Casual restaurant chain Noodles & Company (NASDAQ:NDLS) missed analysts' expectations in Q4 FY2023, with revenue down 8.9% year on year to $124.3 million. The company's full-year revenue guidance of $517.5 million at the midpoint also came in 2.6% below analysts' estimates. It made a non-GAAP loss of $0.07 per share, down from its profit of $0.03 per share in the same quarter last year.

Noodles (NDLS) Q4 FY2023 Highlights:

- Revenue: $124.3 million vs analyst estimates of $125.3 million (0.8% miss)

- EPS (non-GAAP): -$0.07 vs analyst estimates of -$0.01 (-$0.06 miss)

- Management's revenue guidance for the upcoming financial year 2024 is $517.5 million at the midpoint, missing analyst estimates by 2.6% and implying 2.8% growth (vs -0.6% in FY2023)

- Gross Margin (GAAP): 16.4%, down from 17% in the same quarter last year

- Same-Store Sales were down 4.2% year on year

- Store Locations: 470 at quarter end, increasing by 9 over the last 12 months

- Market Capitalization: $112.8 million

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ:NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

The company was founded in 1995 by Aaron Kennedy in Denver, Colorado and birthed from the simple idea that according to the company, “people love noodles”. The cornerstone of the Noodles & Company offering is not just noodles but fresh, made-to-order dishes.

As mentioned, the menu features noodles from all over the world from Japanese pan noodles to stuffed pastas. In addition to standard menu items, customers can also create their own concoctions by picking noodle types, sauces, and add-ons. Finally, Noodles & Company aims to stay attuned to evolving dietary preferences and offers numerous gluten-free, vegetarian, and low-calorie options.

The core Noodles & Company customer is diverse. Maybe it’s a college student looking for a quick bite or a businessperson seeking a convenient but comforting lunch. Families are also a target customer because everyone can find or create something they like, including kids who can select from the children’s menu. Inside Noodles & Company locations, you’ll find an inviting atmosphere with tables and booths surrounded by neutral colors. However, many customers choose to take out.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Competitors offering convenient and casual dining options include Potbelly (NASDAQ:PBPB), Chipotle (NYSE:CMG), Sweetgreen (NYSE:SG), and Shake Shack (NYSE:SHAK).Sales Growth

