Digital casino game platform PlayStudios (NASDAQ:MYPS) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 2.9% year on year to $77.83 million. The company expects the full year's revenue to be around $320 million, in line with analysts' estimates. It made a GAAP loss of $0 per share, improving from its loss of $0.02 per share in the same quarter last year.

PlayStudios (MYPS) Q1 CY2024 Highlights:

- Revenue: $77.83 million vs analyst estimates of $75.91 million (2.5% beat)

- EPS: $0 vs analyst estimates of -$0.02 ($0.02 beat)

- The company reconfirmed its revenue guidance for the full year of $320 million at the midpoint

- Daily Active Users: 3.5 million vs analyst estimates of 3.3 million

- Gross Margin (GAAP): 75.7%, in line with the same quarter last year

- Market Capitalization: $316.7 million

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios offers free-to-play casino games (slot machines, blackjack, and poker) that can be accessed through its mobile app myVEGAS. These are free-to-play games, which means that no real money is wagered, won, or lost.

However, players can earn rewards points that can be redeemed for prizes such as hotel stays, dining experiences, and tickets to events such as shows and concerts. Some argue there might be a potential for legal risk because the prizes that can be redeemed have real cash values. Additionally, some of the hotel stays and experiences won are at real casinos, which could feed a cycle of addictive gambling behaviors.

The company generates revenue primarily from the sale of in-game virtual currency, which players can purchase to enhance their playing experience (additional features, themes, game modes). PlayStudios also generates revenue through advertising and by partnering with real-world businesses to offer rewards to PlayStudios’s players. Businesses such as hotels, restaurants, and entertainment venues may pay PlayStudios for the right to be featured in games or to offer rewards.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors offering casual digital games that may feature casino-like activities include Skillz (NYSE:SKLZ), SciPlay (NASDAQ:SCPL), and Huuuge (WSE:HUG).Sales Growth

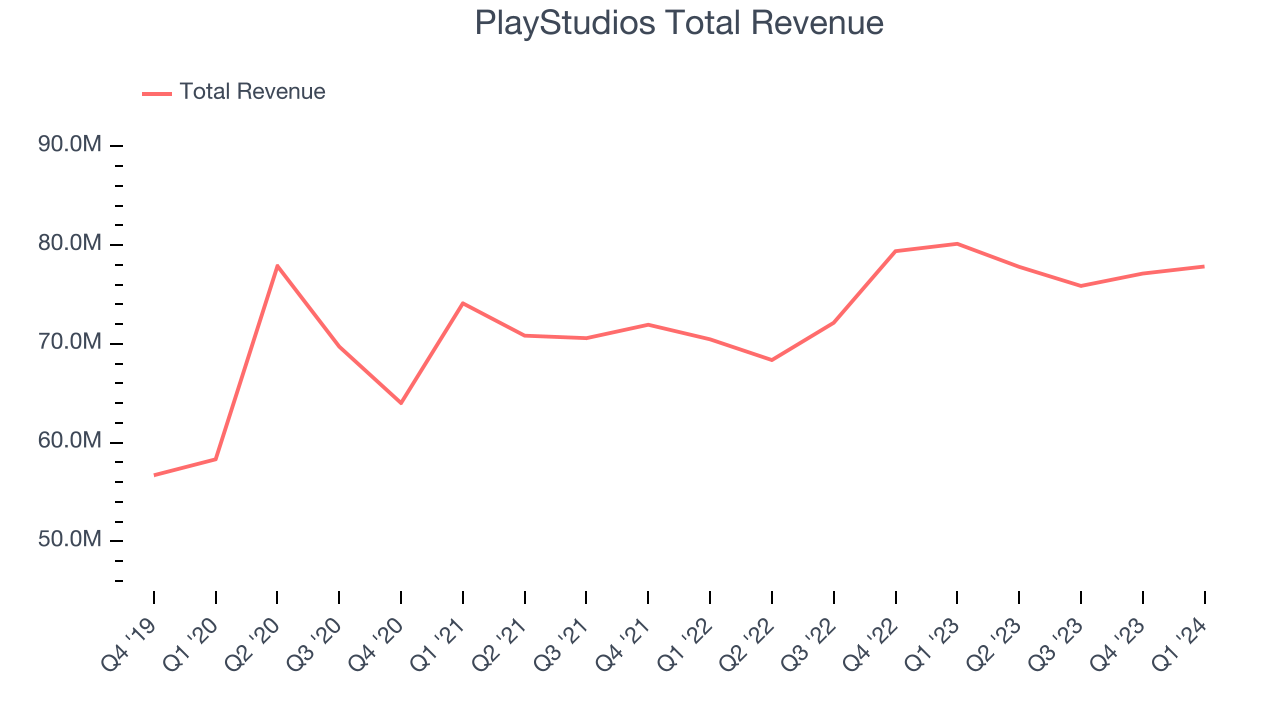

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. PlayStudios's annualized revenue growth rate of 7.7% over the last four years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. PlayStudios's recent history shows the business has slowed as its annualized revenue growth of 4.3% over the last two years is below its four-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. PlayStudios's recent history shows the business has slowed as its annualized revenue growth of 4.3% over the last two years is below its four-year trend.

