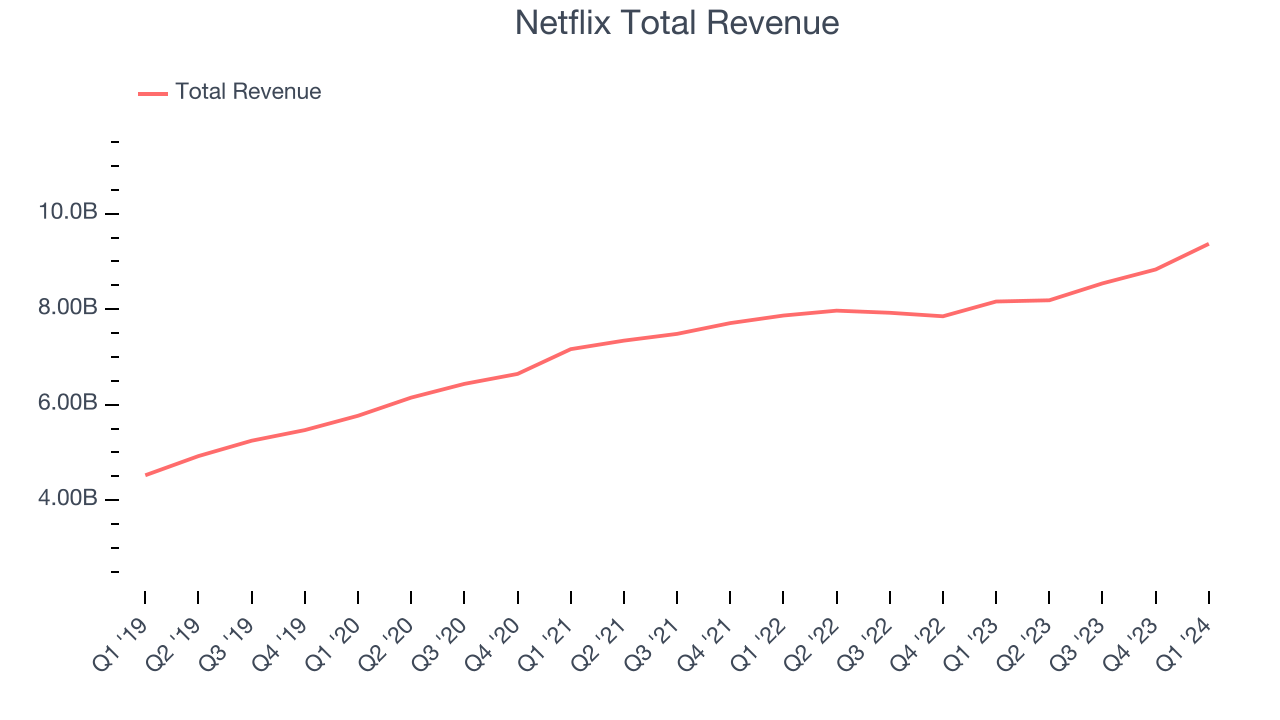

Streaming video giant Netflix (NASDAQ: NFLX) reported Q1 CY2024 results topping analysts' expectations, with revenue up 14.8% year on year to $9.37 billion. The company expects next quarter's revenue to be around $9.49 billion, in line with analysts' estimates. It made a GAAP profit of $5.28 per share, improving from its profit of $2.88 per share in the same quarter last year.

Netflix (NFLX) Q1 CY2024 Highlights:

- Revenue: $9.37 billion vs analyst estimates of $9.28 billion (1% beat)

- EPS: $5.28 vs analyst estimates of $4.53 (16.7% beat)

- Revenue Guidance for Q2 CY2024 is $9.49 billion at the midpoint, roughly in line with what analysts were expecting

