Network chips maker MACOM Technology Solutions (NASDAQ: MTSI) reported results ahead of analysts' expectations in Q1 FY2024, with revenue down 12.7% year on year to $157.1 million. Guidance for next quarter's revenue was also optimistic at $181 million at the midpoint, 11.6% above analysts' estimates. It made a non-GAAP profit of $0.58 per share, down from its profit of $0.81 per share in the same quarter last year.

Is now the time to buy MACOM? Find out by accessing our full research report, it's free.

MACOM (MTSI) Q1 FY2024 Highlights:

- Market Capitalization: $6.22 billion

- Revenue: $157.1 million vs analyst estimates of $152.7 million (2.9% beat)

- EPS (non-GAAP): $0.58 vs analyst estimates of $0.57 (2.2% beat)

- Revenue Guidance for Q2 2024 is $181 million at the midpoint, above analyst estimates of $162.2 million

- Free Cash Flow of $28.45 million, down 36.1% from the previous quarter

- Inventory Days Outstanding: 208, up from 195 in the previous quarter

- Gross Margin (GAAP): 55.6%, down from 61.3% in the same quarter last year

“Q1 was a solid start to fiscal year 2024,” said Stephen G. Daly, President and Chief Executive Officer.

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

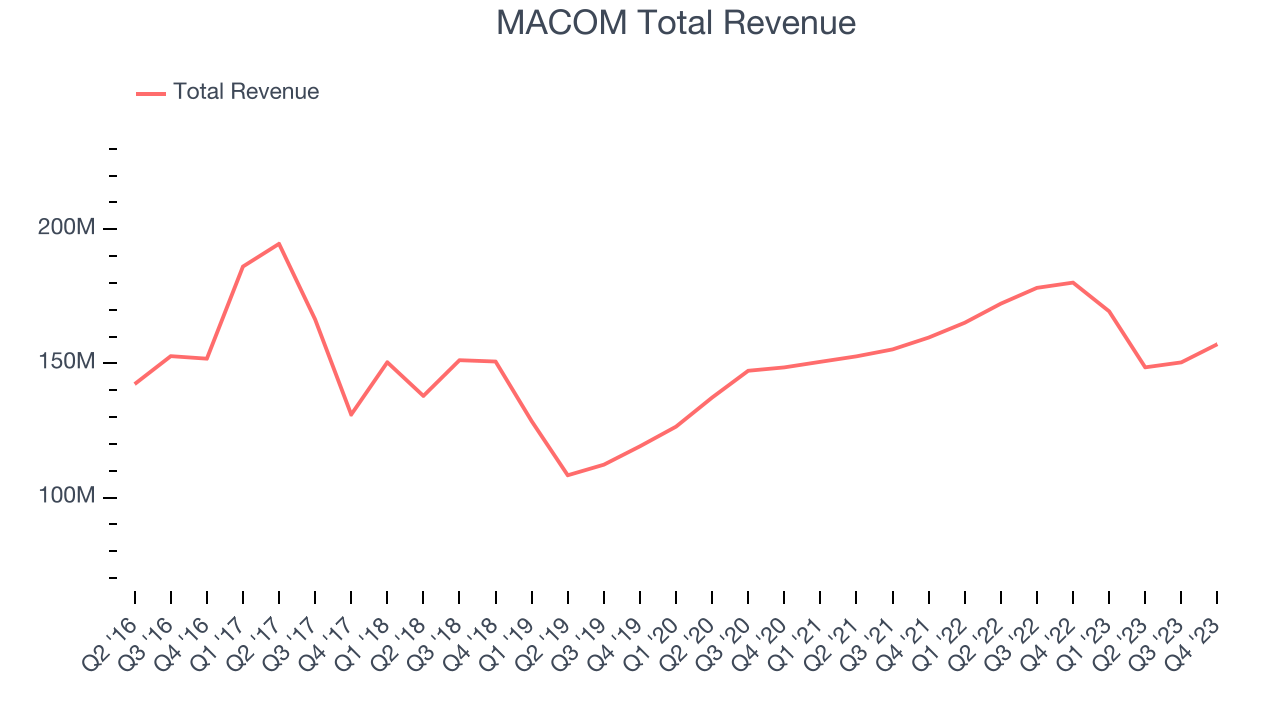

Sales Growth

MACOM's revenue growth over the last three years has been unimpressive, averaging 4.5% annually. This quarter, its revenue declined from $180.1 million in the same quarter last year to $157.1 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though MACOM surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 12.7% year on year. This could mean that the current downcycle is deepening.

