Real estate focused virtual reality platform Matterport (NASDAQ:MTTR) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 4.9% year on year to $39.87 million. It made a non-GAAP loss of $0.01 per share, improving from its loss of $0.07 per share in the same quarter last year.

Is now the time to buy Matterport? Find out by accessing our full research report, it's free.

Matterport (MTTR) Q1 CY2024 Highlights:

- Matterport announced on April 22, 2024 that it would be acquired by CoStar in a half cash and half stock transaction valued at $5.50 per share, representing an equity value of approximately $2.1 billion and an enterprise value of approximately $1.6 billion

- Revenue: $39.87 million vs analyst estimates of $40.03 million (small miss)

- EPS (non-GAAP): -$0.01 vs analyst estimates of -$0.03

- Gross Margin (GAAP): 49.1%, up from 43.2% in the same quarter last year

- Free Cash Flow was -$6.06 million compared to -$10.42 million in the previous quarter

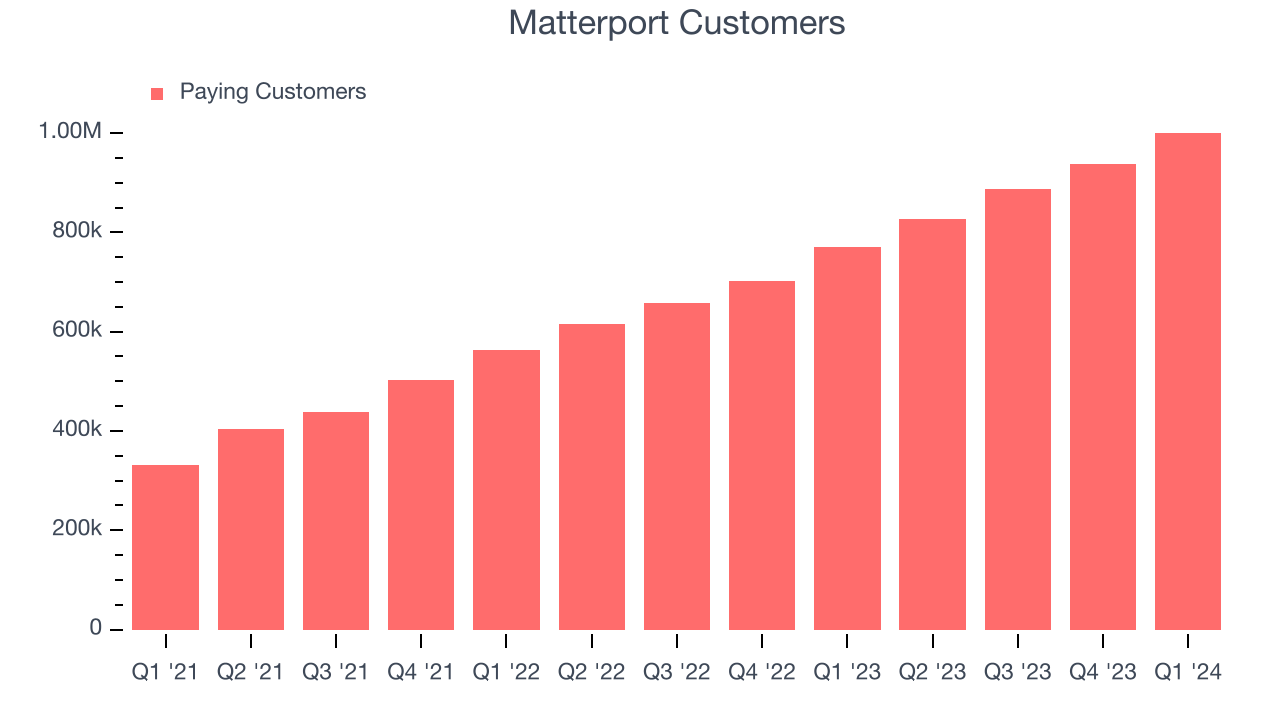

- Customers: 1 million, up from 938,000 in the previous quarter

- Market Capitalization: $1.43 billion

“I'm pleased to announce our first quarter 2024 results, which reflect our continued success in driving efficient growth for the company,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport.

