Real estate focused virtual reality platform Matterport (NASDAQ:MTTR) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 4.9% year on year to $39.87 million. It made a non-GAAP loss of $0.01 per share, improving from its loss of $0.07 per share in the same quarter last year. Matterport announced on April 22, 224 that it will be acquired by CoStar in a half cash and half stock transaction valued at $5.50 per share, representing an equity value of approximately $2.1 billion and an enterprise value of approximately $1.6 billion. We will discontinue coverage after this report.

Matterport (MTTR) Q1 CY2024 Highlights:

- Matterport announced on April 22, 2024 that it would be acquired by CoStar in a half cash and half stock transaction valued at $5.50 per share, representing an equity value of approximately $2.1 billion and an enterprise value of approximately $1.6 billion

- Revenue: $39.87 million vs analyst estimates of $40.03 million (small miss)

- EPS (non-GAAP): -$0.01 vs analyst estimates of -$0.03

- Gross Margin (GAAP): 49.1%, up from 43.2% in the same quarter last year

- Free Cash Flow was -$6.06 million compared to -$10.42 million in the previous quarter

- Customers: 1 million, up from 938,000 in the previous quarter

- Market Capitalization: $1.43 billion

Founded in 2011 before any mass-market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real-world spaces into 3D visualization.

Real estate is the world’s largest asset class and as the designing, construction, and selling of real estate moves online there has been an increasing need for 3D real estate visualization. The internet has become the starting point for almost every property search. Buying, selling, and renting living spaces is a complicated process that historically involves setting up numerous in person showings even when consumers are using internet based real-estate platforms. As technologies continue to reduce the need for human contact and make complicated processes more efficient, real estate digitization has been slowed because people are uncomfortable buying or renting a home without seeing it in person. Matterport helps solve this problem by enabling its customers to create immersive 3D tours that replace in-person viewings. Matterport sells VR hardware to users so that they can capture their spaces in 3D. Matterport also sells software subscriptions that help users effectively leverage their VR spaces. Bringing homes online helps realtors get more enquiries but is also a useful tool for the design and construction process. Using Matterport’s platform, design-focused architects and contractors no longer have to be on site to do their jobs.Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