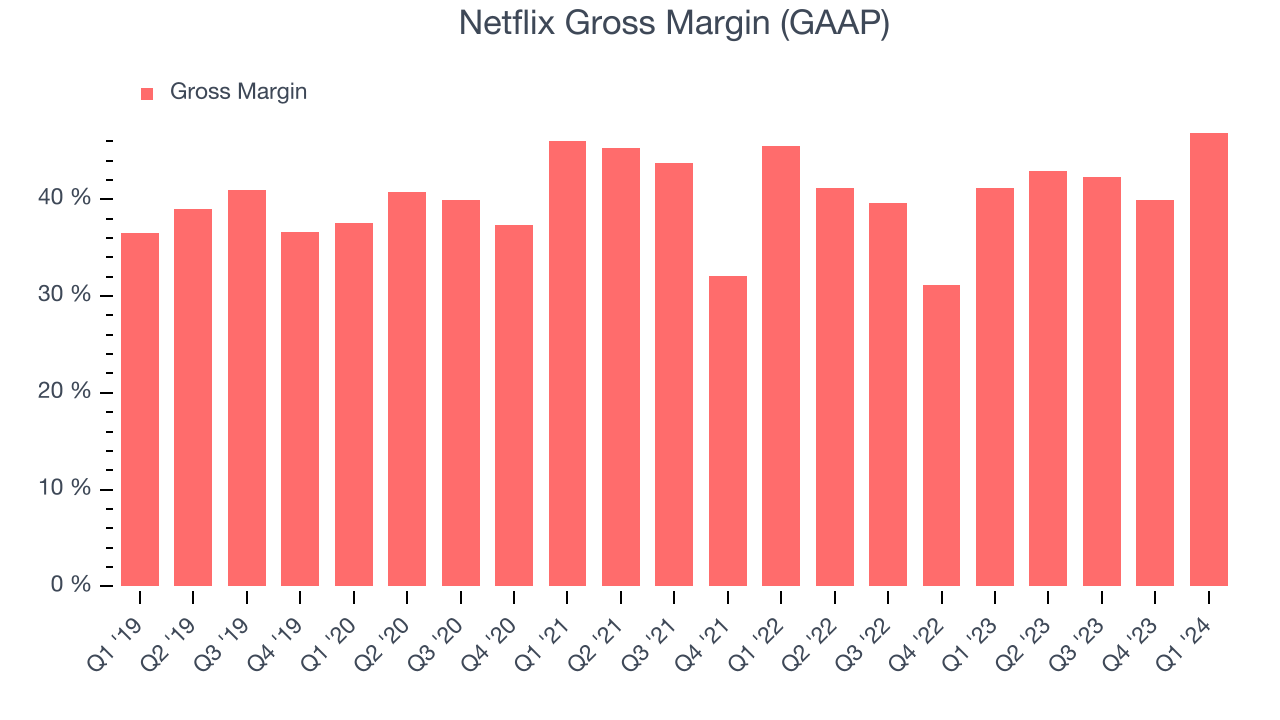

- Gross Margin (GAAP): 46.9%, up from 41.1% in the same quarter last year

- Free Cash Flow of $2.14 billion, up 35.1% from the previous quarter

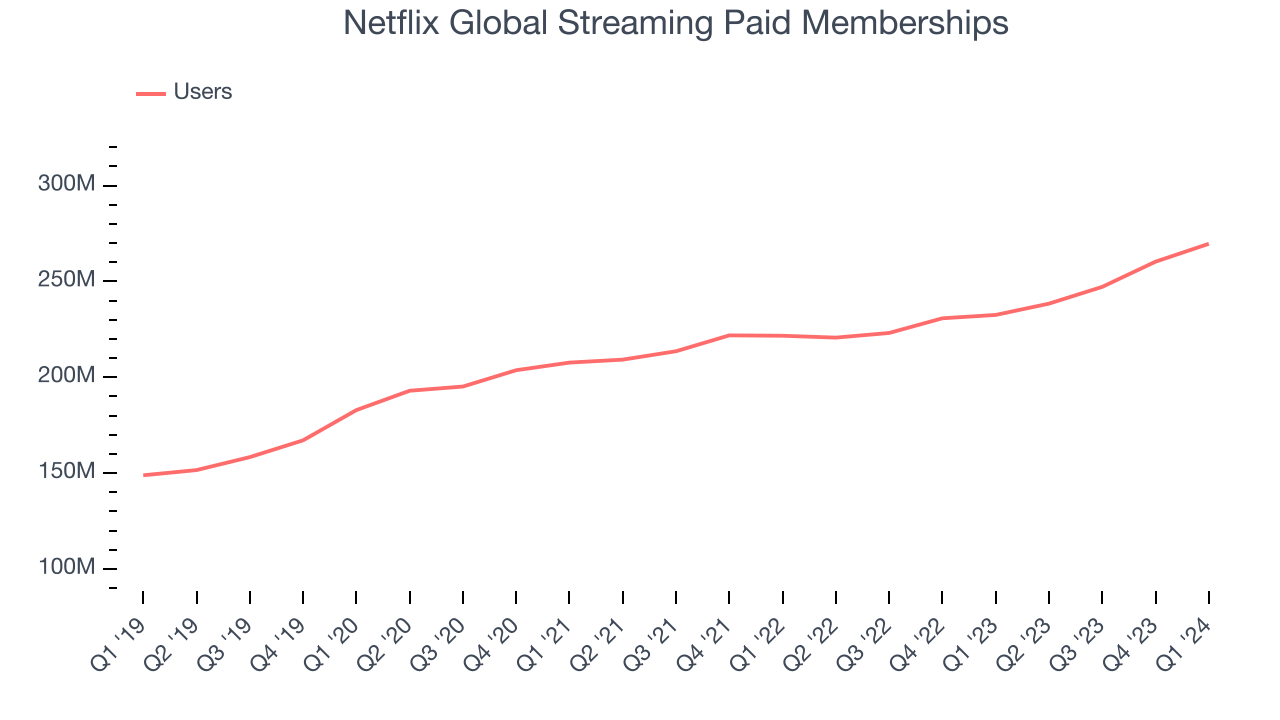

- Global Streaming Paid Memberships: 269.6 million, up 37.1 million year on year

- Market Capitalization: $265.6 billion

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix has a large and ever growing library of TV shows, movies, documentaries, and children’s programming. The company is known for its innovative approach to content delivery. For its first 10 years, that meant DVD rentals by mail with no return date. It launched streaming in 2007, which used customer data to surface programming that users might be interested in.

In 2013, the company began producing its own programming, weaning itself off of relying entirely on other company’s content. Hit shows such as "Stranger Things" and "The Crown" drew in audiences and kept them loyal to the platform. Today, Netflix generates revenue through its subscription-based model as well as an ad-supported one, with different plans at various price points.

