Wellness products company Nature’s Sunshine Products (NASDAQ:NATR) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 2.2% year on year to $111 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $467.5 million at the midpoint. It made a non-GAAP profit of $0.12 per share, improving from its profit of $0.04 per share in the same quarter last year.

Nature's Sunshine (NATR) Q1 CY2024 Highlights:

- Revenue: $111 million vs analyst estimates of $111.2 million (small miss)

- EPS (non-GAAP): $0.12 vs analyst expectations of $0.17 (29.4% miss)

- The company reconfirmed its revenue guidance for the full year of $467.5 million at the midpoint (in line)

- Gross Margin (GAAP): 71.2%, in line with the same quarter last year

- Free Cash Flow was -$1.50 million, down from $8.35 million in the previous quarter

- Market Capitalization: $359.4 million

Started on a kitchen table in Utah, Nature’s Sunshine Products (NASDAQ:NATR) manufactures and sells nutritional and personal care products.

Today, the company offers a broad portfolio of vitamins and supplements related to bone health, cellular health, cognitive function, joint health, and mood, among others. In addition, Nature’s Sunshine boasts a portfolio of personal care products such as lotion, aloe vera gel, herbal shampoo, and toothpaste.

The Nature’s Sunshine core customer is someone who cares about health and nutrition. These individuals are willing to spend a little extra to achieve their wellness goals, whether that is weight loss or improved overall health.

While Nature’s Sunshine products are available in some health stores, the company’s distribution largely relies on a multi-level marketing model. This means that individual customers who are passionate about the products sell directly to other end consumers. Given its multi-level marketing approach, Nature’s Sunshine customers are typically connected to someone who has had a good experience with the products.

However, many are skeptical about multi-level marketing approaches. Some say that these companies rely on recruitment to sustain themselves rather than actual demand for products, which could be very low.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors offering health and wellness supplements and products include Herbalife (NYSE:HLF), USANA Health Sciences (NYSE:USNA), Bellring Brands (NYSE:BRBR), and The Simply Good Foods Company (NASDAQ:SMPL).Sales Growth

