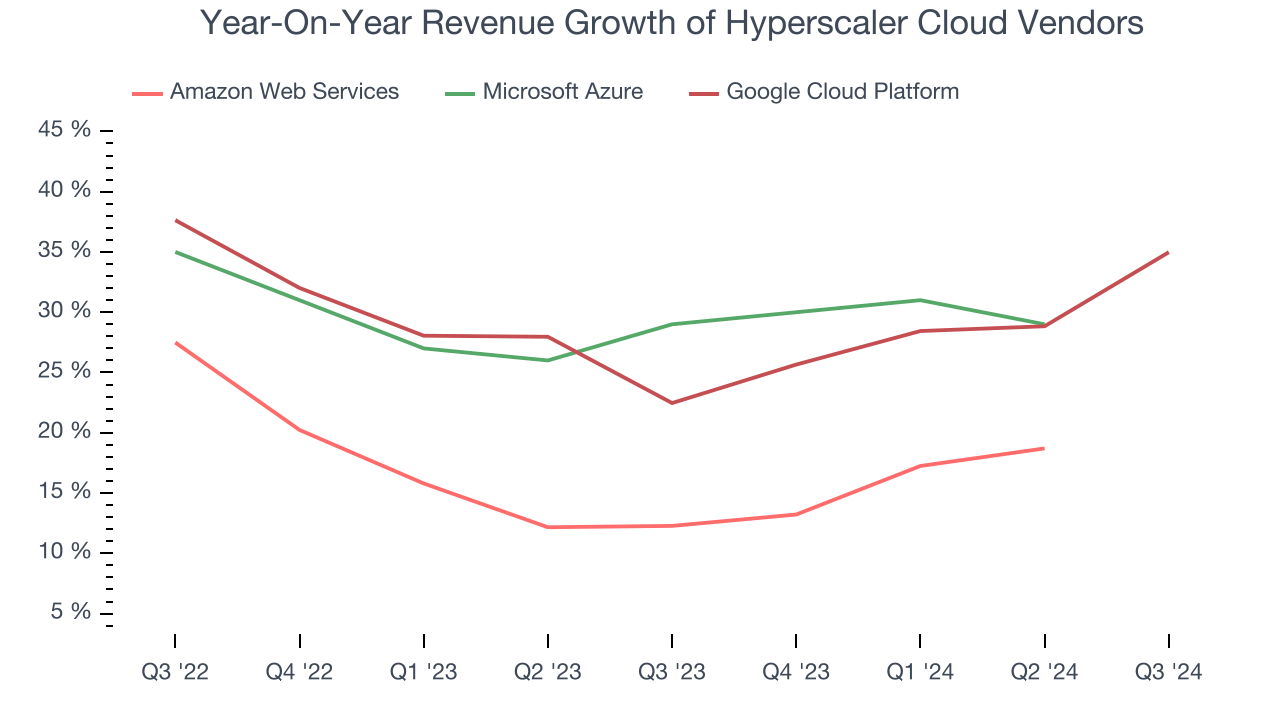

Customers who pay for Microsoft's products and services to enable their own GenAI goals will likely be buying infrastructure, developer tools, and data analytics platforms. Azure sits at the center of Microsoft’s AI ambitions, and it allows enterprise customers to do everything from accessing large language models (LLMs) to analyzing large volumes of data in real-time.

Aside from Azure, Copilot is a suite of AI-powered integrations into various Microsoft products to enhance productivity and streamline tasks. Microsoft 365 Copilot automates writing in Word, modeling in Excel, and email management in Outlook while GitHub Copilot, developed via a collaboration with OpenAI, automates code completion.

Despite its scale, Microsoft doesn’t operate in a vacuum. Alphabet (NASDAQ:GOOGL) competes against Azure with Google Cloud Platform and in productivity tools with G Suite and Google Workspace. Apple’s (NASDAQ:AAPL) macOS operating system also goes head to head against Microsoft’s Windows, and its iPhone and iPad products have been a thorn in its side. Lastly, IBM (NYSE:IBM), Oracle (NYSE:ORCL), SAP (XTRA:SAP), and many others compete with at least some subset of Microsoft’s product portfolio.

