Streaming video giant Netflix (NASDAQ: NFLX) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 12.5% year on year to $8.83 billion. It made a GAAP profit of $2.11 per share, improving from its profit of $0.53 per share in the same quarter last year.

Is now the time to buy Netflix? Find out by accessing our full research report, it's free.

Netflix (NFLX) Q4 FY2023 Highlights:

- Market Capitalization: $212.6 billion

- Revenue: $8.83 billion vs analyst estimates of $8.71 billion (1.4% beat)

- EPS: $2.11 vs analyst expectations of $2.22 (4.8% miss)

- Q1'24 EPS guidance: $4.49 per share (above expectations of $4.14)

- Free Cash Flow of $1.58 billion, down 16.3% from the previous quarter

- Gross Margin (GAAP): 39.9%, up from 31.2% in the same quarter last year

- Global Streaming Paid Memberships: 260.3 million, up 13.1 million quarter on quarter (beat vs. expectations of 8.8 million net adds; every geography beat)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

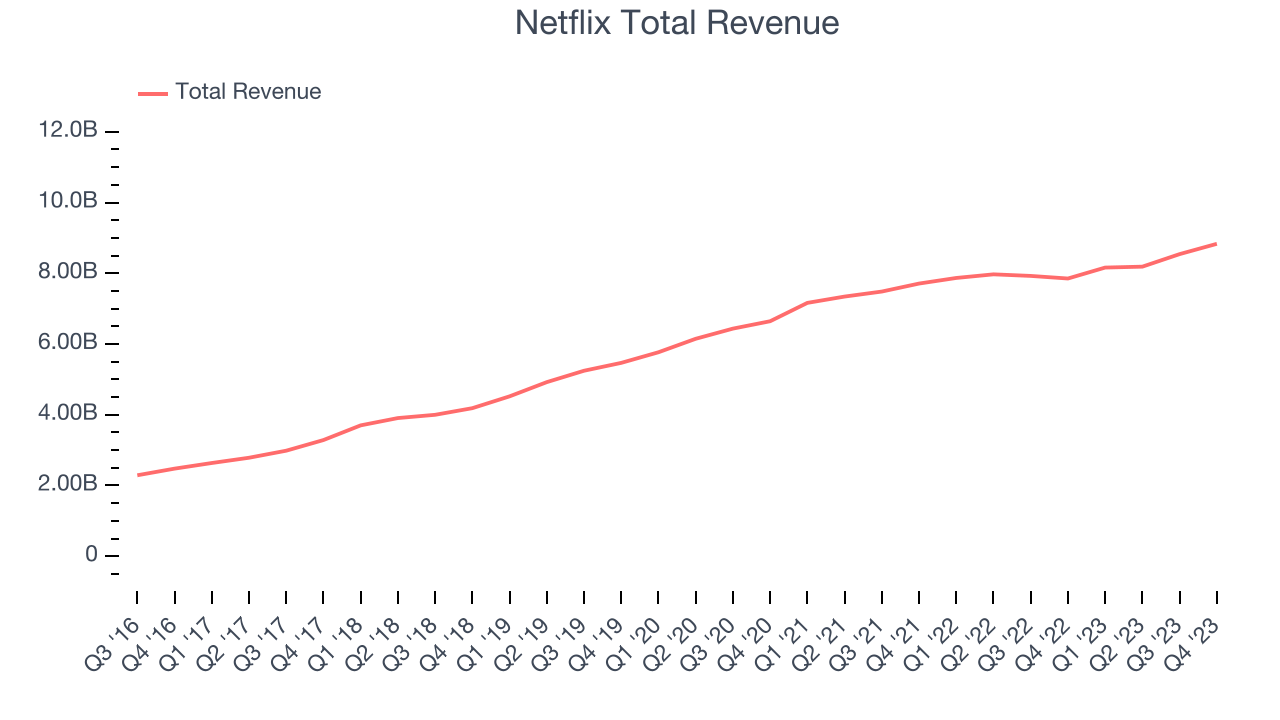

Sales Growth

Netflix's revenue growth over the last three years has been unremarkable, averaging 10.7% annually. This quarter, Netflix beat analysts' estimates but reported mediocre 12.5% year-on-year revenue growth.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