Nature's Sunshine is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

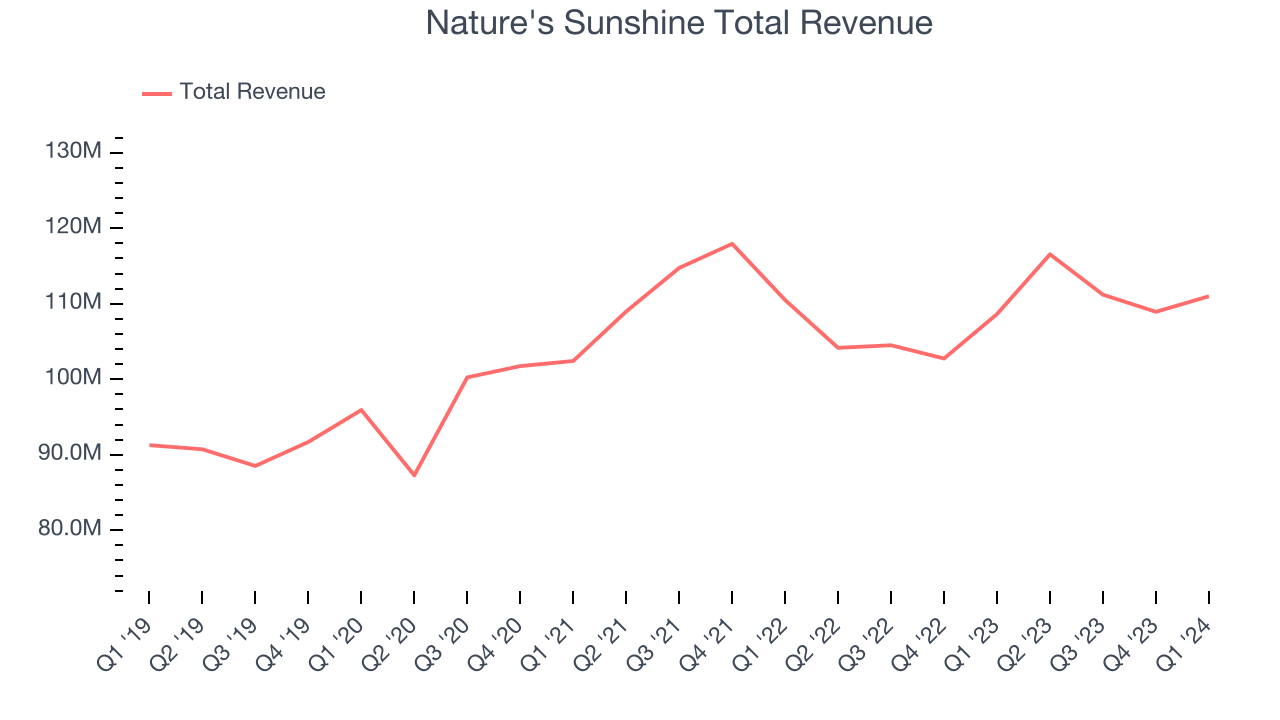

As you can see below, the company's annualized revenue growth rate of 4.6% over the last three years was weak for a consumer staples business.

This quarter, Nature's Sunshine's revenue grew 2.2% year on year to $111 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 6% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

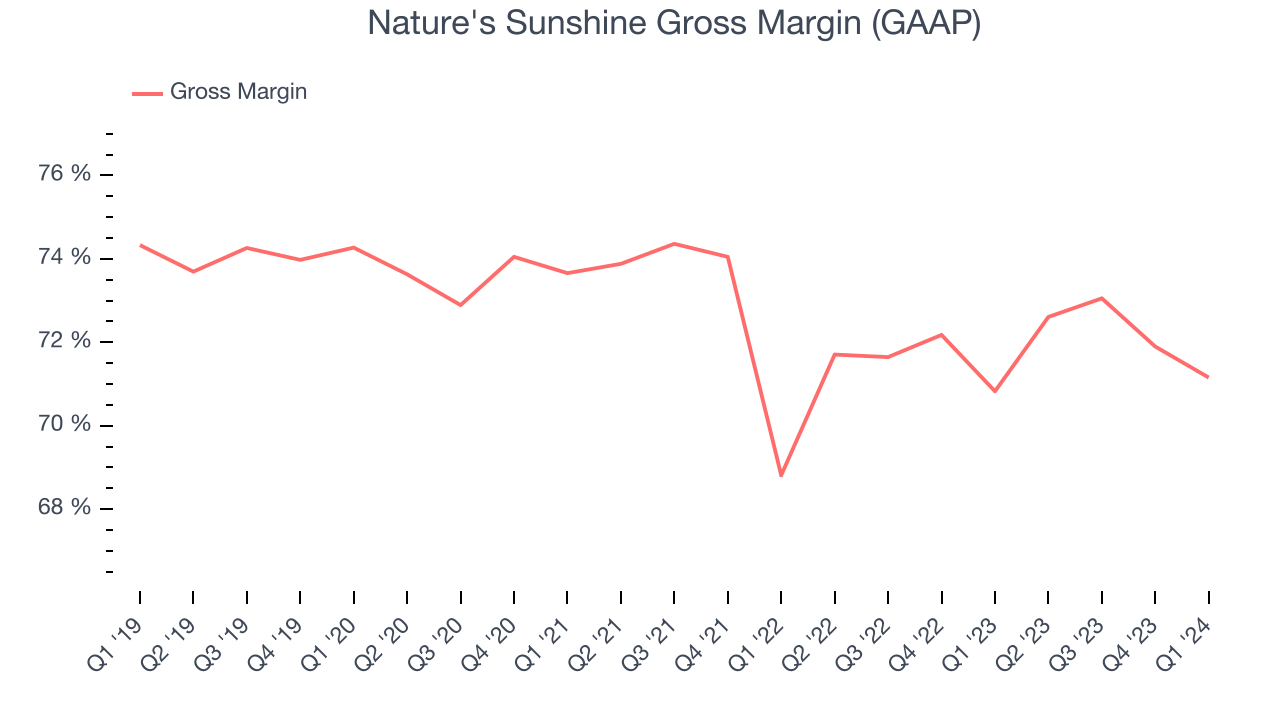

Nature's Sunshine's gross profit margin came in at 71.2% this quarter, in line with the same quarter last year. That means for every $1 in revenue, only $0.29 went towards paying for raw materials, production of goods, and distribution expenses.

