Dating app company Match (NASDAQ:MTCH) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 10.2% year on year to $866.2 million. On the other hand, next quarter's revenue guidance of $855 million was less impressive, coming in 1.4% below analysts' estimates. It made a GAAP profit of $0.81 per share, improving from its profit of $0.29 per share in the same quarter last year.

Match Group (MTCH) Q4 FY2023 Highlights:

- Market Capitalization: $10.43 billion

- Revenue: $866.2 million vs analyst estimates of $861.3 million (small beat)

- EPS: $0.81 vs analyst estimates of $0.49 (64.2% beat)

- Revenue Guidance for Q1 2024 is $855 million at the midpoint, below analyst estimates of $867 million

- Free Cash Flow of $258.7 million, similar to the previous quarter

- Gross Margin (GAAP): 76%, up from 70% in the same quarter last year

- Payers: 15.2 million, down 5% year on year

- RPP: $18.67, up 17% year on year

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

These apps are used by millions globally to find love, friendship, or just a fun night out, although dating is the primary use case for consumers. The problem Match tries to address is simply that dating and finding love is hard, both logistically and emotionally. Specifically, meeting new people with shared interests, putting yourself out there, and trying to find someone you connect with can be a daunting task. Match provides a platform that facilitates connections while also filtering for practical aspects such as location and age.

Match generates revenue largely through paid subscriptions. Tinder and Hinge, the two highest revenue apps for Match, both offer free versions. However, users can access premium features through paid subscription tiers. For example, Tinder Plus gives users unlimited swipes and the option to change their location to connect with people in different cities. Hinge’s paid version allows users to see who has already liked their profile without needing to wait for a match, which can help save time and increase the probability of high-quality matches. The company also generates revenue through advertising, where brands can pay to have their products or services featured within the app.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Competitors offering dating platforms include Bumble (NASDAQ:BMBL), Grindr (NYSE:GRND), and Spark Networks (NYSE:LOV), along with social networks where people can potentially make romantic connections like Snap (NYSE:SNAP) and Meta Platforms (NASDAQ:META).

