Digital casino game platform PlayStudios (NASDAQ:MYPS) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue down 2.9% year on year to $77.11 million. The company expects the full year's revenue to be around $320 million, in line with analysts' estimates. It made a GAAP loss of $0.15 per share, down from its loss of $0.01 per share in the same quarter last year.

PlayStudios (MYPS) Q4 FY2023 Highlights:

- Revenue: $77.11 million vs analyst estimates of $75.31 million (2.4% beat)

- Adjusted EBITDA: $14.7 million vs analyst estimates of $12.3 million (19.5% beat)

- EPS: -$0.15 vs analyst estimates of -$0.02 (-$0.13 miss)

- Management's revenue guidance for the upcoming financial year 2024 is $320 million at the midpoint, in line with analyst expectations and implying 2.9% growth (vs 7.5% in FY2023) (adjusted EBITDA guidance for the period also roughly in line)

- Gross Margin (GAAP): 74.7%, up from 72.6% in the same quarter last year

- Average MAUs: 13.29 million, up 1.83 million year on year

- Market Capitalization: $286.8 million

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios offers free-to-play casino games (slot machines, blackjack, and poker) that can be accessed through its mobile app myVEGAS. These are free-to-play games, which means that no real money is wagered, won, or lost.

However, players can earn rewards points that can be redeemed for prizes such as hotel stays, dining experiences, and tickets to events such as shows and concerts. Some argue there might be a potential for legal risk because the prizes that can be redeemed have real cash values. Additionally, some of the hotel stays and experiences won are at real casinos, which could feed a cycle of addictive gambling behaviors.

The company generates revenue primarily from the sale of in-game virtual currency, which players can purchase to enhance their playing experience (additional features, themes, game modes). PlayStudios also generates revenue through advertising and by partnering with real-world businesses to offer rewards to PlayStudios’s players. Businesses such as hotels, restaurants, and entertainment venues may pay PlayStudios for the right to be featured in games or to offer rewards.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Competitors offering casual digital games that may feature casino-like activities include Skillz (NYSE:SKLZ), SciPlay (NASDAQ:SCPL), and Huuuge (WSE:HUG).Sales Growth