Noodles is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

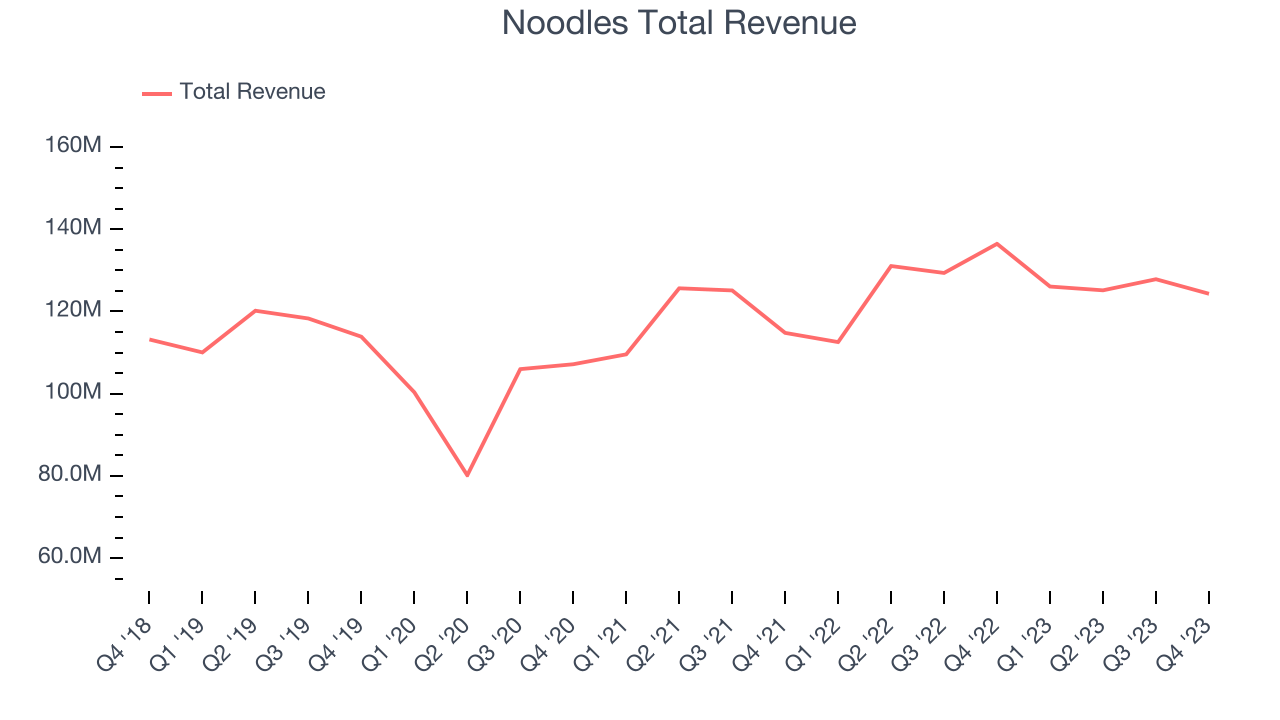

As you can see below, the company's annualized revenue growth rate of 2.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Noodles missed Wall Street's estimates and reported a rather uninspiring 8.9% year-on-year revenue decline, generating $124.3 million in revenue. Looking ahead, Wall Street expects sales to grow 5.4% over the next 12 months, an acceleration from this quarter.