Sales Growth

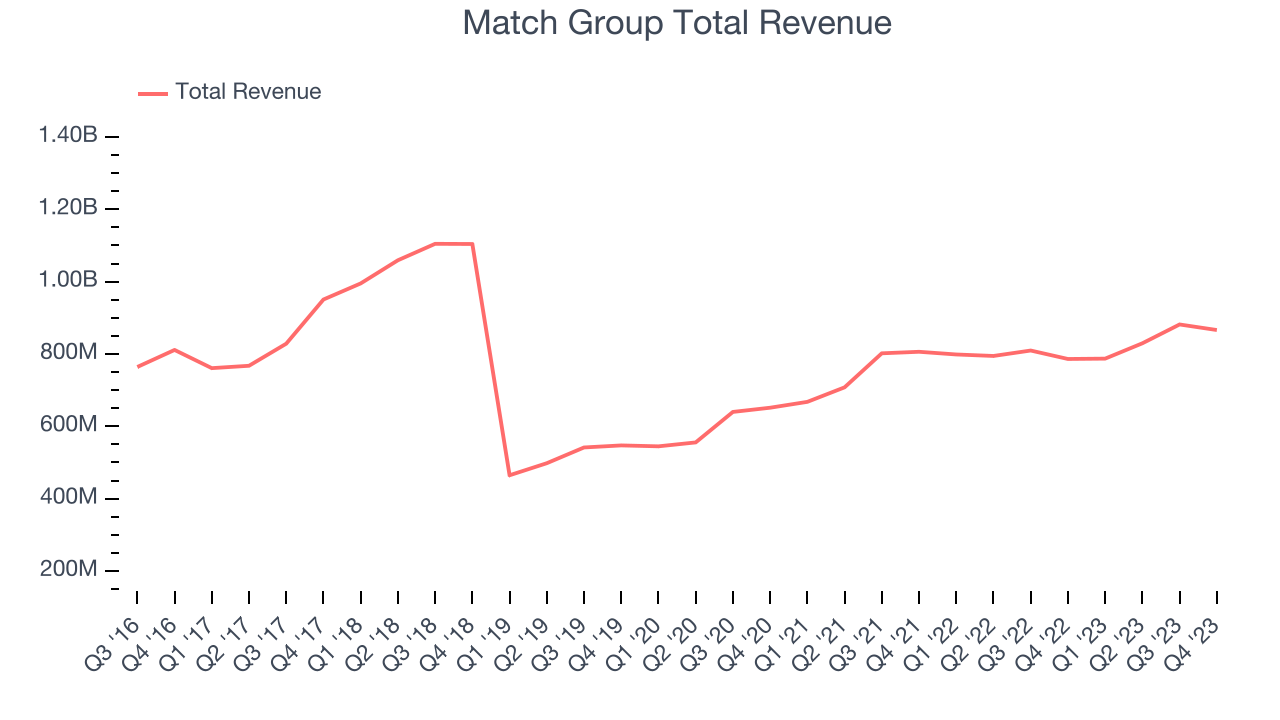

Match Group's revenue growth over the last three years has been unremarkable, averaging 12.6% annually. This quarter, Match Group reported mediocre 10.2% year-on-year revenue growth, in line with what analysts were expecting.

Guidance for the next quarter indicates Match Group is expecting revenue to grow 8.6% year on year to $855 million, improving on the 1.4% year-on-year decline it recorded in the same quarter last year.

Usage Growth

As a subscription-based app, Match Group generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

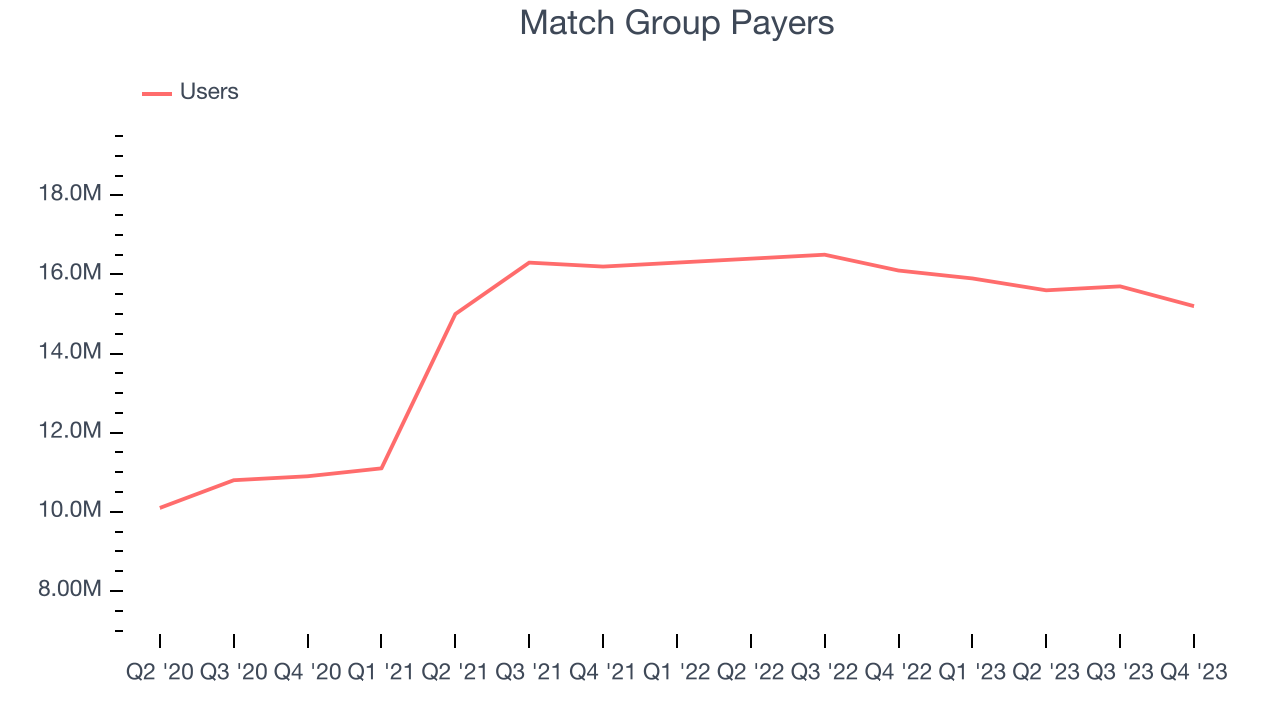

Over the last two years, Match Group's users, a key performance metric for the company, grew 4.9% annually to 15.2 million. This growth lags behind the hottest consumer internet apps.