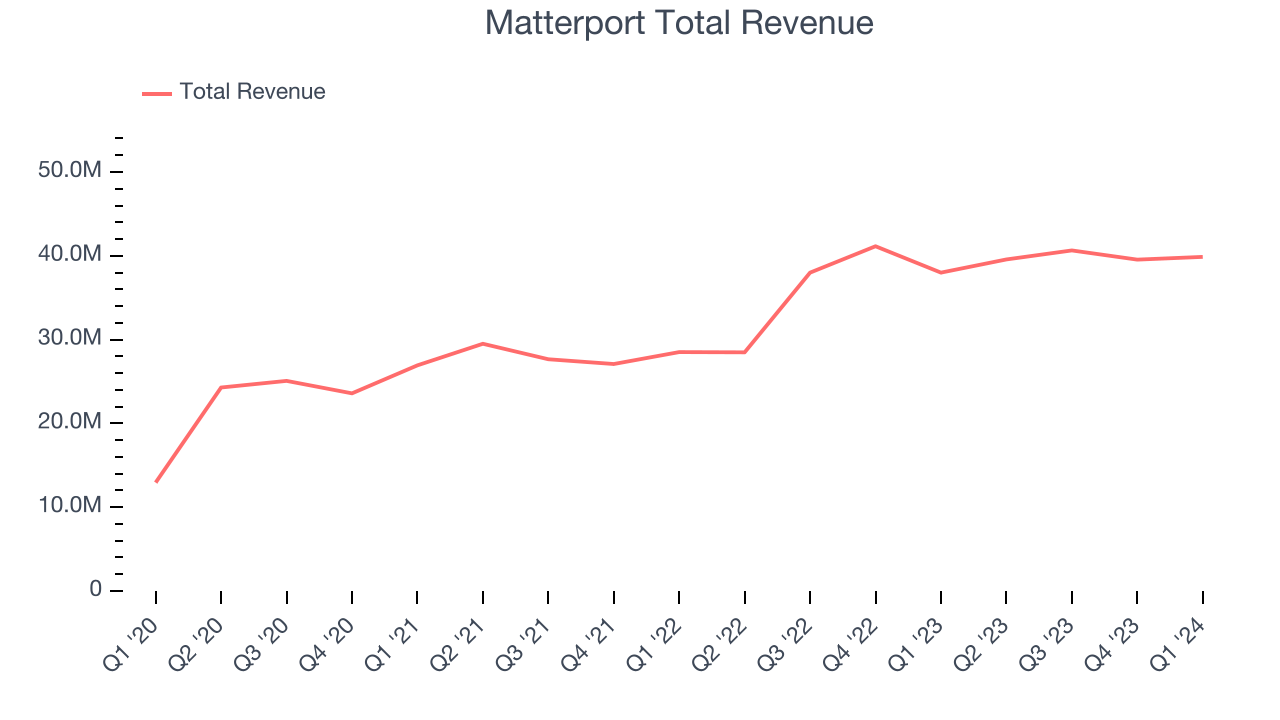

Sales Growth

As you can see below, Matterport's revenue growth has been mediocre over the last three years, growing from $26.93 million in Q1 2021 to $39.87 million this quarter.

Matterport's quarterly revenue was only up 4.9% year on year, which might disappoint some shareholders. However, its revenue increased $327,000 quarter on quarter, a strong improvement from the $1.10 million decrease in Q4 CY2023. This is a sign of acceleration of growth and very nice to see indeed.

Looking ahead, analysts covering the company were expecting sales to grow 13.5% over the next 12 months before the earnings results announcement.

