As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at engineered components and systems stocks, starting with NN (NASDAQ:NNBR).

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a satisfactory Q2. As a group, revenues missed analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.9% below.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Luckily, engineered components and systems stocks have performed well with share prices up 10.2% on average since the latest earnings results.

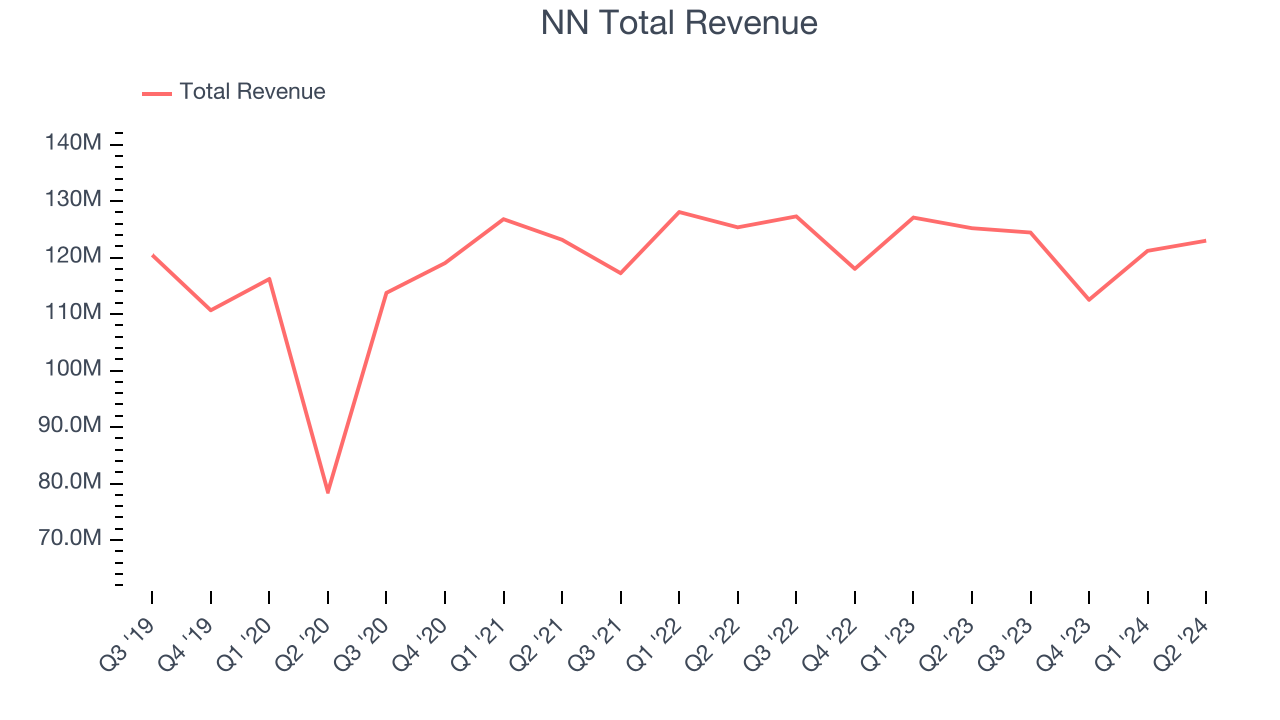

NN (NASDAQ:NNBR)

Formerly known as Nuturn, NN (NASDAQ:NNBR) provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

NN reported revenues of $123 million, down 1.8% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with an impressive beat of analysts’ earnings estimates.

“NN delivered another quarter of improvement, driven by the execution of our strategic transformation plan which is yielding observable momentum across key focus areas of profitability enhancement, operational performance, and accelerated new business wins,” said Harold Bevis, President and Chief Executive Officer.

Interestingly, the stock is up 27.4% since reporting and currently trades at $4.23.

Is now the time to buy NN? Access our full analysis of the earnings results here, it’s free.