Unfortunately, Match Group's users decreased by 900,000 in Q4, a 5.6% drop since last year.

Revenue Per User

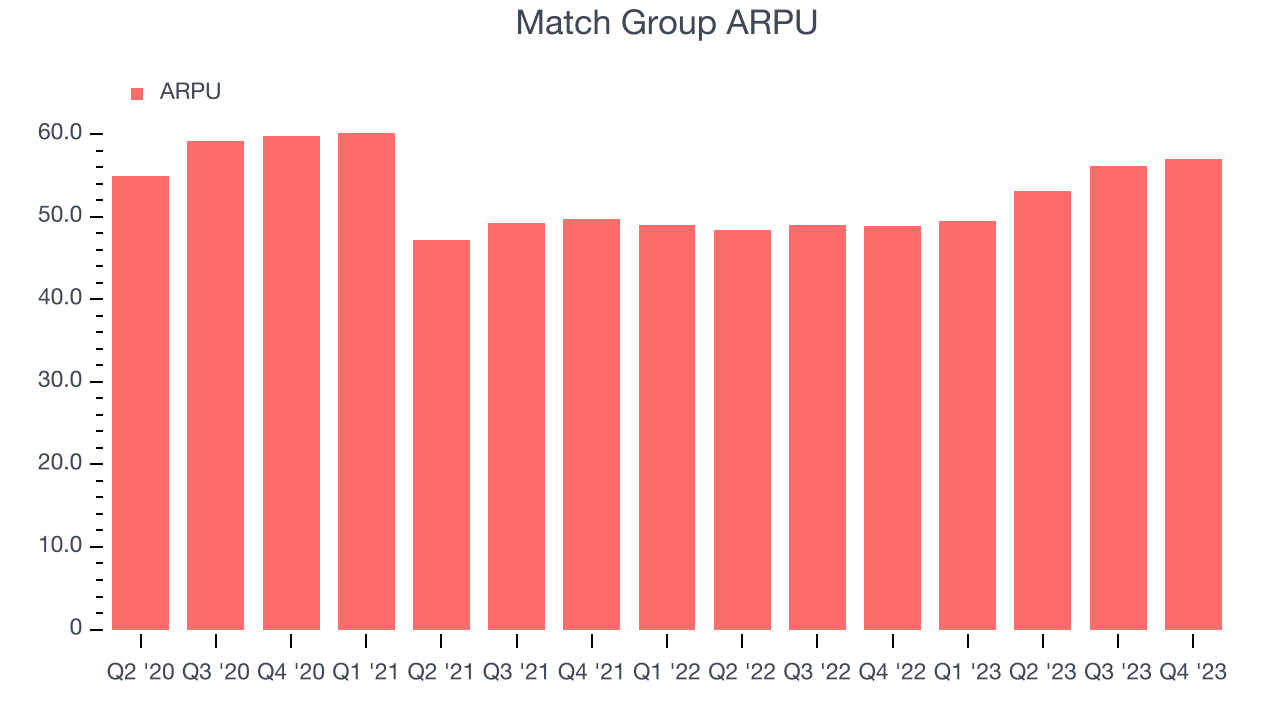

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Match Group because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Match Group's ARPU growth has been mediocre over the last two years, averaging 3%. However, the company's ability to continue increasing prices while growing its users shows that users still find value in its platform. This quarter, ARPU grew 16.7% year on year to $56.99 per user.