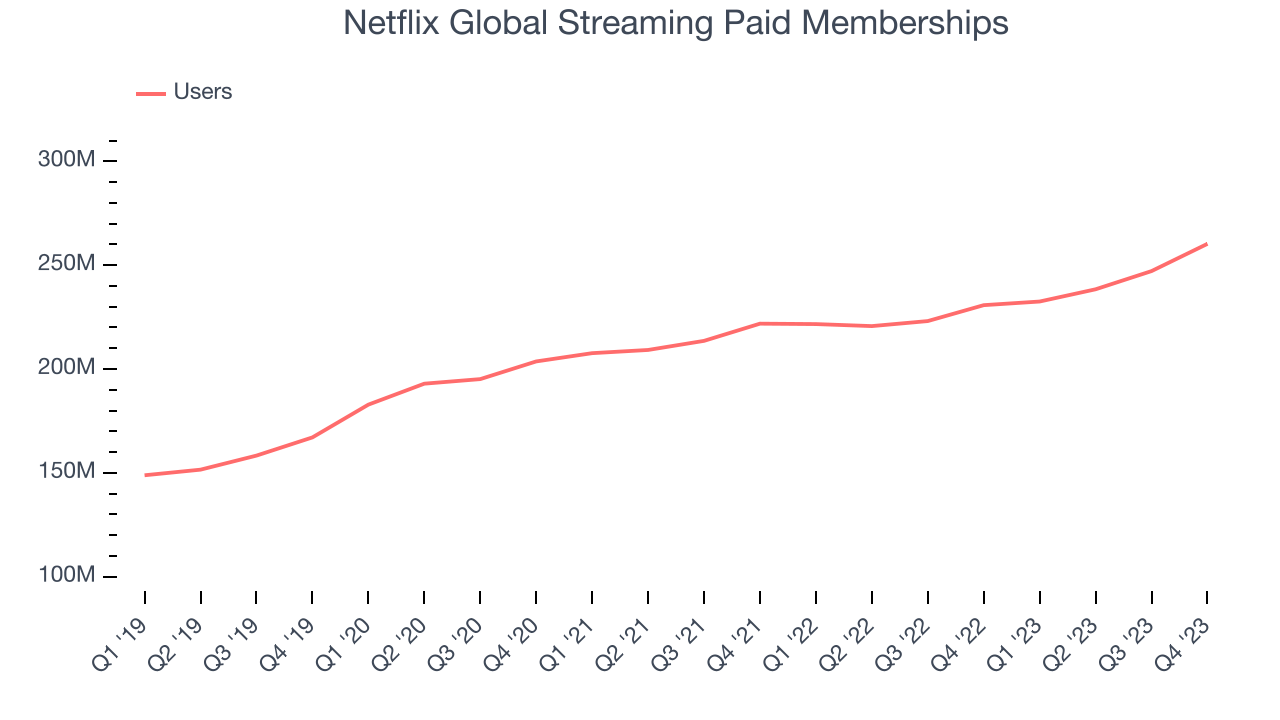

Usage Growth

As a subscription-based app, Netflix generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Netflix's users, a key performance metric for the company, grew 7.2% annually to 260.3 million. This is average growth for a consumer internet company.

In Q4, Netflix added 29.53 million users, translating into 12.8% year-on-year growth.

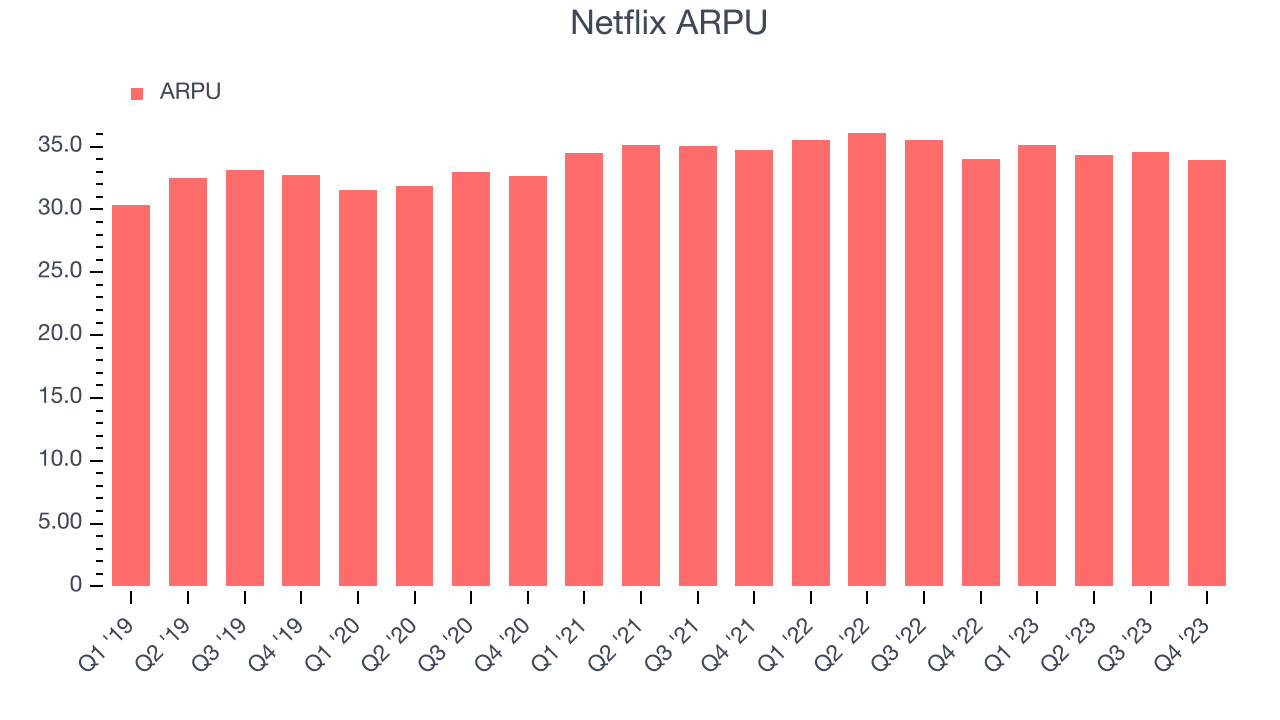

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Netflix because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Netflix's ARPU has declined over the last two years, averaging 0.5%. Although the company's users have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPU declined 0.3% year on year to $33.94 per user.

Key Takeaways from Netflix's Q4 Results

It was great to see Netflix's strong user growth this quarter. The 13.1 million net adds from last quarter were well above expectations of 8.8 million. ARPU also outperformed slightly in every geography except Asia-Pacific. These dynamics led to a revenue beat. Looking ahead, the company called for 16% revenue growth year on year when excluding the impacts of foreign exchange, which was robust. The company also upped its full year operating margin guidance and gave EPS guidance above expectations. Finally, the company struck a bullish tone when speaking about bigger picture competition, saying that industry consolidating is expected but that its opportunity remains vast. Zooming out, we think this was still a solid quarter, showing that the company is exceeding expectations. The stock is up 4.4% after reporting and currently trades at $512.7 per share.

So should you invest in Netflix right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.