The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the semiconductors stocks have fared in Q4, starting with Micron Technology (NASDAQ:MU).

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 22 semiconductors stocks we track reported a solid Q4; on average, revenues beat analyst consensus estimates by 2.43%, while on average next quarter revenue guidance was 3.46% above consensus. Tech stocks have been under pressure since the end of last year, but semiconductors stocks held their ground better than others, with share price down 8.61% since earnings, on average.

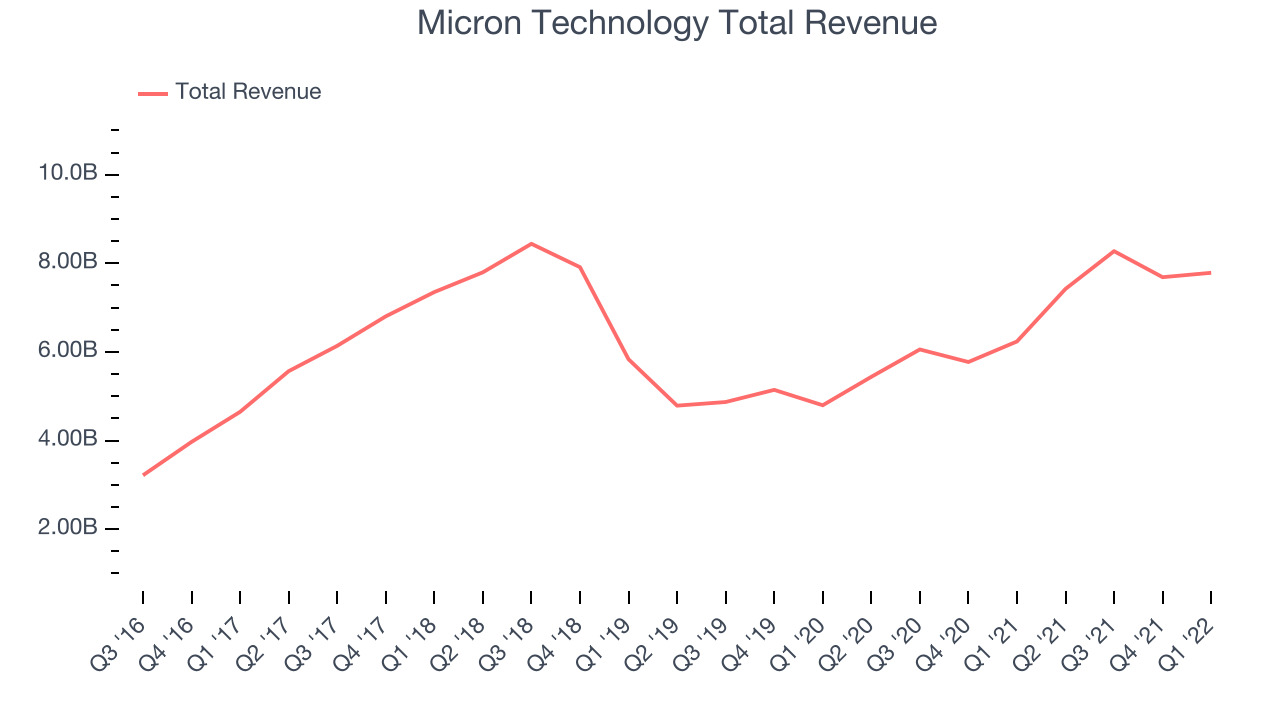

Micron Technology (NASDAQ:MU)

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron Technology reported revenues of $7.78 billion, up 24.8% year on year, beating analyst expectations by 3.2%. It was a very strong quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

The stock is down 9.43% since the results and currently trades at $74.43.

Is now the time to buy Micron Technology? Access our full analysis of the earnings results here, it's free.