This quarter, PlayStudios's revenue fell 2.9% year on year to $77.83 million but beat Wall Street's estimates by 2.5%. Looking ahead, Wall Street expects sales to grow 4.6% over the next 12 months, an acceleration from this quarter.

EPS

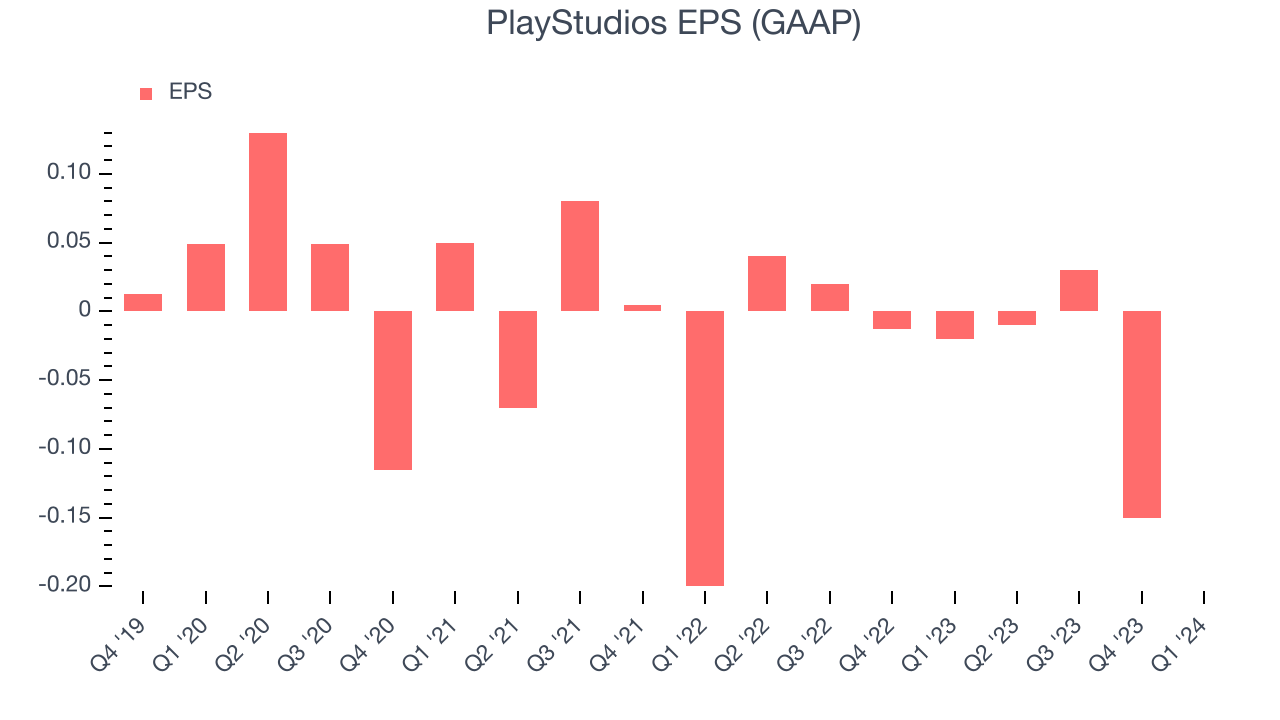

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last four years, PlayStudios's EPS dropped 343%, translating into 45.1% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, PlayStudios reported EPS at $0, up from negative $0.02 in the same quarter last year. This print beat analysts' estimates by 100%. Over the next 12 months, Wall Street is optimistic. Analysts are projecting PlayStudios's LTM EPS of negative $0.13 to reach break even.

Key Takeaways from PlayStudios's Q1 Results

It was great to see PlayStudios beat analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates as it added more daily active users than anticipated.

Looking ahead, the company's full-year revenue guidance was in line with Wall Street's projections while its forecasted EBITDA came in slightly ahead.

Overall, we think this was a really good quarter that should please shareholders. The stock is flat after reporting and currently trades at $2.33 per share.

Is Now The Time?

PlayStudios may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

PlayStudios isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last four years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, unfortunately, its declining EPS over the last four years makes it hard to trust.

In the end, beauty is in the eye of the beholder. While PlayStudios wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $4.92 per share right before these results (compared to the current share price of $2.33).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.