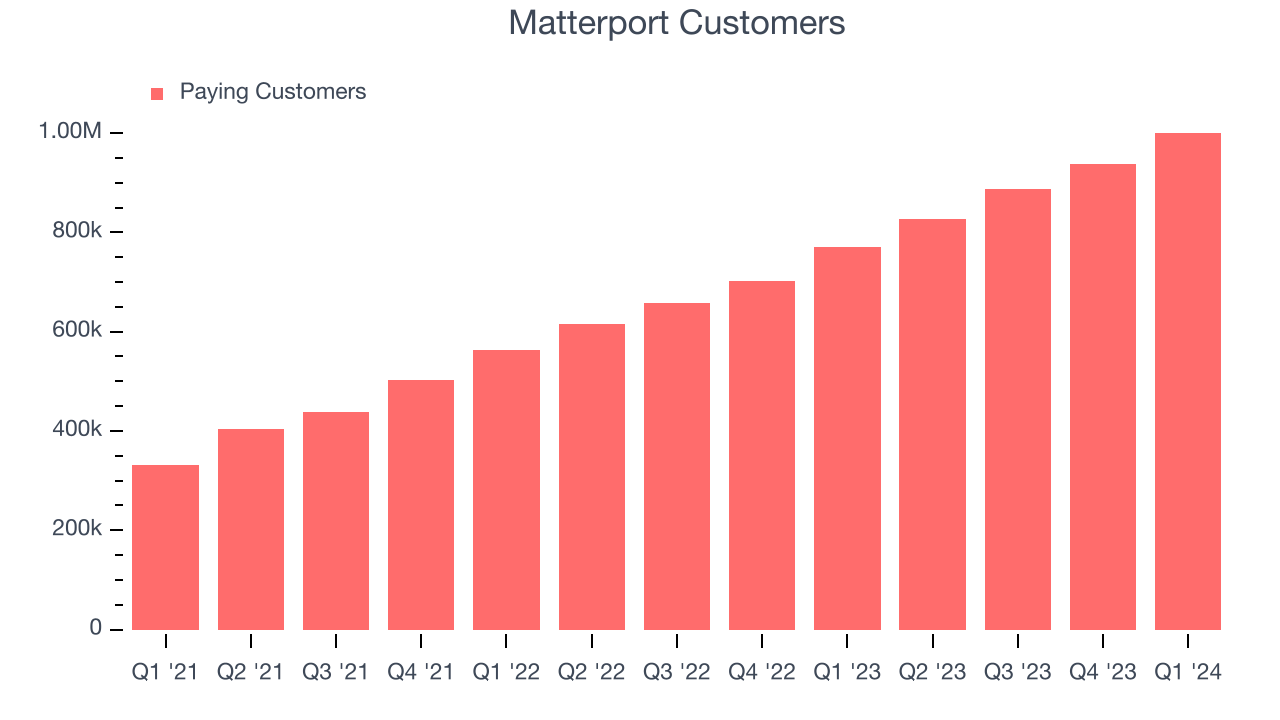

Customer Growth

Matterport reported 1 million customers at the end of the quarter, an increase of 62,000 from the previous quarter. That's a fair bit better customer growth than last quarter and in line with what we've seen in past quarters, demonstrating that the company has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that Matterport's go-to-market strategy is running smoothly.

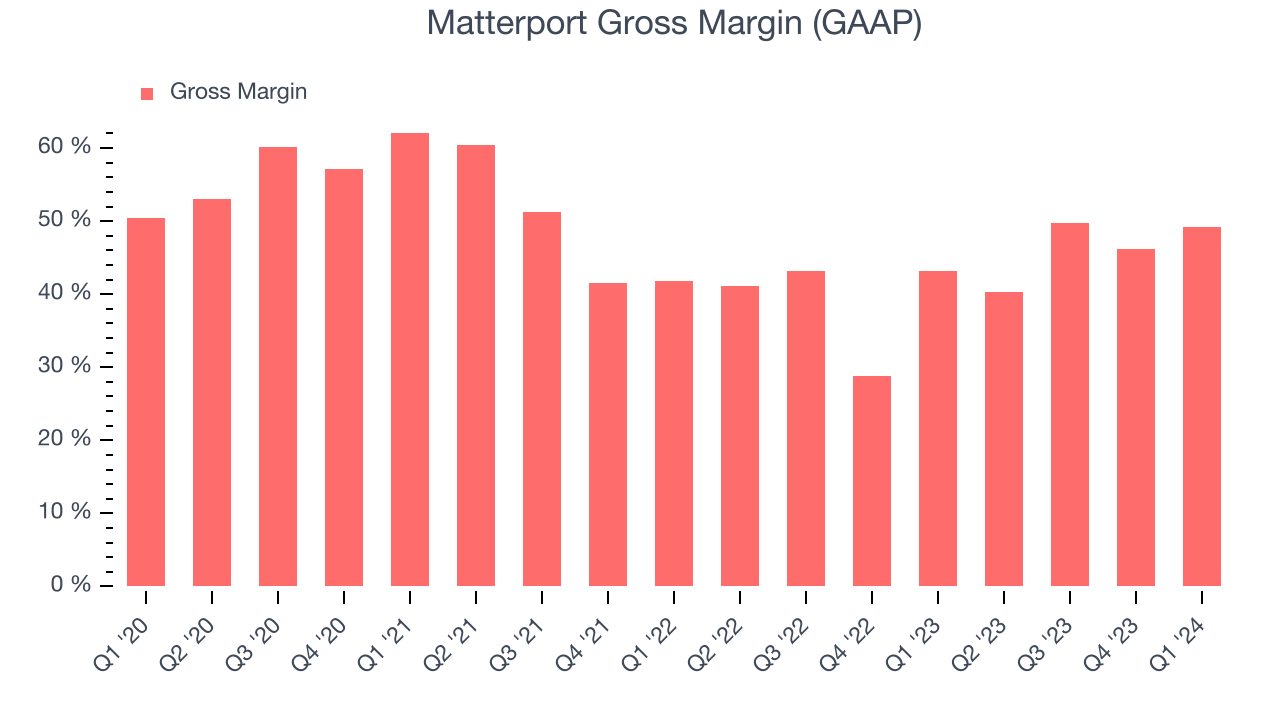

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Matterport's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 49.1% in Q1.

