Wrapping up Q2 earnings, we look at the numbers and key takeaways for the consumer subscription stocks, including Netflix (NASDAQ:NFLX) and its peers.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 2.9% below.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Thankfully, consumer subscription stocks have been resilient with share prices up 6.4% on average since the latest earnings results.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

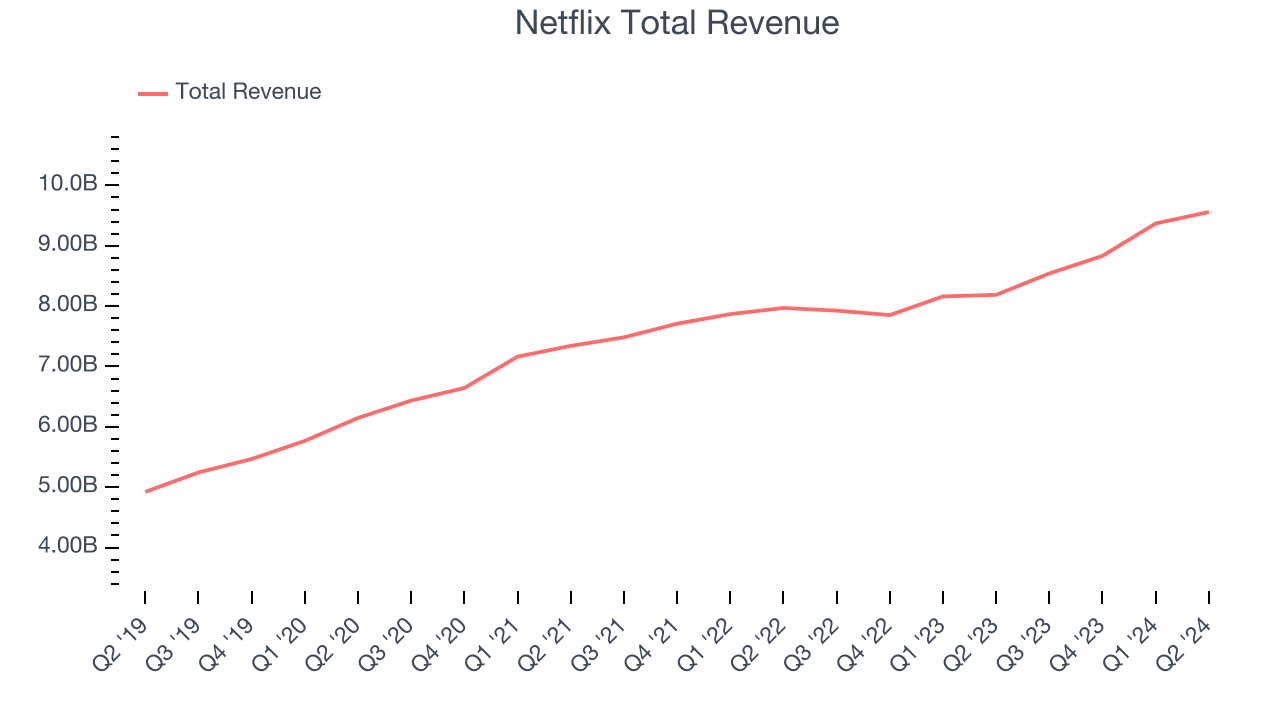

Netflix reported revenues of $9.56 billion, up 16.8% year on year. This print was in line with analysts’ expectations, but overall, it was a weaker quarter for the company with underwhelming revenue guidance for the next quarter and slow revenue growth.

Interestingly, the stock is up 10.1% since reporting and currently trades at $707.80.

Read our full report on Netflix here, it’s free.