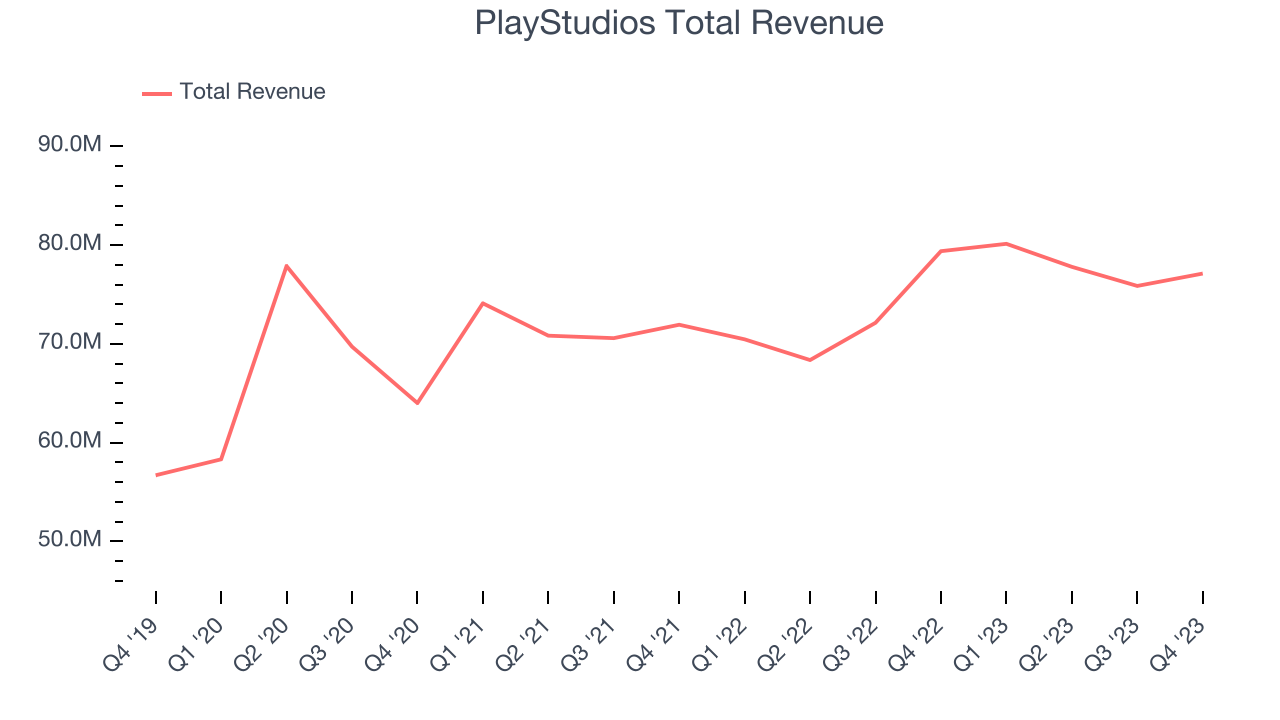

PlayStudios's revenue growth over the last three years has been unimpressive, averaging 5.5% annually. This quarter, PlayStudios beat analysts' estimates but reported a year on year revenue decline of 2.9%.

For the upcoming financial year, management expects revenue to reach $320 million at the midpoint, representing 2.9% growth compared to the 7.5% increase in FY2023.

Usage Growth

As a video gaming company, PlayStudios generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

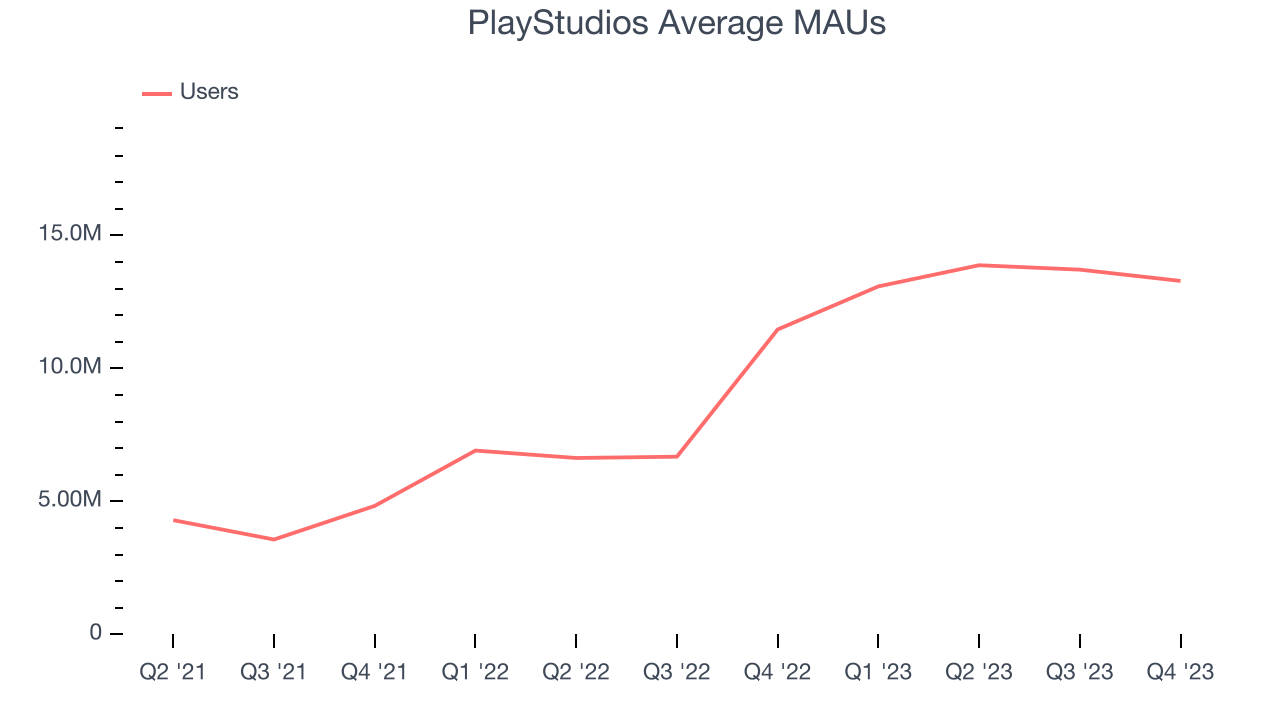

Over the last two years, PlayStudios's monthly active users, a key performance metric for the company, grew 85.5% annually to 13.29 million. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

In Q4, PlayStudios added 1.83 million monthly active users, translating into 15.9% year-on-year growth.