Pricing Power

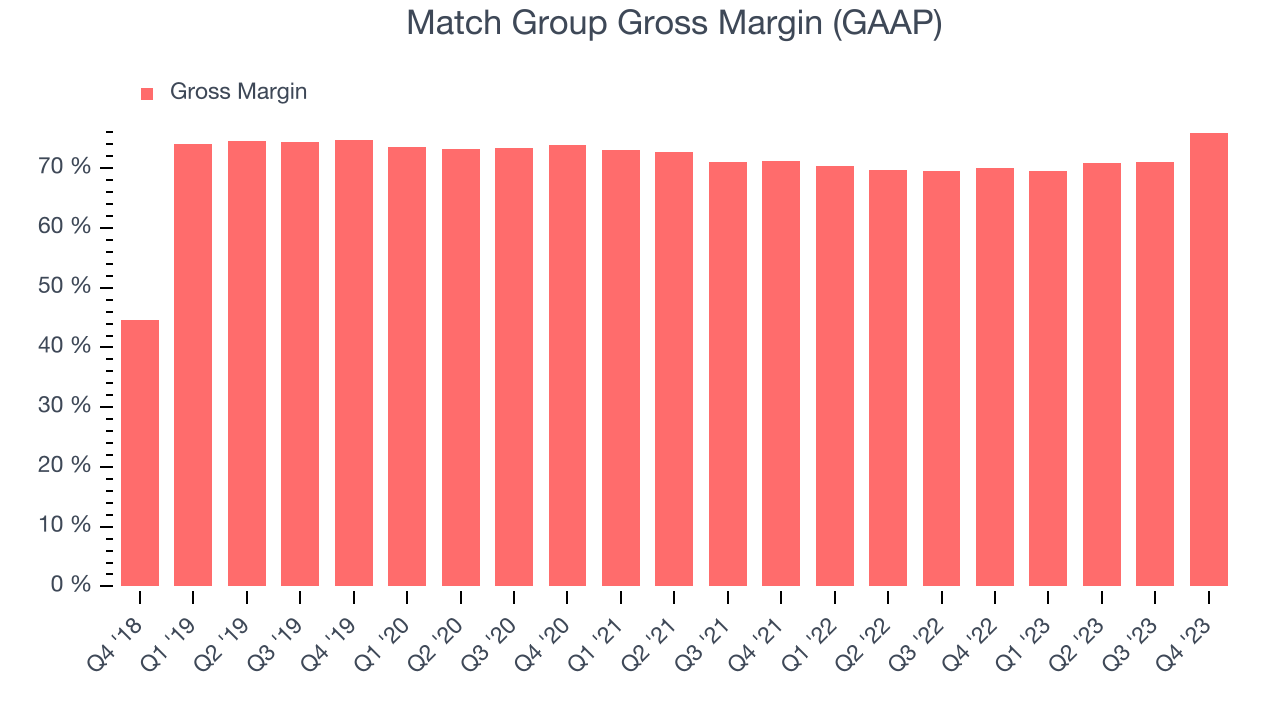

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor. Match Group's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 76% this quarter, up 6 percentage points year on year.

For internet subscription businesses like Match Group, these aforementioned costs typically include customer service, data center and infrastructure expenses, and royalties and other content-related costs if the company's offering includes features such as video or music services. After paying for these expenses, Match Group had $0.76 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Over the past year, Match Group has seen its already strong gross margins rise, averaging 71.8%. These robust unit economics, driven by the company's lucrative business model and strong pricing power, are higher than its peers and allow Match Group to make more investments in product and marketing.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Match Group grow from a combination of product virality, paid advertisement, and incentives.

Match Group is very efficient at acquiring new users, spending only 24.3% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a strong brand reputation and customer acquisition advantages from scale, giving Match Group the freedom to invest its resources into new growth initiatives while maintaining optionality.