For consumers, Netflix upended the traditional model of consuming content, flipping the paradigm from “appointment viewing” to a more customer centric “on demand viewing” Netflix’s granular viewing data also fundamentally altered what type of content was produced, stratifying what was once a handful of genres into dozens of niches that are able to find audiences in a sea of viewers. These innovations have been mimicked by many streaming services, and have become a quasi-standard of content consumption today.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Netflix (NASDAQ:NFLX) competes with a range of streaming content rivals, from Amazon (NASDAQ: AMZN) and Disney (NYSE:DIS) to Paramount (NASDAQ:PARA) and Warner Bros Discovery (NASDAQ:WBD).

Sales Growth

Netflix's revenue growth over the last three years has been unremarkable, averaging 10% annually. This quarter, Netflix reported mediocre 14.8% year-on-year revenue growth, in line with analysts' expectations.

Guidance for the next quarter indicates Netflix is expecting revenue to grow 15.9% year on year to $9.49 billion, improving from the 2.7% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 14.1% over the next 12 months.

Usage Growth

As a subscription-based app, Netflix generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Netflix's users, a key performance metric for the company, grew 8.3% annually to 269.6 million. This is decent growth for a consumer internet company.

In Q1, Netflix added 37.1 million users, translating into 16% year-on-year growth.

