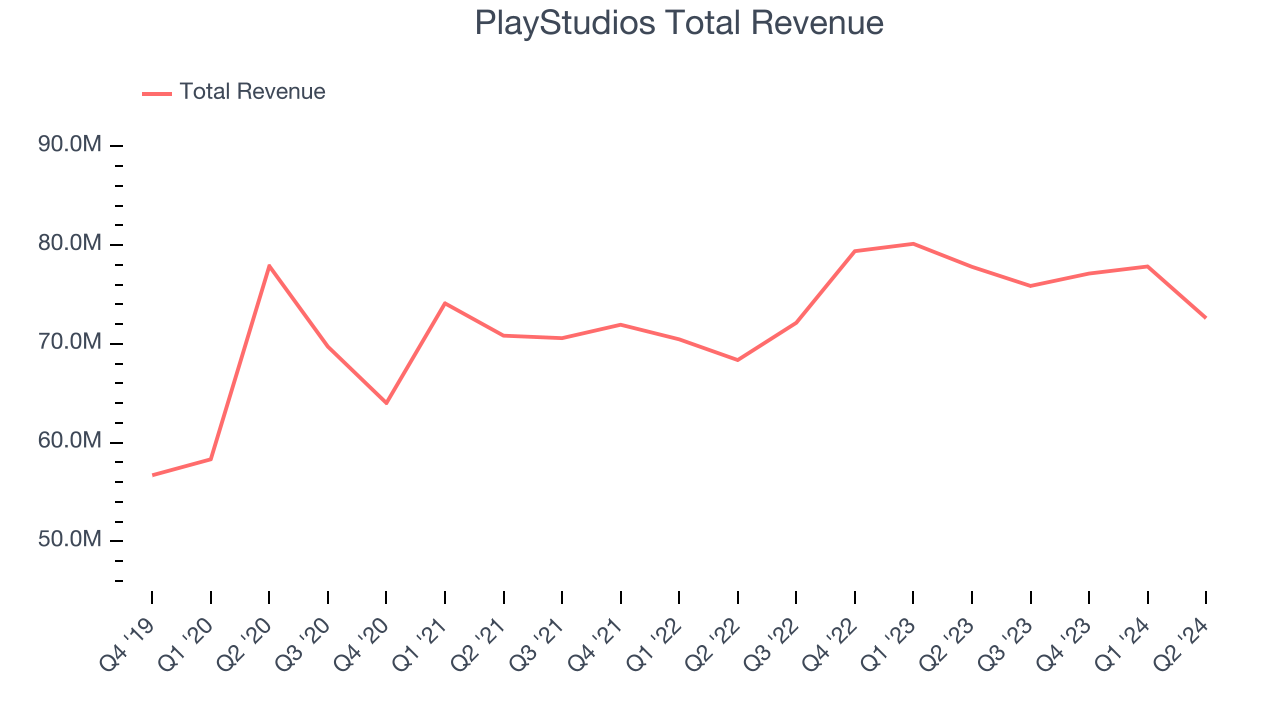

Digital casino game platform PlayStudios (NASDAQ:MYPS) fell short of analysts' expectations in Q2 CY2024, with revenue down 6.7% year on year to $72.59 million. The company's full-year revenue guidance of $290 million at the midpoint also came in 8.3% below analysts' estimates. It made a GAAP loss of $0.02 per share, down from its loss of $0.01 per share in the same quarter last year.

Is now the time to buy PlayStudios? Find out by accessing our full research report, it's free.

PlayStudios (MYPS) Q2 CY2024 Highlights:

- Revenue: $72.59 million vs analyst estimates of $74.55 million (2.6% miss)

- EPS: -$0.02 vs analyst estimates of -$0.01 (-$0.01 miss)

- The company dropped its revenue guidance for the full year from $320 million to $290 million at the midpoint, a 9.4% decrease

- Gross Margin (GAAP): 75.1%, in line with the same quarter last year

- Adjusted EBITDA Margin: 19.5%, down from 20.9% in the same quarter last year

- Monthly Active Users: 13.6 million, down 281,000 year on year

- Market Capitalization: $258.6 million

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “We had a busy and productive quarter completing many strategic initiatives that better position our company for future growth. While persistent industry weakness continues to be a challenge for our Social Casino portfolio, I believe we have opportunities in our portfolio that will eventually override this pressure. We have been steadily making progress on these efforts and continued to do so this quarter. Longer term, our focus remains on building a strong and durable business that can produce exceptional returns regardless of industry dynamics.”

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Unfortunately, PlayStudios's 4.2% annualized revenue growth over the last four years was weak. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. PlayStudios's annualized revenue growth of 3.9% over the last two years aligns with its four-year trend, suggesting its demand was consistently weak.

This quarter, PlayStudios missed Wall Street's estimates and reported a rather uninspiring 6.7% year-on-year revenue decline, generating $72.59 million of revenue. Looking ahead, Wall Street expects sales to grow 7% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from PlayStudios's Q2 Results

We struggled to find many positives in these results. Its full-year revenue guidance was lowered and this quarter's revenue and EPS fell short of Wall Street's estimates. Overall, this was a bad quarter for PlayStudios, but the stock traded up 1.5% to $1.98 immediately after reporting due to some news about the company repurchasing shares from Microsoft.

So should you invest in PlayStudios right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.