Profitability & Free Cash Flow

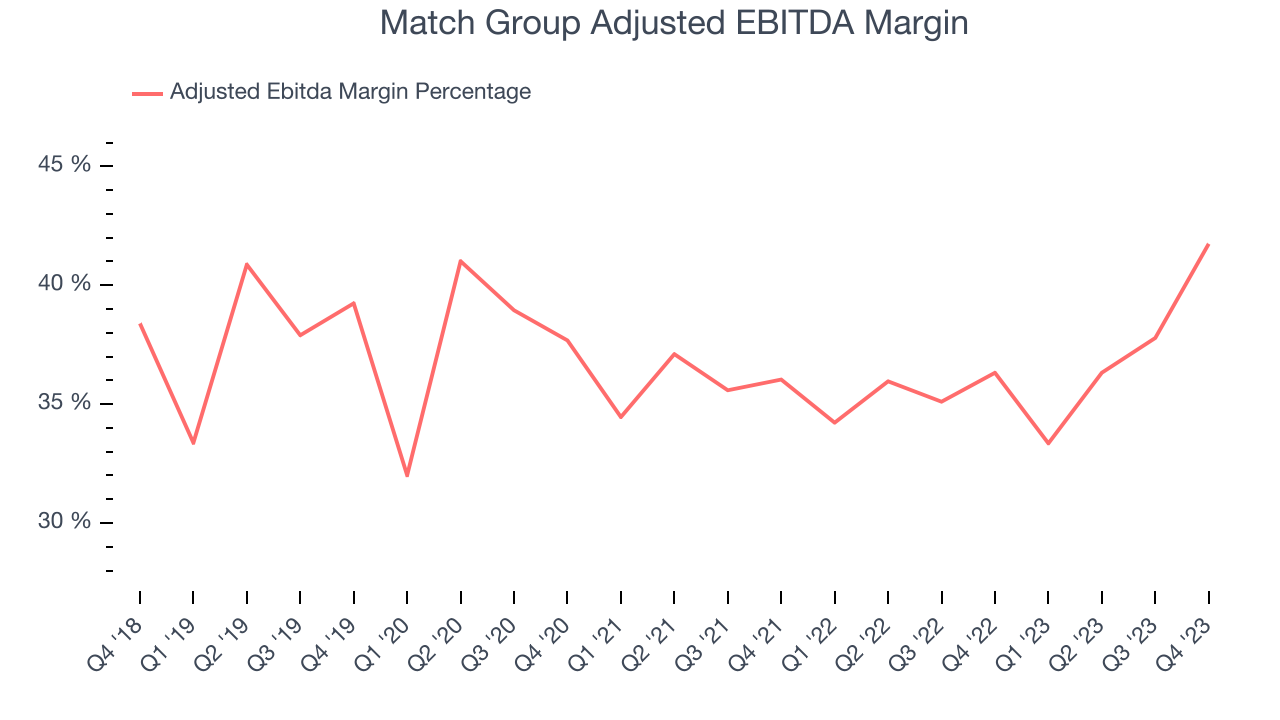

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

This quarter, Match Group's EBITDA came in at $361.6 million, resulting in a 41.7% margin. On top of that, Match Group's spectacular EBITDA margins over the last four quarters have placed it among a handful of the most profitable consumer internet companies in the world.