Number of Stores

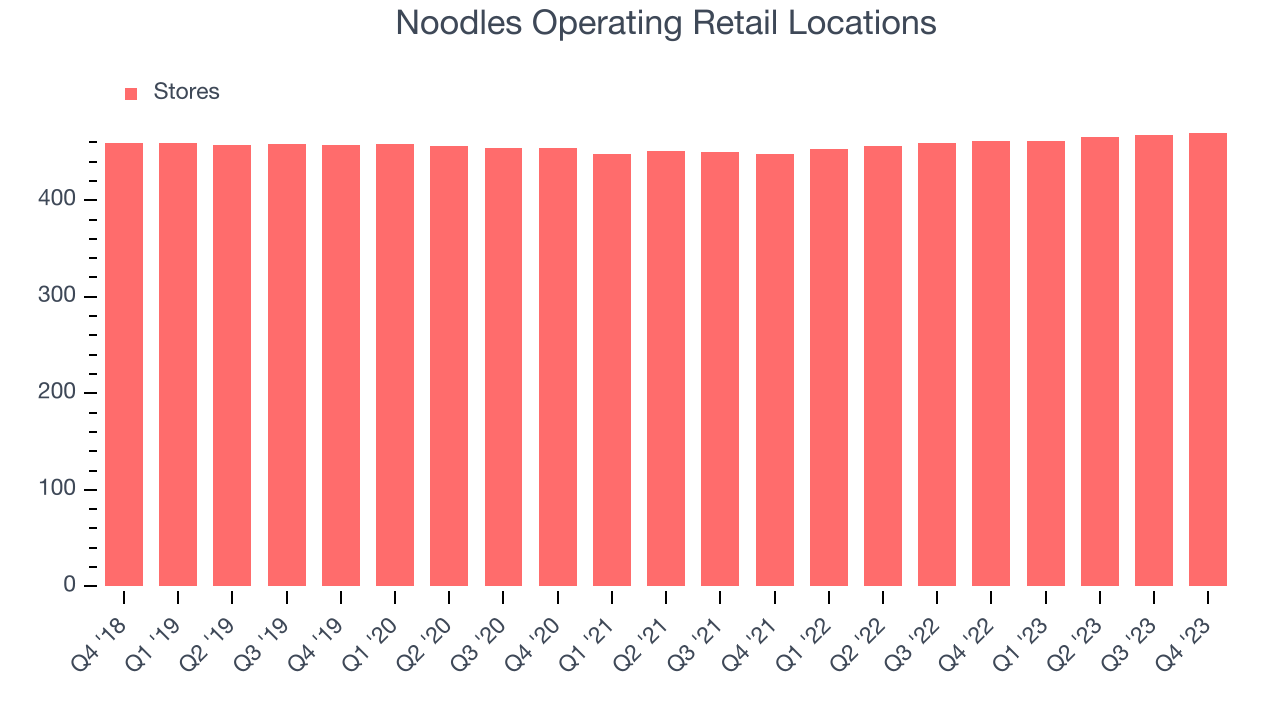

The number of dining locations a restaurant chain operates is a major determinant of how much it can sell and how quickly company-level sales can grow.

When a chain like Noodles is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Noodles's restaurant count increased by 9, or 2%, to 470 locations in the most recently reported quarter.

Taking a step back, Noodles has generally opened new restaurants over the last eight quarters, averaging 1.8% annual increases in new locations. This growth is decent compared to other restaurant businesses but should be taken lightly as the industry is quite mature. Analyzing a restaurant's location growth is important because expansion means Noodles has more opportunities to feed customers and generate sales.

Same-Store Sales

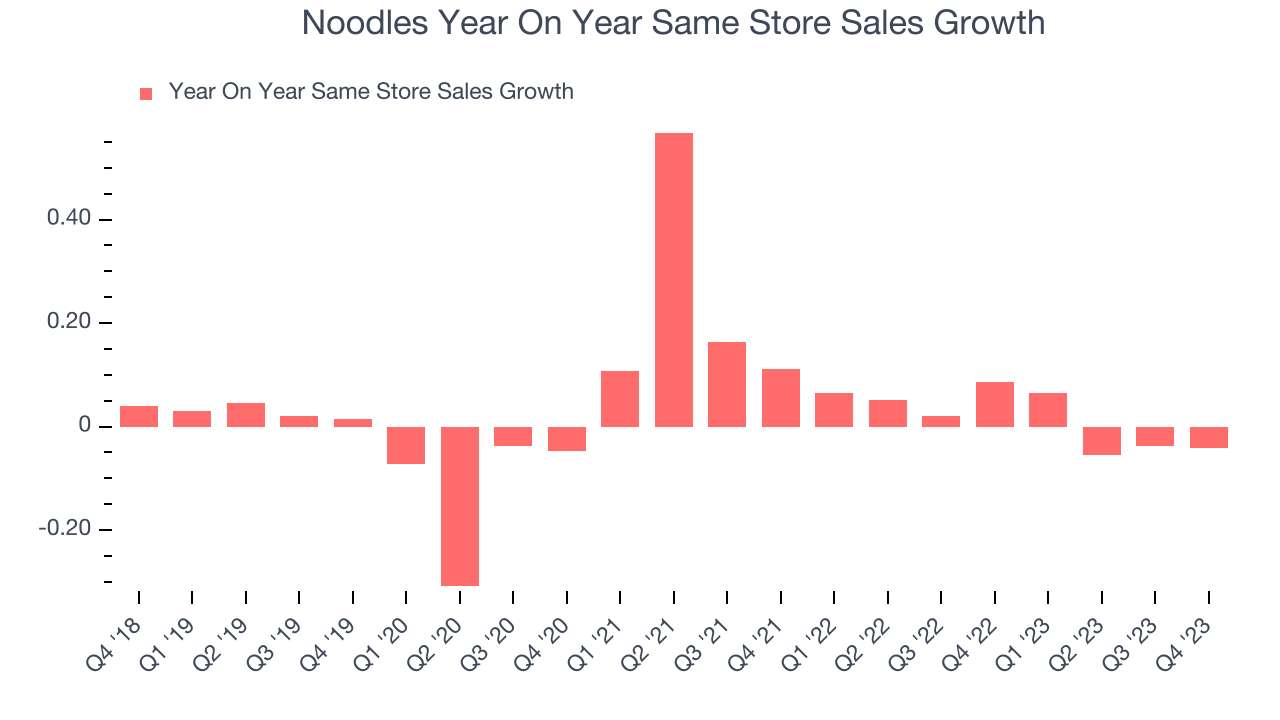

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Noodles's demand within its existing restaurants has been relatively stable over the last eight quarters but fallen behind the broader sector. On average, the company's same-store sales have grown by 1.9% year on year. With positive same-store sales growth amid an increasing number of restaurants, Noodles is reaching more diners and growing sales.