Revenue Per User

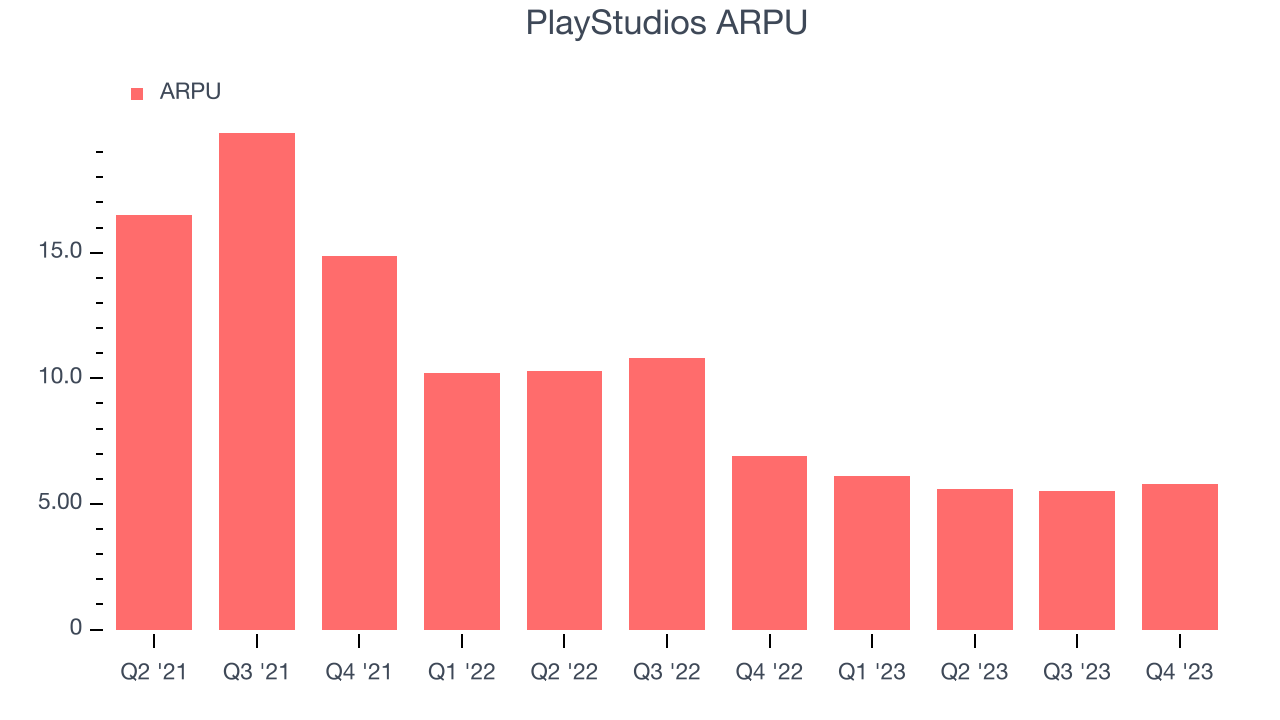

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like PlayStudios because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

PlayStudios's ARPU has declined over the last two years, averaging 41%. Although it's unfortunate to see the company lose its pricing power, it was still able to achieve strong user growth. This quarter, ARPU declined 16.2% year on year to $5.80 per user.

