Wrapping up Q1 earnings, we look at the numbers and key takeaways for the semiconductors stocks, including Micron Technology (NASDAQ:MU) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.1%, while on average next quarter revenue guidance was 0.46% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but semiconductors stocks held their ground better than others, with the share prices up 15.5% since the previous earnings results, on average.

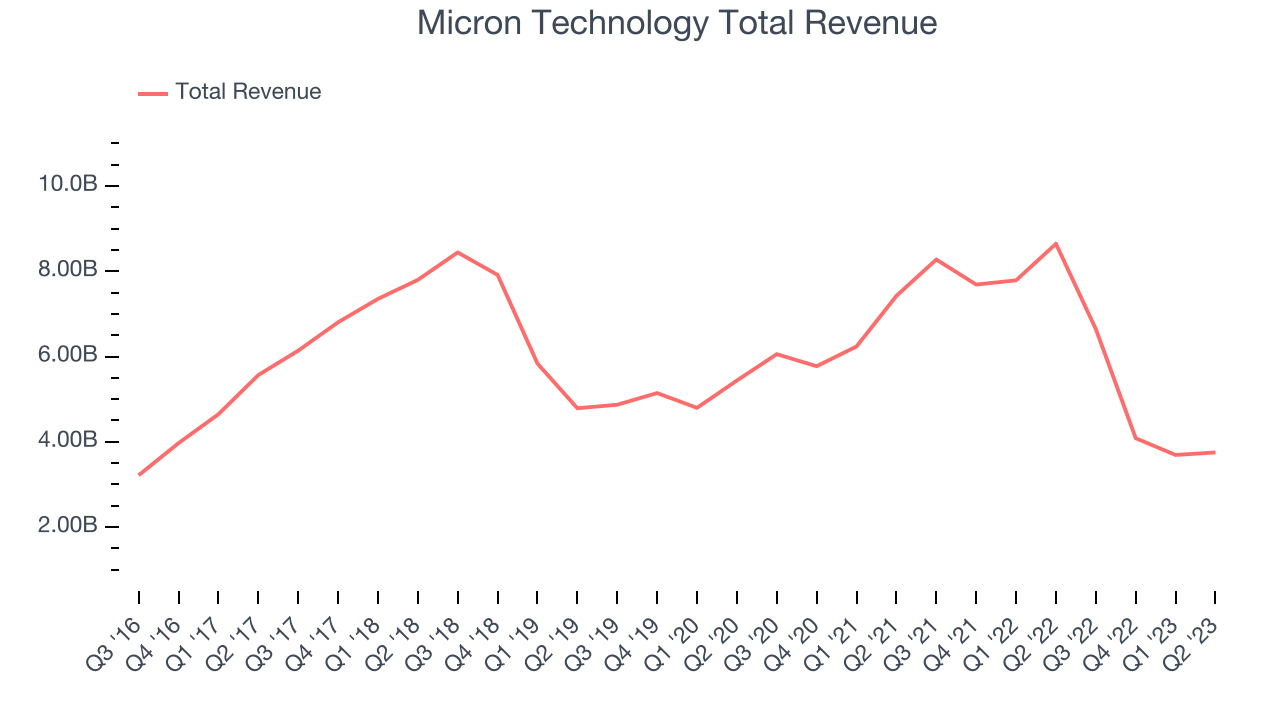

Micron Technology (NASDAQ:MU)

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron Technology reported revenues of $3.75 billion, down 56.6% year on year, beating analyst expectations by 2.05%. It was a mixed quarter for the company, with revenue and earnings outperforming expectations. However, there was a significant deterioration in gross and operating margins. The company's CEO said, "The memory industry has passed its trough in revenue, and we expect margins to improve as the industry supply-demand balance is gradually restored."

Micron Technology delivered the slowest revenue growth of the whole group. The stock is down 4.13% since the results and currently trades at $64.34.

Read our full report on Micron Technology here, it's free.