Nature's Sunshine has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 71.9% gross margin over the last two years. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

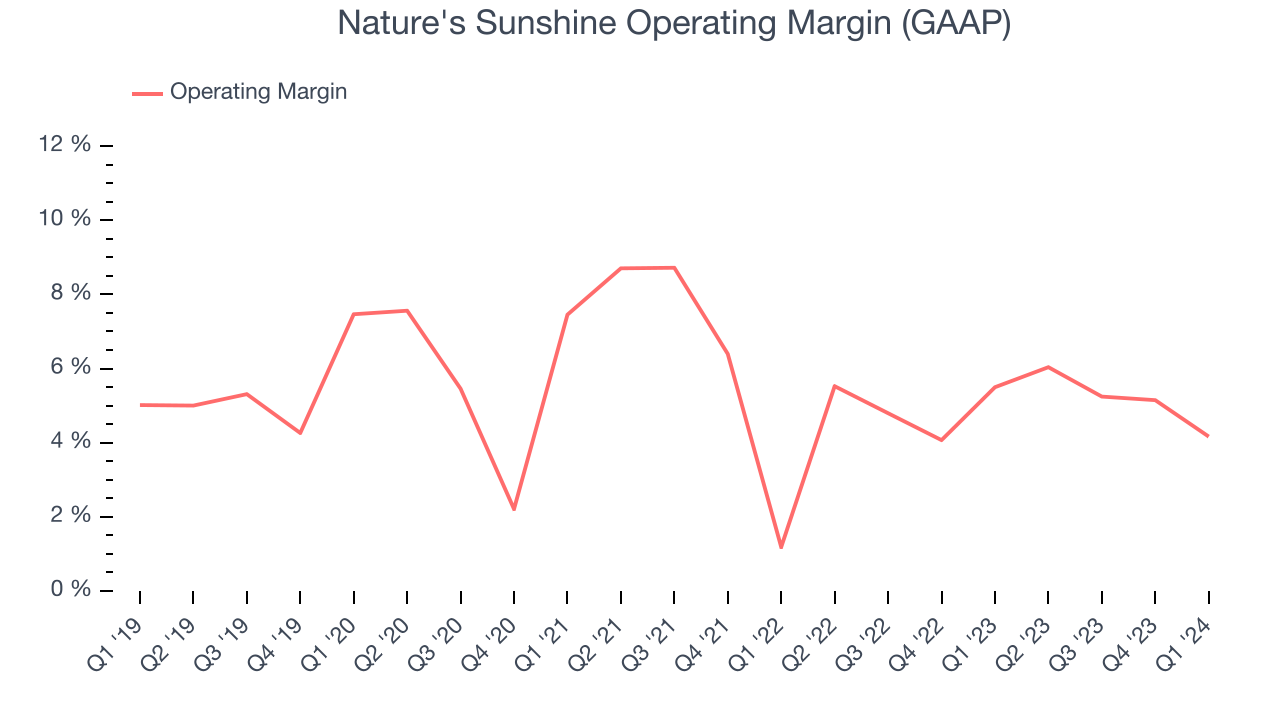

In Q1, Nature's Sunshine generated an operating profit margin of 4.2%, down 1.3 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, Nature's Sunshine was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 5.1%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.

Zooming out, Nature's Sunshine was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 5.1%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.EPS