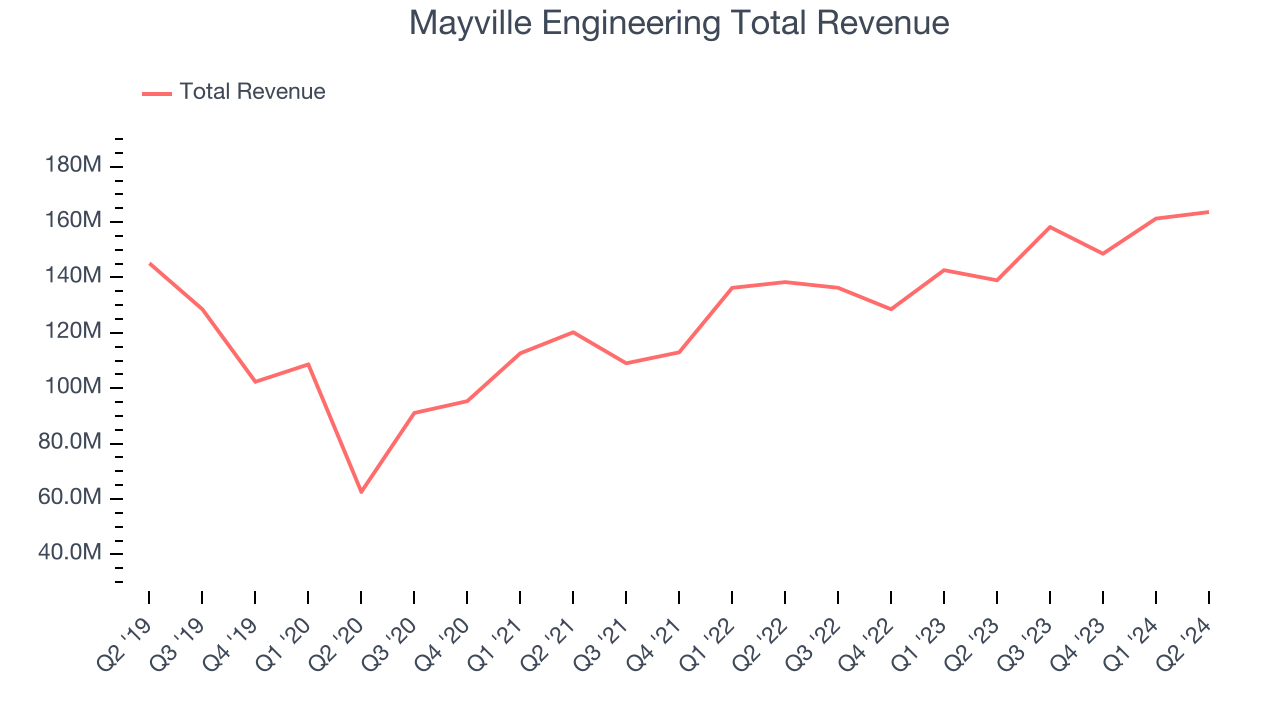

Best Q2: Mayville Engineering (NYSE:MEC)

Originally founded solely on tool and die manufacturing, Mayville Engineering Company (NYSE:MEC) specializes in metal fabrication, tube bending, and welding to be used in various industries.

Mayville Engineering reported revenues of $163.6 million, up 17.7% year on year, outperforming analysts’ expectations by 2.8%. The business had a stunning quarter with an impressive beat of analysts’ operating margin estimates and full-year revenue guidance exceeding analysts’ expectations.

Mayville Engineering achieved the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 26.7% since reporting. It currently trades at $21.23.

Is now the time to buy Mayville Engineering? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Worthington (NYSE:WOR)

Founded by a steel salesman, Worthington (NYSE:WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

Worthington reported revenues of $257.3 million, down 17.5% year on year, falling short of analysts’ expectations by 13.1%. It was a disappointing quarter as it posted a miss of analysts’ operating margin estimates.

Worthington delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10.7% since the results and currently trades at $40.40.

Read our full analysis of Worthington’s results here.

Park-Ohio (NASDAQ:PKOH)

Based in Cleveland, Park-Ohio (NASDAQ:PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $432.6 million, up 1.1% year on year. This number lagged analysts' expectations by 2.9%. Overall, it was a mixed quarter for the company. Park-Ohio beat analysts' EPS expectations. On the other hand, its revenue unfortunately missed.

The stock is up 16.9% since reporting and currently trades at $30.67.

Read our full, actionable report on Park-Ohio here, it’s free.

RBC Bearings (NYSE:RBC)

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE:RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

RBC Bearings reported revenues of $406.3 million, up 5% year on year. This result came in 2.5% below analysts' expectations. It was a softer quarter as it also recorded a miss of analysts’ earnings estimates and revenue guidance for next quarter missing analysts’ expectations.

The stock is flat since reporting and currently trades at $289.75.

Read our full, actionable report on RBC Bearings here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.