Revenue Per User

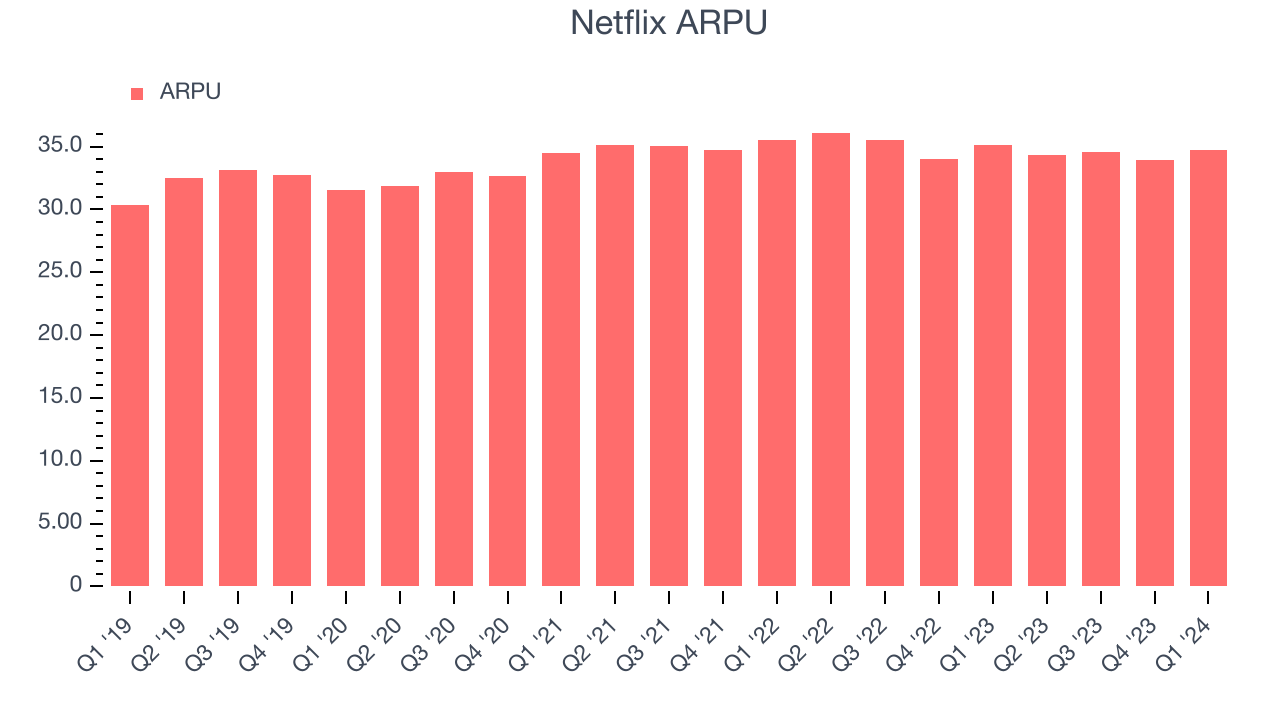

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Netflix because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Netflix's ARPU has declined over the last two years, averaging 1%. Although the company's users have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPU declined 1% year on year to $34.76 per user.

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Netflix's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 46.9% this quarter, up 5.7 percentage points year on year.

For internet subscription businesses like Netflix, these aforementioned costs typically include customer service, data center and infrastructure expenses, and royalties and other content-related costs if the company's offering includes features such as video or music services. After paying for these expenses, Netflix had $0.47 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Netflix's gross margins have been trending up over the last 12 months, averaging 43.1%. This is a welcome development, as Netflix's margins are below the industry average, and rising margins could suggest improved demand and pricing power.

User Acquisition Efficiency

Consumer internet businesses like Netflix grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Netflix is extremely efficient at acquiring new users, spending only 18.6% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving Netflix the freedom to invest its resources into new growth initiatives while maintaining optionality.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Key Takeaways from Netflix's Q1 Results

This was a great quarter as Netflix beat analysts' estimates for nearly every metric we track: paid subscribers, revenue, operating income, EPS, and free cash flow. We were also glad it raised its operating profitability expectations as this quarter's margin expanded seven percentage points year on year, reaching 28%. The company's revenue outlook was in line with Wall Street's forecast.

A key thing to watch for Netflix in the coming quarters is its new ad-supported membership tier, where ad-supported members grew 65% from Q4 2023. Furthermore, over 40% of new signups came from this plan. This performance is certainly evidence its strategy is working.

Overall, this was a good quarter for Netflix. However, the market was likely pricing in loftier revenue numbers, and the stock is down 3.4% on the results. It currently trades at $589.76 per share.

Is Now The Time?

When considering an investment in Netflix, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that Netflix isn't a bad business. Although its revenue growth has been a little slower over the last three years, its growth over the next 12 months is expected to be higher. And while its ARPU has declined over the last two years, its user acquisition efficiency is best in class.

At the moment, Netflix trades at 25.6x next 12 months EV-to-EBITDA. We don't really see a big opportunity in the stock right now, but in the end, beauty is in the eye of the beholder. If you like the company, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $627.52 per share right before these results (compared to the current share price of $589.76).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.