In the latest quarter, Noodles's same-store sales fell 4.2% year on year. This decline was a reversal from the 8.7% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Gross Margin & Pricing Power

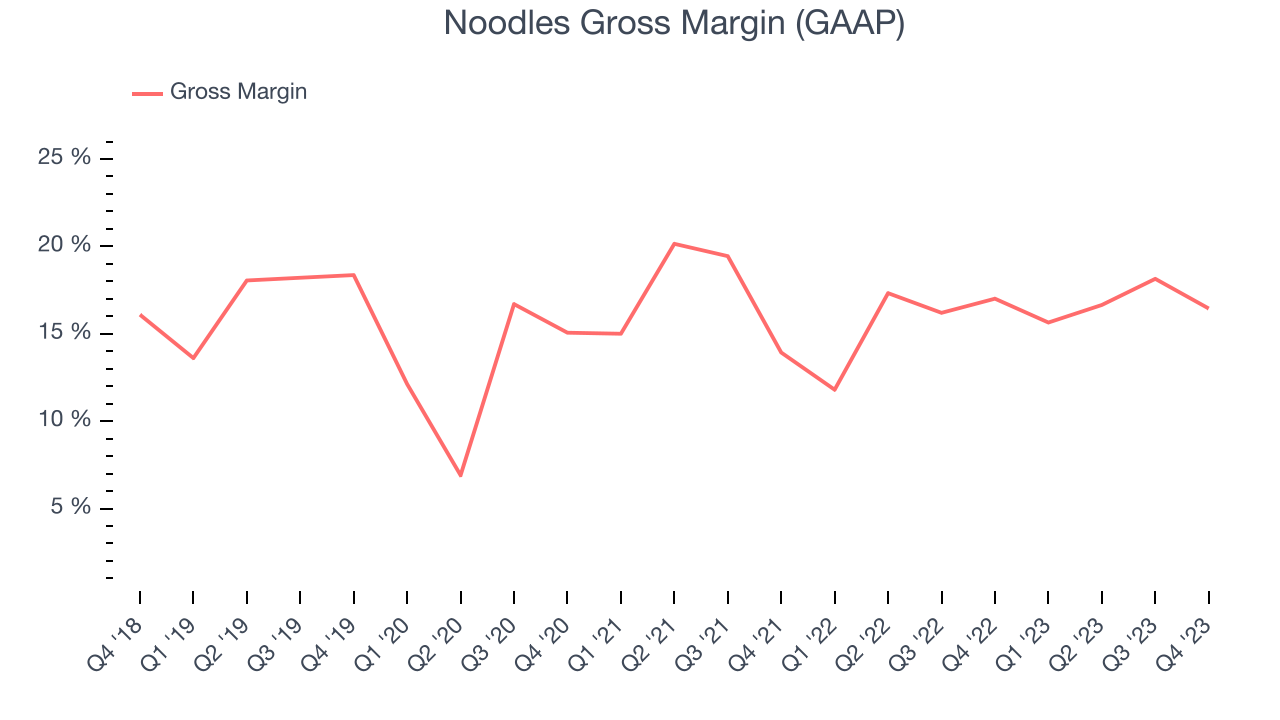

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Noodles's gross profit margin came in at 16.4% this quarter. in line with the same quarter last year. This means the company makes $0.16 for every $1 in revenue before accounting for its operating expenses.