Revenue Growth

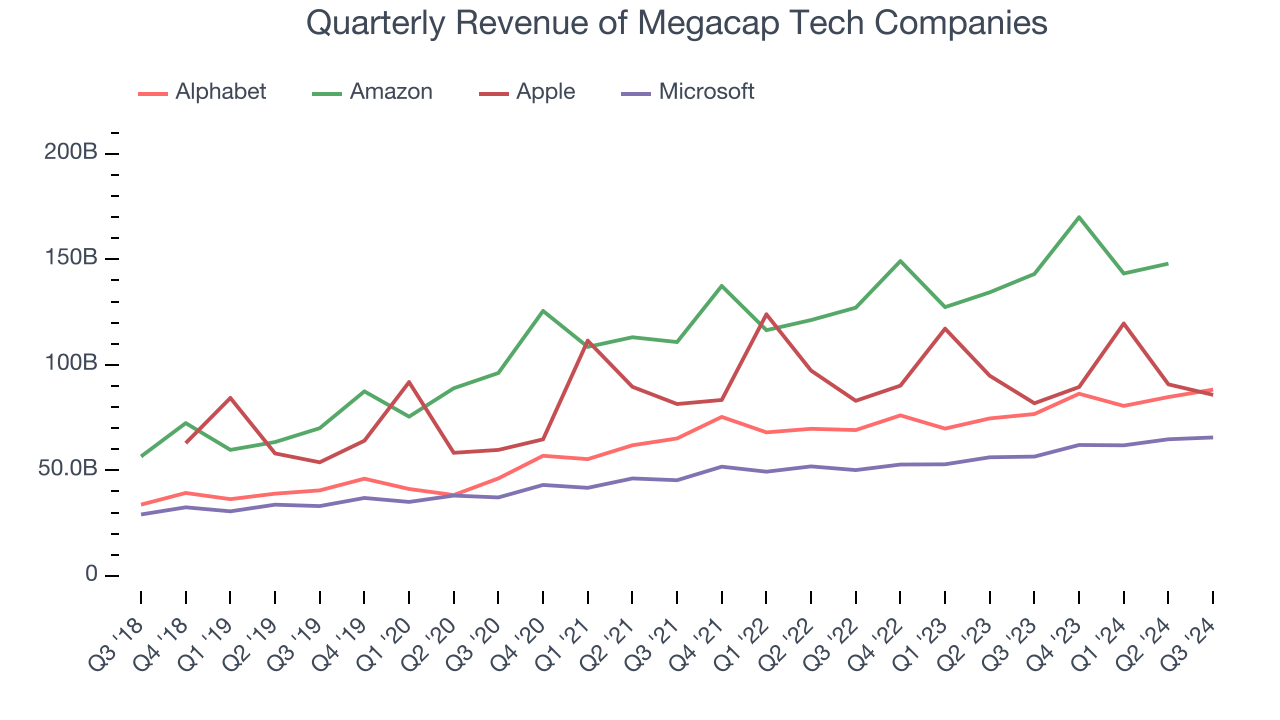

Microsoft proves that huge, scaled companies can still grow quickly. The company’s revenue base of $129.8 billion five years ago has nearly doubled to $254.2 billion in the last year, translating into an exceptional 14.4% annualized growth rate.

Over the same period, Amazon, Alphabet, and Apple put up revenue growth rates of 19.1%, 17%, and 8.3%, respectively. Comparing the four is relevant because investors often pit them against each other to derive their valuations. With these benchmarks in mind, we think Microsoft is a bit on the expensive side but still worth owning.

