As Q4 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the analog semiconductors stocks, including MACOM Technology (NASDAQ:MTSI) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 9 analog semiconductors stocks we track reported a strong Q4; on average, revenues beat analyst consensus estimates by 2.68%, while on average next quarter revenue guidance was 4.03% above consensus. Technology stocks have been hit hard on fears of higher interest rates, but analog semiconductors stocks held their ground better than others, with share price down 7.76% since earnings, on average.

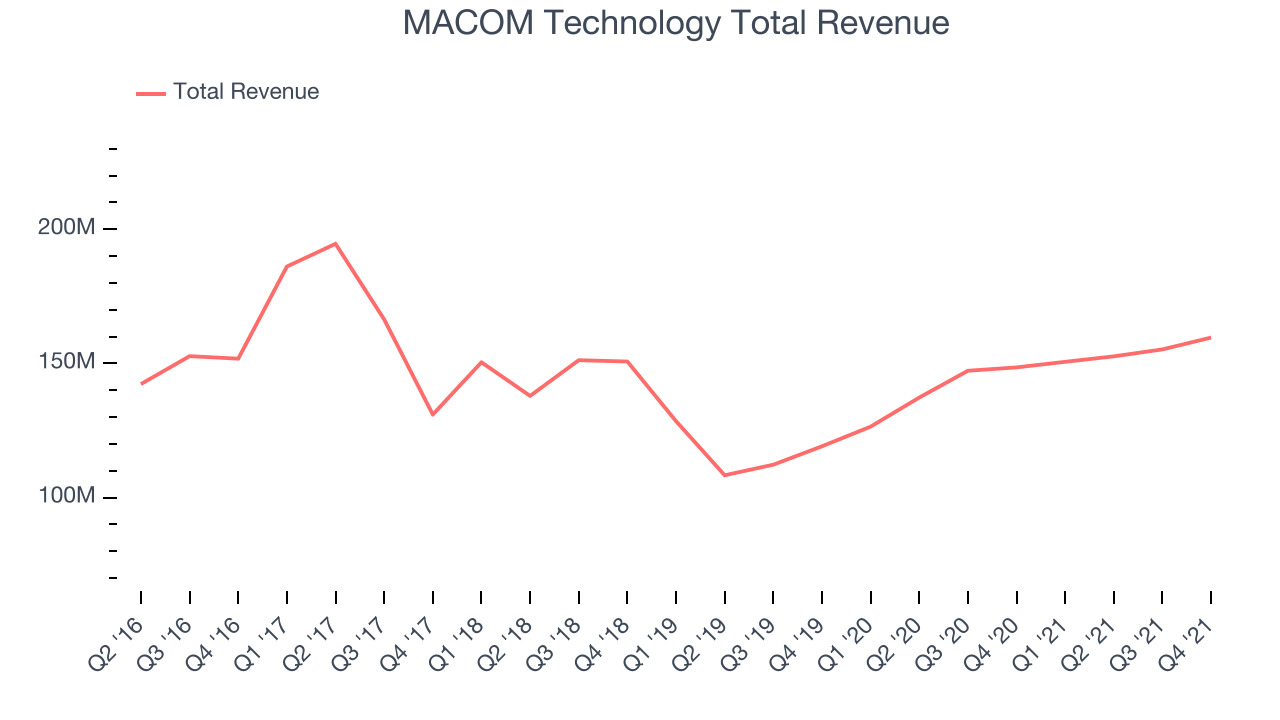

MACOM Technology (NASDAQ:MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM Technology reported revenues of $159.6 million, up 7.48% year on year, in line with analyst expectations. It was a decent quarter for the company, with a significant improvement in operating margin and guidance for the next quarter roughly in line with analysts' expectations.

“Our focus on internal investment continues to drive technology and product development, revenue growth and improved financial results,” said Stephen G. Daly, President and Chief Executive Officer.

MACOM Technology delivered the smallest earnings surprise of the whole group. The stock is down 17.5% since the results and currently trades at $52.

Is now the time to buy MACOM Technology? Access our full analysis of the earnings results here, it's free.

