Newmark’s 31.9% return over the past six months has outpaced the S&P 500 by 24.2%, and its stock price has climbed to $13.20 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Newmark, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Newmark. Here are three reasons why you should be careful with NMRK and a stock we'd rather own.

Why Do We Think Newmark Will Underperform?

Founded in 1929, Newmark (NASDAQ:NMRK) provides commercial real estate services, including leasing advisory, global corporate services, investment sales and capital markets, property and facilities management, valuation and advisory, and consulting.

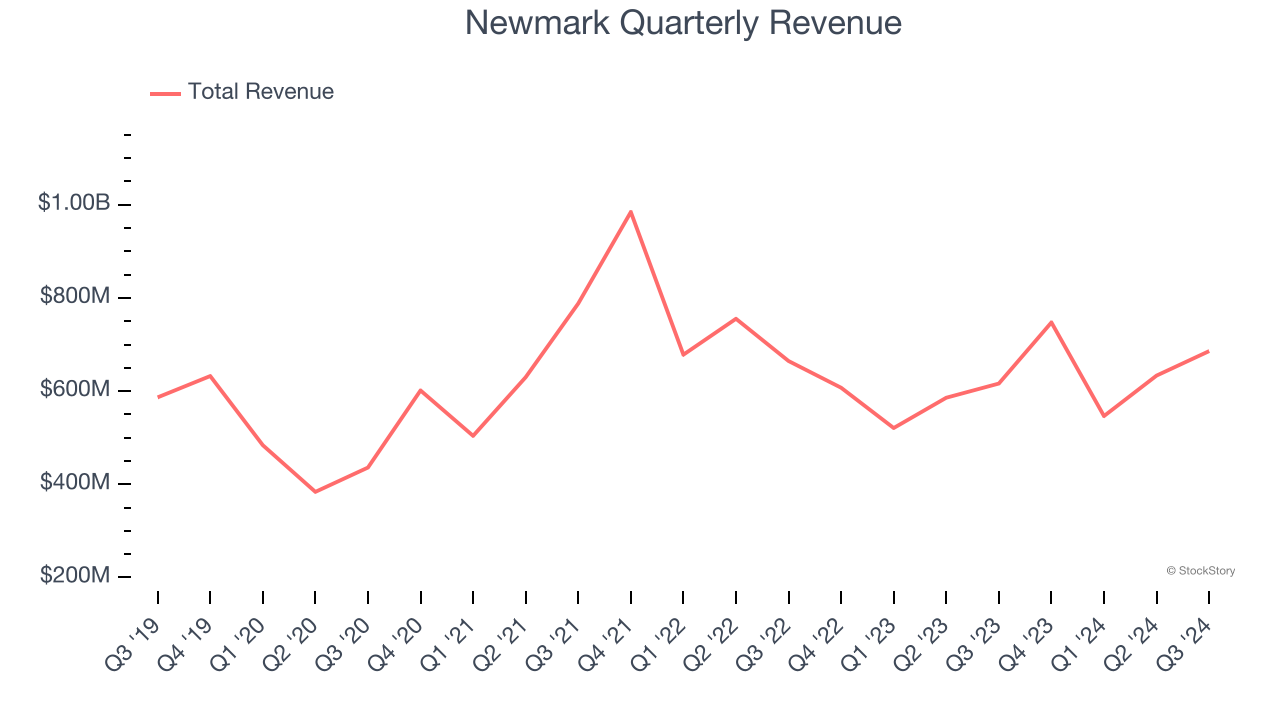

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Newmark grew its sales at a sluggish 3.3% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