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

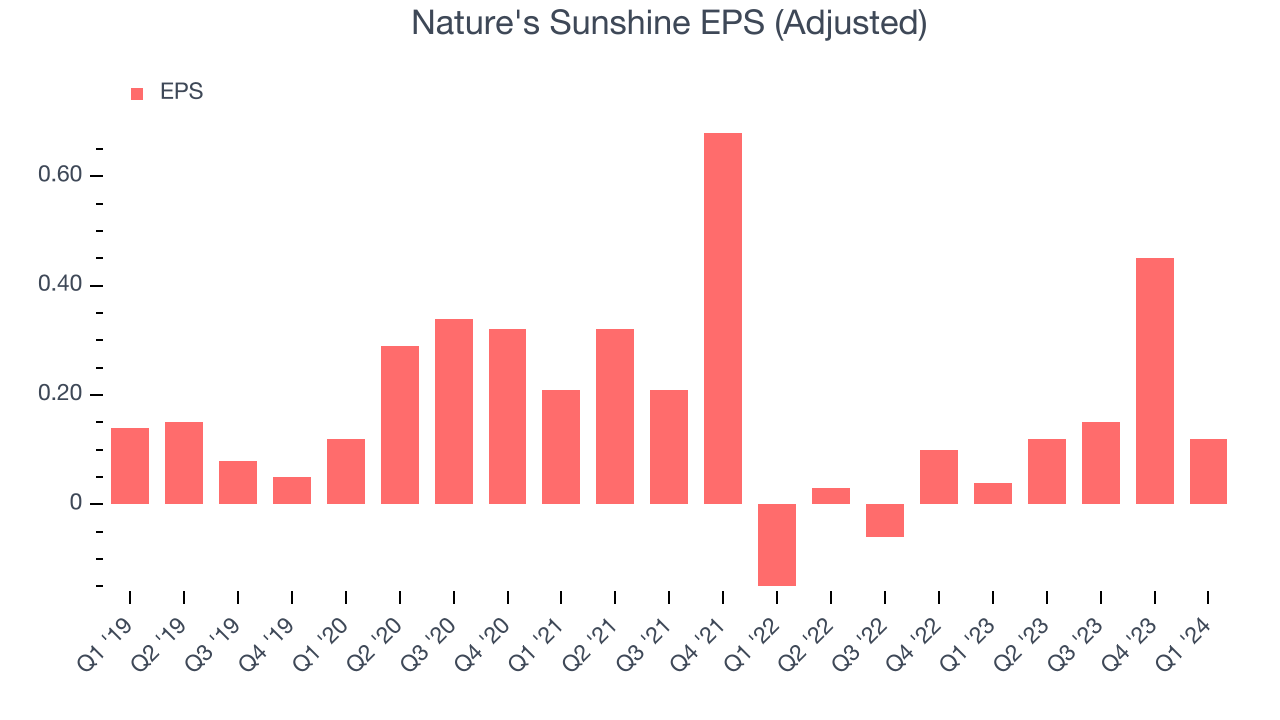

In Q1, Nature's Sunshine reported EPS at $0.12, up from $0.04 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Nature's Sunshine's EPS dropped 27.6%, translating into 10.2% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 3.6% year-on-year increase in EPS.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

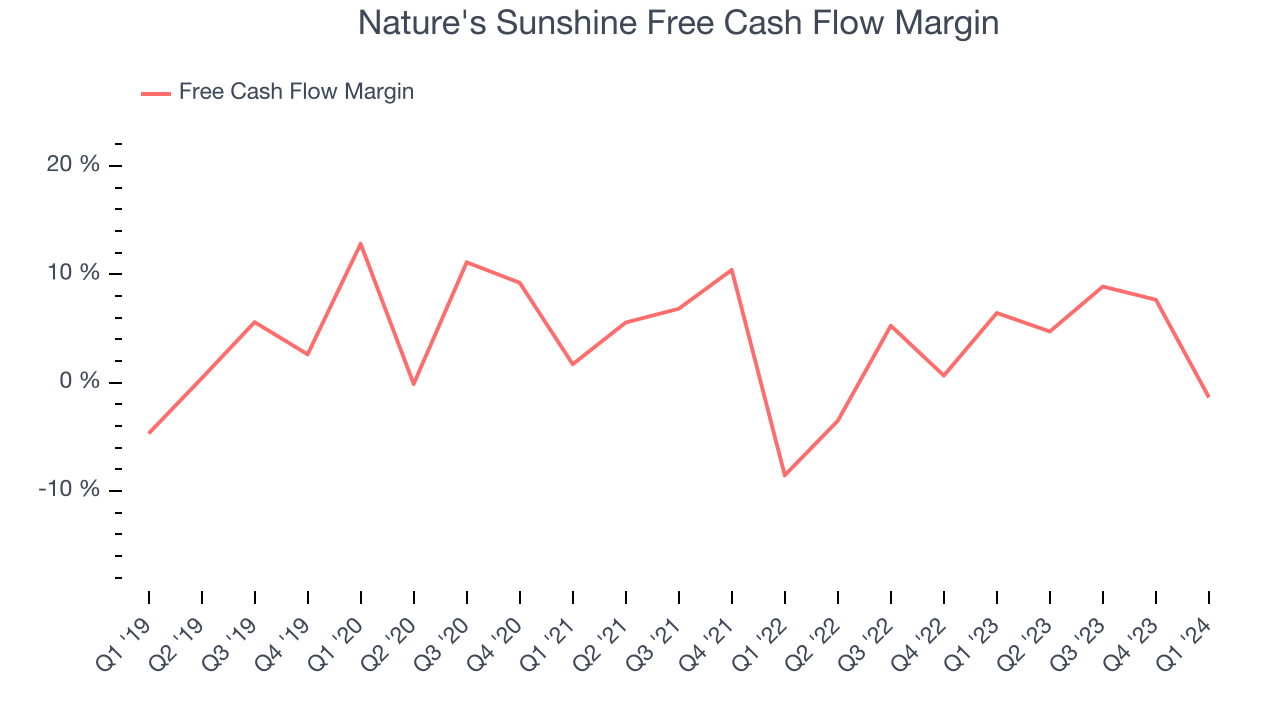

Nature's Sunshine burned through $1.50 million of cash in Q1, representing a negative 1.4% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which caught our eye as we'd like consumer staples companies to have more consistent performance.