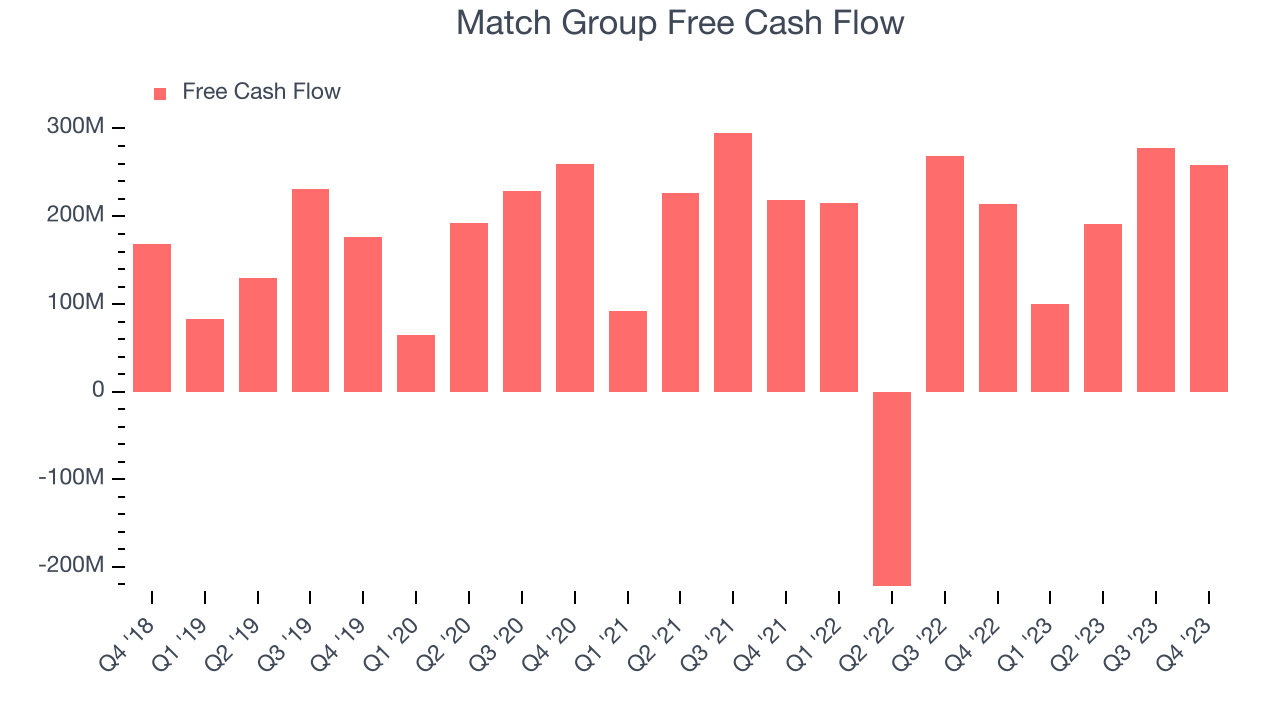

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Match Group's free cash flow came in at $258.7 million in Q4, up 20.6% year on year.

Match Group has generated $829.4 million in free cash flow over the last 12 months, an eye-popping 24.3% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Match Group's Q4 Results

It was great to see Match beat analysts' operating margin and EPS estimates. Although its user base fell (driven by softness at Tinder), its average price increase of 17% across its apps enabled the company to narrowly top expectations. Hinge was a bright spot this quarter as its revenue growth accelerated to 50%+, setting the stage for $1 billion of Hinge revenue in the coming years.

On the other hand, its revenue guidance for next quarter missed Wall Street's estimates as it expects Tinder subscribers to decline. That anticipated drop, however, will be offset by continued price increases at Tinder, whose pricing is playing catching up with its peers (the app's services have been underpriced for years).

In terms of leadership changes, Match appointed Faye Iosotaluno as its Tinder CEO. Faye was the Group’s former Chief Strategy Officer and has spent the last 18 months as COO of Tinder. Bernard Kim, previously CEO of both Tinder and the parent entity, will remain closely involved as CEO of Match Group. Elliott Management, an activist hedge fund known for helping companies improve their fundamentals, also built a large $1 billion stake in the company, which was announced on January 8th, 2024.

Lastly, with the stock trading cheaply, the Board authorized a new $1.0 billion share repurchase program. The company used more than half of its free cash flow to repurchase its shares in 2023 and has stated it intends to do the same in 2024.

Overall, the results could have been better, but we remain constructive and will look for subscribers to stabilize in Q1 2024 when it will have easier base-year comps and lap its one-time, 60%+ price increases that happened at the start of 2023. The stock is flat after reporting and currently trades at $37.48 per share.

Is Now The Time?

Match Group may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Match Group is a good business. Although its revenue growth has been mediocre over the last three years, its growth over the next 12 months is expected to accelerate. And while its growth in users has been slower, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its user acquisition efficiency is best in class.

At the moment Match Group trades at 8.3x next 12 months EV-to-EBITDA. There's definitely a lot of things to like about Match Group and looking at the consumer internet landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $44 per share right before these results (compared to the current share price of $37.48), implying they saw upside in buying Match Group in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.