That means that for every $1 in revenue the company had $0.49 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, Matterport's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

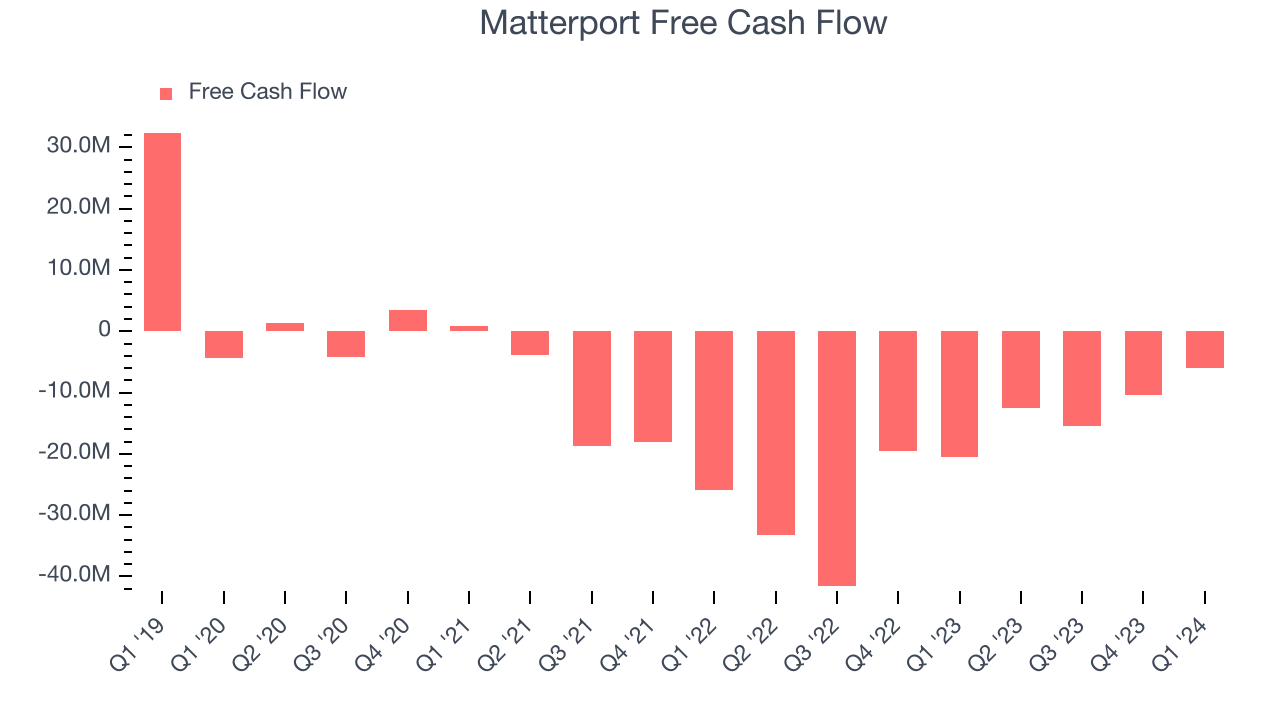

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Matterport burned through $6.06 million of cash in Q1 , increasing its cash burn by 70.4% year on year.

Matterport has burned through $44.42 million of cash over the last 12 months, resulting in a negative 27.8% free cash flow margin. This low FCF margin stems from Matterport's constant need to reinvest in its business to stay competitive.

Is Now The Time?

When considering an investment in Matterport, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Matterport, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last three years, and analysts expect growth to deteriorate from here. And while its customers are spending noticeably more each year, which is great to see, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Given its price-to-sales ratio of 7.8x based on the next 12 months, Matterport is priced with expectations for long-term growth. While there are some things to like about Matterport and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $5.50 right before these results (compared to the current share price of $4.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.