Banking software company nCino (NASDAQ:NCNO) reported results in line with analysts' expectations in Q4 CY2023, with revenue up 13.3% year on year to $123.7 million. On the other hand, next quarter's revenue guidance of $126.5 million was less impressive, coming in 1.5% below analysts' estimates. It made a non-GAAP profit of $0.21 per share, improving from its profit of $0.04 per share in the same quarter last year.

nCino (NCNO) Q4 CY2023 Highlights:

- Revenue: $123.7 million vs analyst estimates of $124.2 million (small miss)

- EPS (non-GAAP): $0.21 vs analyst estimates of $0.12 ($0.09 beat)

- Revenue Guidance for Q1 CY2024 is $126.5 million at the midpoint, below analyst estimates of $128.5 million

- Management's revenue guidance for the upcoming financial year 2024 is $541.5 million at the midpoint, in line with analyst expectations and implying 13.6% growth (vs 16.9% in FY2023)

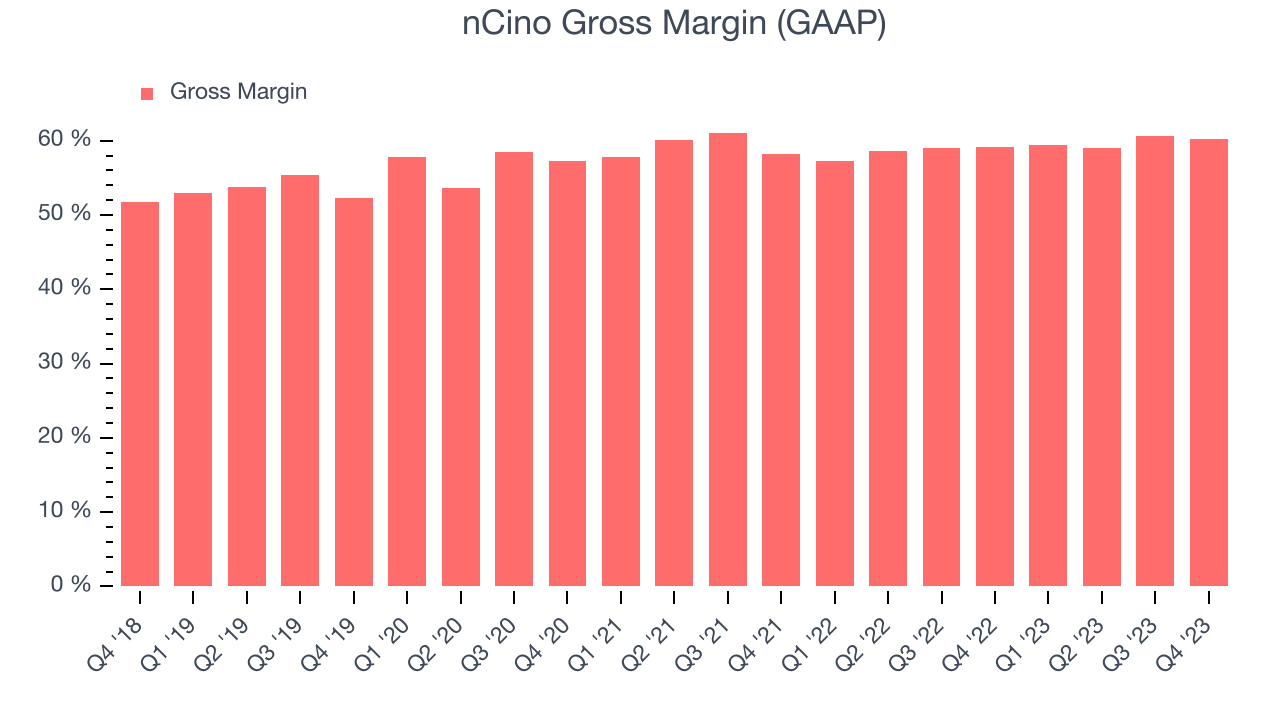

- Gross Margin (GAAP): 60.2%, up from 59.2% in the same quarter last year

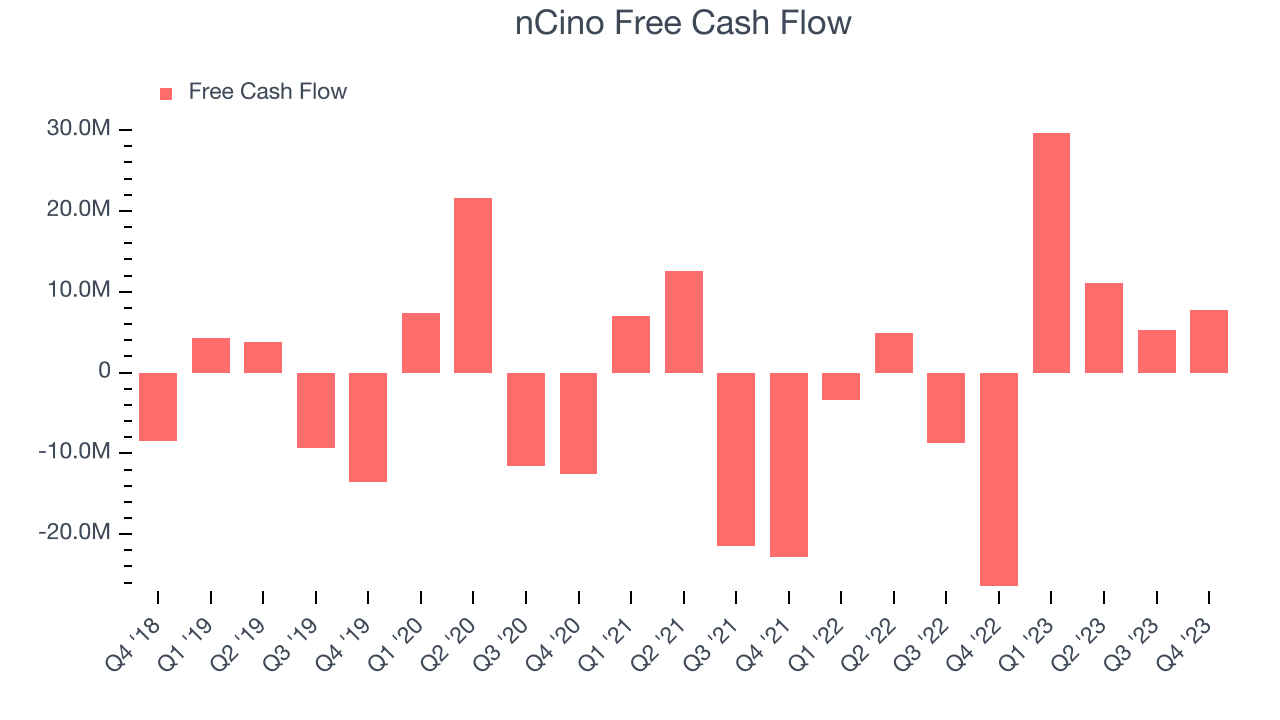

- Free Cash Flow of $7.72 million, up 46.9% from the previous quarter

- Market Capitalization: $3.44 billion

Founded in 2011 in North Carolina, nCino (NASDAQ:NCNO) makes cloud-based operating systems for banks and provides that software-as-a-service.

Banks are complex to run, heavily regulated and often lag far behind the curve in adopting cloud technologies, instead relying on decades old on-premise software. nCino offers cloud-based software that promises to replace the functionalities of the banks legacy systems, making it easier and cheaper to operate the bank. The company built its software on top of the Salesforce platform and as a result has a very close partnership with Salesforce (CRM).

nCino works as a central system for banks and credit unions allowing them to onboard new customers by offering them loans or checking and savings accounts, all online and in compliance with regulatory requirements. The platform becomes the single central location where all the data about customers and decisions are stored, which improves effectiveness of banking operations and allows banks to offer more personalised services to their clients.

Banking Software

Consumers these days are accustomed to frictionless digital experiences from online shopping to ordering food or hailing a cab. Financial services firms are notoriously risk averse in adopting modern software, often lacking the resources or competency to develop the digital solutions in-house. That drives demand for software as a service platforms that allows banks and other finance institutions to offer the digital services without having to run or maintain them.

Other players with solutions addressing nCino’s fintech niche include Oracle (NYSE:ORCL), Infosys (INFY), and Q2 Holdings (NYSE:QTWO).

Sales Growth