MACOM looks like it's on the cusp of a rebound, as it's guiding to 6.8% year-on-year revenue growth for the next quarter. Analysts seem to agree as consesus estimates call for 13.6% growth over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

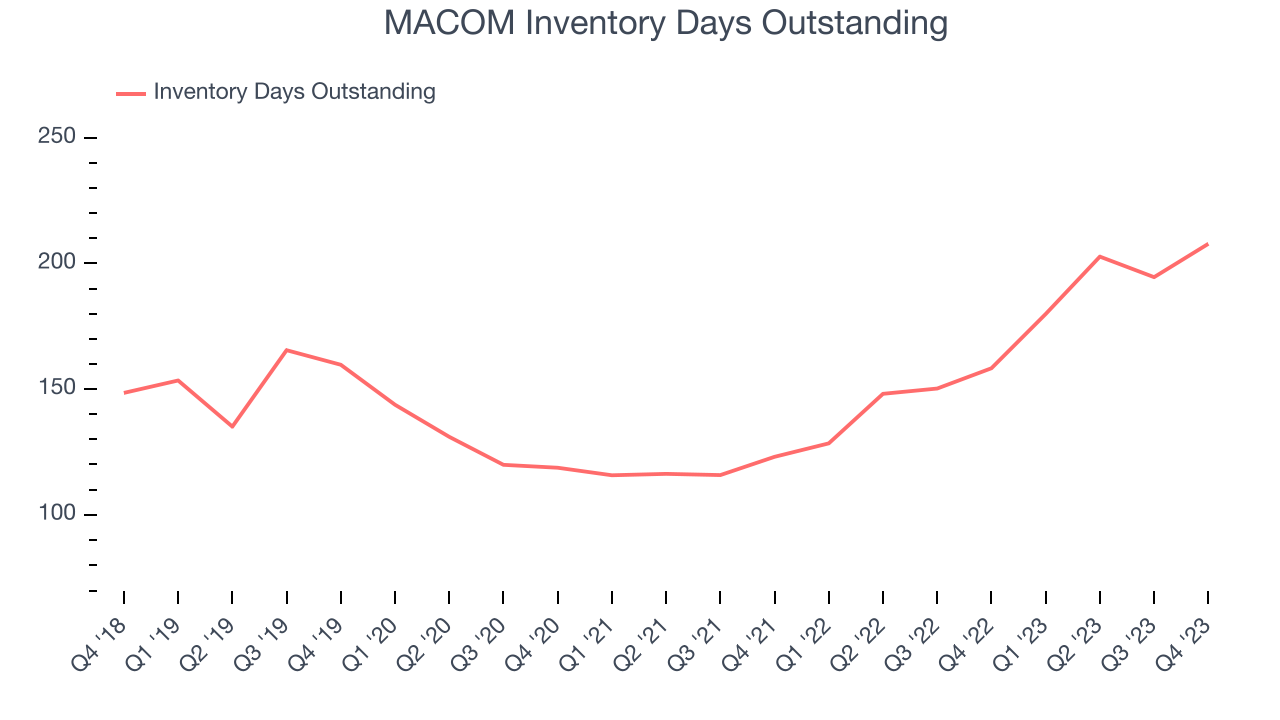

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, MACOM's DIO came in at 208, which is 59 days above its five-year average, suggesting that the company's inventory has grown to higher levels than we've seen in the past.

Key Takeaways from MACOM's Q1 Results

We were impressed by MACOM's revenue guidance for next quarter, which blew past analysts' expectations. We were also glad this quarter's revenue outperformed Wall Street's estimates, driven by strong demand from the industrial and defense, telecommunications, and data center markets. On the other hand, its operating margin fell, its gross margin shrunk, and its EPS guidance for next quarter underwhelmed. Overall, this was a mixed quarter for MACOM. The stock is up 4.3% after reporting and currently trades at $89.94 per share.

So should you invest in MACOM right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.