As we reflect back on the just completed Q3 semiconductors sector earnings season, we dig into the relative performance of Micron Technology (NASDAQ:MU) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 24 semiconductors stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.36%, while on average next quarter revenue guidance was 4.34% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but semiconductors stocks held their ground better than others, with the share prices up 10.9% since the previous earnings results, on average.

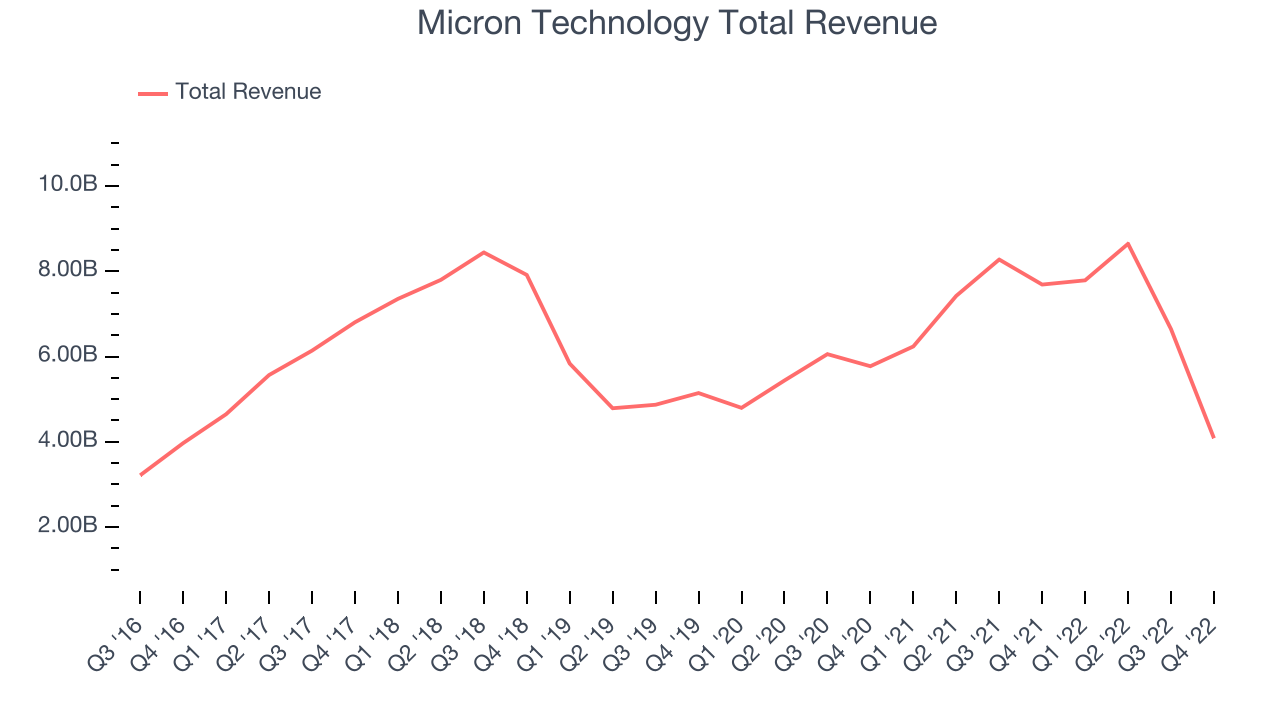

Micron Technology (NASDAQ:MU)

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron Technology reported revenues of $4.08 billion, down 46.8% year on year, missing analyst expectations by 1.39%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

Micron Technology delivered the slowest revenue growth of the whole group. The stock is up 10.5% since the results and currently trades at $56.58.

Read our full report on Micron Technology here, it's free.