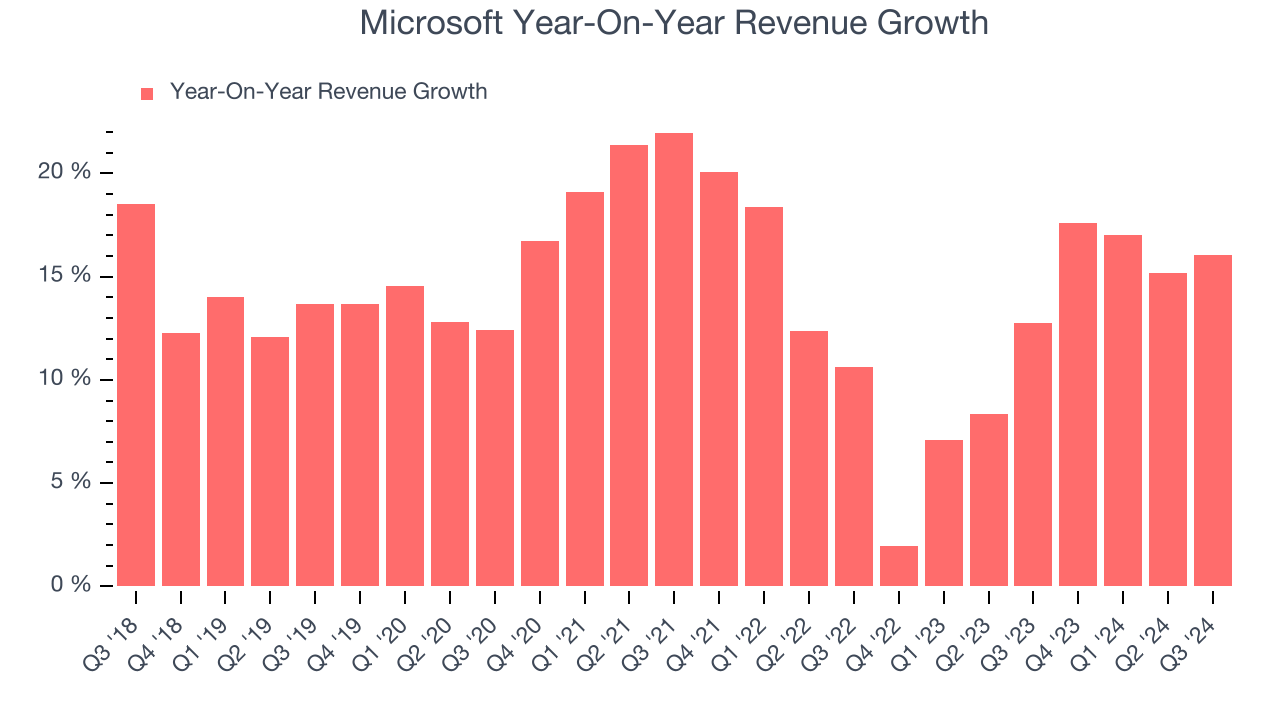

We at StockStory emphasize long-term growth, but for megacap tech companies, a half-decade historical view may miss the impact of emerging trends like AI. Microsoft’s annualized revenue growth of 11.9% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Microsoft reported year-on-year revenue growth of 16%, and its $65.59 billion of revenue exceeded Wall Street’s estimates by 1.6%. Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is admirable for a company of its scale and illustrates the market sees it as a beneficiary of the AI trend rather than a victim.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