As you can see below, nCino's revenue growth has been very strong over the last three years, growing from $56.59 million in Q4 2021 to $123.7 million this quarter.

Even though nCino fell short of analysts' revenue estimates, its quarterly revenue growth was still up 13.3% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $1.75 million in Q4 compared to $4.71 million in Q3 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that nCino is expecting revenue to grow 11.3% year on year to $126.5 million, slowing down from the 20.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $541.5 million at the midpoint, growing 13.6% year on year compared to the 16.7% increase in FY2023.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. nCino's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 60.2% in Q4.

That means that for every $1 in revenue the company had $0.60 left to spend on developing new products, sales and marketing, and general administrative overhead. nCino's gross margin is poor for a SaaS business and we'd like to see it start improving.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. nCino's free cash flow came in at $7.72 million in Q4, turning positive over the last year.

nCino has generated $53.77 million in free cash flow over the last 12 months, or 11.3% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from nCino's Q4 Results

This was a decent quarter for nCino. Its revenue was in line with analysts' expectations, but its operating income, EPS, and free cash flow significantly beat, painting a picture of stronger profitability. The company's full-year 2024 guidance confirmed this, as its forecasted EPS blew past Wall Street's projections.

During the quarter, nCino's President and Chief Revenue Officer, Josh Glover, announced he would be stepping down to join another company. Furthermore, on March 18, 2024, nCino announced it would acquire DocFox, a solution provider automating onboarding experiences for commercial and business banking clients. The terms of the deal were not disclosed. DocFox was founded in 2016 and has over 450 global customers.

The stock is up 13% after reporting and currently trades at $34.1 per share.

Is Now The Time?

When considering an investment in nCino, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of nCino, we'll be cheering from the sidelines. Although its revenue growth has been strong over the last three years, Wall Street expects growth to deteriorate from here. On top of that, its gross margins show its business model is much less lucrative than the best software businesses.

Given its price-to-sales ratio of 6.4x based on the next 12 months, nCino is priced with expectations for long-term growth. While we have no doubt one can find things to like about the company, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $35.59 right before these results (compared to the current share price of $34.10).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.