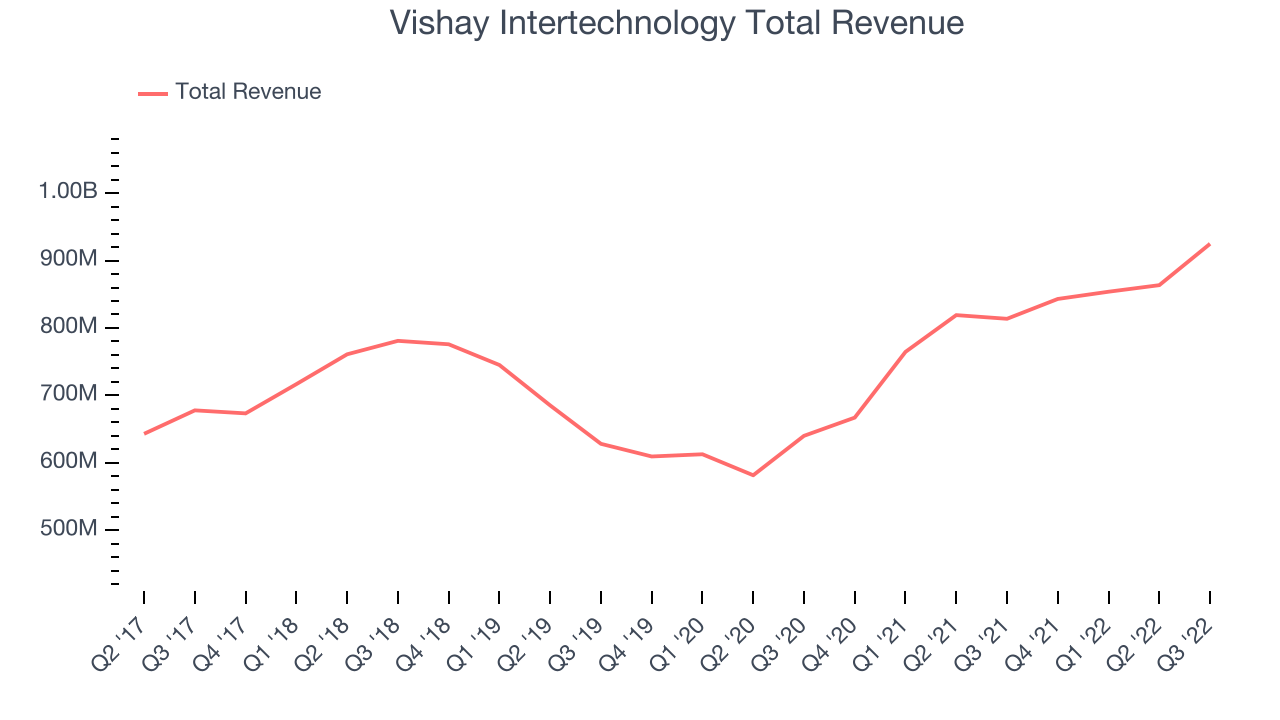

Best Q3: Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $924.7 million, up 13.6% year on year, in line with analyst expectations. It was an impressive quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

The stock is up 2.52% since the results and currently trades at $21.92.

Is now the time to buy Vishay Intertechnology? Access our full analysis of the earnings results here, it's free.

Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.03 billion, down 34.6% year on year, missing analyst expectations by 3.36%. It was a weak quarter for the company, with declining revenue and underwhelming guidance for the next quarter.

Seagate Technology had the weakest performance against analyst estimates in the group. The stock is up 1% since the results and currently trades at $58.55.

Read our full analysis of Seagate Technology's results here.

Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $495.4 million, up 53.1% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a significant improvement in operating margin but underwhelming revenue guidance for the next quarter.

Monolithic Power Systems delivered the fastest revenue growth among the peers. The stock is up 16.9% since the results and currently trades at $385.43.

Read our full, actionable report on Monolithic Power Systems here, it's free.

Skyworks Solutions (NASDAQ:SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.4 billion, up 7.33% year on year, in line with analyst expectations. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The stock is up 22.1% since the results and currently trades at $100.52.

Read our full, actionable report on Skyworks Solutions here, it's free.

The author has no position in any of the stocks mentioned