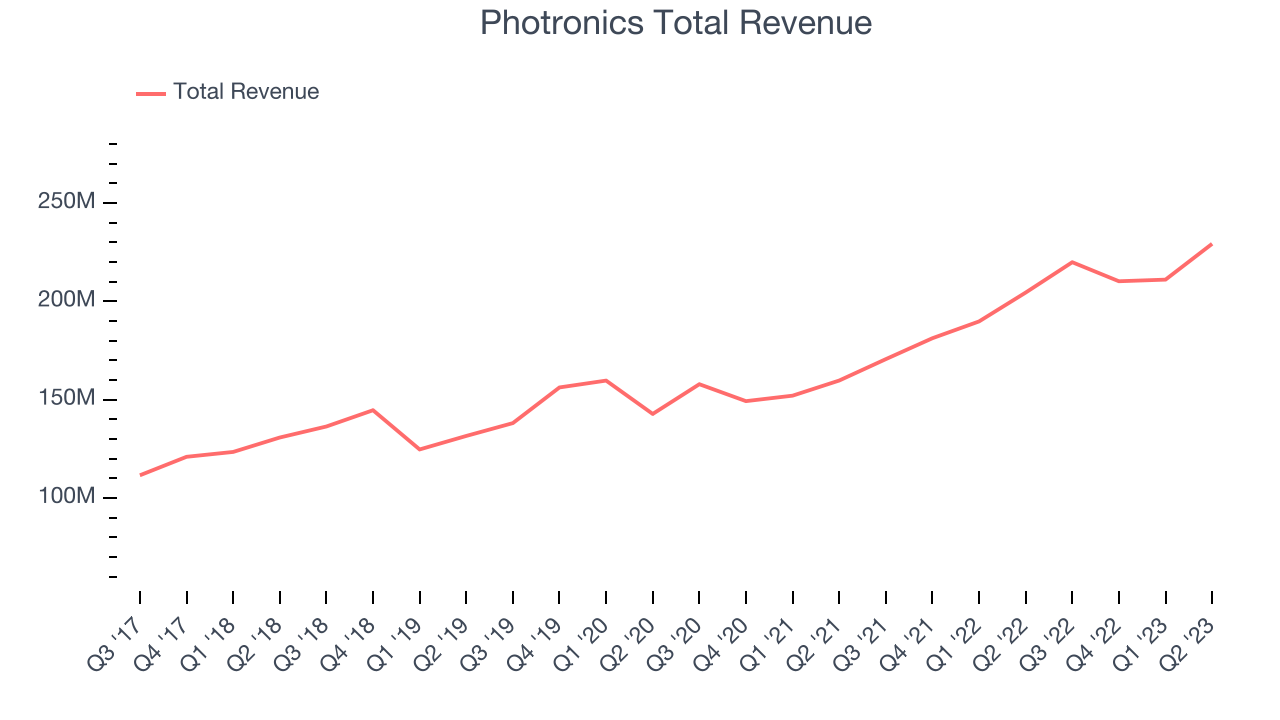

Best Q1: Photronics (NASDAQ:PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $229.3 million, up 12.1% year on year, beating analyst expectations by 8.68%. It was an exceptional quarter for the company, with a significant improvement in gross margin and strong revenue guidance for the next quarter.

The stock is up 48.8% since the results and currently trades at $25.63.

Is now the time to buy Photronics? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Seagate Technology (NASDAQ:STX)

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $1.86 billion, down 33.6% year on year, missing analyst expectations by 5.78%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

The stock is down 1.43% since the results and currently trades at $62.

Read our full analysis of Seagate Technology's results here.

Intel (NASDAQ:INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $11.7 billion, down 36.2% year on year, beating analyst expectations by 5.25%. It was a mixed quarter for the company, with a beat on the bottom line but a decline in operating margin.

The stock is up 11.2% since the results and currently trades at $33.17.

Read our full, actionable report on Intel here, it's free.

Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $2.23 billion, up 21.1% year on year, in line with analyst expectations. It was a mixed quarter for the company, with strong sales guidance for the next quarter but an increase in inventory levels.

The stock is up 15.1% since the results and currently trades at $87.5.

Read our full, actionable report on Microchip Technology here, it's free.

The author has no position in any of the stocks mentioned