Best Q2: Duolingo (NASDAQ:DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

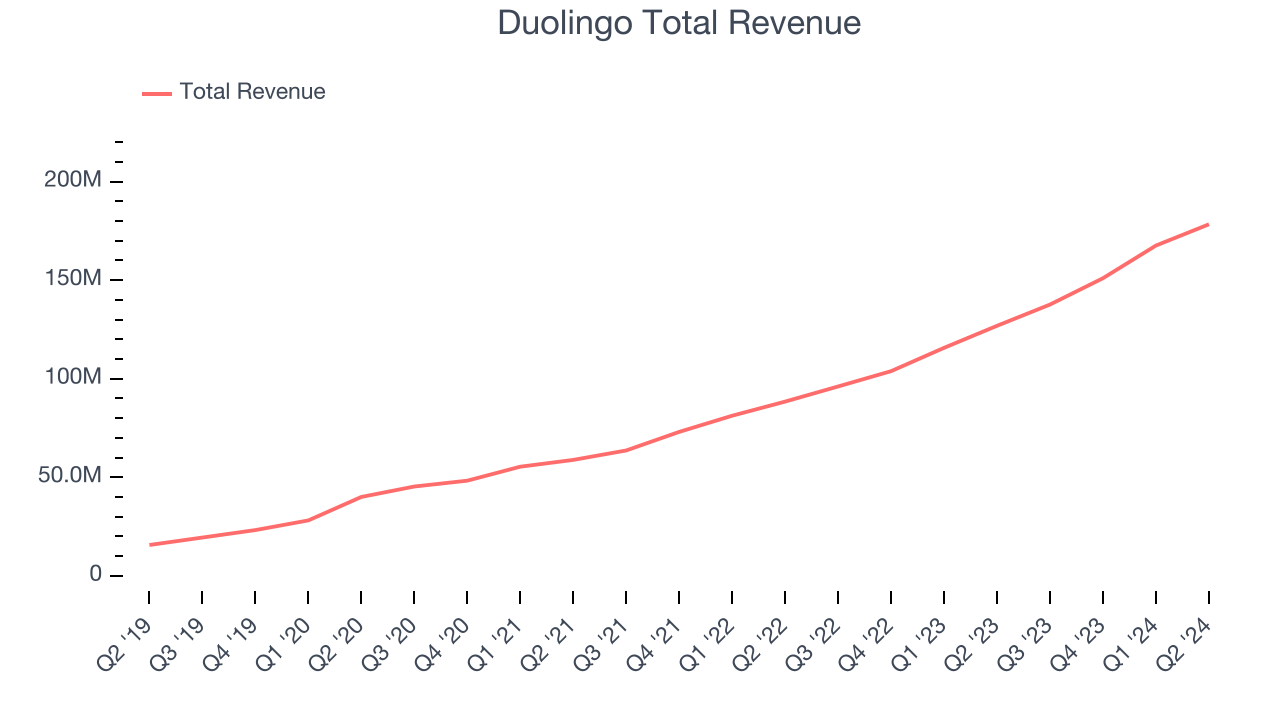

Duolingo reported revenues of $178.3 million, up 40.6% year on year, in line with analysts’ expectations. The business had a strong quarter with impressive growth in its users and exceptional revenue growth.

Duolingo scored the fastest revenue growth and highest full-year guidance raise among its peers. The company reported 103.6 million users, up 39.8% year on year. The market seems happy with the results as the stock is up 75.5% since reporting. It currently trades at $284.01.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Chegg (NYSE:CHGG)

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $163.1 million, down 10.8% year on year, exceeding analysts’ expectations by 2%. Still, it was a softer quarter as it posted a decline in its users and slow revenue growth.

Chegg delivered the slowest revenue growth in the group. The company reported 4.37 million users, down 9.1% year on year. As expected, the stock is down 42.5% since the results and currently trades at $1.69.

Read our full analysis of Chegg’s results here.

Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $968.2 million, up 14.3% year on year. This result topped analysts’ expectations by 3.2%. More broadly, it was a satisfactory quarter as it also produced solid growth in its users but slow revenue growth.

The company reported 83.6 million monthly active users, up 13.7% year on year. The stock is up 32.6% since reporting and currently trades at $73.31.

Read our full, actionable report on Roku here, it’s free.

Coursera (NYSE:COUR)

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $170.3 million, up 10.8% year on year. This print topped analysts’ expectations by 3.5%. Aside from that, it was a mixed quarter as it also recorded strong growth in its users but slow revenue growth.

Coursera pulled off the biggest analyst estimates beat among its peers. The company reported 155 million users, up 20.2% year on year. The stock is up 3% since reporting and currently trades at $7.62.

Read our full, actionable report on Coursera here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.