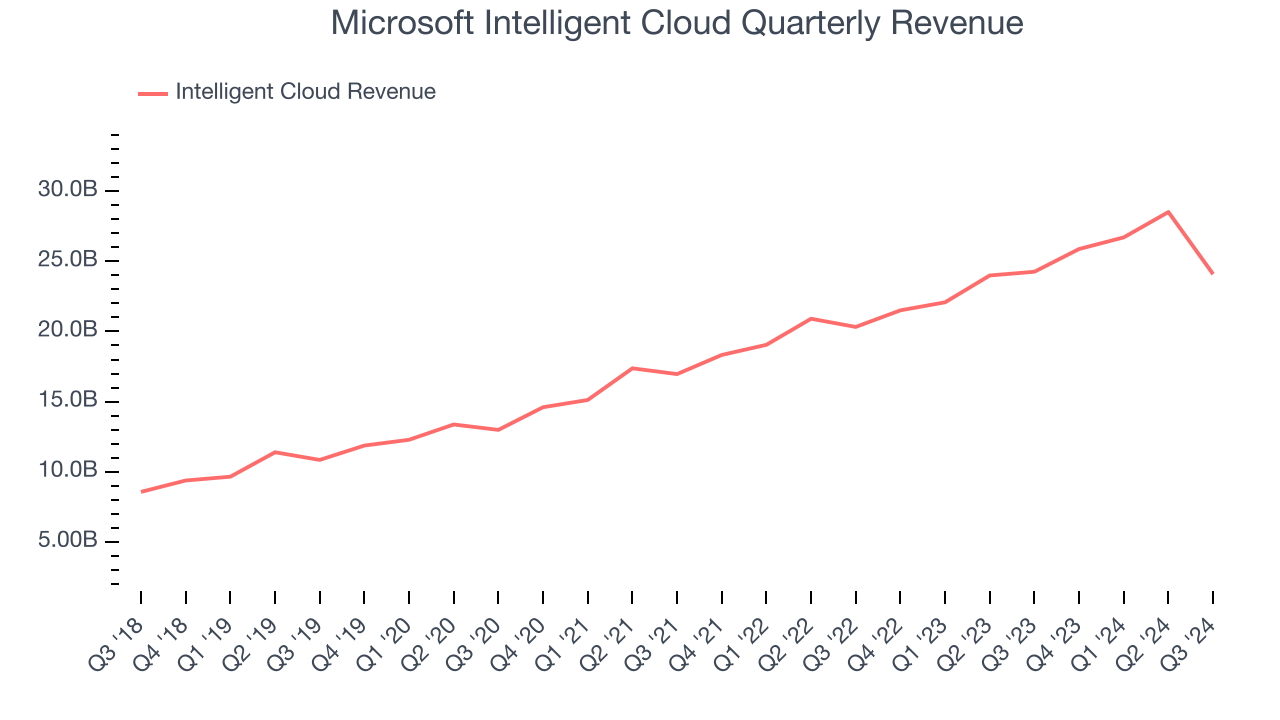

Intelligent Cloud: Azure & Cloud Computing

The most pressing question about Microsoft’s business is how big of a benefit AI will be for revenues. The company's cloud computing division, Intelligent Cloud, is one we carefully watch because its Azure platform and server and database offerings could be the biggest beneficiaries of the AI megatrend.

Intelligent Cloud is the most sizeable chunk of Microsoft’s revenue at 41.4% of total sales and grew at a 20.6% annualized rate over the last five years, faster than its consolidated revenues. The previous two years saw deceleration as it grew 15.7% annually, though this isn’t a bad thing since it’s still expanding quickly.

Intelligent Cloud’s flat revenue fell short of expectations in Q3, missing Wall Street’s estimates by 16.8%. However, note that the company changed the way it reports segments, starting with this quarter. It seems like not all Wall Street analysts were correctly capturing this dynamic, leading to a large miss that seems artificial.

In terms of market share, Azure is a close second as its run-rate revenue (current quarter’s sales times four) is around $80 billion versus roughly $100 billion and $45 billion for AWS and Google Cloud. If Azure wants to catch up to AWS in the coming years, growth will have to accelerate beyond its current levels.

Key Takeaways from Microsoft’s Q3 Results

It was good to see Microsoft top analysts’ revenue expectations this quarter. We were also excited its operating income outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Note that changes in how the company reports segments led to large segment beats and misses that are a bit artificial to us. The stock remained flat at $435.72 immediately following the results.

Microsoft put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.