Over the last eight quarters, Nature's Sunshine has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.7%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 2.7 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

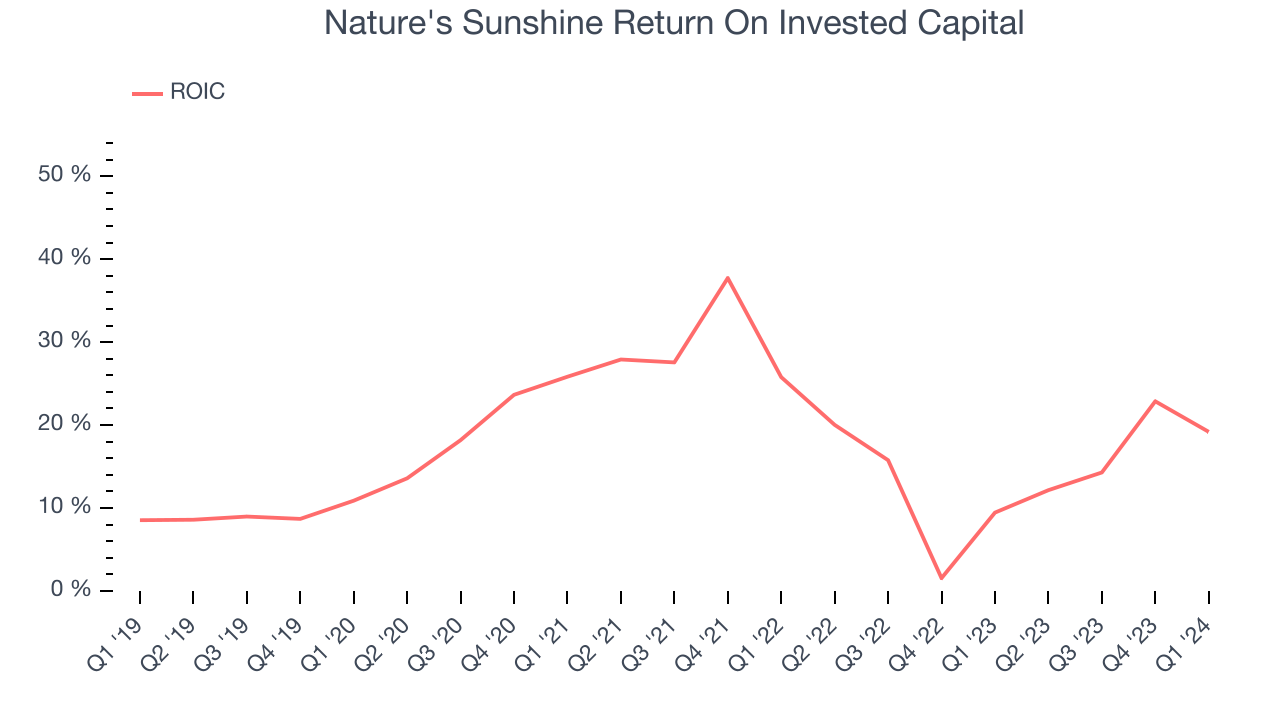

Although Nature's Sunshine hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 18.2%, higher than most consumer staples companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Nature's Sunshine's ROIC averaged 4 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Nature's Sunshine is a profitable, well-capitalized company with $77.77 million of cash and $17.71 million of debt, meaning it could pay back all its debt tomorrow and still have $60.06 million of cash on its balance sheet. This net cash position gives Nature's Sunshine the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Nature's Sunshine's Q1 Results

The company's operating margin and EPS both missed analysts' expectations. Full year revenue guidance was maintained and is in line with expectations. Overall, this was a mediocre quarter for Nature's Sunshine. The company is down 1.4% on the results and currently trades at $18.75 per share.

Is Now The Time?

Nature's Sunshine may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Nature's Sunshine isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last three years, but at least growth is expected to increase in the short term. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its brand caters to a niche market. On top of that, its declining EPS over the last three years makes it hard to trust.

Nature's Sunshine's price-to-earnings ratio based on the next 12 months is 21.9x. We can find things to like about Nature's Sunshine and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $24 per share right before these results (compared to the current share price of $18.75).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.