Pricing Power

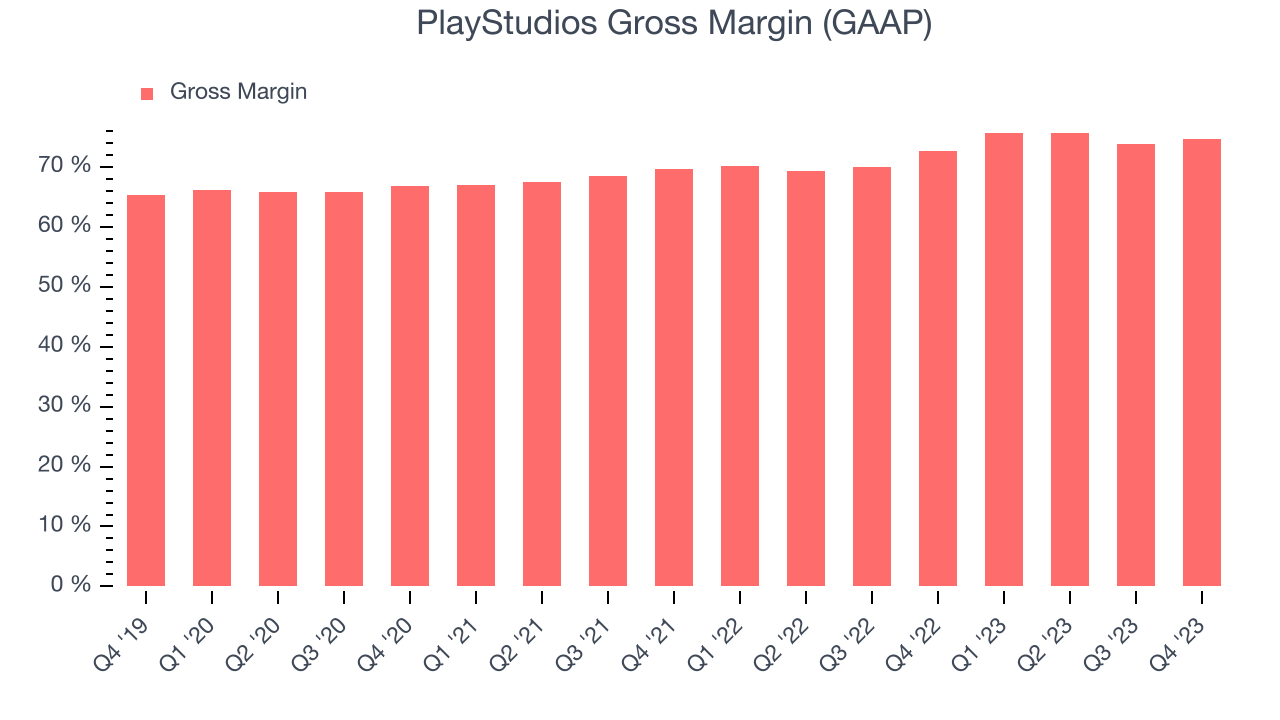

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

PlayStudios's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 74.7% this quarter, up 2.1 percentage points year on year.

For gaming businesses like PlayStudios, these aforementioned costs typically include royalties to sports leagues or celebrities featured in games, fees paid to Alphabet or Apple for games downloaded in their digital app stores, and data center and bandwidth expenses associated with delivering games over the internet. After paying for these expenses, PlayStudios had $0.75 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Gross margins have been trending up over the last 12 months, averaging 75%. PlayStudios's margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like PlayStudios grow from a combination of product virality, paid advertisement, and incentives.

PlayStudios is quite efficient at acquiring new users, spending only 31.9% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that PlayStudios has a highly differentiated product offering, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from PlayStudios's Q4 Results

It was great to see PlayStudios's strong user growth this quarter. We were also glad its revenue and adjusted EBITDA outperformed Wall Street's estimates. On the other hand, its revenue growth regrettably slowed. Guidance seemed fine even though it wasn't too exciting, with full year revenue and adjusted EBITDA guidance relatively in line with expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely expecting more, and the stock is down 4.8% after reporting, trading at $2.09 per share.

Is Now The Time?

When considering an investment in PlayStudios, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that PlayStudios isn't a bad business. Although its revenue growth has been uninspiring over the last three years with analysts expecting growth to slow from here, its growth in monthly active users has been strong. Investors should still be cautious, however, as its ARPU has declined over the last two years.

At the moment PlayStudios trades at 4.6x next 12 months EV-to-EBITDA. In the end, beauty is in the eye of the beholder. While PlayStudios wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price point right now.

Wall Street analysts covering the company had a one-year price target of $5.08 per share right before these results (compared to the current share price of $2.09).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.

Key Takeaways from PlayStudios's Q3 Results

With a market capitalization of $368.2 million and more than $129.8 million in cash on hand, PlayStudios can continue prioritizing growth.

We were very impressed by PlayStudios's robust user growth this quarter. That really stood out as a positive in these results. On the other hand, revenue in the quarter missed and its full-year revenue guidance underwhelmed, as it was lowered and came in below expectations. However, the company did raise its full year EBITDA guidance in spite of the lowered revenue outlook. Overall, this was a mixed quarter for PlayStudios. The stock is flat after reporting and currently trades at $2.9 per share.