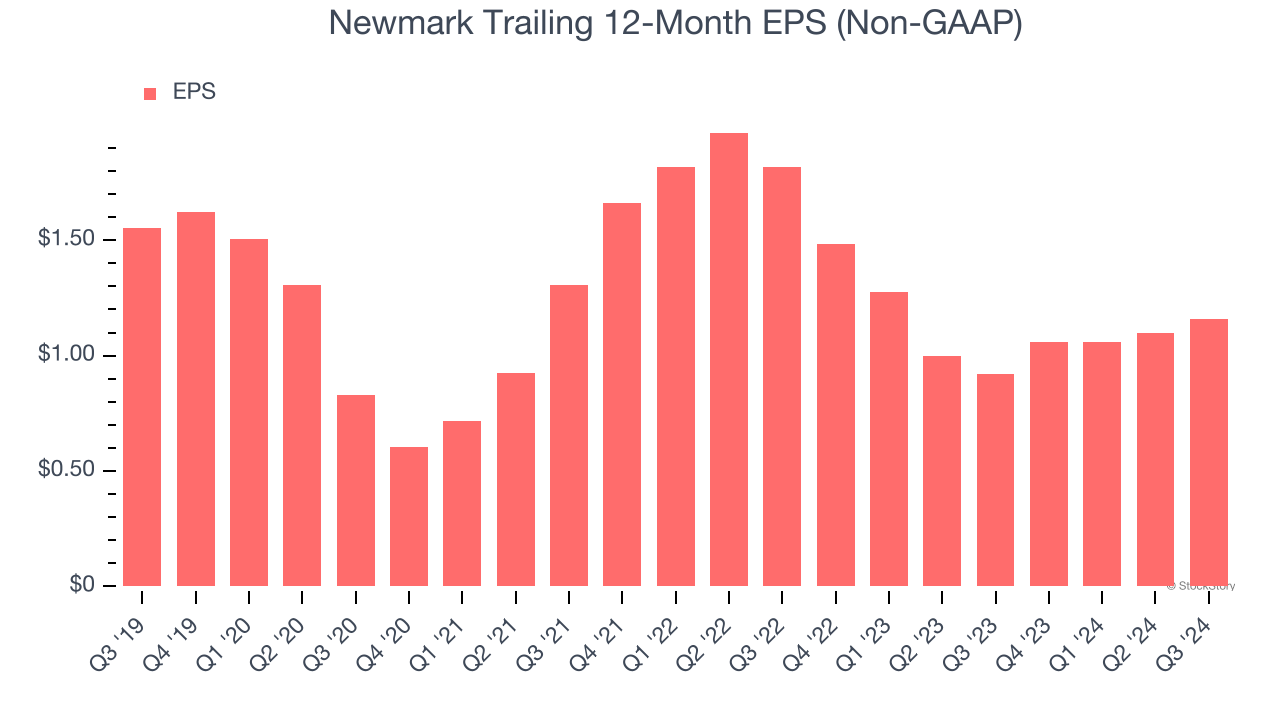

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Newmark, its EPS declined by 5.7% annually over the last five years while its revenue grew by 3.3%. This tells us the company became less profitable on a per-share basis as it expanded.

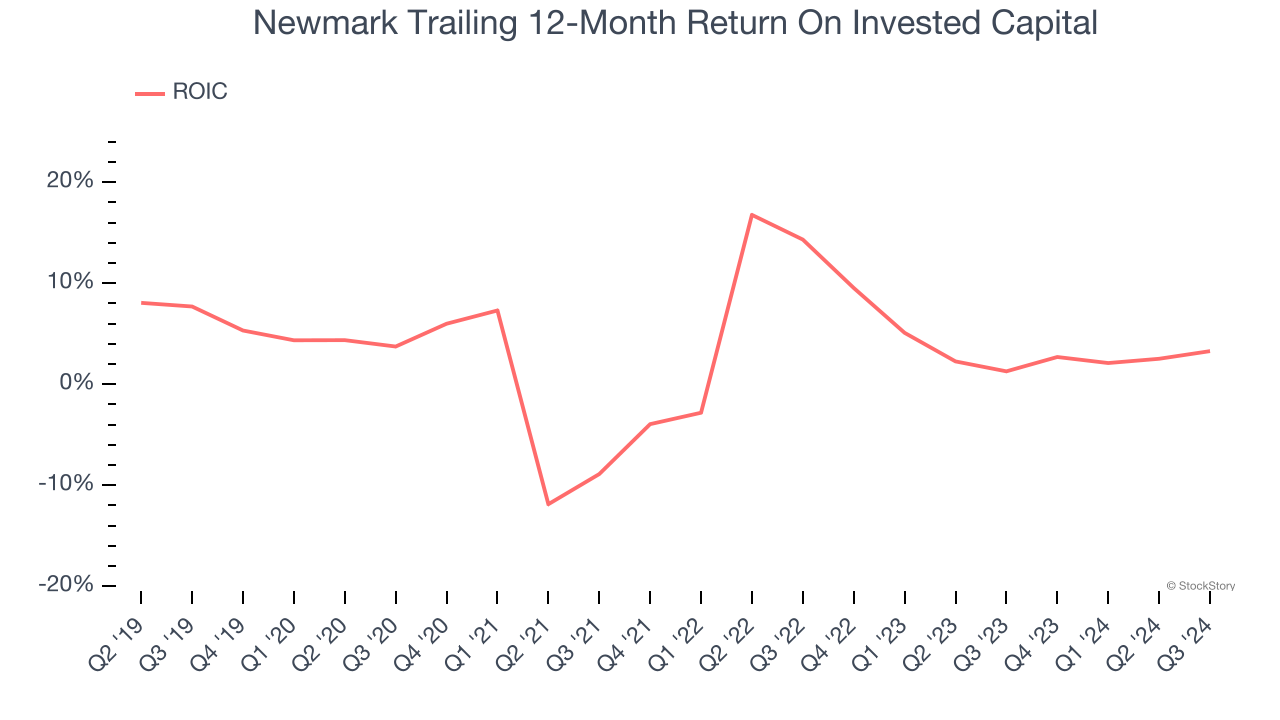

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Newmark historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.7%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

Newmark doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 10.1× forward price-to-earnings (or $13.20 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. We’d recommend looking at Wingstop, a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Newmark

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.