Noodles has poor unit economics for a restaurant company, leaving it with little room for error if things go awry. As you can see above, it's averaged a 16.2% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 9.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

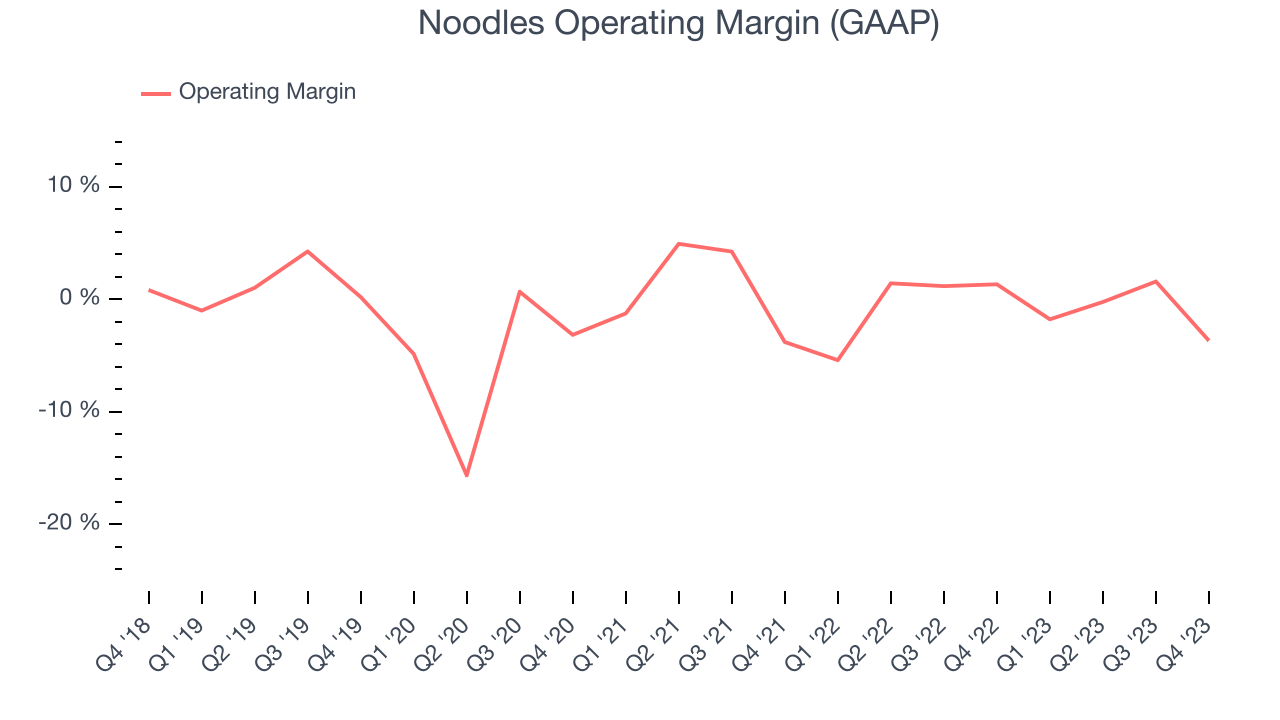

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Noodles generated an operating profit margin of negative 3.7%, down 5 percentage points year on year. Because Noodles's operating margin decreased more than its gross margin, we can infer the company was less efficient with its expenses or had lower leverage on its fixed costs.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. Unfortunately, Noodles has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 0.6%. On top of that, Noodles's margin has remained more or less the same, showing the company needs to change something about its operating practices.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. Unfortunately, Noodles has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 0.6%. On top of that, Noodles's margin has remained more or less the same, showing the company needs to change something about its operating practices.EPS

