Digital casino game platform PlayStudios (NASDAQ:MYPS) reported results ahead of analyst expectations in the Q1 FY2023 quarter, with revenue up 13.7% year on year to $80.1 million. PlayStudios made a GAAP loss of $2.57 million, improving on its loss of $25.2 million, in the same quarter last year.

Is now the time to buy PlayStudios? Access our full analysis of the earnings results here, it's free.

PlayStudios (MYPS) Q1 FY2023 Highlights:

- Revenue: $80.1 million vs analyst estimates of $73.4 million (9.12% beat)

- EPS: -$0.02 vs analyst estimates of -$0.05 ($0.03 beat)

- The company lifted revenue guidance for the full year, from $310 million to $315 million at the midpoint, a 1.61% increase

- Gross Margin (GAAP): 75.6%, up from 70.1% same quarter last year

- Average MAUs: 13.1 million, up 6.17 million year on year

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “Our momentum exiting 2022 continued as we posted another terrific quarter. Revenue and AEBITDA exceeded year ago and fourth quarter results, continuing to validate our unique strategy and focus on execution. We’ve accomplished this despite numerous industry and economic headwinds that continue to make operating conditions challenging.”

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Cheap, powerful computing and graphics chips have made ever more realistic versions of classic sports, driving and shooting games while also introducing immersive metaverse-like gaming. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

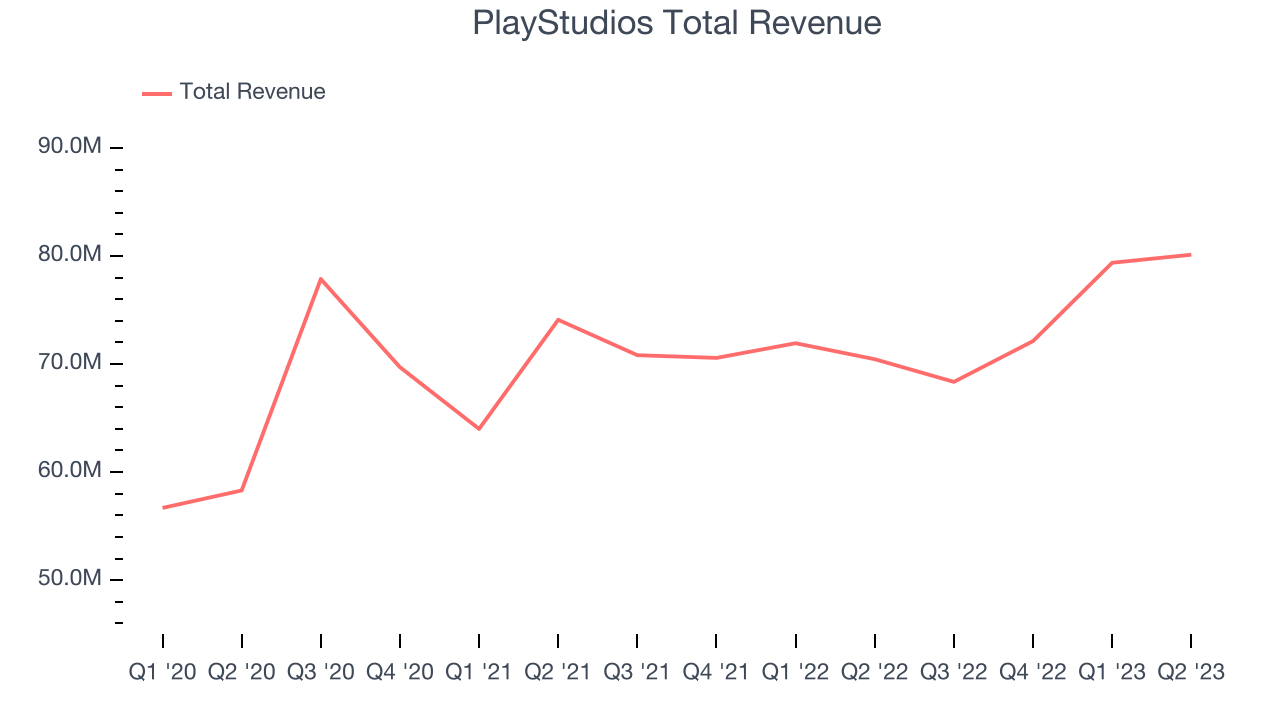

Sales Growth

PlayStudios's revenue growth over the last three years has been unimpressive, averaging 6.24% annually. This quarter, PlayStudios beat analyst estimates but reported a mediocre 13.7% year on year revenue growth.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 5.39% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