Founded in 2011 before any mass-market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real-world spaces into 3D visualization.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

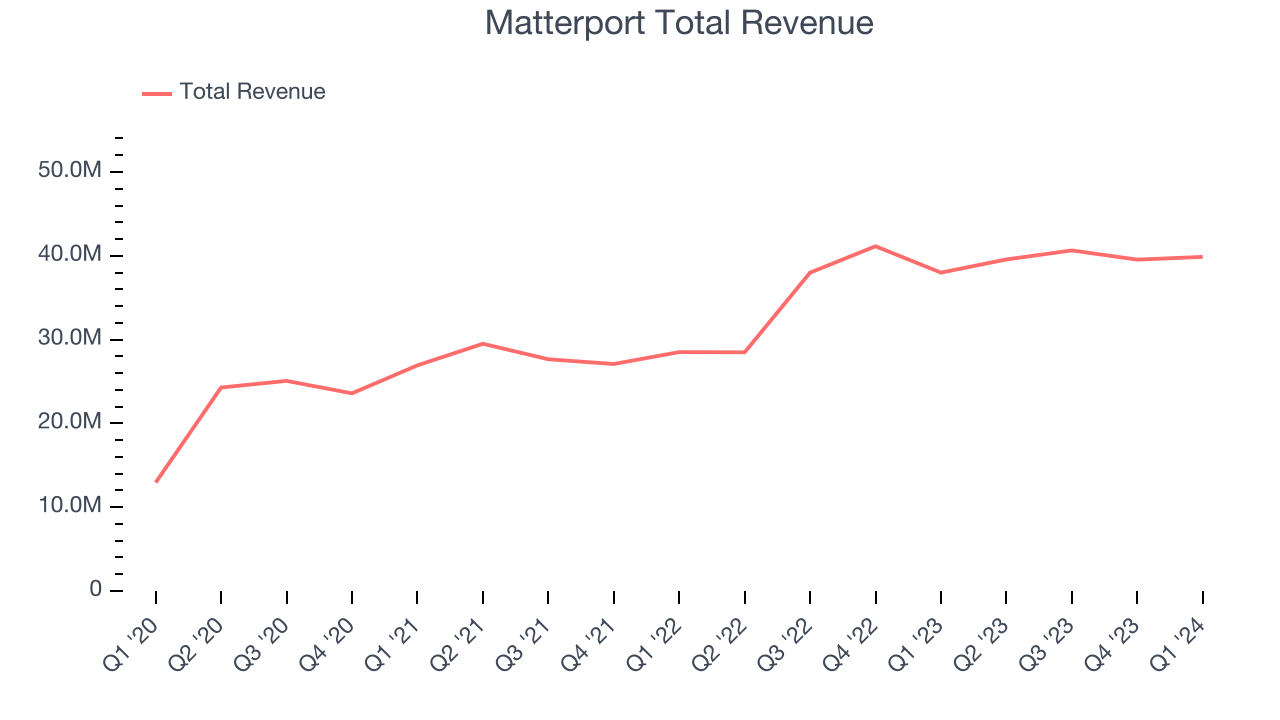

Sales Growth

As you can see below, Matterport's revenue growth has been mediocre over the last three years, growing from $26.93 million in Q1 2021 to $39.87 million this quarter.

Matterport's quarterly revenue was only up 4.9% year on year, which might disappoint some shareholders. However, its revenue increased $327,000 quarter on quarter, a strong improvement from the $1.10 million decrease in Q4 CY2023. This is a sign of acceleration of growth and very nice to see indeed.

Looking ahead, analysts covering the company were expecting sales to grow 13.5% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Customer Growth

Matterport reported 1 million customers at the end of the quarter, an increase of 62,000 from the previous quarter. That's a fair bit better customer growth than last quarter and in line with what we've seen in past quarters, demonstrating that the company has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that Matterport's go-to-market strategy is running smoothly.

Matterport may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.