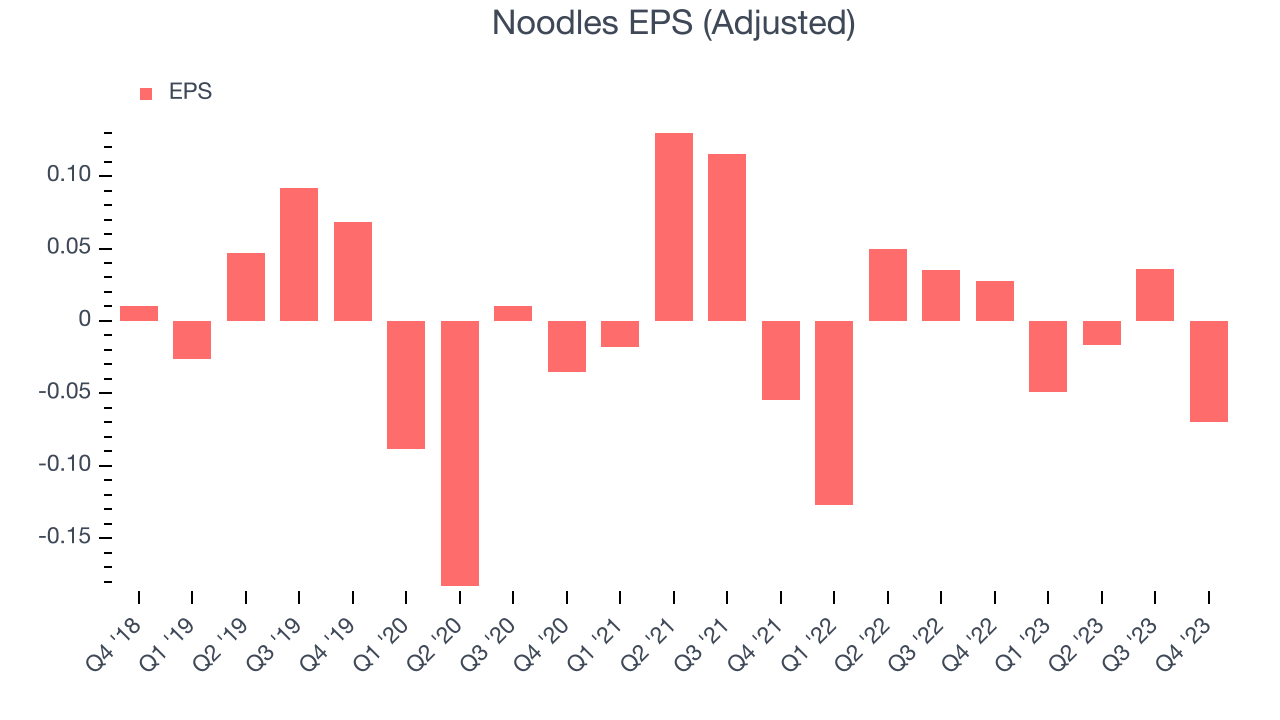

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Noodles reported EPS at negative $0.07, down from $0.03 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, Noodles's adjusted diluted EPS dropped 70.7%, translating into 26.4% annualized declines. We tend to steer our readers away from companies with falling EPS, especially restaurants, which are arguably some of the hardest businesses to manage because of constantly changing consumer tastes, input costs, and labor dynamics. If there's no earnings growth, it's difficult to build confidence in a company's underlying fundamentals, leaving a low margin of safety around its valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 40% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Noodles's five-year average ROIC was negative 6.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Noodles's ROIC averaged 6.6 percentage point increases each year. This is a good sign and we hope the company can continue to improving.

Key Takeaways from Noodles's Q4 Results

We enjoyed seeing Noodles exceed analysts' gross margin expectations this quarter. On the other hand, its revenue and EPS fell short thanks to worse-than-expected same-store sales performance (4.2% system-wide declines compared to estimates of 3.9%). Furthermore, its full-year revenue guidance fell short as the company expects to build fewer new restaurants than Wall Street had forecasted. Overall, this was a bad quarter for Noodles. The company is down 5.5% on the results and currently trades at $2.32 per share.

Is Now The Time?

Noodles may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Noodles, we'll be cheering from the sidelines. Its revenue growth has been weak over the last four years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last four years makes it hard to trust. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

While we've no doubt one can find things to like about Noodles, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.83 per share right before these results (compared to the current share price of $2.32).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.