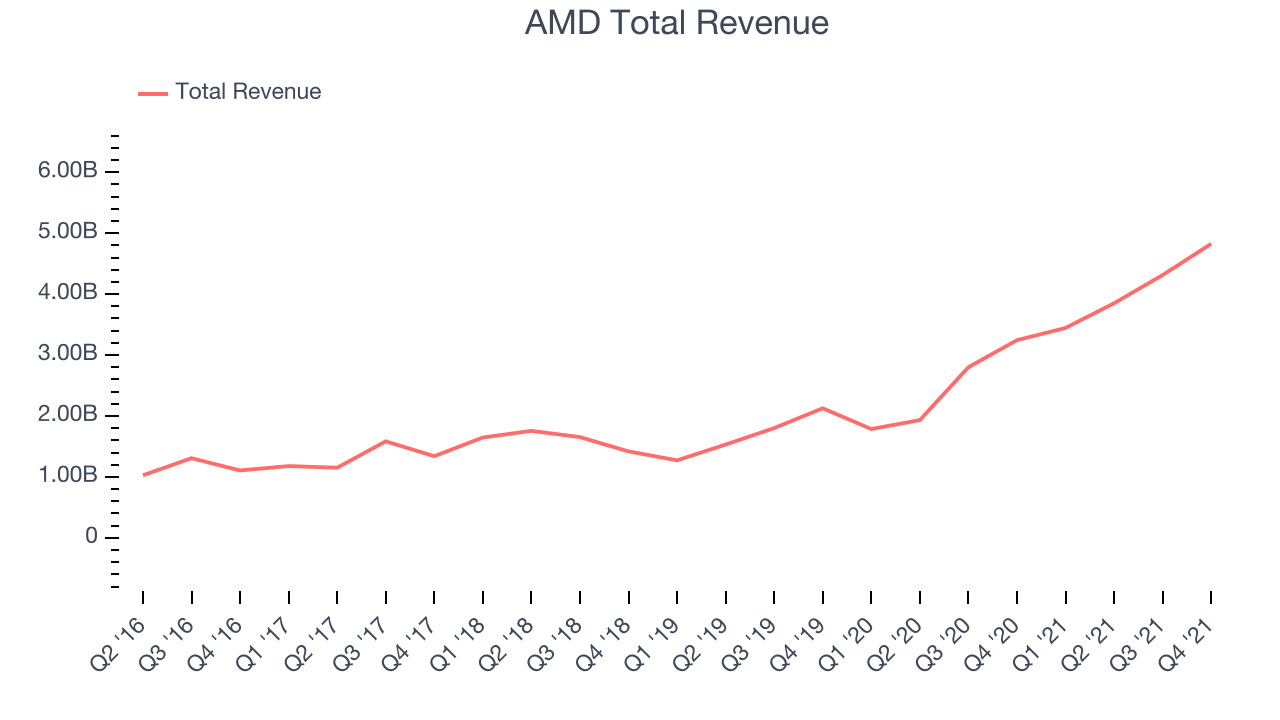

Best Q4: AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $4.82 billion, up 48.7% year on year, beating analyst expectations by 6.54%. It was a stunning quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

AMD scored the highest full year guidance raise among its peers. The stock is down 10.3% since the results and currently trades at $104.77.

Is now the time to buy AMD? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Lam Research Corporation (NASDAQ:LRCX)

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is a one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research Corporation reported revenues of $4.22 billion, up 51.3% year on year, missing analyst expectations by 4.26%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

Lam Research Corporation had the weakest performance against analyst estimates in the group. The stock is down 15.9% since the results and currently trades at $502.30.

Read our full analysis of Lam Research Corporation's results here.

Nvidia (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $7.64 billion, up 52.7% year on year, beating analyst expectations by 2.87%. It was an impressive quarter for the company, with an improvement in operating margin and a very optimistic guidance for the next quarter.

The stock is down 6.97% since the results and currently trades at $246.87.

Read our full, actionable report on Nvidia here, it's free.

Texas Instruments (NASDAQ:TXN)

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $4.83 billion, up 18.5% year on year, beating analyst expectations by 9.05%. It was a very strong quarter for the company, with an impressive beat of analyst estimates.

The stock is up 2.35% since the results and currently trades at $178.29.

Read our full, actionable report on Texas Instruments here, it's free.

The author has no position in any of the stocks mentioned