Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Matterport (NASDAQ:MTTR), and the best and worst performers in the design software group.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 4 design software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 1.16%, while on average next quarter revenue guidance was 3.44% above consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but design software stocks held their ground better than others, with the share prices up 15.9% since the previous earnings results, on average.

Best Q3: Matterport (NASDAQ:MTTR)

Founded in 2011 before any mass market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real world spaces into 3D visualization.

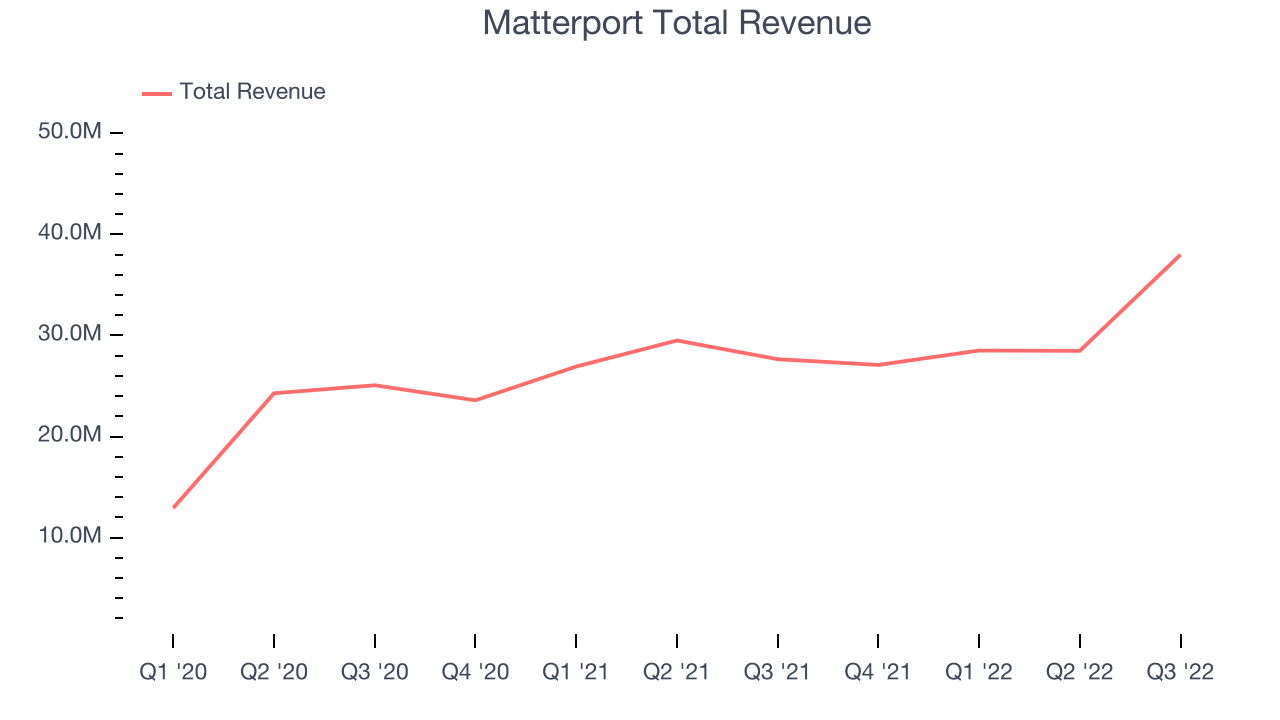

Matterport reported revenues of $37.9 million, up 37.3% year on year, beating analyst expectations by 5.69%. It was a very strong quarter for the company, with exceptional revenue growth and a solid beat of analyst estimates.

“We delivered outstanding third quarter results, with record total revenue, demonstrating that our strategy is working,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport.

Matterport pulled off the strongest analyst estimates beat and fastest revenue growth of the whole group. The company added 41,000 customers to a total of 657,000. The stock is up 0.16% since the results and currently trades at $3.03.