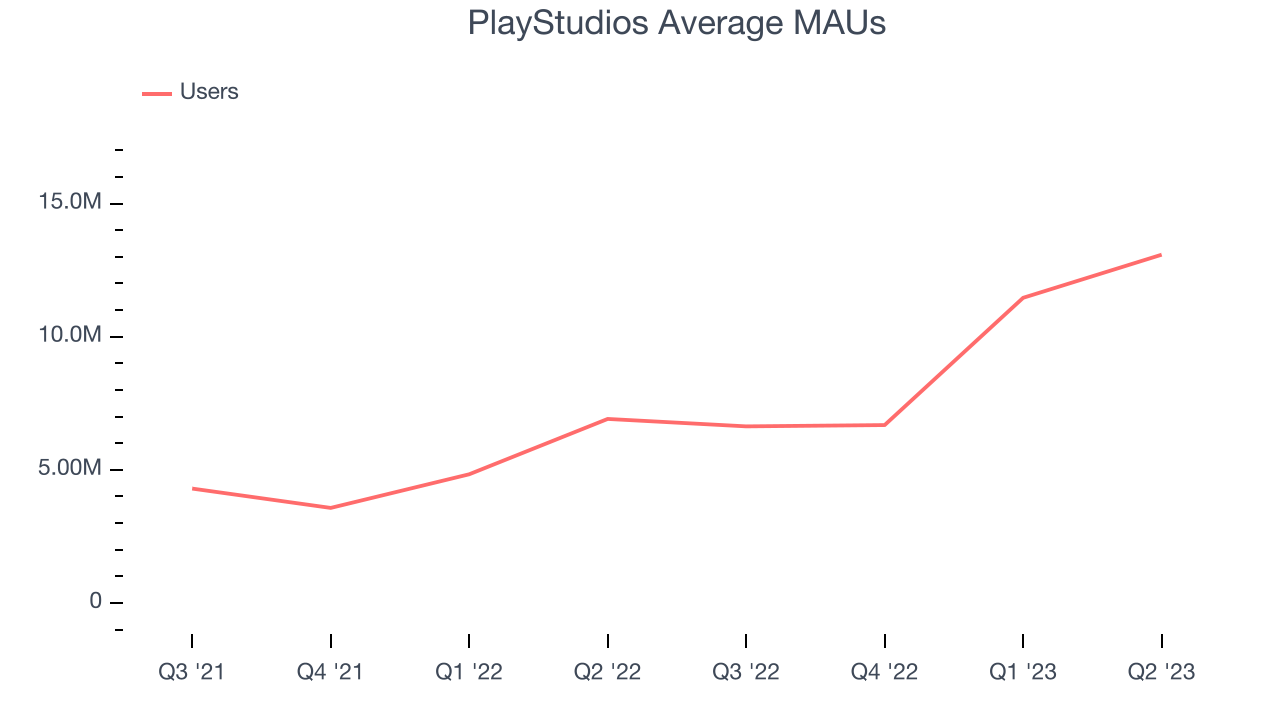

Usage Growth

As a video gaming company, PlayStudios generates revenue growth by growing both the number of players playing its games, as well as how much each of those players spends on (or in) their games.

Over the last two years the number of PlayStudios's monthly active users, a key usage metric for the company, grew 92% annually to 13.1 million. This is among the fastest growth of any consumer internet company, indicating that users are excited about the offering.

In Q1 the company added 6.17 million monthly active users, translating to a 89.2% growth year on year.

Key Takeaways from PlayStudios's Q1 Results

With a market capitalization of $588 million and more than $127.5 million in cash, the company has the capacity to continue to prioritise growth.

We were very impressed by PlayStudios’s strong user growth this quarter. And we were also excited to see that it outperformed Wall St’s revenue expectations and raised full year revenue and EBITDA guidance. On the other hand, revenue growth is overall a bit slower these days. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The company is up 2.34% on the results and currently trades at $4.38 per share.

PlayStudios may have had a good quarter, so should you invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.