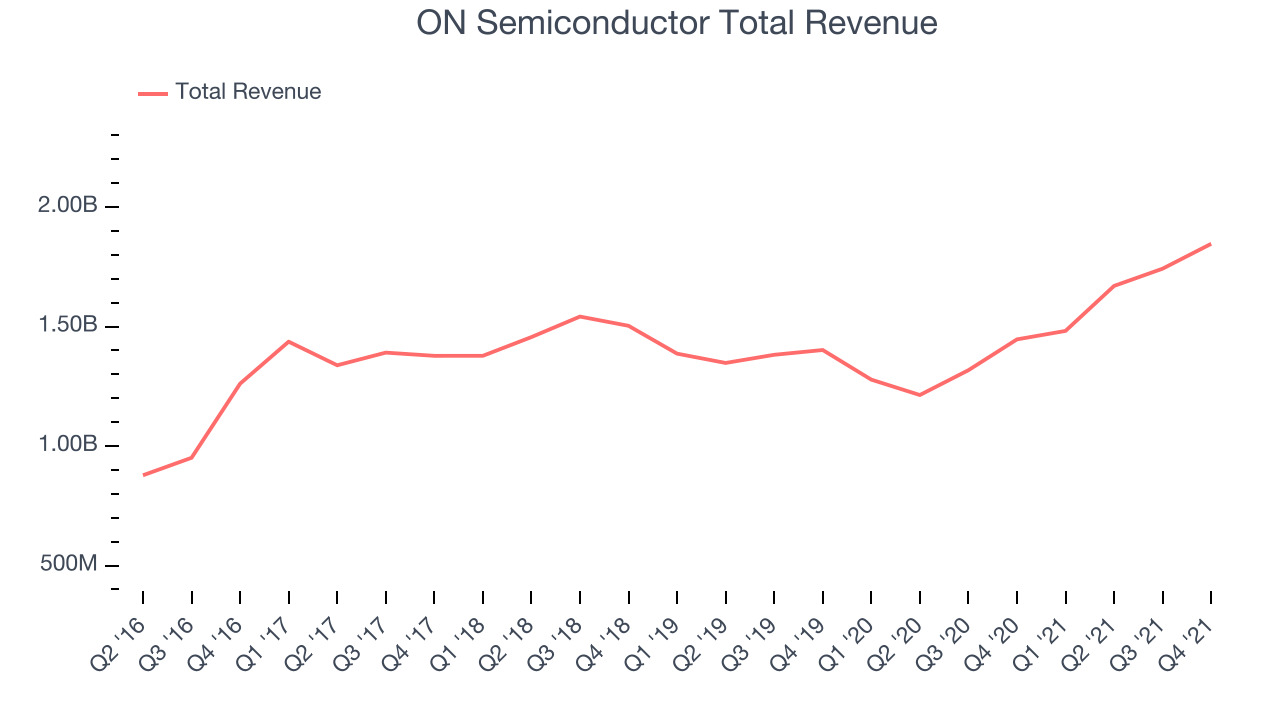

Best Q4: ON Semiconductor (NASDAQ:ON)

Spun out of Motorola in 1999, and built through a series of acquisitions, ON Semiconductor (NASDAQ: ON) is a global provider of analog chips with specialization in autos, industrial applications, and power management in cloud data centers.

ON Semiconductor reported revenues of $1.84 billion, up 27.6% year on year, beating analyst expectations by 3.08%. It was an impressive quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

The stock is down 2.17% since the results and currently trades at $56.20.

Is now the time to buy ON Semiconductor? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Sensata Technologies (NYSE:ST)

Originally a temperature sensor control maker and part of Texas Instruments for 60 years, before eventually being spun out, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

Sensata Technologies reported revenues of $934.5 million, up 3.1% year on year, beating analyst expectations by 1.73%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

The stock is down 18% since the results and currently trades at $46.97.

Read our full analysis of Sensata Technologies's results here.

Texas Instruments (NASDAQ:TXN)

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $4.83 billion, up 18.5% year on year, beating analyst expectations by 9.05%. . It was a good quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Texas Instruments pulled off the strongest analyst estimates beat among the peers. The stock is up 1.15% since the results and currently trades at $176.20.

Read our full, actionable report on Texas Instruments here, it's free.

Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $336.5 million, up 44.3% year on year, beating analyst expectations by 4.57%. It was a very strong quarter for the company, with a beat on the bottom line and guidance for the next quarter above analysts' estimates.

The stock is up 5.37% since the results and currently trades at $428.90.

Read our full, actionable report on Monolithic Power Systems here, it's free.

The author has no position in any of the stocks mentioned