Is now the time to buy Matterport? Access our full analysis of the earnings results here, it's free.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

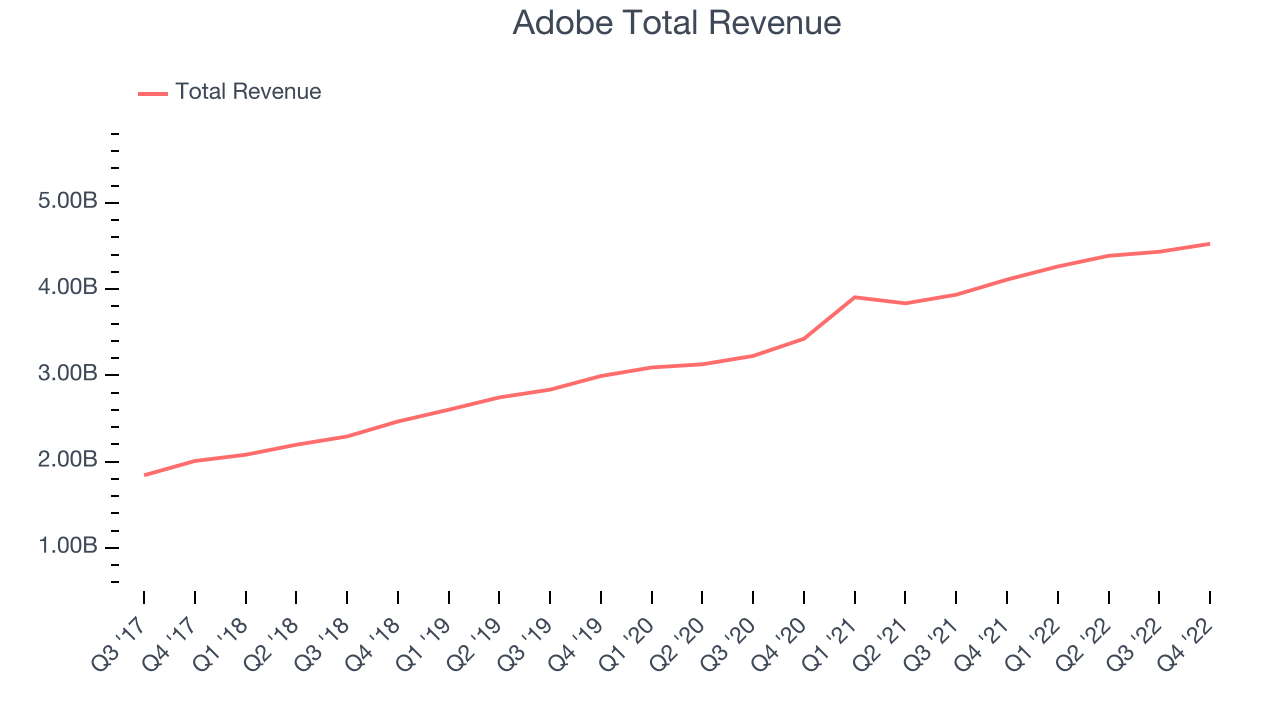

Adobe reported revenues of $4.52 billion, up 10% year on year, inline with analyst expectations. It was a weaker quarter for the company, with a full year guidance missing analysts' expectations and slow revenue growth.

Adobe had the slowest revenue growth and weakest full year guidance update among its peers. The stock is up 8.06% since the results and currently trades at $355.22.

Is now the time to buy Adobe? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.28 billion, up 13.6% year on year, inline with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is down 3.13% since the results and currently trades at $202.33.

Read our full analysis of Autodesk's results here.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $322.8 million, up 12.7% year on year, missing analyst expectations by 0.85%. It was a weak quarter for the company, with a decline in net revenue retention rate and decelerating growth in large customers.

Unity pulled off the highest full year guidance raise but had the weakest performance against analyst estimates among the peers. The company lost 10 enterprise customers paying more than $100,000 annually and ended up with a total of 1,075. The stock is up 58.7% since the results and currently trades at $34.13.

Read our full, actionable report on Unity here, it's free.

The author has no position in any of the stocks mentioned